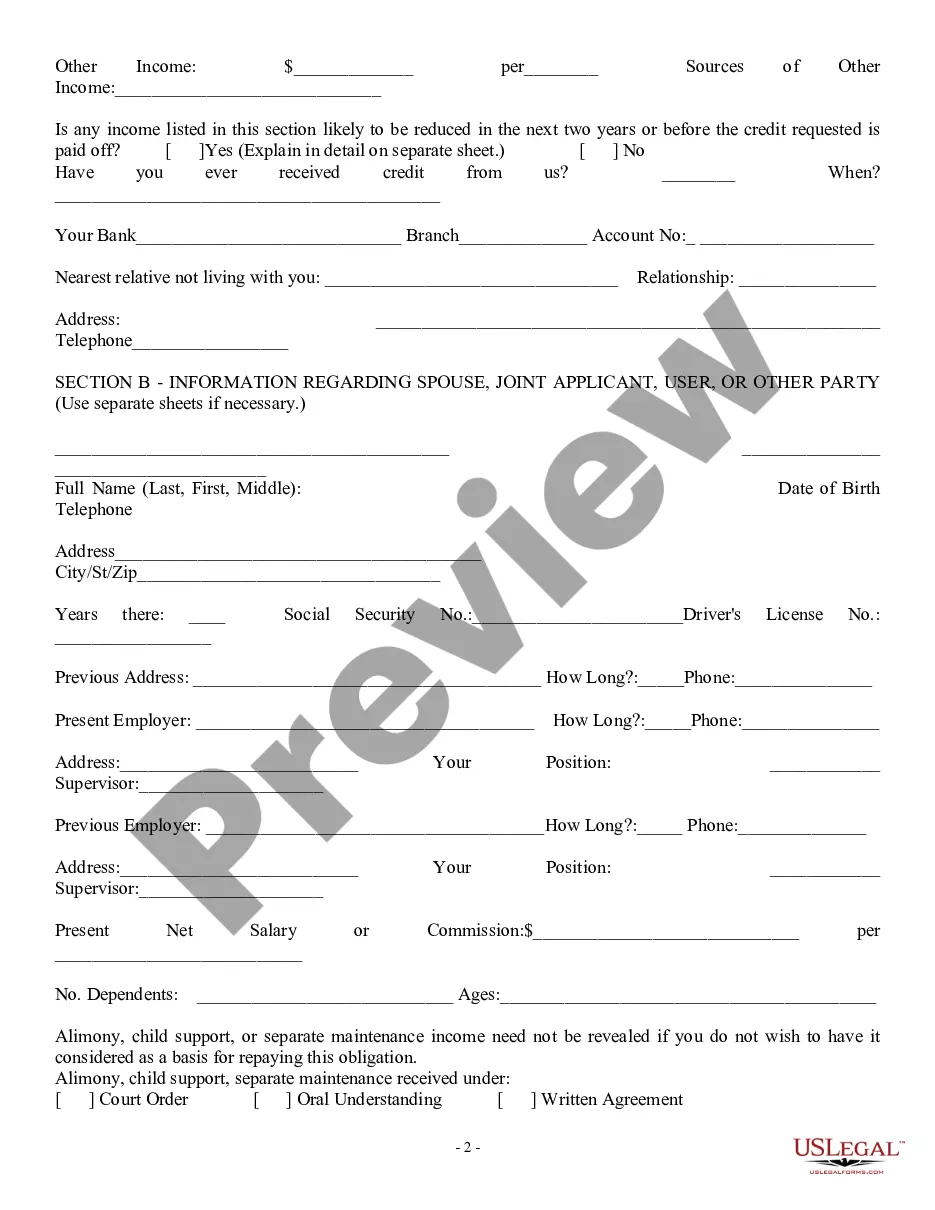

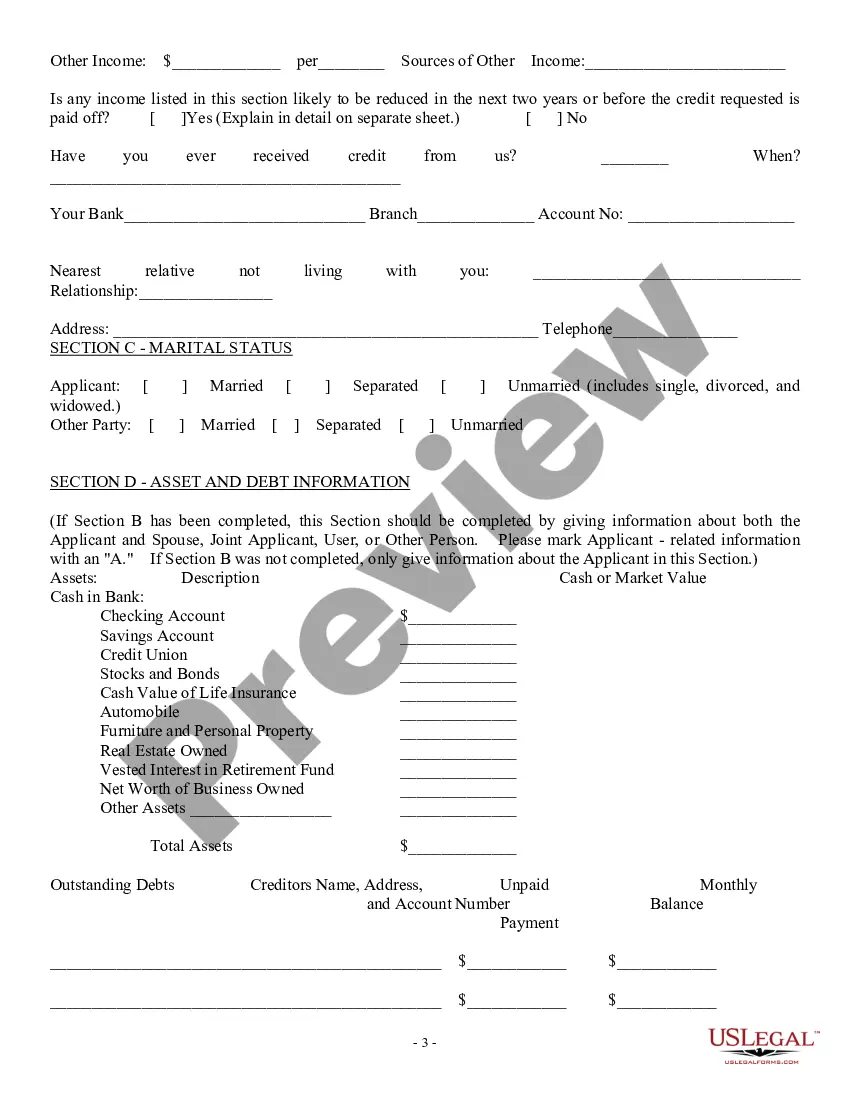

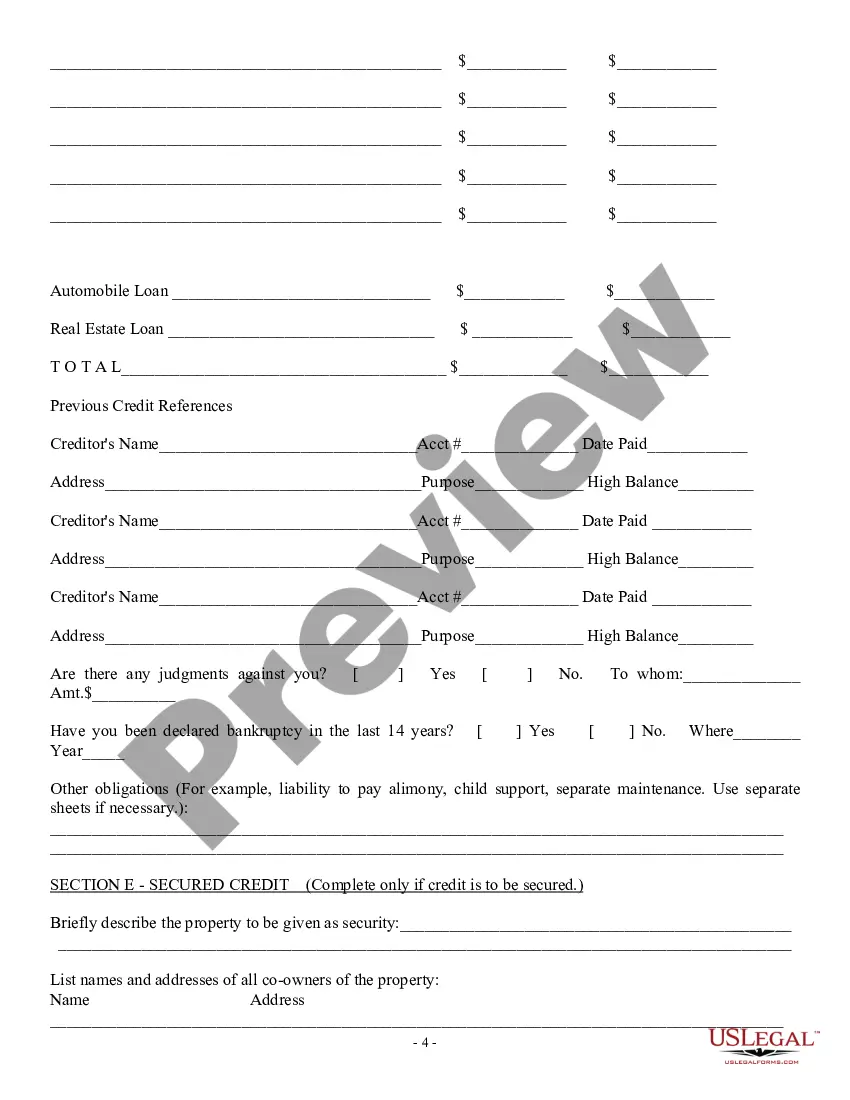

Wake North Carolina Consumer Loan Application — Personal Loan Agreement is a legal document that outlines the terms and conditions between a lender and a borrower when obtaining a personal loan. It serves as a binding agreement that governs the loan process, repayment terms, interest rates, and other essential details. This application is specifically designed for residents of Wake, North Carolina, looking to secure a personal loan. The form collects pertinent information from the borrower, such as personal details (name, address, contact information), employment information, income details, and the purpose of the loan. Keywords: Wake North Carolina, consumer loan application, personal loan agreement, legal document, terms and conditions, lender, borrower, personal loan, binding agreement, loan process, repayment terms, interest rates, residents, form, collect information, personal details, employment information, income details, loan purpose. There may be different types of Wake North Carolina Consumer Loan Application — Personal Loan Agreements, depending on various factors such as loan amount, loan type, and repayment terms. These agreements could include: 1. Fixed-Rate Personal Loan Agreement: This agreement specifies a fixed interest rate for the duration of the loan term. Borrowers benefit from stable monthly payments, making budgeting easier and predictable. 2. Variable-Rate Personal Loan Agreement: This agreement features an interest rate that fluctuates based on market conditions. Borrowers should carefully consider the potential risks and rewards associated with variable interest rates. 3. Secured Personal Loan Agreement: This agreement requires the borrower to provide collateral, such as a car or property. If the borrower fails to repay the loan, the lender has the right to seize the collateral as a form of repayment. 