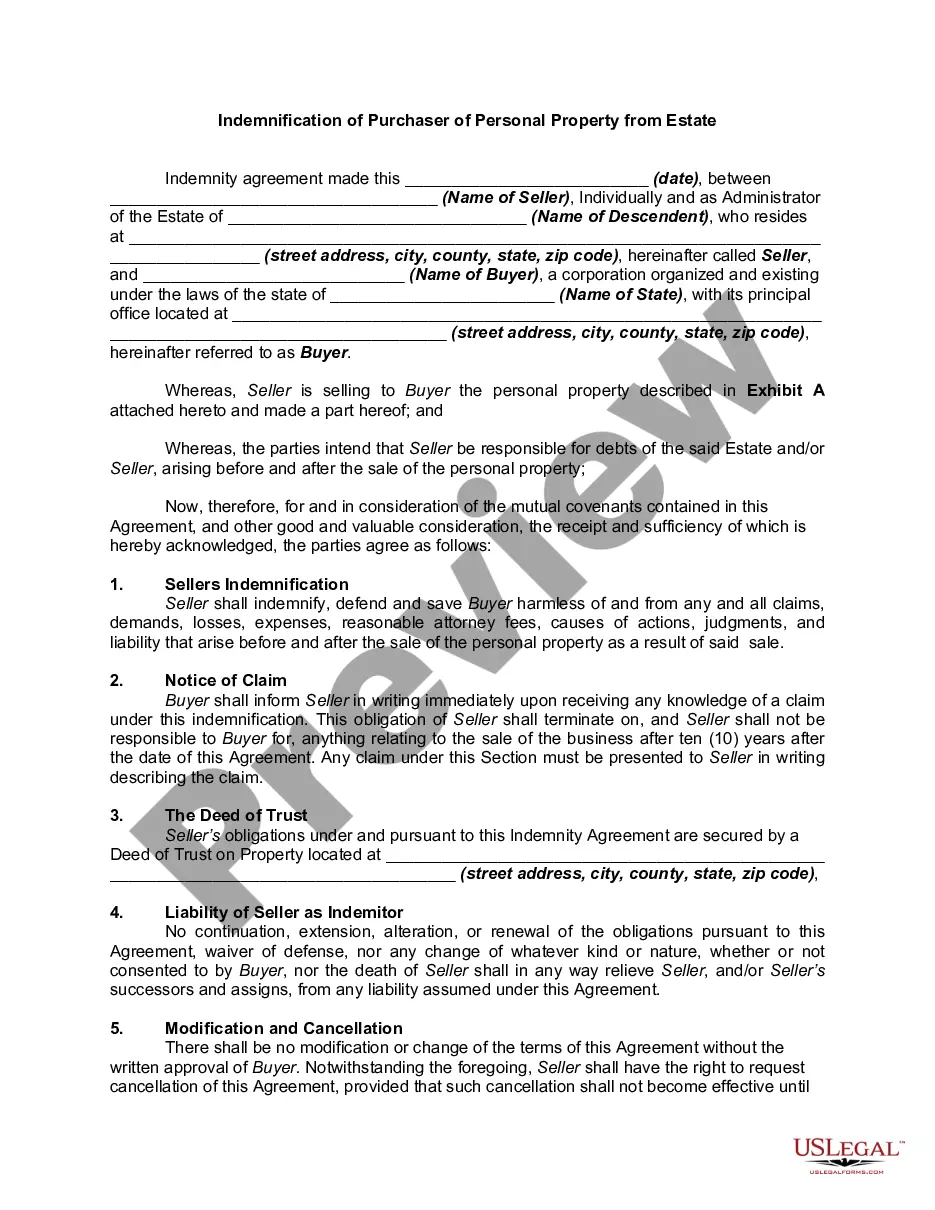

Indemnification is the act of making another "whole" by paying any loss another might suffer. This usually arises from a clause in a contract where a party agrees to pay for any monetary damages which arise or have arisen.

