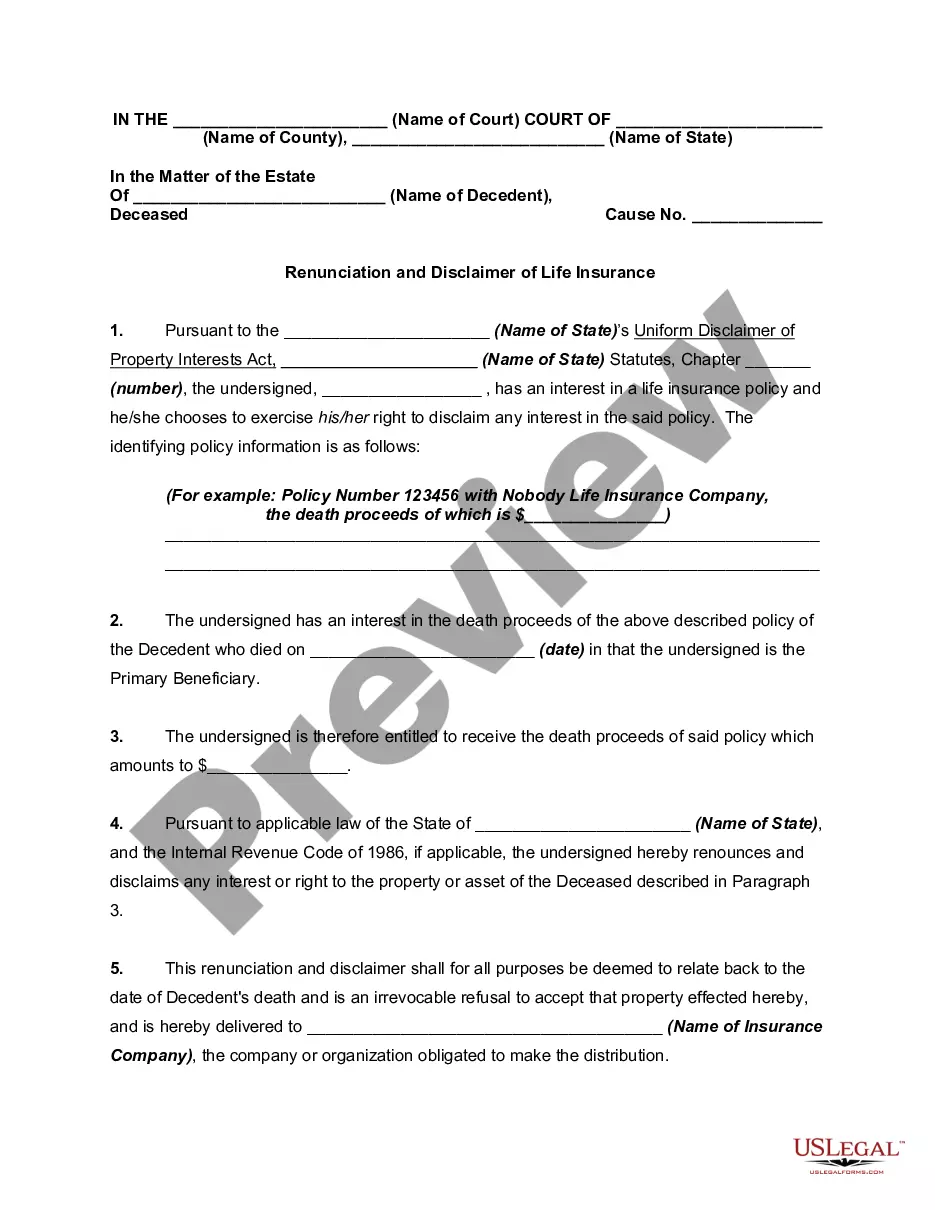

Disclaimers are used by those who receive property as heirs or legatees in an estate, or by beneficiaries of a non-testamentary transfer of property at death; for example, the beneficiaries of a life insurance policy. A disclaimer is simply a declaration by the person entitled to property that the interest in that property is disclaimed or renounced. A disclaimer allows the disclaiming heir or beneficiary to disclaim an interest in such a fashion that the right to the property that is disclaimed is treated as if it never existed.