4. Unsecured Personal Loan Agreement: In this type of agreement, no collateral is required. However, interest rates may be higher since there is more risk for the lender. 5. Debt Consolidation Loan Agreement: This agreement is specifically for borrowers seeking to consolidate multiple debts into a single loan. It allows borrowers to simplify their financial obligations and potentially lower their overall interest rates. 6. Payday Loan Agreement: This agreement is for short-term, small-dollar loans to be repaid on the borrower's next payday. These loans typically have higher interest rates and fees, so borrowers should exercise caution when considering them. Keywords: fixed-rate loan agreement, variable-rate loan agreement, secured loan agreement, unsecured loan agreement, debt consolidation loan agreement, payday loan agreement, loan amount, loan type, repayment terms, collateral, interest rates, market conditions, financial obligations, short-term loan, small-dollar loan.

Wake North Carolina Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Wake North Carolina Consumer Loan Application - Personal Loan Agreement?

If you need to get a reliable legal paperwork provider to get the Wake Consumer Loan Application - Personal Loan Agreement, consider US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to find and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to search or browse Wake Consumer Loan Application - Personal Loan Agreement, either by a keyword or by the state/county the document is created for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Wake Consumer Loan Application - Personal Loan Agreement template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less costly and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Wake Consumer Loan Application - Personal Loan Agreement - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

The easiest loans to get approved for would probably be payday loans, car title loans, pawnshop loans, and personal installment loans. These are all short-term cash solutions for bad credit borrowers in need. Many of these options are designed to help borrowers who need fast cash in times of need.

