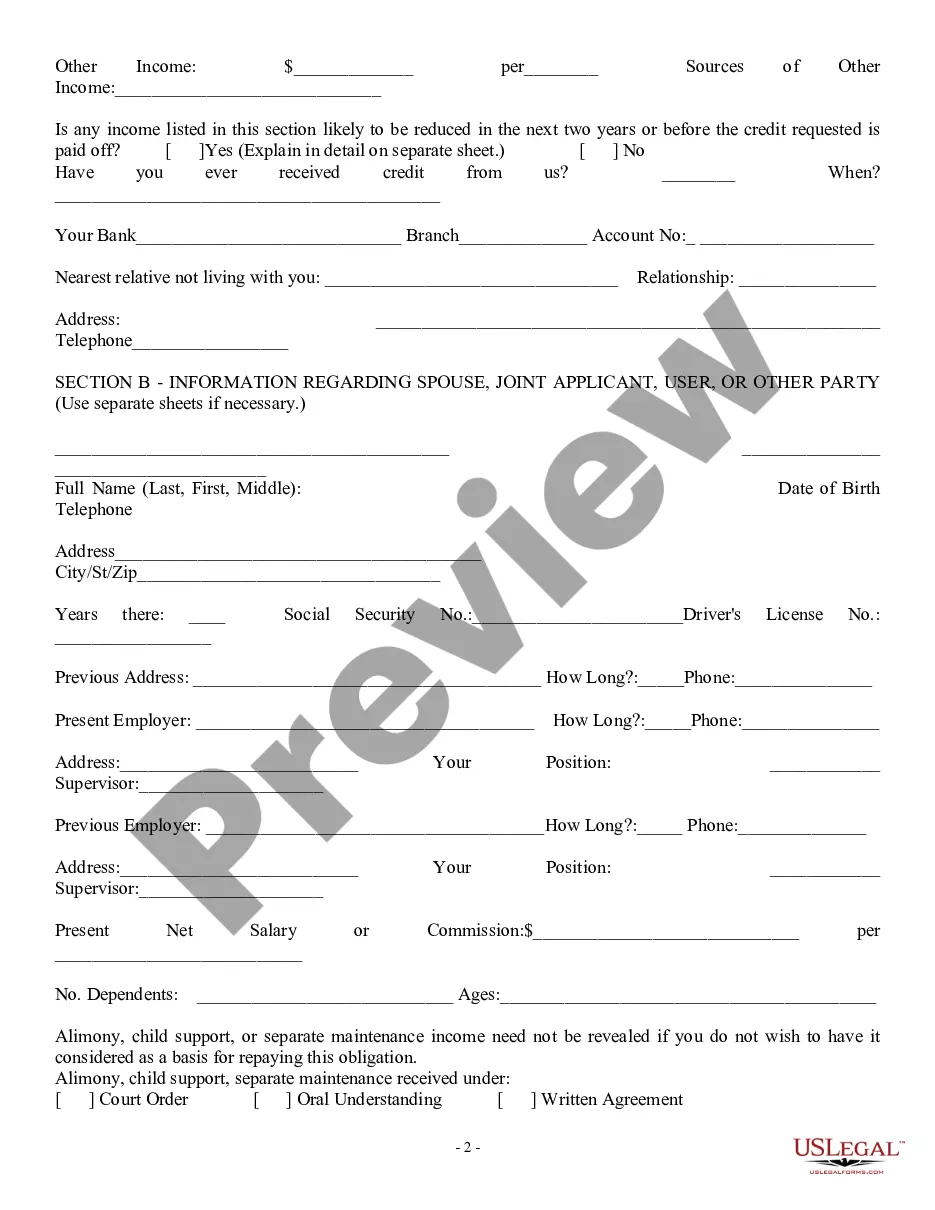

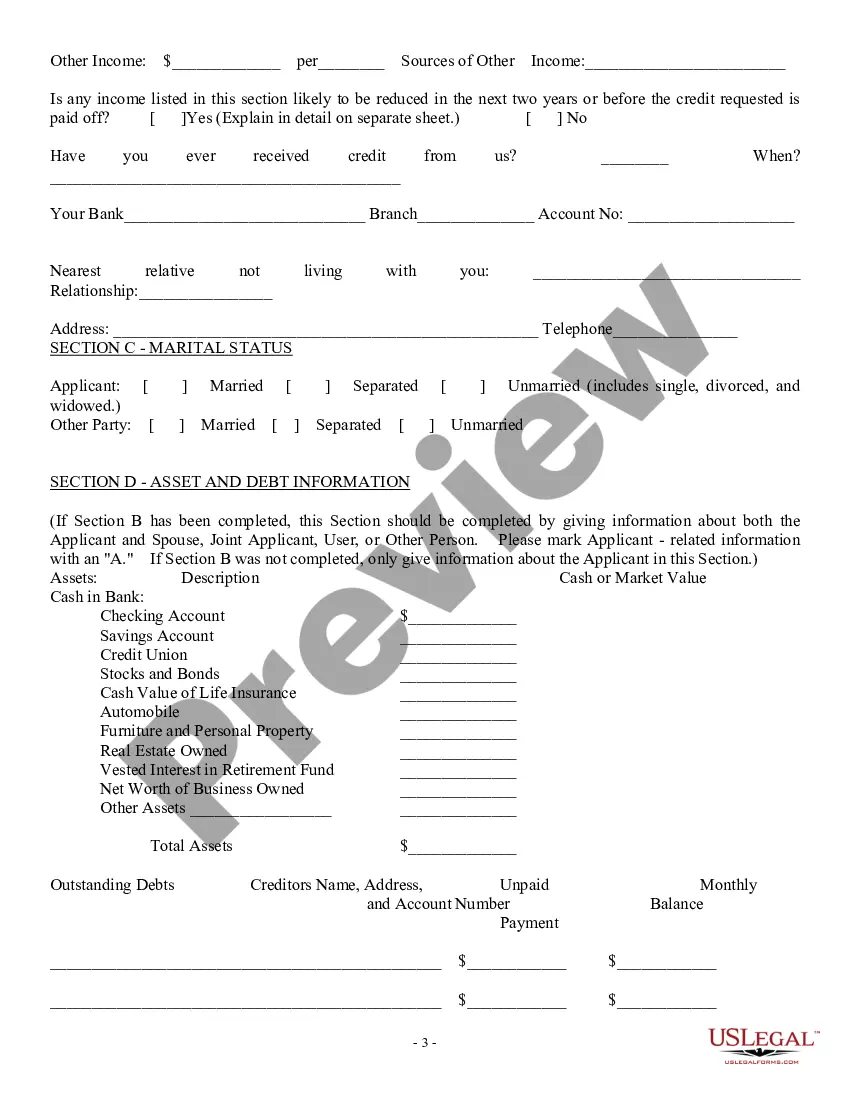

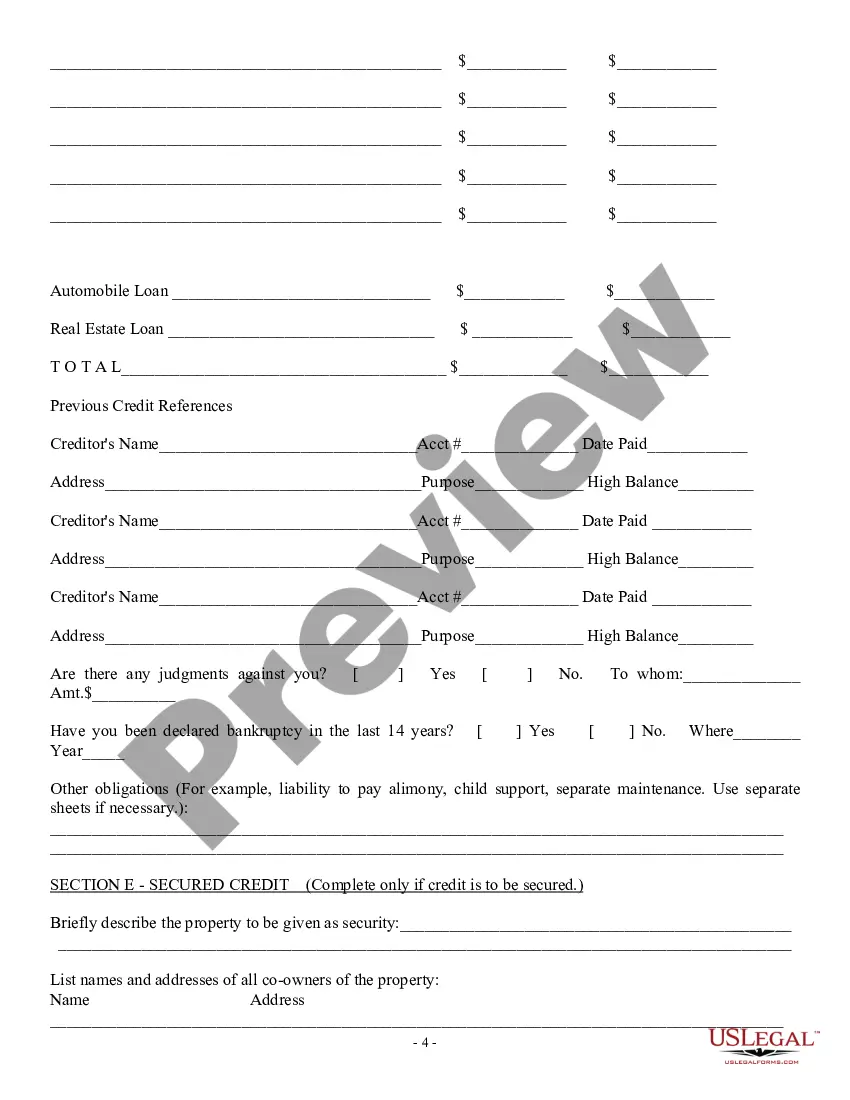

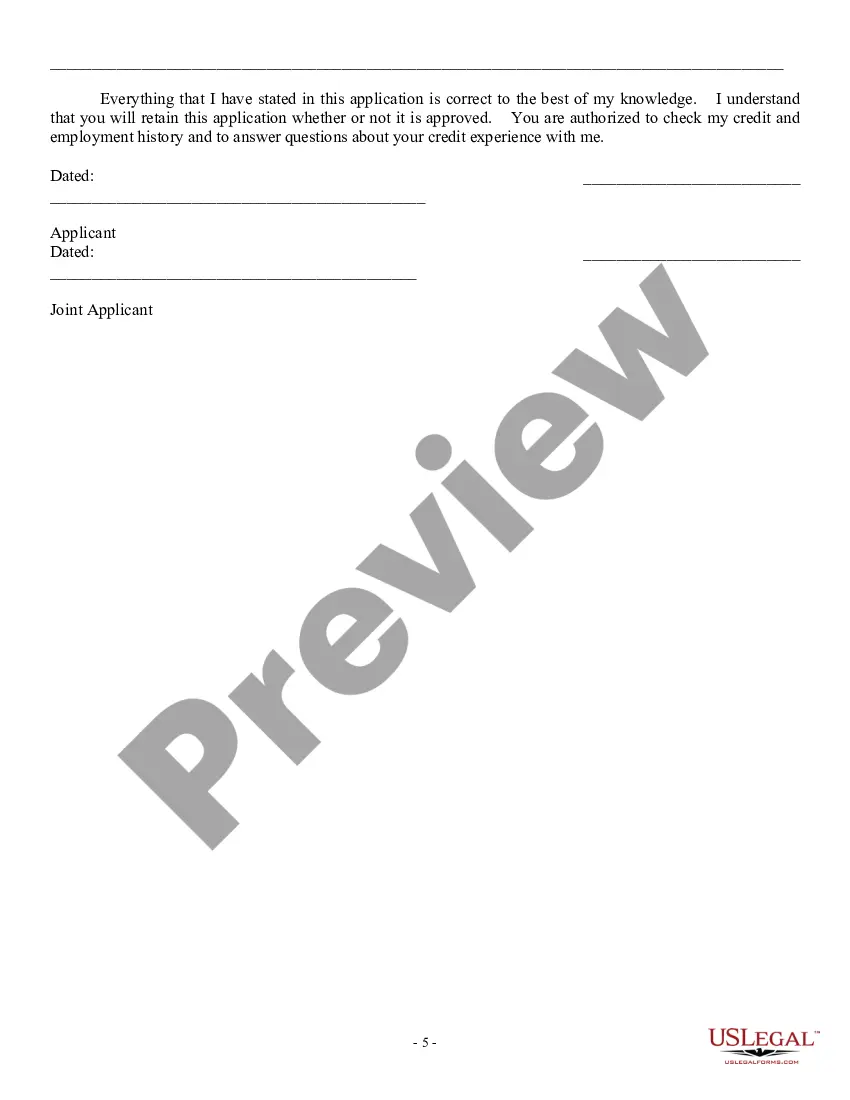

San Diego California Consumer Loan Application — Personal Loan Agreement is a legal document that outlines the terms and conditions between a lender and a borrower when applying for a personal loan in San Diego, California. This agreement incorporates all the essential information regarding the loan application process, including the borrower's personal details, loan amount, interest rate, repayment terms, and any associated fees or penalties. The San Diego California Consumer Loan Application — Personal Loan Agreement is designed to protect both parties involved in the lending process. It helps ensure transparency and clarity in the loan transaction while safeguarding the rights and responsibilities of the borrower and the lender. By signing this agreement, the borrower acknowledges that they understand the terms and conditions of the loan and agree to abide