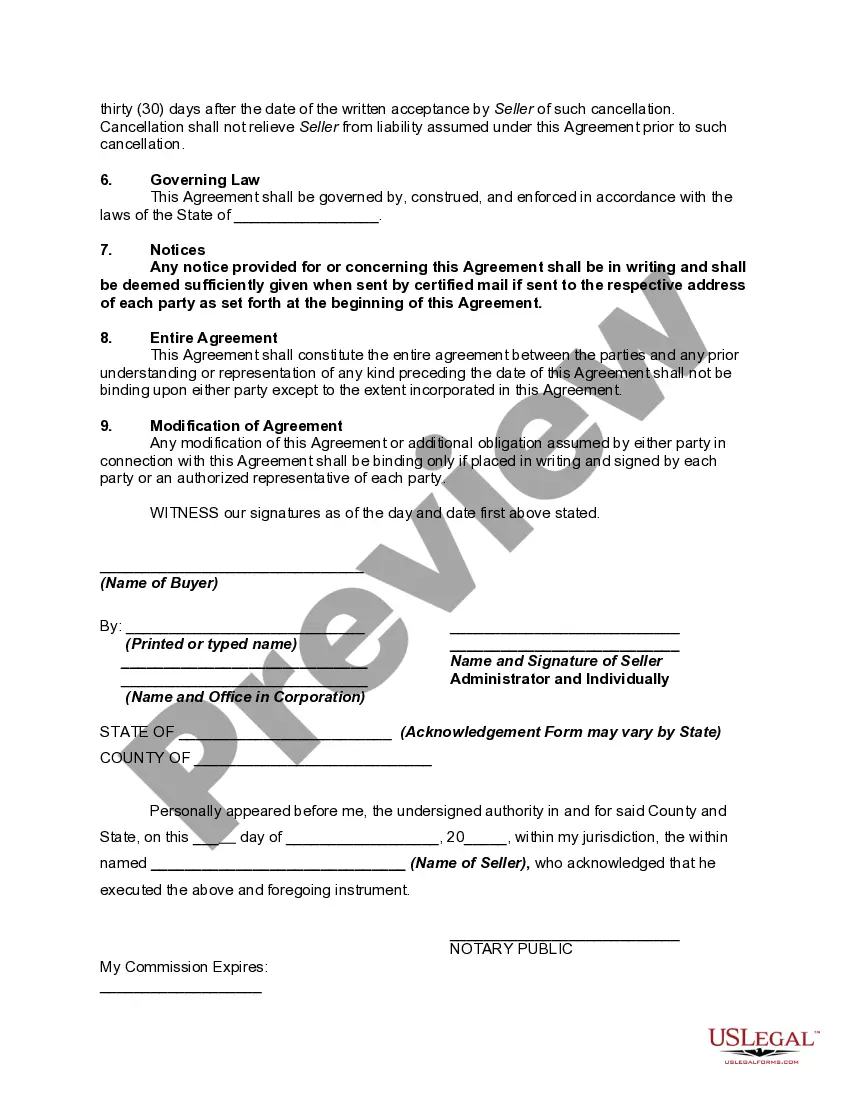

Houston, Texas is a vibrant city and the fourth largest in the United States. Known for its diverse and thriving economy, the city offers a plethora of opportunities for residents and visitors alike. One aspect of Houston Texas that stands out is its robust real estate market, which includes the buying and selling of personal property from estates. The Indemnification of Purchaser of Personal Property from Estate in Houston Texas is a critical legal provision aimed at protecting buyers from any potential liabilities or claims that may arise after the purchase of personal property from an estate. This indemnification ensures that purchasers are safeguarded in case there are any undisclosed debts, legal issues, or other unforeseen problems associated with the property acquired. Essentially, the indemnification clause serves as a form of insurance for the buyer, ensuring that they will be financially reimbursed or supported in the event they encounter any legal disputes, liabilities, or financial burdens related to the purchased estate property. This provision offers buyers in Houston Texas peace of mind and added protection when making significant purchases from estates. There can be different types of Houston Texas Indemnification of Purchaser of Personal Property from Estate, including: 1. General Indemnification: This type of indemnification covers buyers against any undisclosed legal claims, liens, or debts associated with the personal property purchased from an estate. It protects buyers from unforeseen financial burdens that may arise after the purchase. 2. Title Indemnification: This specific indemnification focuses on safeguarding buyers against any potential title defects or disputes related to the purchased estate property. It ensures that purchasers have a clear and unencumbered title to the property they acquire. 3. Physical Condition Indemnification: This type of indemnification protects buyers from any undisclosed physical defects or damages to the personal property from the estate. It may cover issues such as structural damage, safety hazards, or other physical problems that were not disclosed during the buying process. In summary, the Indemnification of Purchaser of Personal Property from Estate is a crucial legal provision in Houston, Texas, that shields buyers from potential liabilities and claims arising after the purchase of personal property from an estate. Whether it is general indemnification, title indemnification, or physical condition indemnification, these provisions serve to provide protection and peace of mind to purchasers in Houston's bustling real estate market.Houston, Texas is a vibrant city and the fourth largest in the United States. Known for its diverse and thriving economy, the city offers a plethora of opportunities for residents and visitors alike. One aspect of Houston Texas that stands out is its robust real estate market, which includes the buying and selling of personal property from estates. The Indemnification of Purchaser of Personal Property from Estate in Houston Texas is a critical legal provision aimed at protecting buyers from any potential liabilities or claims that may arise after the purchase of personal property from an estate. This indemnification ensures that purchasers are safeguarded in case there are any undisclosed debts, legal issues, or other unforeseen problems associated with the property acquired. Essentially, the indemnification clause serves as a form of insurance for the buyer, ensuring that they will be financially reimbursed or supported in the event they encounter any legal disputes, liabilities, or financial burdens related to the purchased estate property. This provision offers buyers in Houston Texas peace of mind and added protection when making significant purchases from estates. There can be different types of Houston Texas Indemnification of Purchaser of Personal Property from Estate, including: 1. General Indemnification: This type of indemnification covers buyers against any undisclosed legal claims, liens, or debts associated with the personal property purchased from an estate. It protects buyers from unforeseen financial burdens that may arise after the purchase. 2. Title Indemnification: This specific indemnification focuses on safeguarding buyers against any potential title defects or disputes related to the purchased estate property. It ensures that purchasers have a clear and unencumbered title to the property they acquire. 3. Physical Condition Indemnification: This type of indemnification protects buyers from any undisclosed physical defects or damages to the personal property from the estate. It may cover issues such as structural damage, safety hazards, or other physical problems that were not disclosed during the buying process. In summary, the Indemnification of Purchaser of Personal Property from Estate is a crucial legal provision in Houston, Texas, that shields buyers from potential liabilities and claims arising after the purchase of personal property from an estate. Whether it is general indemnification, title indemnification, or physical condition indemnification, these provisions serve to provide protection and peace of mind to purchasers in Houston's bustling real estate market.