Orange California Financing Statement is a legal document used to secure a financial interest in personal property located in Orange, California. It serves as a public notice to creditors and other interested parties, providing information about a debtor's obligation to repay a debt or loan. The Orange California Financing Statement is governed by the Uniform Commercial Code (UCC), specifically Article 9. This statement acts as a form of collateral, allowing lenders or creditors to claim priority over other potential creditors in case of default or bankruptcy. The financing statement typically includes the following information: the debtor's name and address, the creditor's name and address, a description of the collateral being used to secure the debt, a statement acknowledging consent of the debtor, the signature of the creditor, and any additional relevant details. There are various types of financing statements that can be filed in Orange, California, depending on the specific transaction or circumstance. Some common types include: 1. General Financing Statement: This is the most common type of financing statement, covering all types of collateral that a debtor may possess. 2. Specific Financing Statement: This type of statement is used when the creditor wants to secure a particular type of collateral, such as a specific piece of equipment or a vehicle. 3. After-Acquired Property Statement: This statement covers property acquired by the debtor after the initial financing statement has been filed. It ensures that any newly acquired assets also become part of the secured collateral. 4. Fixture Filing Statement: If the collateral includes fixtures or other property attached to a real estate property, this statement is used to establish the creditor's interest in these assets. 5. Assignment of Financing Statement: This type of financing statement is filed to transfer the rights and interests in an existing financing statement from one creditor to another. By filing an Orange California Financing Statement, creditors protect their financial interests and establish priority over other parties with potential claims to the debtor's property. It ensures transparency and facilitates secured transactions, providing confidence to lenders and creditors in Orange, California.

