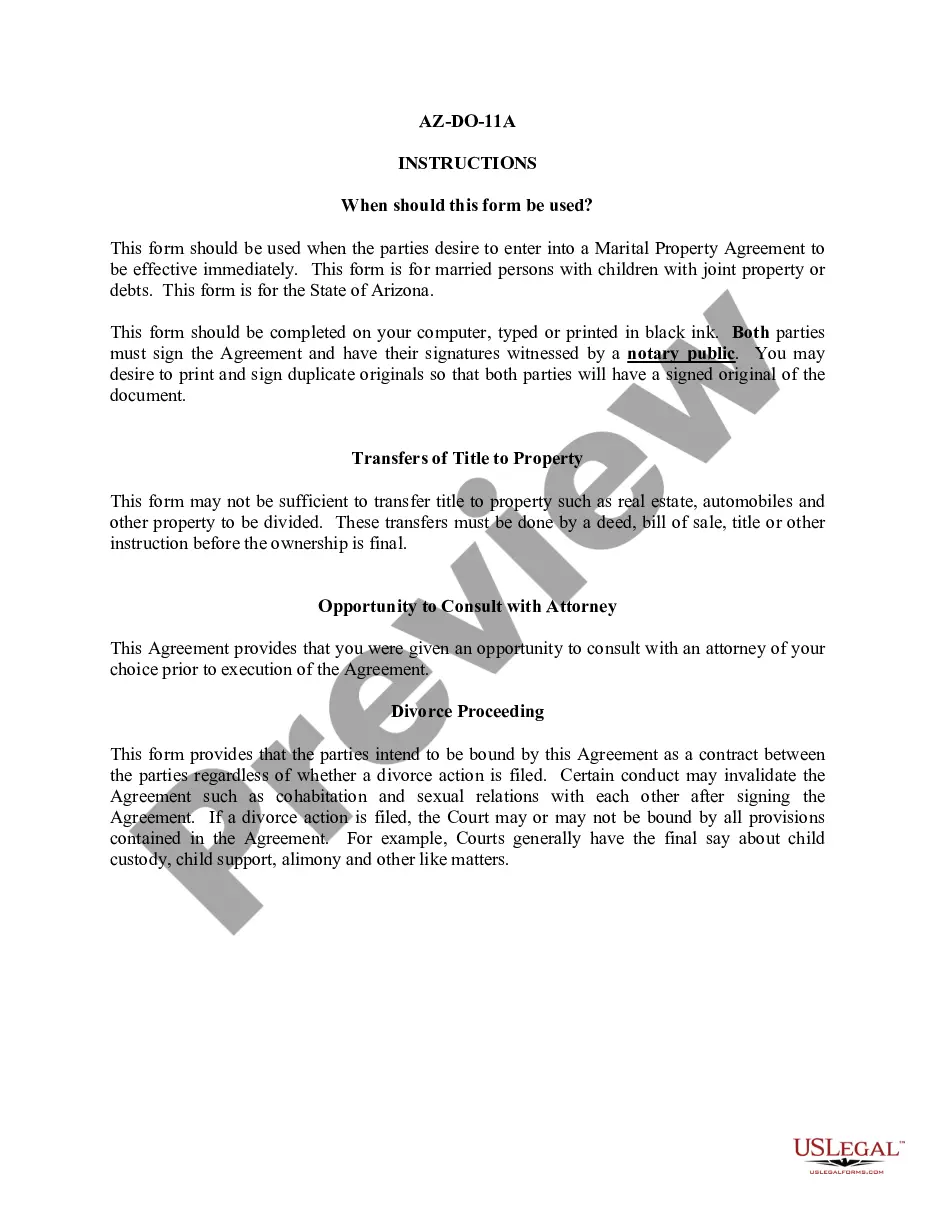

The courts have inherent power to restrain the sale of mortgaged premises in foreclosure proceedings, but are reluctant to exercise such power except where it is shown that particular circumstances, extrinsic to the instrument, would render its enforcement in this manner inequitable and work irreparable injury, and that complainant has no adequate remedy at law. Furthermore, a party must show a probable right of recovery in order to obtain a temporary injunction of a foreclosure action.

A Bexar Texas Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note is a legal document that aims to halt the foreclosure sale of a property. This action is taken because there has been a misunderstanding regarding the terms of payment outlined in the promissory note upon the assumption of the note. This type of complaint or petition is typically filed in Bexar County, Texas, when parties involved in a promissory note transaction believe there has been an error or miscommunication regarding the payment terms, leading to potential foreclosure. There are different types of complaints or petitions that can be filed under this category, depending on the specific circumstances of the misunderstanding of the promissory note's terms of payment. Some possible types may include: 1. Complaint or Petition to Enjoin Foreclosure Sale due to Misinterpretation of Interest Rates: This type of complaint is filed when there is a discrepancy or disagreement over the interest rates stated in the promissory note. The party assuming the note may argue that they misunderstood or were not aware of the specific interest rate, leading to difficulties in meeting payment obligations. 2. Complaint or Petition to Enjoin Foreclosure Sale due to Miscommunication of Payment Deadline: This type of complaint is filed when there is confusion or miscommunication regarding the specified deadline for making payments on the promissory note. The party assuming the note may argue that they were given incorrect or unclear information, leading to missed payments and subsequent foreclosure proceedings. 3. Complaint or Petition to Enjoin Foreclosure Sale due to Inaccurate Calculation of Payment Amounts: This type of complaint is filed when there is a discrepancy in the calculation or determination of the payment amounts outlined in the promissory note. The party assuming the note may argue that they were provided incorrect or misleading information, resulting in payment amounts that are higher or lower than initially anticipated, potentially leading to an inability to fulfill the obligations and foreclosure. It's important to note that the specific circumstances of each case may vary, and parties involved should seek proper legal advice to determine the most appropriate course of action based on their unique situation.