Below are the stages that are critical components of Loan Origination process : Pre-Qualification Process : This is the first step in the Loan origination process.Loan Application : This is the second stage of the loan origination process.Application Processing :Underwriting Process :

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

The three stages of every loan are the application, underwriting and closing. Application. In the application phase, a loan officer will work with you directly to gather all information needed to prequalify your loan request.Underwriting Process.Loan Closing.

The most common types of consumer loans are mortgage, auto loan, education loan, personal loan, refinance loan, and credit card.

The main purpose of a loan contract is to define what the parties involved are agreeing to, what responsibilities each party has and for how long the agreement will last.

In a mortgage loan process, there are six phases: pre-approval, shopping for house, the mortgage application, processing the loan, underwriting and then the closing. Here's an in-depth explanation for each step.

A consumer credit agreement is an agreement under which credit is extended to an individual. Those agreements that are regulated agreements cover extensions of credit up to a statutory limit.

To get approved for a Woodforest National Bank personal loan, you will have to be at least 18 years old and a U.S. citizen or permanent resident with a Social Security number. It's not clear whether Woodforest National Bank has a minimum credit score for personal loan approval.

Compared to other types of loans, consumer loans are very small. They are repaid on an annuity basis, i.e. each month the borrower pays a portion of the credit and interest. Mortgage loans are regulated as defined in the Law on Real Estate Related Credit or the Law on Crowdfunding.