A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

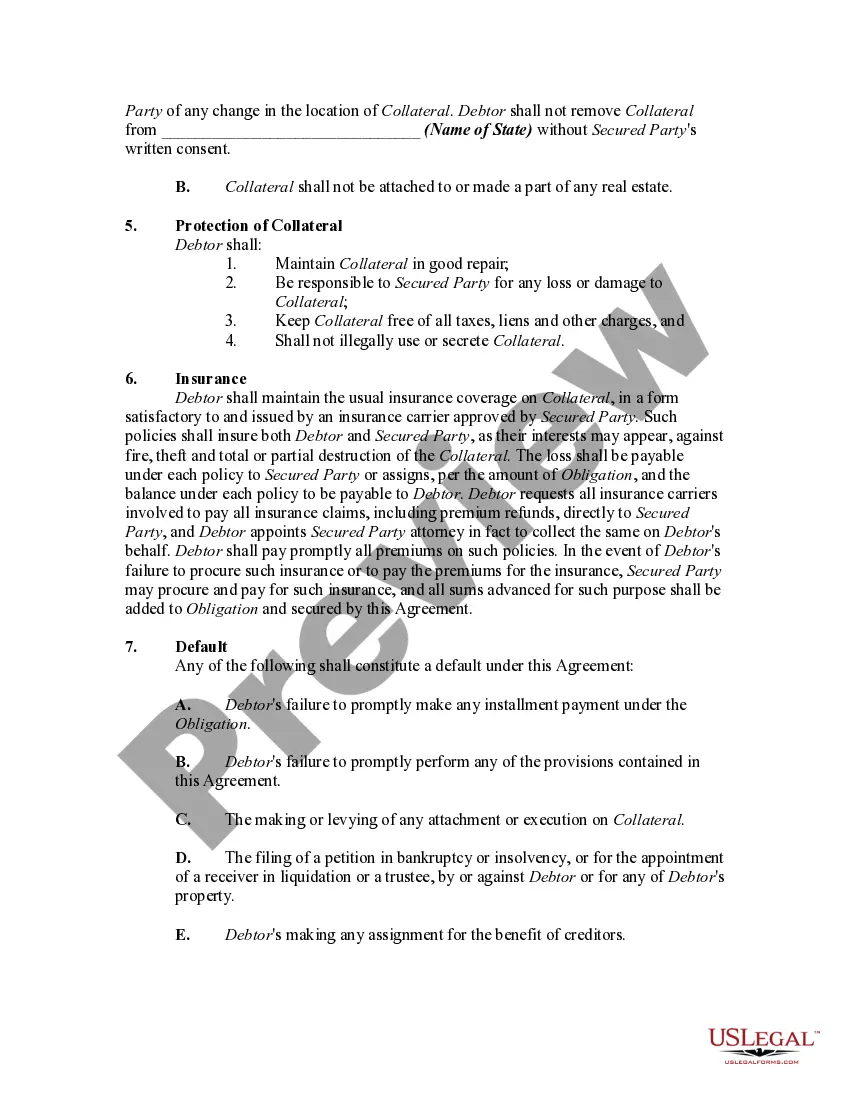

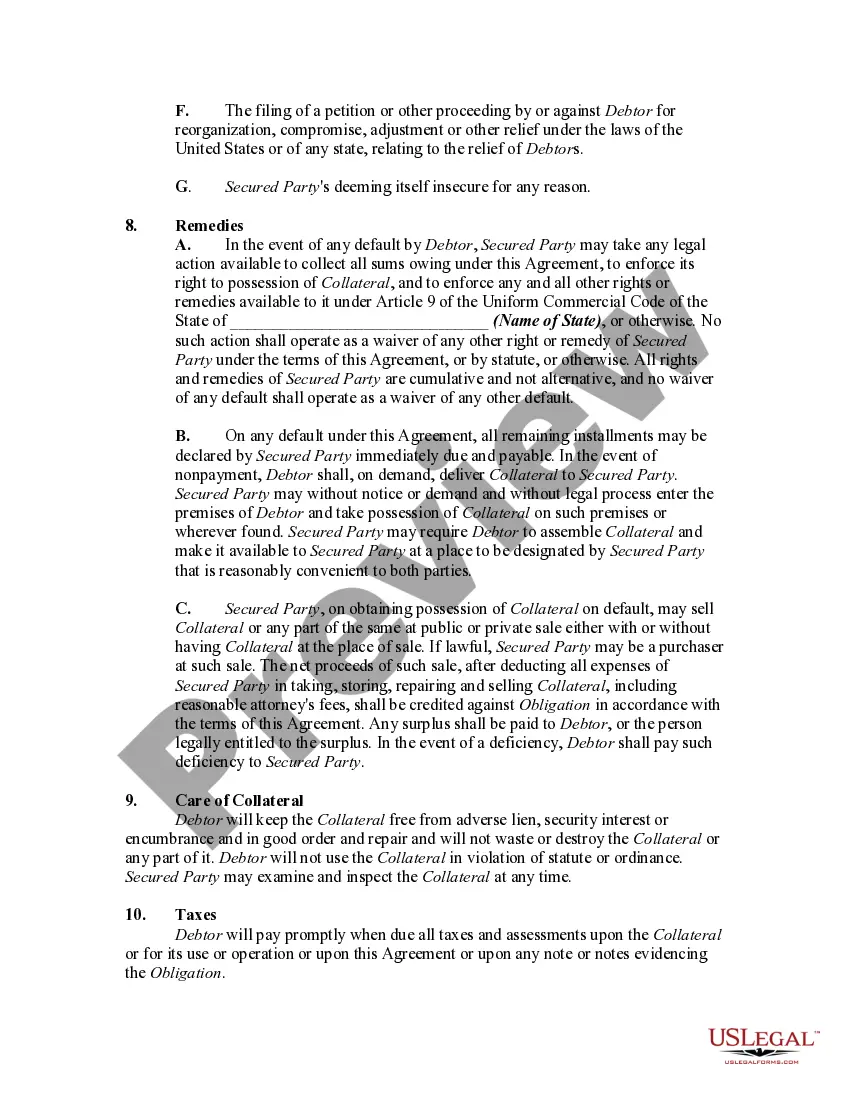

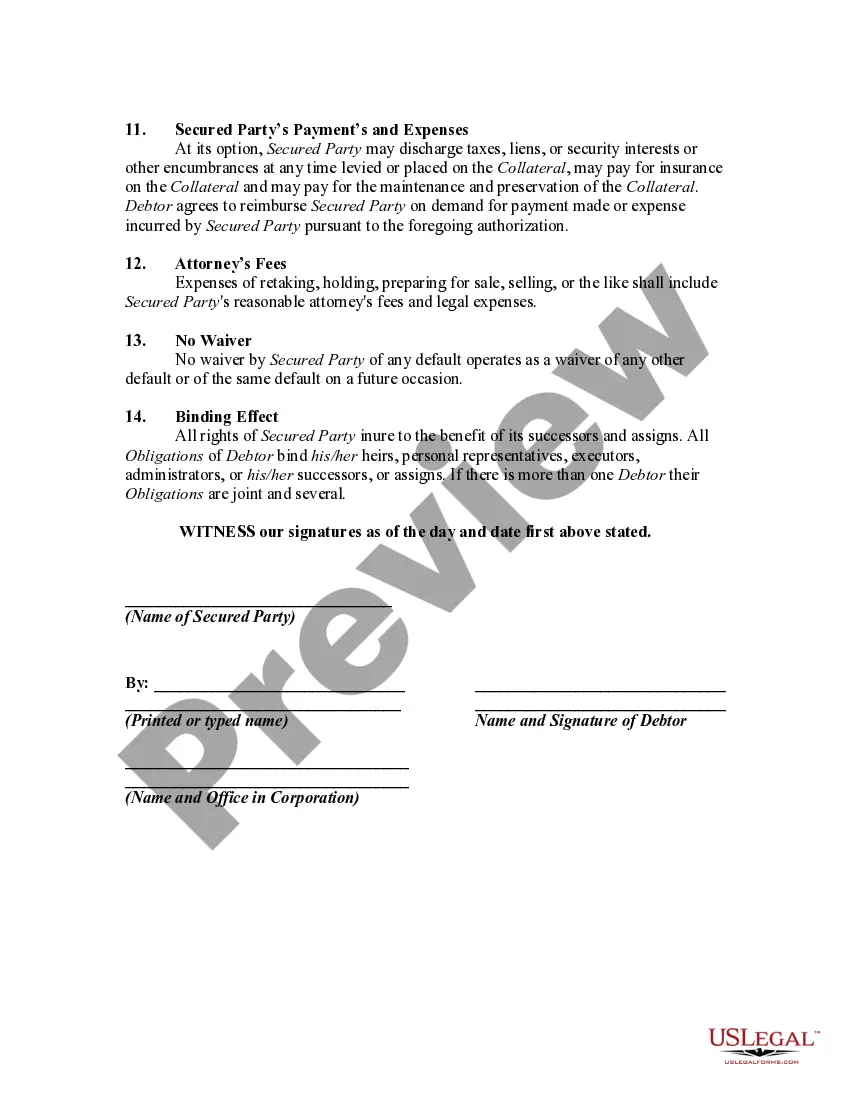

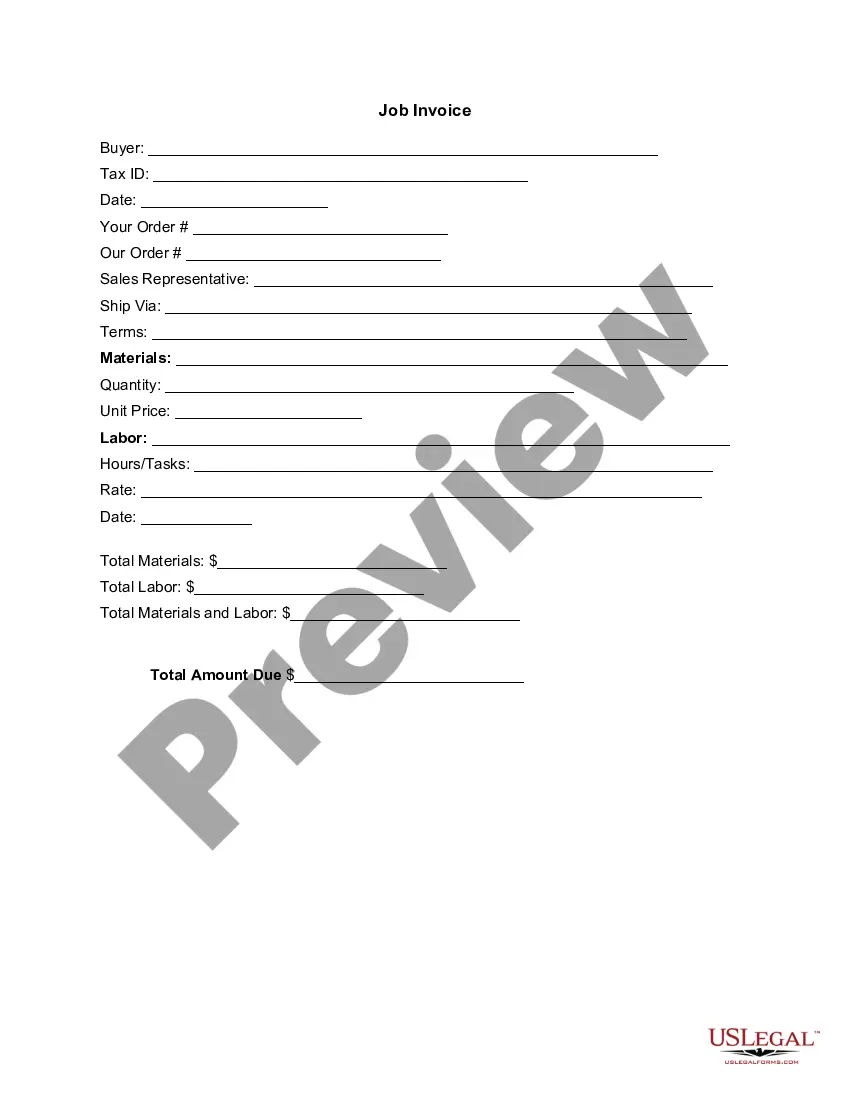

Miami-Dade, Florida is a vibrant and diverse county located in the southeastern part of the state. It is renowned for its beautiful beaches, vibrant nightlife, and rich cultural heritage. Home to Miami, the county seat and largest city, Miami-Dade attracts millions of visitors each year and is also a popular destination for business and commerce. Within the realm of legal documentation, the Miami-Dade Florida General Form of Security Agreement in Equipment plays a crucial role. This agreement is a legal contract that governs the relationship between a lender and a borrower regarding the security interest in equipment. It outlines the terms and conditions under which the lender grants a loan or credit facility to the borrower, secured against the equipment owned by the borrower. The Miami-Dade Florida General Form of Security Agreement in Equipment includes several key components. These may include: 1. Identification of the parties involved: The agreement clearly identifies the lender and the borrower, along with their legal names, addresses, and contact information. 2. Equipment description: Detailed information about the equipment used as collateral is provided, including make, model, serial number, and any unique identifying characteristics. 3. Security interest: The agreement clearly establishes the security interest held by the lender in the equipment. This means that the lender has the right to repossess the equipment if the borrower defaults on the loan or fails to fulfill their obligations. 4. Loan terms and conditions: The agreement outlines the specific terms and conditions of the loan, including interest rates, repayment plans, and any other relevant provisions. It also specifies the duration of the loan and any penalties or default provisions. 5. Insurance requirements: The agreement may require the borrower to maintain insurance coverage on the equipment to protect against damage, loss, or theft. The lender may need to be named as a loss payee or additional insured on the policy. 