A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

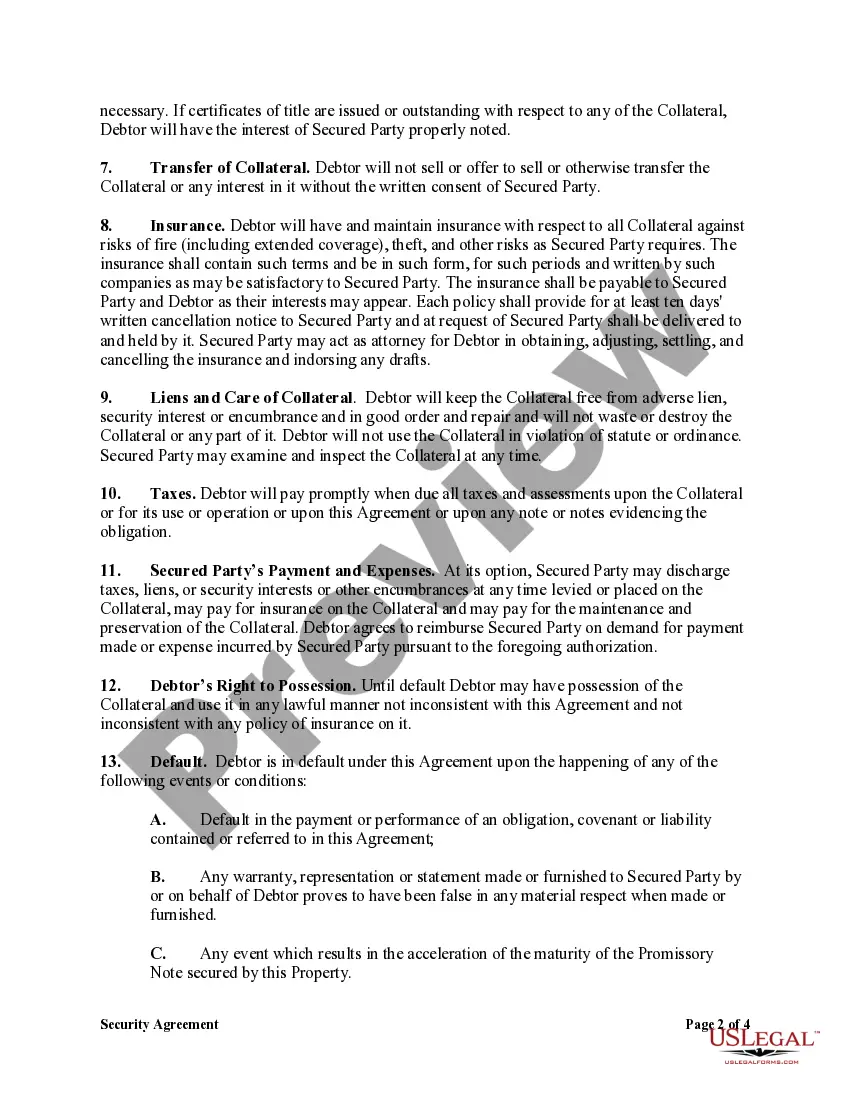

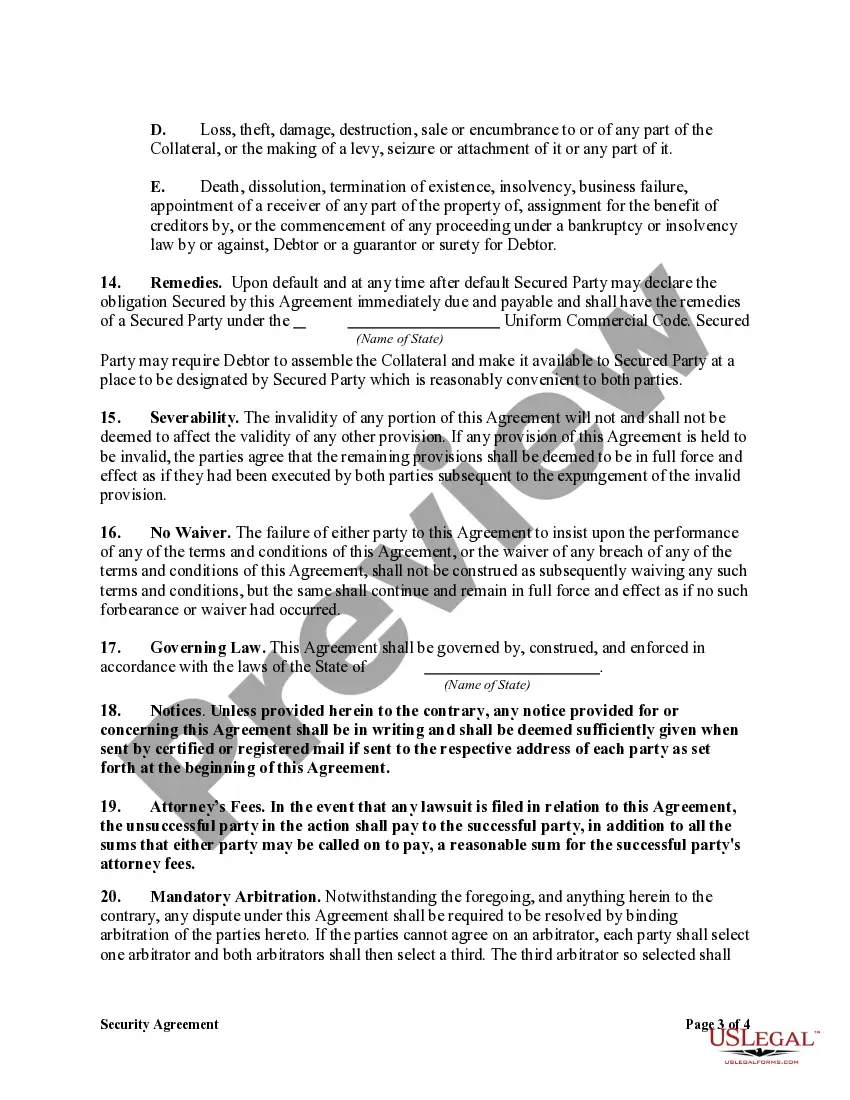

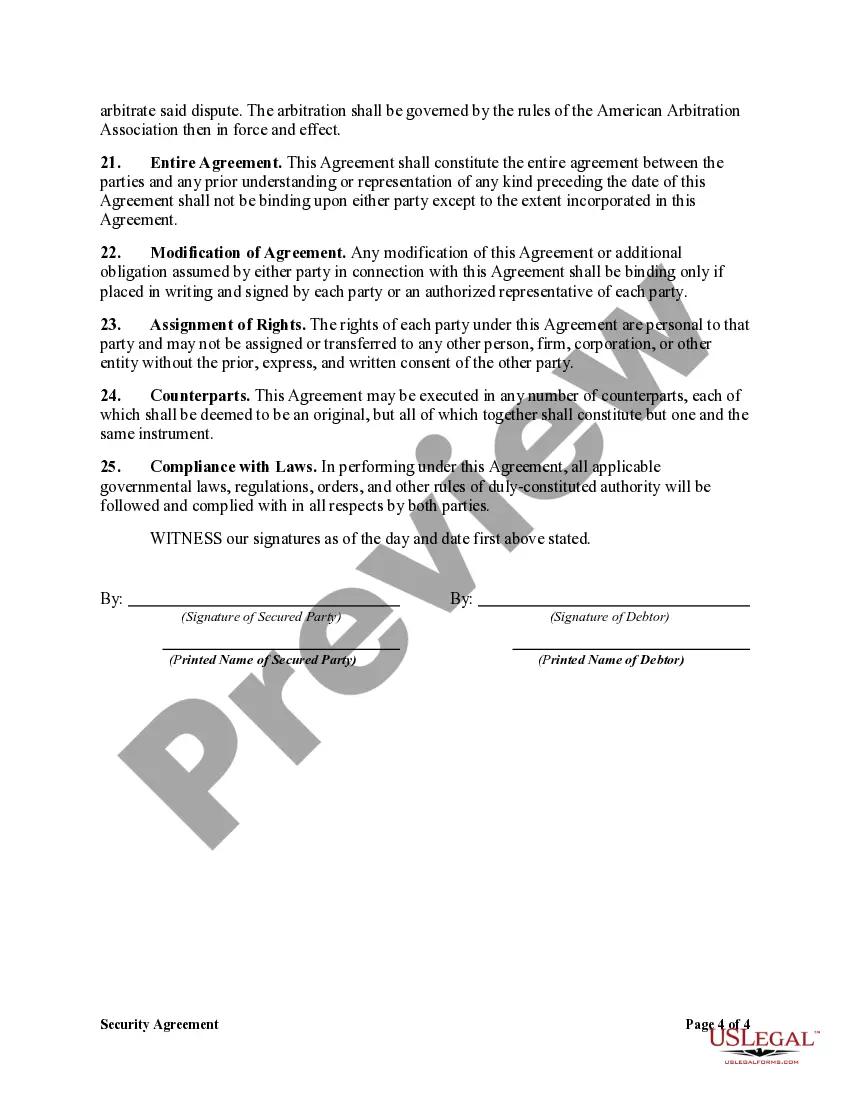

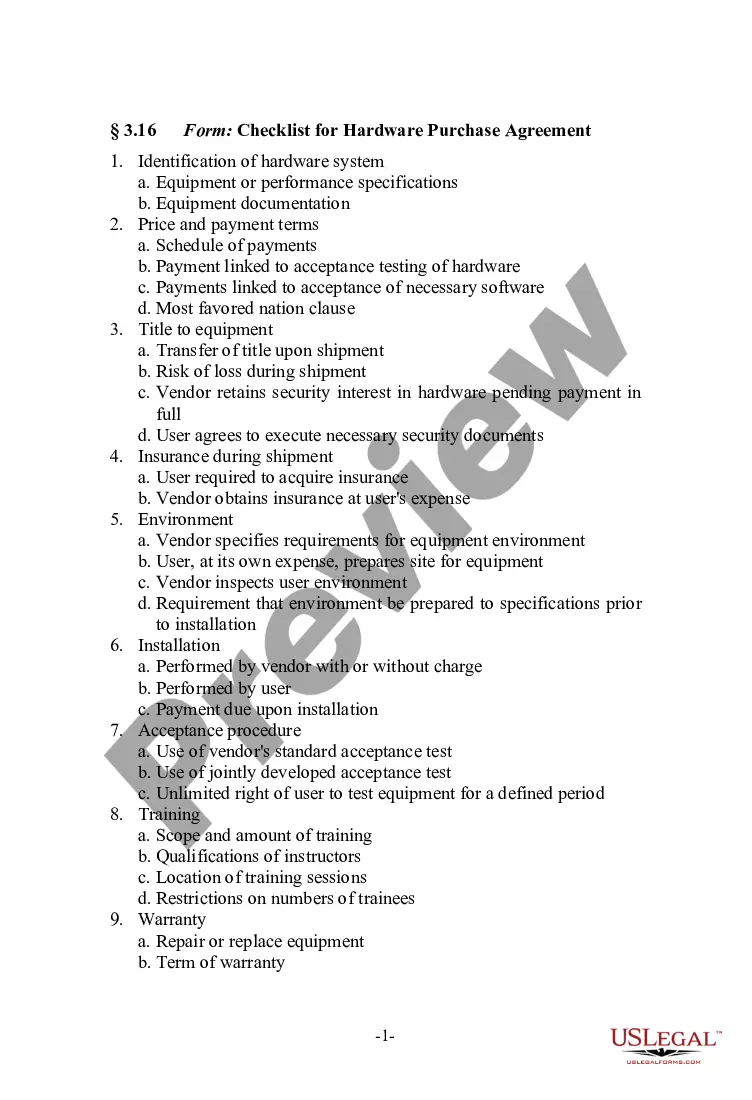

A Los Angeles California Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. In this specific case, the borrower uses equipment as collateral to secure the repayment of the promissory note. The agreement establishes the rights and responsibilities of both parties involved in the loan transaction. It typically begins with a detailed description of the equipment being used as collateral, including make, model, serial number, and any other pertinent details. This description ensures that all parties have a clear understanding of the equipment being used as collateral. The agreement further outlines the terms of the promissory note, including the principal amount, interest rate, and repayment schedule. It may also include provisions for late payments or defaults, as well as any additional fees or charges that may apply in such cases. In Los Angeles, California, there may be various types of Security Agreements in Equipment for Business Purposes — Securing Promissory Notes, including: 1. Conditional Sale Agreement: This type of agreement states that the ownership of