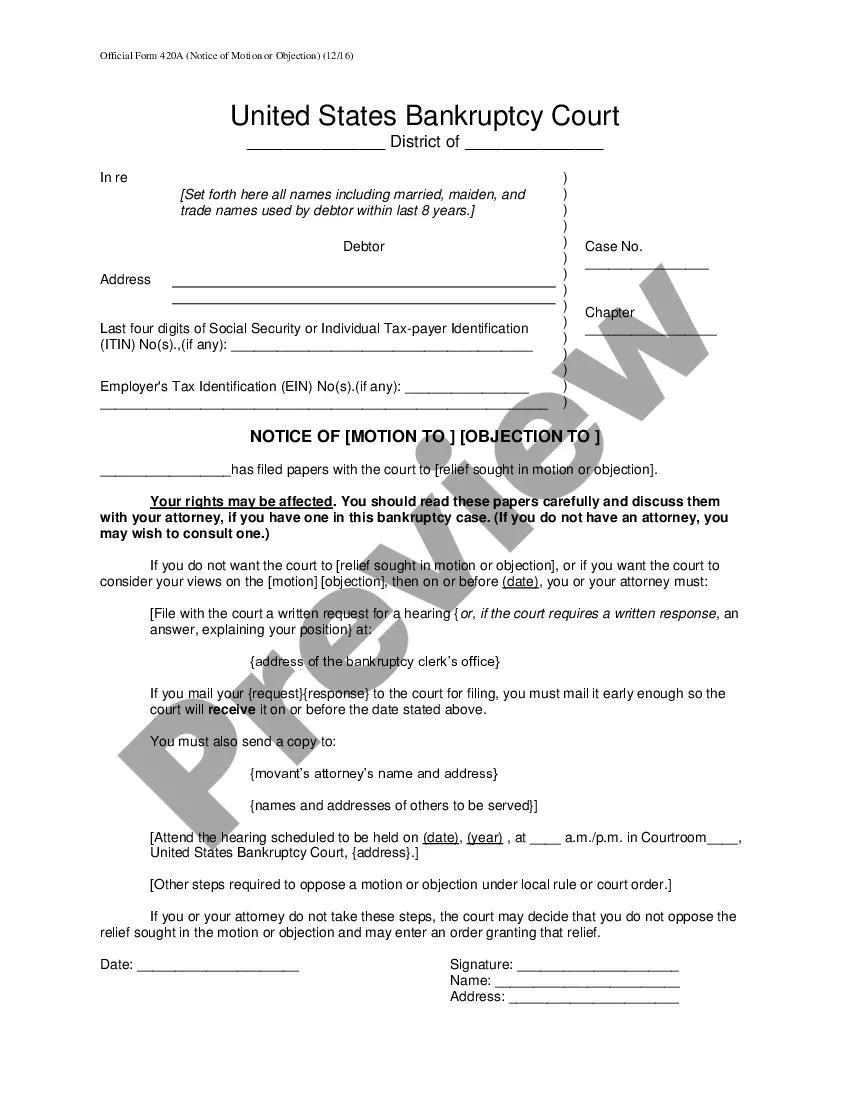

Collin Texas Financing Statement, also known as a UCC Financing Statement, is a legal document filed by a creditor to protect their interest in collateral provided by a debtor to secure a loan or financial obligation. The purpose of this statement is to publicly notify other potential creditors about the creditor's claim on the collateral, ensuring that the creditor's interest is recognized and protected. Collateral refers to any asset or property offered by the debtor to secure the loan, such as equipment, real estate, inventory, or accounts receivable. By recording a Collin Texas Financing Statement with the appropriate authority, often the Secretary of State's office, the creditor establishes a priority claim in case of the debtor's default or bankruptcy. Keyword: Collin Texas Financing Statement. Different types of Collin Texas Financing Statements can be based on the specific nature of the transaction: 1. Collateralized Debt: A financing statement is filed when a debtor provides collateral to secure a loan or debt. This type of financing statement protects the creditor's interest in the collateral until the debt is fully repaid. 2. Real Estate: In some cases, a Collin Texas Financing Statement is filed specifically for real estate transactions. This ensures that the creditor's interest is recognized and prioritized against other claims on the property. 3. Equipment and Machinery: If the debtor offers equipment or machinery as collateral, the creditor may file a financing statement specific to these assets. It allows the creditor to claim priority over other potential creditors if the debtor defaults. 4. Inventory or Accounts Receivable: Financing statements can also be filed for collateral consisting of inventory or accounts receivable. This type of filing allows creditors to assert their priority claim over these assets, protecting their interest and minimizing the risk of loss in case of default. 5. Public Notice: Collin Texas Financing Statements are considered public records, providing notice to other potential creditors of the creditor's interest in the collateral. Searching these statements helps interested parties determine the status of collateral and potential competing claims. The use of relevant keywords throughout this description helps enhance search engine optimization and improve the visibility of the content for users searching for information about Collin Texas Financing Statements.

Collin Texas Financing Statement

Description

How to fill out Collin Texas Financing Statement?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Collin Financing Statement, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any tasks associated with document execution straightforward.

Here's how you can purchase and download Collin Financing Statement.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Check the related document templates or start the search over to locate the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Collin Financing Statement.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Collin Financing Statement, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer completely. If you have to deal with an exceptionally complicated situation, we advise getting a lawyer to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!