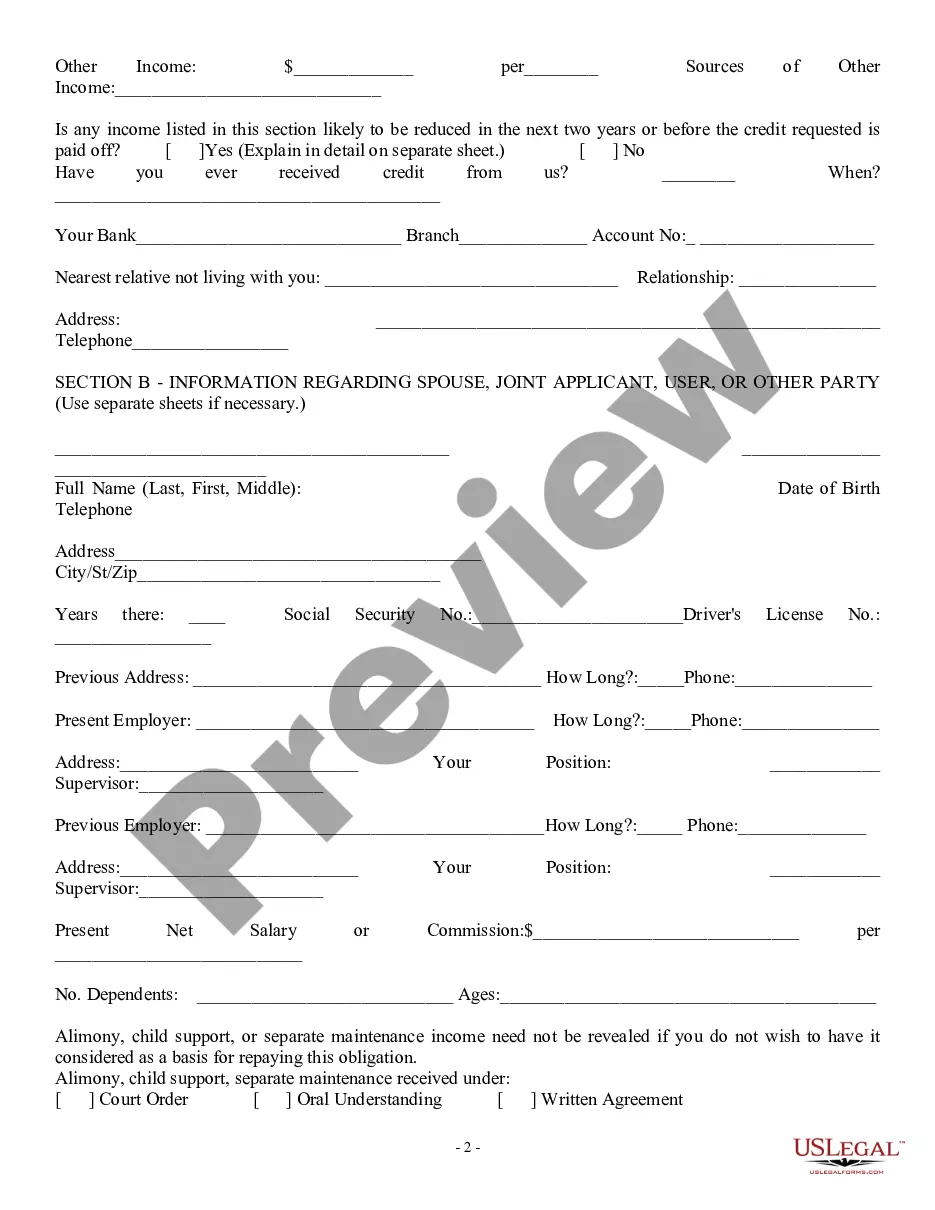

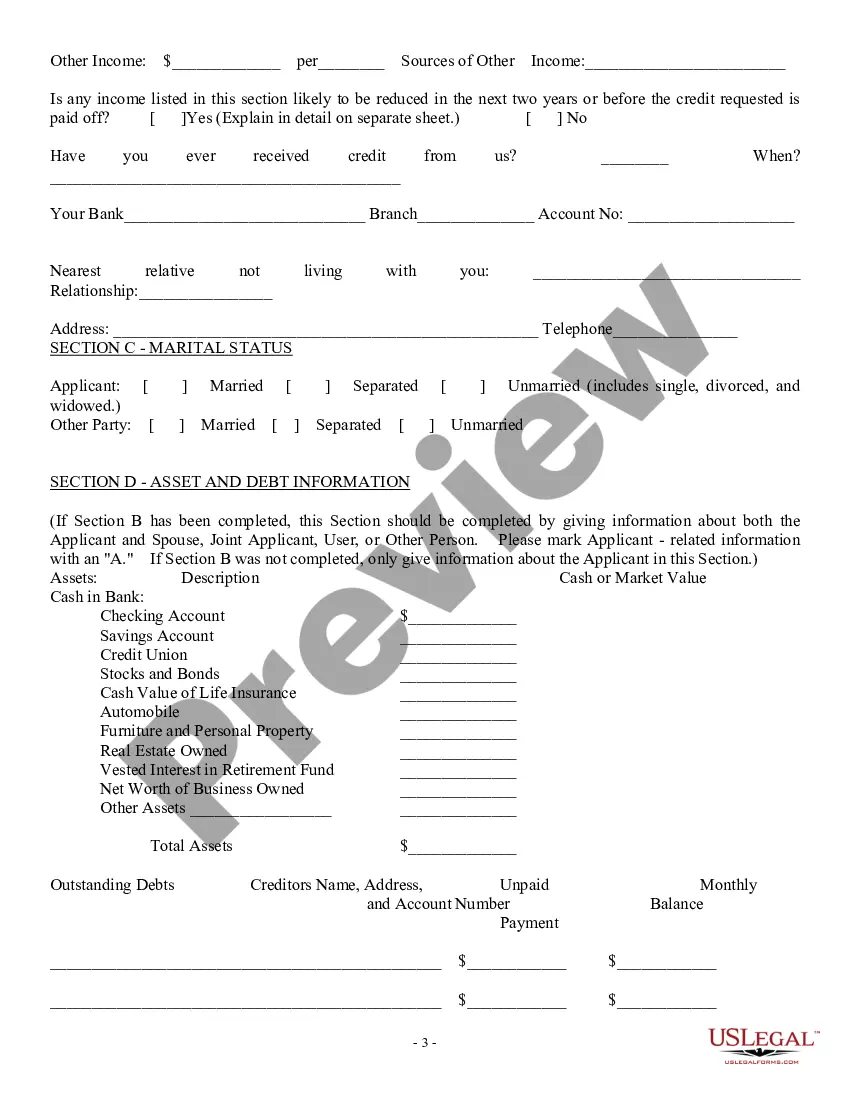

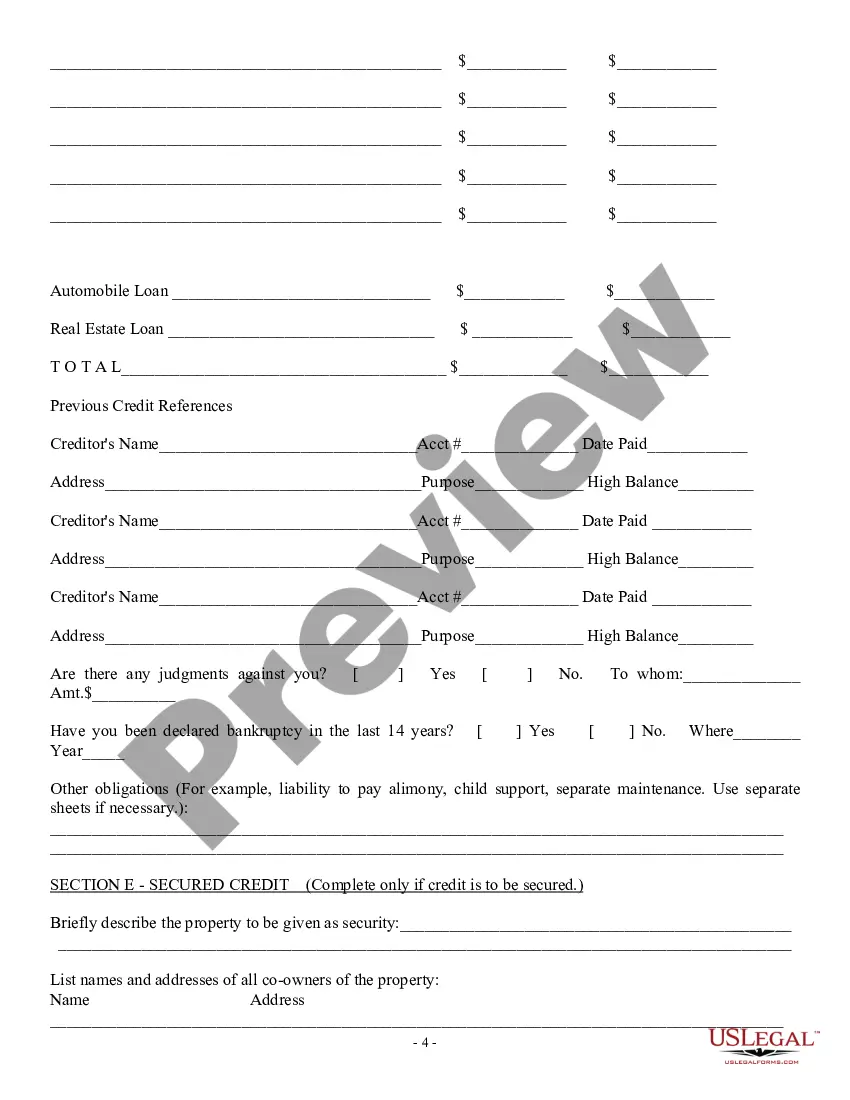

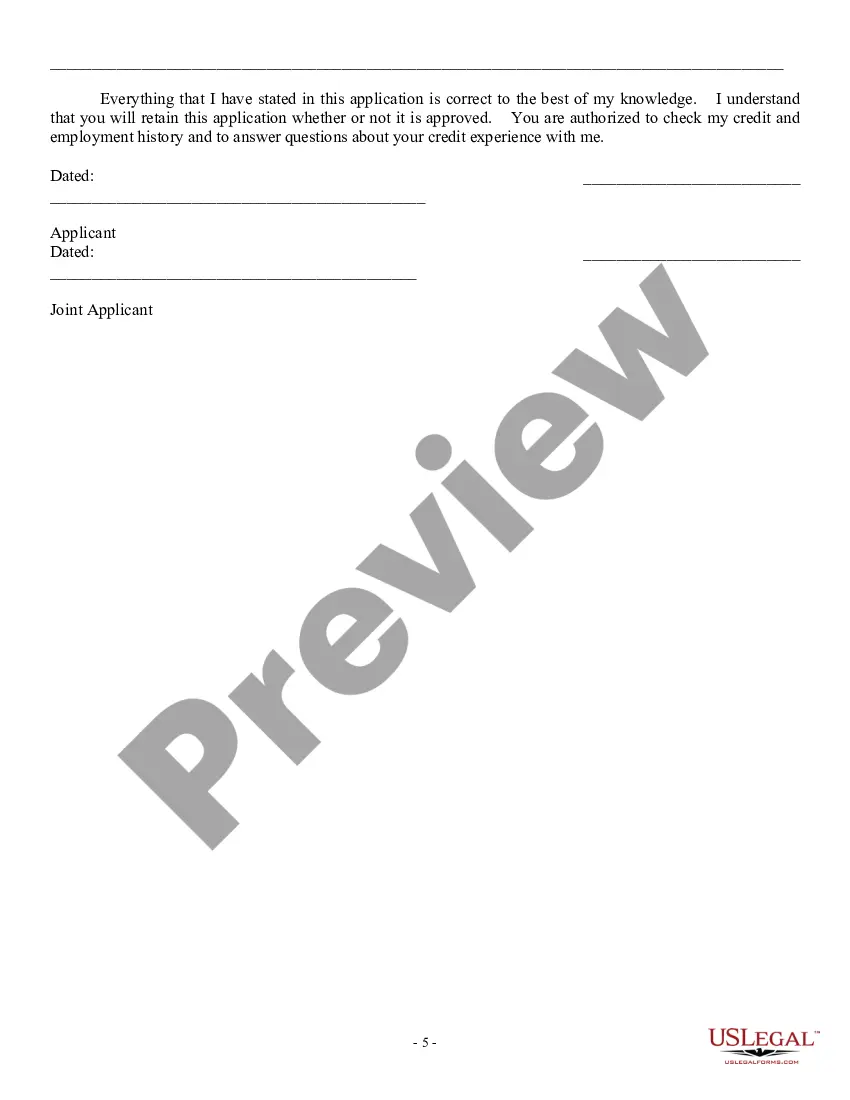

Introduction: An Oakland Michigan consumer loan application is a formal document used by individuals in Oakland, Michigan, seeking financial assistance through a personal loan. This comprehensive agreement outlines the terms, conditions, and responsibilities of both the lender and borrower. It serves as a legally binding contract that governs the lending and repayment process. Keywords: Oakland Michigan, consumer loan application, personal loan agreement, terms, conditions, lender, borrower, repayment process. 1. Purpose of the Oakland Michigan Consumer Loan Application — Personal Loan Agreement: The Oakland Michigan consumer loan application — personal loan agreement is specifically designed to facilitate the lending and borrowing process between a financial institution and an individual residing in Oakland, Michigan. It lays down the framework for obtaining funds for various personal needs while ensuring clear expectations and obligations for both parties. Keywords: facilitate, lending, borrowing process, financial institution, personal needs. 