A Houston Texas security agreement involving the sale of collateral by a debtor is a legally binding document that establishes a relationship between a borrower and a lender regarding the protection of assets used as security for a loan. This agreement ensures that the lender has the right to seize and sell the borrower's collateral in the event of default or non-payment. Such security agreements are crucial in various lending transactions, including commercial loans, personal loans, mortgages, and business financing. By entering into this agreement, both parties acknowledge and agree upon the terms and conditions under which the collateral may be sold to recover the outstanding debt. Here are a few types of Houston Texas security agreements involving the sale of collateral by the debtor: 1. Business Security Agreement: This type of agreement is commonly used in commercial transactions where a borrower pledges business assets such as equipment, inventory, or accounts receivable as collateral. In case of a default, the lender has the right to sell the pledged assets to recover the debt. 2. Personal Property Security Agreement: This agreement applies to personal loans, helping lenders secure their loan by using personal assets like vehicles, jewelry, or valuable possessions as collateral. In the event of non-payment, the lender can sell the pledged items to satisfy the debt. 3. Real Estate Security Agreement: When obtaining a mortgage loan, borrowers often agree to a security agreement that allows lenders to foreclose and sell the property if the borrower defaults. It grants the lender the right to recover the loan amount by selling the real estate collateral. 4. Accounts Receivable Security Agreement: In business financing, a debtor may use its accounts receivable as collateral to secure a loan. A security agreement helps define the lender's rights in collecting outstanding debts from the debtor's customers in case of default. When drafting a Houston Texas security agreement involving the sale of collateral by a debtor, it is essential to include specific keywords that would outline the agreement's terms and conditions. Some relevant keywords for the content may include "security agreement," "collateral," "debtor," "lender," "sale of collateral," "default," "non-payment," "asset seizure," "borrower," "loan agreement," "foreclosure," "commercial loan," "personal loan," "mortgage," and "business financing." Remember that specific provisions and terms may differ based on the nature of the loan and the collateral involved. Professional legal advice is strongly recommended when creating or executing a security agreement to ensure compliance with Houston Texas laws and regulations.

Houston Texas Security Agreement involving Sale of Collateral by Debtor

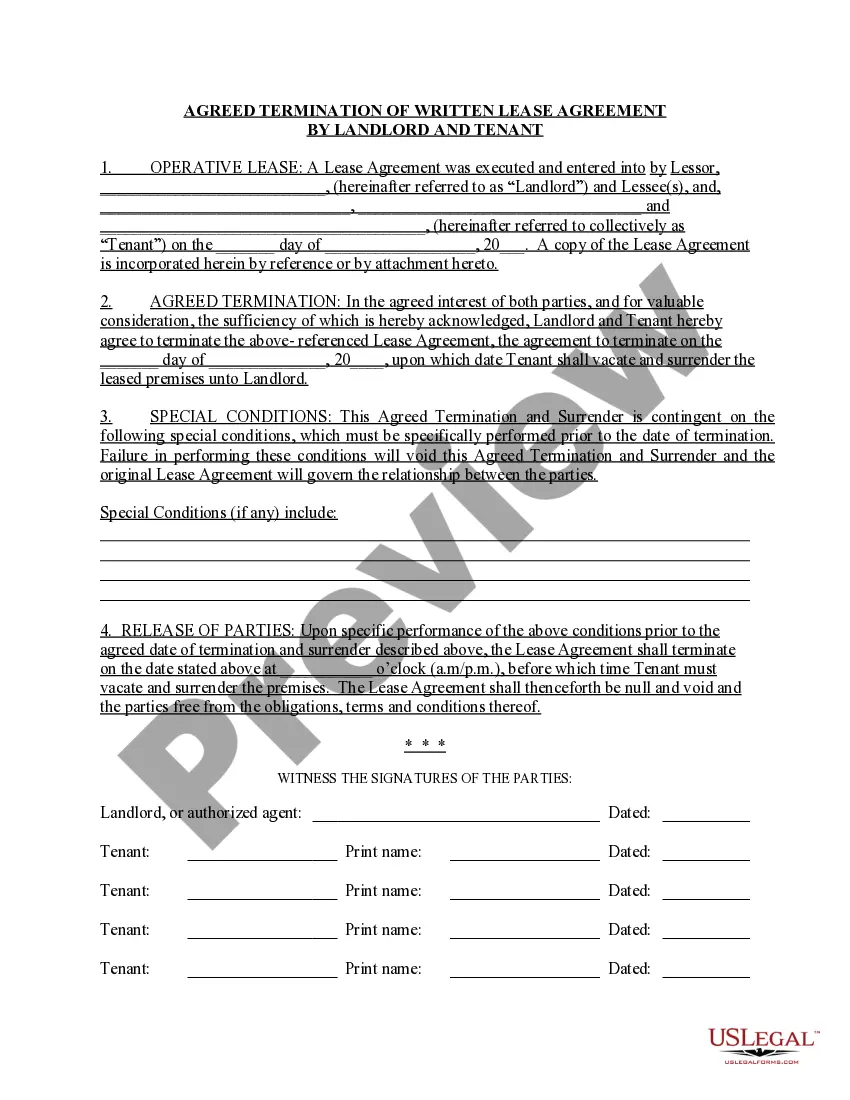

Description

How to fill out Houston Texas Security Agreement Involving Sale Of Collateral By Debtor?

Creating forms, like Houston Security Agreement involving Sale of Collateral by Debtor, to manage your legal matters is a challenging and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms created for a variety of scenarios and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Houston Security Agreement involving Sale of Collateral by Debtor template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before getting Houston Security Agreement involving Sale of Collateral by Debtor:

- Make sure that your template is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Houston Security Agreement involving Sale of Collateral by Debtor isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin utilizing our service and get the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is good to go. You can try and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!