Orange California Financing Statement

Description

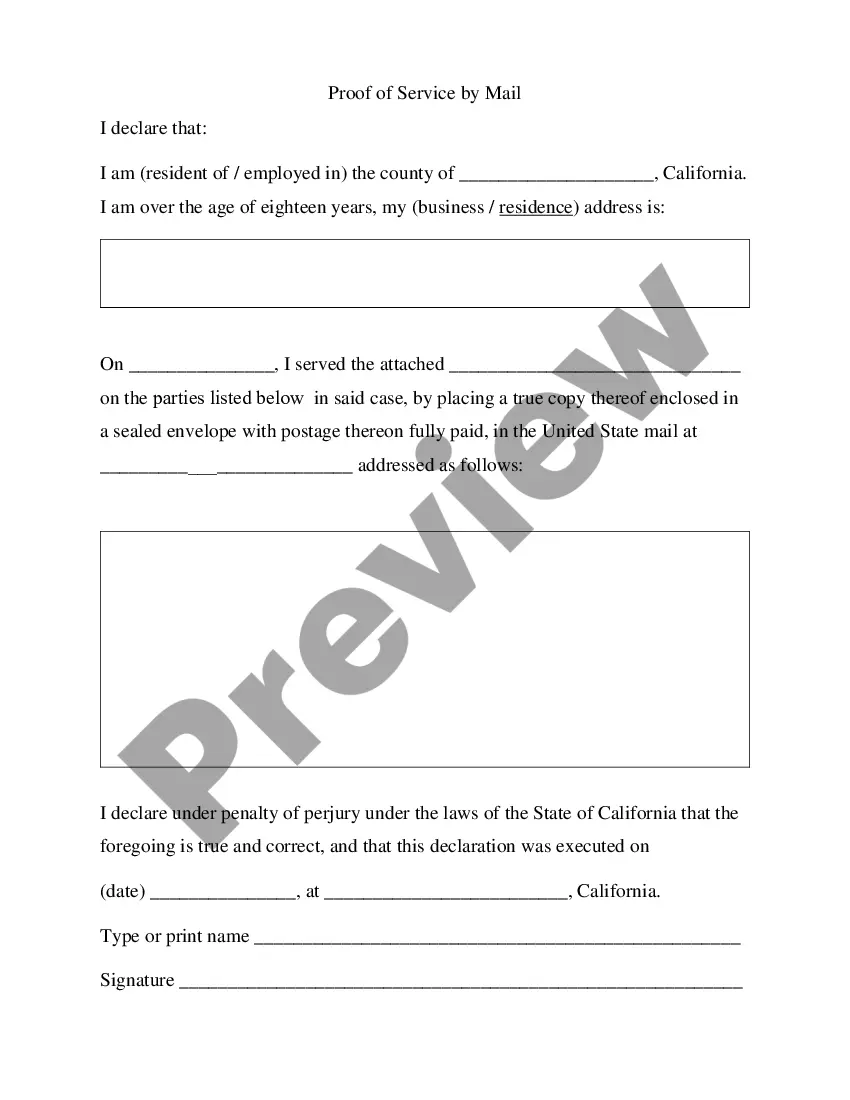

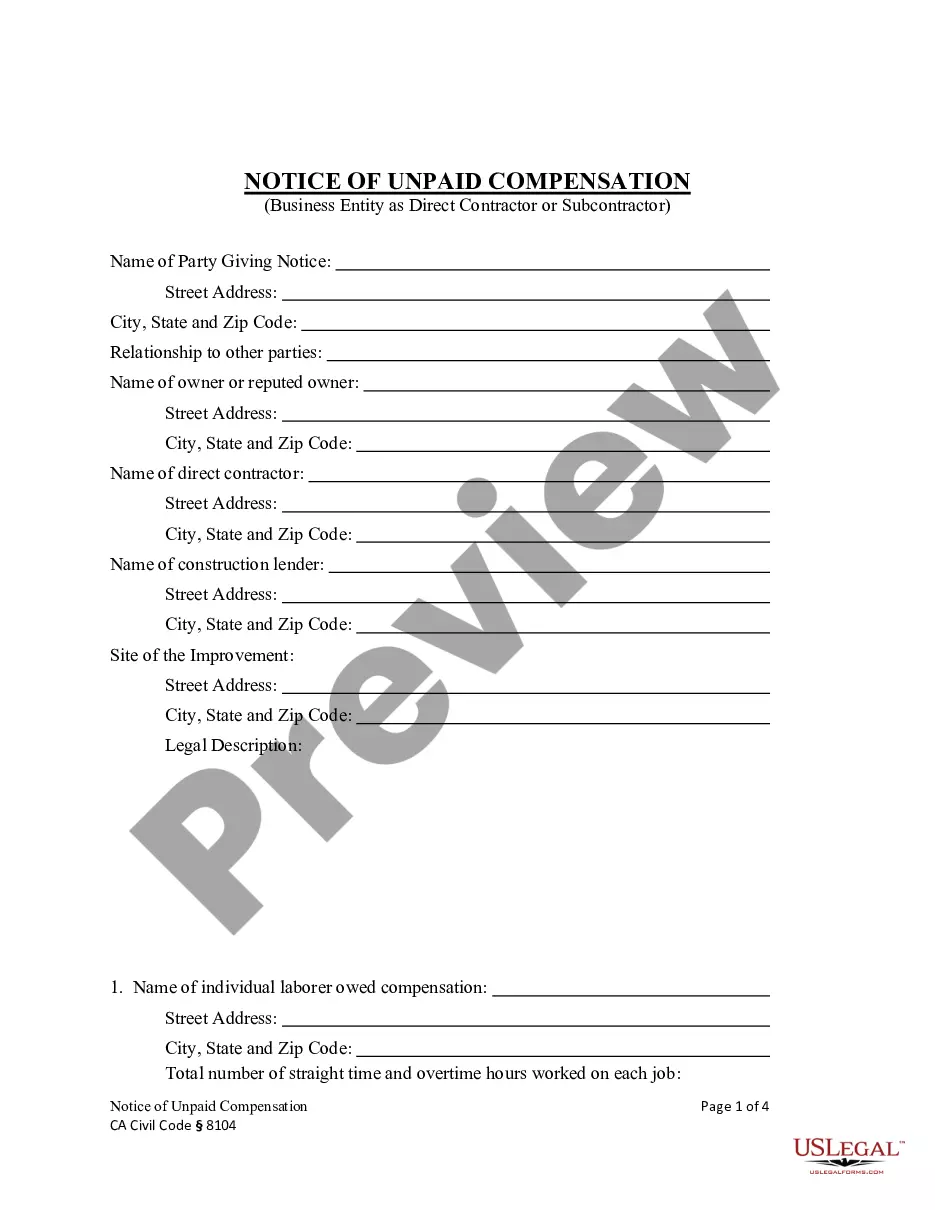

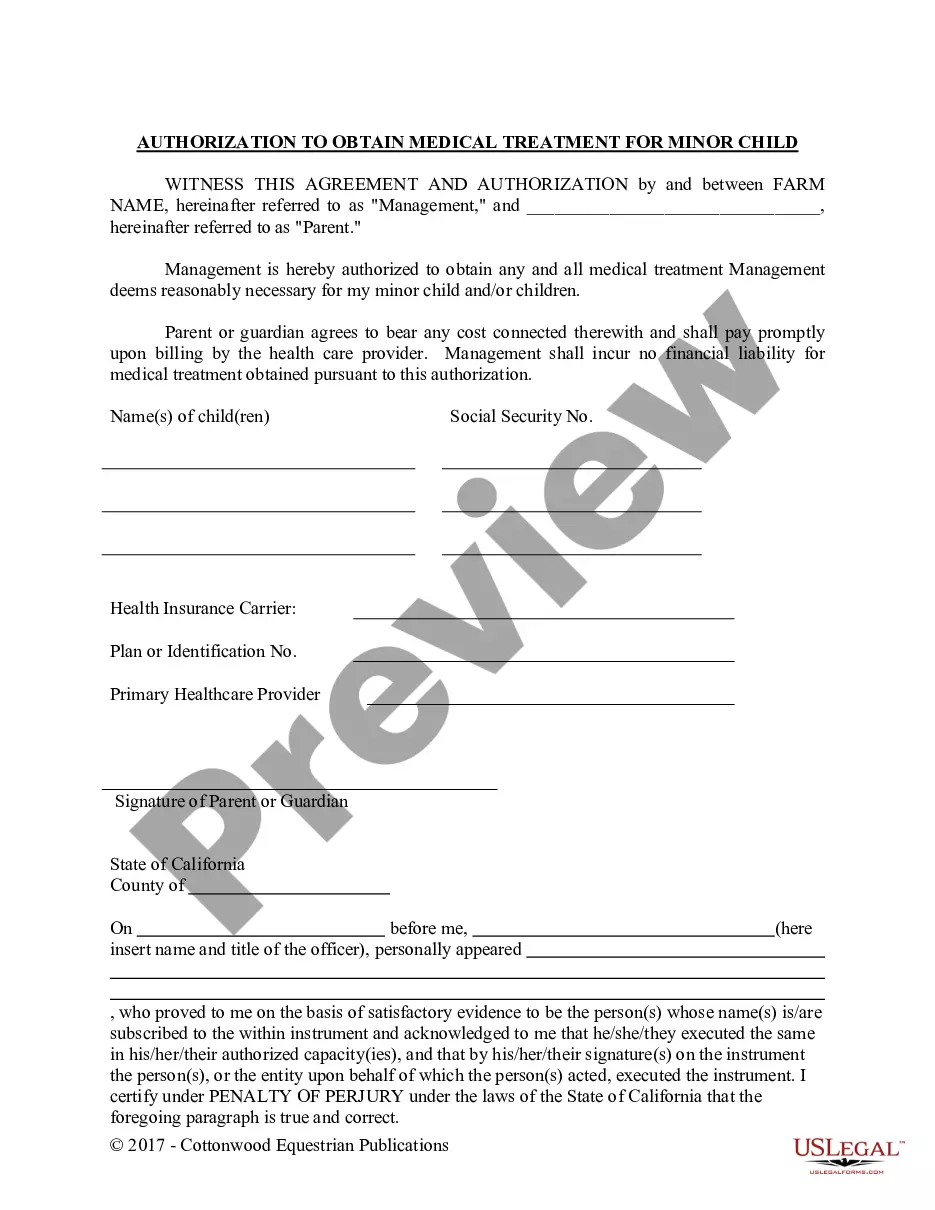

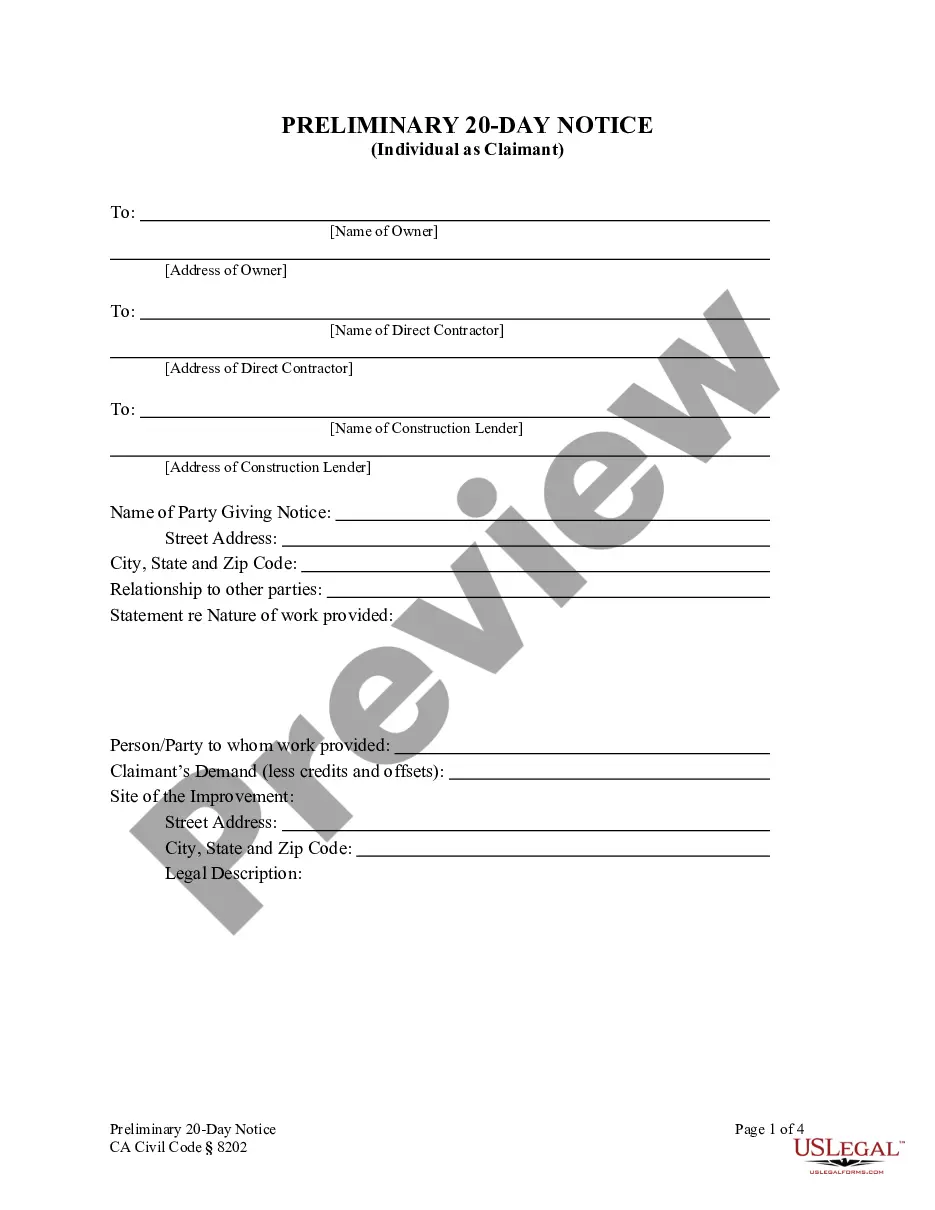

How to fill out Orange California Financing Statement?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Financing Statement, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the latest version of the Orange Financing Statement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Orange Financing Statement:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Orange Financing Statement and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!