6. Default and remedies: The agreement spells out the consequences of default by the borrower, such as late payments or breach of any other terms. It also details the remedies available to the lender in case of default, including repossession and resale of the equipment. It is important to note that while the Miami-Dade Florida General Form of Security Agreement in Equipment exists, it can be modified or customized to suit specific needs or circumstances. Different variations or specialized forms of this agreement may be used based on factors such as industry, equipment type, or specific legal requirements. Some different types of the Miami-Dade Florida General Form of Security Agreement in Equipment may include: 1. Construction Equipment Security Agreement: Designed specifically to secure loans or credit facilities related to construction equipment, this agreement may have provisions related to heavy machinery, vehicles, or tools commonly used in the construction industry. 2. Medical Equipment Security Agreement: This type of agreement focuses on securing loans related to medical equipment such as diagnostic machines, surgical tools, or specialized devices used in healthcare facilities. 3. Technology Equipment Security Agreement: Tailored for loans involving technology equipment, this agreement may include provisions for computer hardware, software, servers, or other electronic devices commonly used in the tech industry. 4. Agriculture Equipment Security Agreement: Designed for loans granted for agricultural equipment such as tractors, harvesters, or irrigation machinery, this agreement may have specific provisions relating to farming and agriculture. In conclusion, the Miami-Dade Florida General Form of Security Agreement in Equipment is a crucial legal document that outlines the terms and conditions for securing loans or credit facilities with equipment as collateral. It ensures the lender's rights and provides a framework for resolving potential disputes or default