Harris Texas Financing Statement is an essential document used in Texas to secure a debtor's interest in personal property as collateral for a loan or credit transaction. It serves as a public record that informs other parties about the creditor's claim to the debtor's assets. This legal document is filed with the Harris County Clerk's Office and complies with the Uniform Commercial Code (UCC), a standardized set of laws governing commercial transactions in the United States. The Harris Texas Financing Statement contains crucial information such as the debtor's name and address, the creditor's name and address, and a detailed description of the collateral being used to secure the debt. The purpose of filing a Harris Texas Financing Statement is to establish priority among multiple creditors who may have claims on the same assets. By publicly disclosing the creditor's interest in the debtor's property, it ensures that future lenders or potential buyers are aware of existing liens or encumbrances. This helps creditors protect their rights and increases transparency in business transactions. There are different types of Harris Texas Financing Statements that can be filed depending on the circumstances: 1. Original Financing Statement: This type of statement is filed when a debtor initially enters into a credit agreement and grants the creditor a security interest in specific assets or all of their personal property. 2. Amendment Financing Statement: If there are changes to the original financing agreement, an amendment financing statement is filed to update the information. This type of statement is used when modifying the collateral description, extending the maturity date, or adding or removing the name of a debtor or creditor. 3. Continuation Statement: A continuation statement is filed to extend the effectiveness of the original financing statement. According to the UCC, a financing statement is typically effective for five years, and if a creditor wishes to retain their priority over other potential claimants, they must file a continuation statement before the expiration date. It is crucial for both creditors and debtors to understand the importance of the Harris Texas Financing Statement. Creditors depend on it to protect their rights and preserve their priority in cases of debt default or bankruptcy, while debtors must be aware of the potential encumbrances or financial obligations associated with their personal property. By properly filing and maintaining these statements, both parties can engage in secure and transparent transactions, ensuring a healthy business environment in Harris County, Texas.