2. Key Components of the Oakland Michigan Consumer Loan Application — Personal Loan Agreement: The Oakland Michigan consumer loan application — personal loan agreement includes several crucial sections to protect both the lender's and borrower's interests. These may include: a. Borrower Information: The application requests detailed personal information from the borrower, such as name, address, contact details, employment history, and social security number. b. Loan Details: This section outlines the loan amount, interest rate, repayment schedule, and any additional fees associated with the loan. c. Terms and Conditions: The agreement specifies the terms under which both parties agree to enter into the loan arrangement, including late payment penalties, default consequences, and dispute resolution procedures. d. Collateral (if applicable): If the loan requires collateral, such as a vehicle or property, the terms of its assessment, value, and potential repossession are outlined in this section. e. Signatures: Both the borrower and lender must sign the agreement to acknowledge their understanding and acceptance of the terms. Keywords: components, borrower information, loan details, terms, conditions, collateral, signatures. Types of Oakland Michigan Consumer Loan Application — Personal Loan Agreement: 1. Secured Personal Loan Agreement: This type of personal loan agreement requires borrowers to provide collateral as security against the loan. It may be in the form of real estate, vehicles, or other valuable assets. In case of default, the lender can seize and sell the collateral to recover the outstanding debt. Keywords: secured personal loan agreement, collateral, default, outstanding debt. 2. Unsecured Personal Loan Agreement: Unlike secured loans, unsecured personal loan agreements do not require collateral. Borrowers can obtain funds based solely on their creditworthiness and income. However, as there is no collateral, lenders may charge higher interest rates to mitigate the risk. Keywords: unsecured personal loan agreement, creditworthiness, income, interest rates, risk. 3. Fixed-Rate Personal Loan Agreement: In a fixed-rate personal loan agreement, the interest rate remains constant throughout the loan's duration. This ensures a predictable payment structure, allowing borrowers to budget and plan their repayments effectively. Keywords: fixed-rate personal loan agreement, interest rate, constant, predictable payment structure, budget. 4. Variable-Rate Personal Loan Agreement: Contrarily, a variable-rate personal loan agreement has an interest rate that fluctuates over time. It is typically tied to an index or reference rate and may vary based on market conditions. Borrowers must be prepared for potential interest rate changes during the loan term. Keywords: variable-rate personal loan agreement, interest rate, fluctuates, index, market conditions. Conclusion: An Oakland Michigan consumer loan application, in the form of a personal loan agreement, serves as a contract governing the lending and repayment process between a financial institution and an individual borrower. It outlines terms, conditions, and responsibilities, ensuring a clear understanding of the agreement for both parties involved. Various types of personal loan agreements are available, including secured, unsecured, fixed-rate, and variable-rate options, catering to the diverse needs and circumstances of Oakland, Michigan residents. Keywords: contract, lending, repayment process, terms, conditions, responsibilities, secured, unsecured, fixed-rate, variable-rate.