situations. Different variations of this agreement may exist, tailored to specific industry needs or types of equipment.Miami-Dade, Florida is a vibrant and diverse county located in the southeastern part of the state. It is renowned for its beautiful beaches, vibrant nightlife, and rich cultural heritage. Home to Miami, the county seat and largest city, Miami-Dade attracts millions of visitors each year and is also a popular destination for business and commerce. Within the realm of legal documentation, the Miami-Dade Florida General Form of Security Agreement in Equipment plays a crucial role. This agreement is a legal contract that governs the relationship between a lender and a borrower regarding the security interest in equipment. It outlines the terms and conditions under which the lender grants a loan or credit facility to the borrower, secured against the equipment owned by the borrower. The Miami-Dade Florida General Form of Security Agreement in Equipment includes several key components. These may include: 1. Identification of the parties involved: The agreement clearly identifies the lender and the borrower, along with their legal names, addresses, and contact information. 2. Equipment description: Detailed information about the equipment used as collateral is provided, including make, model, serial number, and any unique identifying characteristics. 3. Security interest: The agreement clearly establishes the security interest held by the lender in the equipment. This means that the lender has the right to repossess the equipment if the borrower defaults on the loan or fails to fulfill their obligations. 4. Loan terms and conditions: The agreement outlines the specific terms and conditions of the loan, including interest rates, repayment plans, and any other relevant provisions. It also specifies the duration of the loan and any penalties or default provisions. 5. Insurance requirements: The agreement may require the borrower to maintain insurance coverage on the equipment to protect against damage, loss, or theft. The lender may need to be named as a loss payee or additional insured on the policy. 