The Cuyahoga Ohio Financing Statement is a legal document that serves as a public record of a security interest in personal property. It provides valuable information about the collateral used to secure a loan or debt, allowing potential lenders, creditors, and other interested parties to assess the debtor's financial situation. The Cuyahoga Ohio Financing Statement contains key elements such as the debtor's name and address, the secured party's name and address, a description of the collateral, and any other necessary details. This document is crucial in various financial transactions, including loans, leasing agreements, and sales contracts where personal property is involved. Keyword variations: — Cuyahoga County Ohio Financing Statement — Cuyahoga Ohio UCC FinancinStatementen— - Cuyahoga UCC-1 Financing Statement Different types of Cuyahoga Ohio Financing Statements include: 1. UCC-1 Financing Statement: This type of financing statement is filed under the Uniform Commercial Code (UCC) guidelines and is typically used to establish a security interest in personal property. It provides notice to third parties about a creditor's claim on the collateral. 2. UCC-3 Financing Statement Amendment: When any changes or amendments are made to an existing financing statement, a UCC-3 Financing Statement Amendment is filed. This can include modifications to debtor or secured party information, collateral changes, or terminations. 3. UCC-5 Financing Statement Correction Statement: If there are errors or mistakes in a previously filed financing statement, a UCC-5 Financing Statement Correction Statement is used to rectify the inaccuracies. It helps ensure that the public record remains accurate and reliable. 4. UCC-11 Information Request: A UCC-11 Information Request is not a financing statement but is a crucial document used to obtain information about any existing financing statements or liens concerning a particular debtor. It assists interested parties in understanding the debtor's financial obligations and potential risks before engaging in a transaction. Overall, the Cuyahoga Ohio Financing Statement is a critical legal document used in financial transactions to establish and protect secured interests in personal property. By filing and maintaining accurate financing statements, both debtors and secured parties can ensure transparency, protect their rights, and make informed decisions.

Cuyahoga Ohio Financing Statement

Description

How to fill out Cuyahoga Ohio Financing Statement?

Drafting documents for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Cuyahoga Financing Statement without professional help.

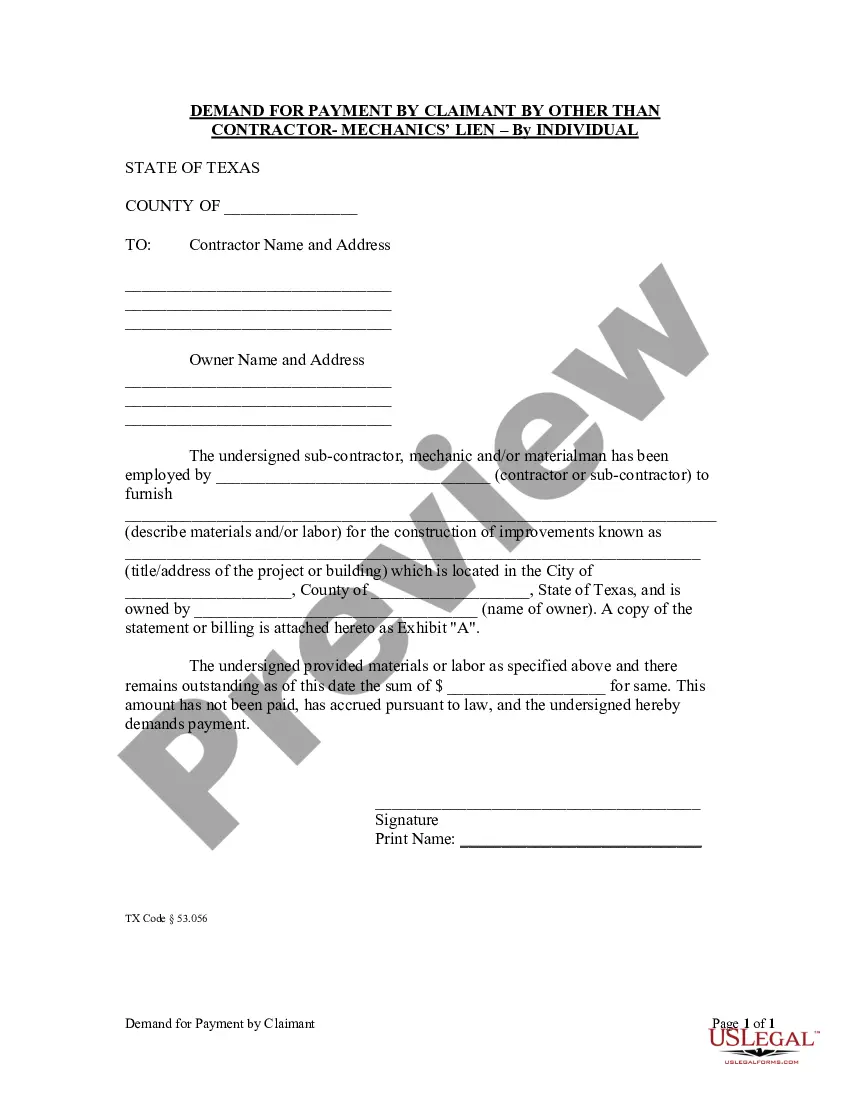

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Cuyahoga Financing Statement by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Cuyahoga Financing Statement:

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Conveyance Fee: 0.4% of the sale price or value of real property being transferred. Transfer Fee: $0.50 per lot or part of lot transferred.

The Deed Transfer Department transfers the owner's name and address on the real estate tax list and duplicate. The department also collects the transfer tax/ conveyance fee ($4.00 per $1,000 of sale price) and the transfer fee ($. 50 per parcel).

CUYAHOGA COUNTY, Ohio ? 200,000 Cuyahoga County residents will head to their mailboxes to find a bill from the county. Property tax bills were sent out to residents with a Thursday, July 14, 2022 deadline to pay. Need to know how to pay your property taxes?

The real property conveyance fee is paid by persons who make sales of real estate or used manufactured homes. The base of the tax is the value of real estate sold or transferred from one person to another.

General Information. The Homestead Exemption is a property tax reduction available by application to seniors (age 65 or older) and the disabled (permanent/total). In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners.

To transfer title, you must deliver the executed and acknowledged deed to the grantee. This means that you must give up control over the deed during your lifetime and intend to transfer title to the grantee. To complete the transfer, the grantee must accept the delivered deed.

Contact Cuyahoga County Probate Court at (216) 443-8764.

Please visit: . Information available to taxpayers about each property includes land and buildings data, ownership history, parcel and mailing addresses, transfer dates, purchase prices and taxes on all residential and commercial properties.

Finding the present owner of a property or home, if it is not you, can be done through the County Auditor's website using their property search tool. Note that you can search using the address, owner's name (if you know who owns it), or parcel ID.

This is a collaborative effort between Cuyahoga County Treasurer's Office and US Bank. You do NOT need to have an account with US Bank in order to make an online payment. STEP 1: HOW MUCH DO YOU WANT TO PAY? The First Half 20 Tax Collection closing date is Saturday, December 30, 1899 at midnight.