Oakland Michigan Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Oakland Michigan Consumer Loan Application - Personal Loan Agreement?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Oakland Consumer Loan Application - Personal Loan Agreement suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the Oakland Consumer Loan Application - Personal Loan Agreement, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Oakland Consumer Loan Application - Personal Loan Agreement:

- Check the content of the page you’re on.

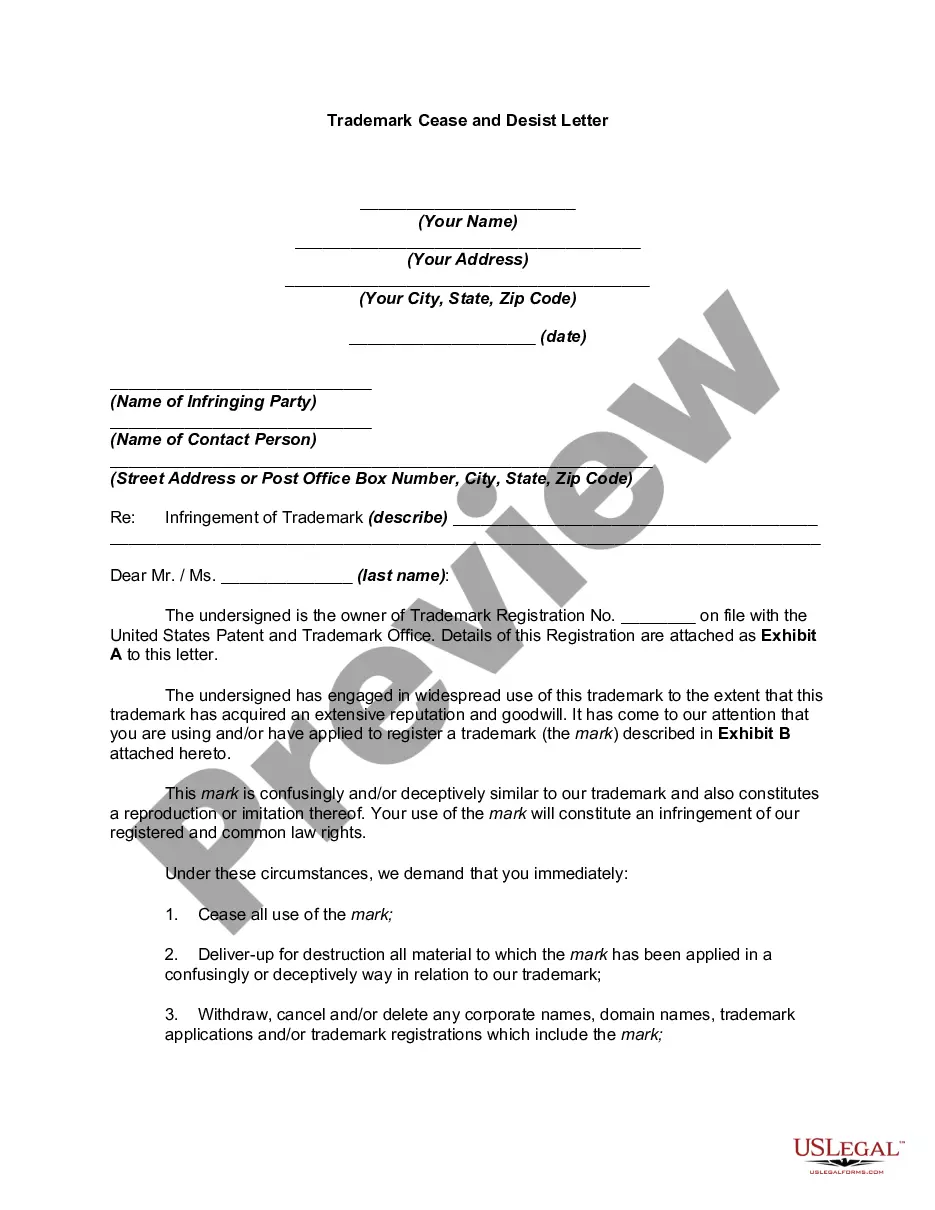

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Oakland Consumer Loan Application - Personal Loan Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!