The Uniform Disclaimers of Property Interests Act (which has been adopted by a number of states) provides the authority to make disclaimers, what interests may be disclaimed, the time when disclaimers are effective, and the effect on the distribution of the disclaimed property interests.

Fairfax Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds refer to legal documents that allow individuals to renounce or disclaim any interest they may have in receiving life insurance proceeds. This renunciation or disclaimer is typically done voluntarily by the beneficiary of a life insurance policy, and it means that the individual is waiving their right to receive the insurance proceeds. These documents are essential in situations where the beneficiary does not wish to accept the life insurance proceeds for various reasons. It could be because they have sufficient financial resources, they want to avoid potential tax implications, or they want the proceeds to go to another designated beneficiary. There are two types of Fairfax Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds: 1. Renunciation: Renunciation is a legal act where the beneficiary formally gives up their right to receive the life insurance proceeds. By renouncing the proceeds, the beneficiary acknowledges that they do not wish to accept the benefits of the policy. This renunciation allows the insurance company to distribute the proceeds to an alternate beneficiary or according to the policy's terms. 2. Disclaimer of Interest: A disclaimer of interest is similar to renunciation, but it may involve additional legal considerations. This document is used when the beneficiary wants to disclaim their interest in the life insurance proceeds. By disclaiming, the beneficiary is stating that they do not want to inherit the policy benefits and are relinquishing any legal claim to them. The disclaimer must meet specific legal requirements to be valid and effective. To initiate a Fairfax Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds, beneficiaries are usually required to submit a written document to the insurance company stating their intentions. The document should clearly state their decision to renounce or disclaim interest in the life insurance proceeds and may need to be notarized. It's important to note that seeking professional legal advice is recommended when considering renunciation or disclaimer of interest in life insurance proceeds in Fairfax, Virginia. An attorney specializing in estate planning or insurance law can guide individuals through the process, ensuring all legal requirements are met and the beneficiary's intentions are clearly stated. Overall, Fairfax Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds provide an avenue for beneficiaries to voluntarily waive their right to receive life insurance policy benefits. These legal documents help ensure a smooth and proper distribution of the proceeds according to the policy's terms or the beneficiary's alternate designation.Fairfax Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds refer to legal documents that allow individuals to renounce or disclaim any interest they may have in receiving life insurance proceeds. This renunciation or disclaimer is typically done voluntarily by the beneficiary of a life insurance policy, and it means that the individual is waiving their right to receive the insurance proceeds. These documents are essential in situations where the beneficiary does not wish to accept the life insurance proceeds for various reasons. It could be because they have sufficient financial resources, they want to avoid potential tax implications, or they want the proceeds to go to another designated beneficiary. There are two types of Fairfax Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds: 1. Renunciation: Renunciation is a legal act where the beneficiary formally gives up their right to receive the life insurance proceeds. By renouncing the proceeds, the beneficiary acknowledges that they do not wish to accept the benefits of the policy. This renunciation allows the insurance company to distribute the proceeds to an alternate beneficiary or according to the policy's terms. 2. Disclaimer of Interest: A disclaimer of interest is similar to renunciation, but it may involve additional legal considerations. This document is used when the beneficiary wants to disclaim their interest in the life insurance proceeds. By disclaiming, the beneficiary is stating that they do not want to inherit the policy benefits and are relinquishing any legal claim to them. The disclaimer must meet specific legal requirements to be valid and effective. To initiate a Fairfax Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds, beneficiaries are usually required to submit a written document to the insurance company stating their intentions. The document should clearly state their decision to renounce or disclaim interest in the life insurance proceeds and may need to be notarized. It's important to note that seeking professional legal advice is recommended when considering renunciation or disclaimer of interest in life insurance proceeds in Fairfax, Virginia. An attorney specializing in estate planning or insurance law can guide individuals through the process, ensuring all legal requirements are met and the beneficiary's intentions are clearly stated. Overall, Fairfax Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds provide an avenue for beneficiaries to voluntarily waive their right to receive life insurance policy benefits. These legal documents help ensure a smooth and proper distribution of the proceeds according to the policy's terms or the beneficiary's alternate designation.