the equipment remains with the lender until the borrower completes the payment obligations. Once the borrower fulfills the terms of the promissory note, ownership of the equipment transfers to the borrower. 2. Equipment Financing Agreement: In this type of agreement, the lender provides financing for the purchase of specific equipment. The equipment itself serves as collateral for the loan, and the lender may repossess it in case of default. 3. Chattel Mortgage Agreement: This agreement involves the transfer of a security interest in the equipment to the lender. The lender holds a lien on the equipment until the borrower completes the repayment of the loan, after which the lien is released. 4. Lease Agreement with Option to Purchase: This type of agreement combines a lease contract with an option for the lessee to purchase the equipment at the end of the lease term. The promissory note secures the option to purchase, and if the lessee fails to fulfill the repayment obligations, the lender can repossess the equipment. It is essential for both the lender and borrower to carefully review and understand the provisions outlined in the Los Angeles California Security Agreement in Equipment for Business Purposes — Securing Promissory Note. Seeking legal counsel and professional advice is highly recommended ensuring compliance with local regulations and to protect the interests of all parties involved.A Los Angeles California Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. In this specific case, the borrower uses equipment as collateral to secure the repayment of the promissory note. The agreement establishes the rights and responsibilities of both parties involved in the loan transaction. It typically begins with a detailed description of the equipment being used as collateral, including make, model, serial number, and any other pertinent details. This description ensures that all parties have a clear understanding of the equipment being used as collateral. The agreement further outlines the terms of the promissory note, including the principal amount, interest rate, and repayment schedule. It may also include provisions for late payments or defaults, as well as any additional fees or charges that may apply in such cases. In Los Angeles, California, there may be various types of Security Agreements in Equipment for Business Purposes — Securing Promissory Notes, including: 1. Conditional Sale Agreement: This type of agreement states that the ownership of the equipment remains with the lender until the borrower completes the payment obligations. Once the borrower fulfills the terms of the promissory note, ownership of the equipment transfers to the borrower. 2. Equipment Financing Agreement: In this type of agreement, the lender provides financing for the purchase of specific equipment. The equipment itself serves as collateral for the loan, and the lender may repossess it in case of default. 3. Chattel Mortgage Agreement: This agreement involves the transfer of a security interest in the equipment to the lender. The lender holds a lien on the equipment until the borrower completes the repayment of the loan, after which the lien is released. 4. Lease Agreement with Option to Purchase: This type of agreement combines a lease contract with an option for the lessee to purchase the equipment at the end of the lease term. The promissory note secures the option to purchase, and if the lessee fails to fulfill the repayment obligations, the lender can repossess the equipment. It is essential for both the lender and borrower to carefully review and understand the provisions outlined in the Los Angeles California Security Agreement in Equipment for Business Purposes — Securing Promissory Note. Seeking legal counsel and professional advice is highly recommended ensuring compliance with local regulations and to protect the interests of all parties involved.