6. Default and remedies: The agreement spells out the consequences of default by the borrower, such as late payments or breach of any other terms. It also details the remedies available to the lender in case of default, including repossession and resale of the equipment. It is important to note that while the Miami-Dade Florida General Form of Security Agreement in Equipment exists, it can be modified or customized to suit specific needs or circumstances. Different variations or specialized forms of this agreement may be used based on factors such as industry, equipment type, or specific legal requirements. Some different types of the Miami-Dade Florida General Form of Security Agreement in Equipment may include: 1. Construction Equipment Security Agreement: Designed specifically to secure loans or credit facilities related to construction equipment, this agreement may have provisions related to heavy machinery, vehicles, or tools commonly used in the construction industry. 2. Medical Equipment Security Agreement: This type of agreement focuses on securing loans related to medical equipment such as diagnostic machines, surgical tools, or specialized devices used in healthcare facilities. 3. Technology Equipment Security Agreement: Tailored for loans involving technology equipment, this agreement may include provisions for computer hardware, software, servers, or other electronic devices commonly used in the tech industry. 4. Agriculture Equipment Security Agreement: Designed for loans granted for agricultural equipment such as tractors, harvesters, or irrigation machinery, this agreement may have specific provisions relating to farming and agriculture. In conclusion, the Miami-Dade Florida General Form of Security Agreement in Equipment is a crucial legal document that outlines the terms and conditions for securing loans or credit facilities with equipment as collateral. It ensures the lender's rights and provides a framework for resolving potential disputes or default situations. Different variations of this agreement may exist, tailored to specific industry needs or types of equipment.