Harris Texas Financing Statement

Description

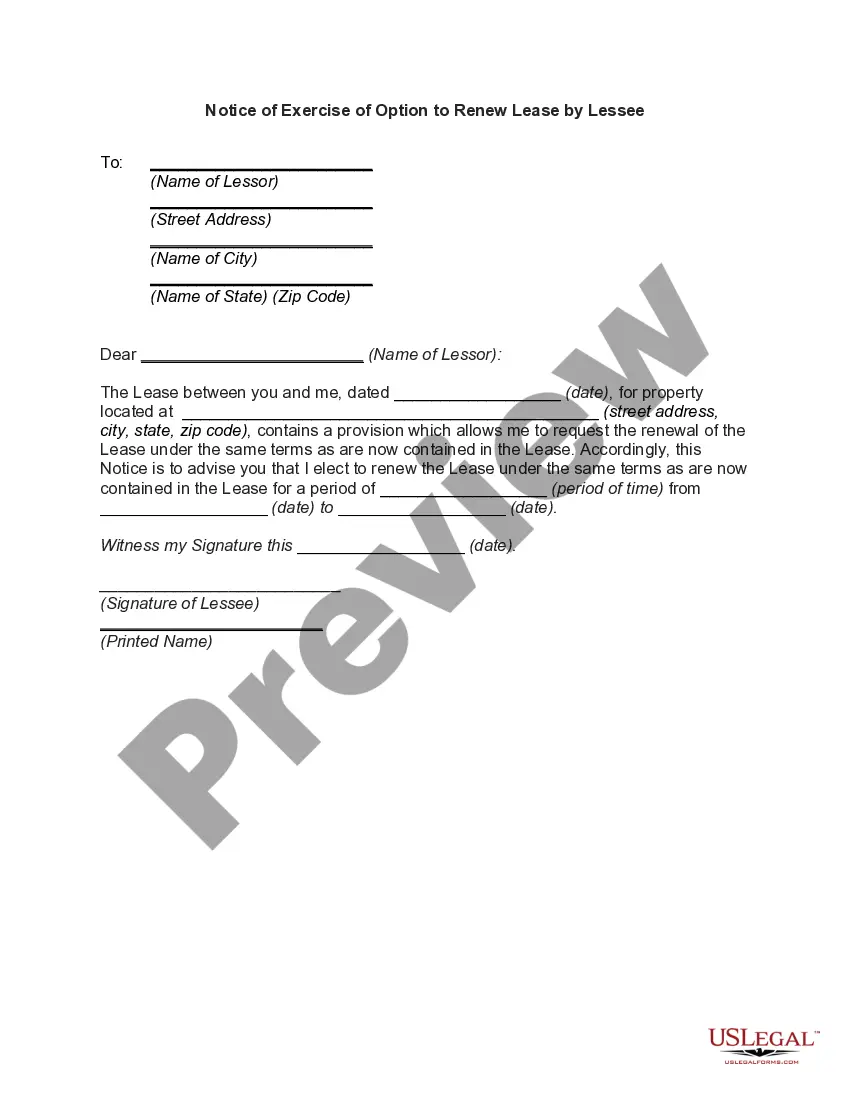

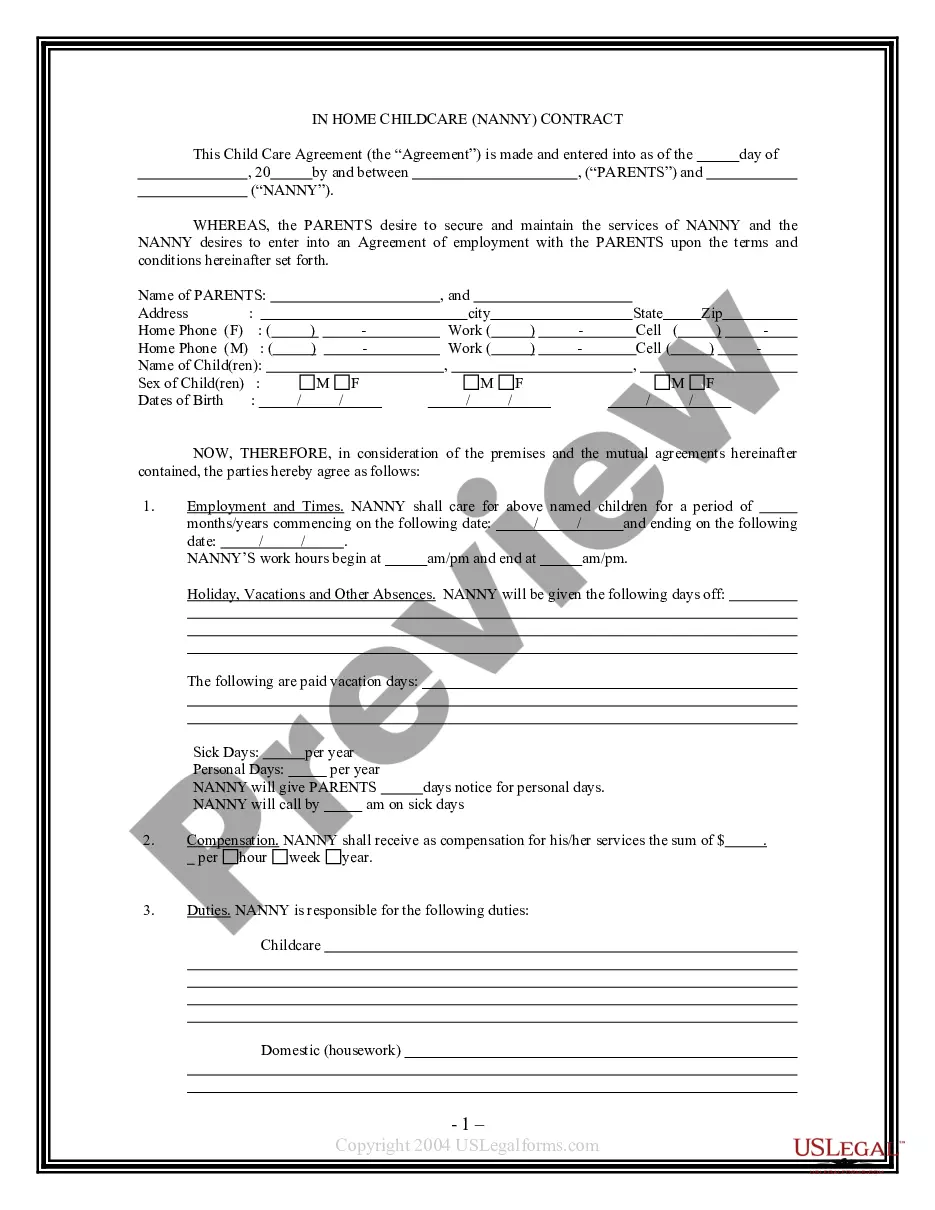

How to fill out Harris Texas Financing Statement?

If you need to get a reliable legal form provider to get the Harris Financing Statement, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can select from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it simple to locate and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Harris Financing Statement, either by a keyword or by the state/county the form is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Harris Financing Statement template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less pricey and more affordable. Set up your first business, arrange your advance care planning, create a real estate contract, or complete the Harris Financing Statement - all from the comfort of your home.

Sign up for US Legal Forms now!