by them. There can be different types of San Diego California Consumer Loan Application — Personal Loan Agreements depending on the specific requirements or nature of the personal loan. Some common variations include: 1. Unsecured Personal Loan Agreement: This type of agreement applies when the borrower does not provide any collateral to secure the loan. Instead, the lender relies on the borrower's creditworthiness to determine the terms of the loan. 2. Secured Personal Loan Agreement: In this agreement, the borrower pledges collateral, such as a vehicle or property, as security for the loan. This provides the lender with an added layer of protection in case the borrower defaults on the loan. 3. Fixed-Rate Personal Loan Agreement: This agreement specifies a fixed interest rate for the duration of the loan. It ensures that the borrower's monthly payments remain constant throughout the repayment period, providing predictability and ease of budgeting. 4. Variable-Rate Personal Loan Agreement: Unlike a fixed-rate agreement, this type of agreement allows the interest rate to fluctuate over time, based on market conditions or other predetermined factors. The borrower's monthly payments may vary, making it important for them to understand the potential risks associated with interest rate changes. 5. Payday Loan Agreement: This agreement typically pertains to short-term loans with high-interest rates that are intended to be repaid by the borrower's next paycheck. The loan amount is often limited, and the agreement may include specific provisions related to repayment deadlines and consequences of nonpayment. In conclusion, the San Diego California Consumer Loan Application — Personal Loan Agreement is a comprehensive legal document that outlines the terms and conditions for personal loans in San Diego, California. It assists in protecting the rights and interests of both the borrower and the lender. It's essential for borrowers to carefully read, understand, and seek legal advice if needed before signing this agreement to ensure complete comprehension and compliance.

San Diego California Consumer Loan Application - Personal Loan Agreement

Description

How to fill out San Diego California Consumer Loan Application - Personal Loan Agreement?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including San Diego Consumer Loan Application - Personal Loan Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any activities related to document execution simple.

Here's how to find and download San Diego Consumer Loan Application - Personal Loan Agreement.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar forms or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase San Diego Consumer Loan Application - Personal Loan Agreement.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate San Diego Consumer Loan Application - Personal Loan Agreement, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you have to cope with an exceptionally complicated situation, we recommend using the services of a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant documents effortlessly!