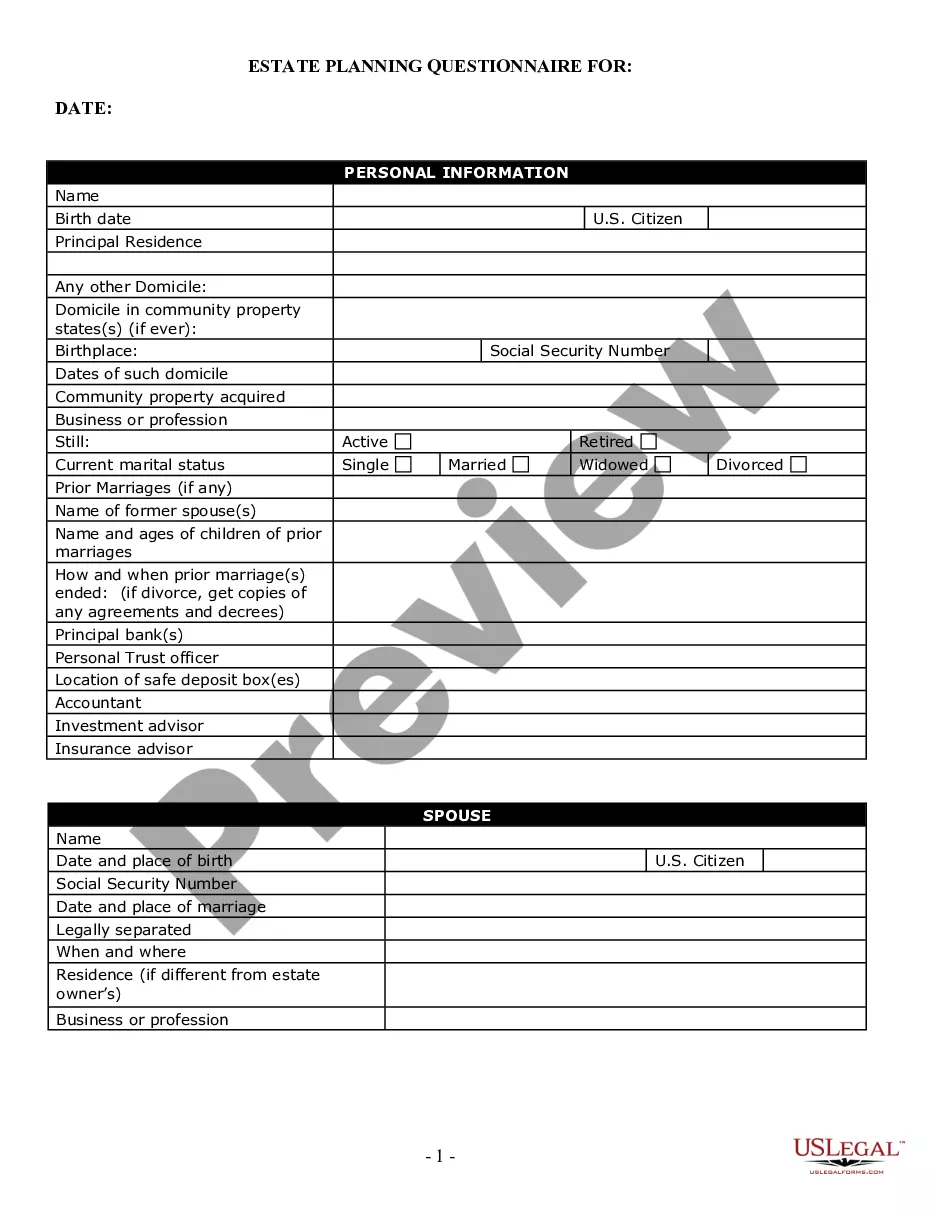

When looking to establish or expand a business in Philadelphia, Pennsylvania, it is crucial to understand the process and significance of the Philadelphia Pennsylvania Business Credit Application. This application serves as a formal request for credit extended to businesses by financial institutions within the region. By completing and submitting this application, businesses can access funds for various purposes, such as capital investments, operational expenses, or expansion projects. The Philadelphia Pennsylvania Business Credit Application encompasses a comprehensive set of paperwork that requires to be detailed and accurate information about the applying business. It typically includes sections such as business background, financial statements, projections, business plan, owner information, and collateral or asset details. The application gathers crucial details about the company's financial health, creditworthiness, and ability to repay any potential debts. To successfully complete the Philadelphia Pennsylvania Business Credit Application, businesses need to provide information such as the legal name and structure of the enterprise, the nature of the business, industry, and market analysis, as well as past and projected financial statements, including income statements, balance sheets, and cash flow statements. Additionally, the application may require details about the business owners, including personal financial statements, credit history, and personal guarantees. These help financial institutions assess the creditworthiness of both the business and its owners. Furthermore, businesses may be required to offer collateral or describe the assets that can be used as security for the credit requested. While there are no distinct types of Philadelphia Pennsylvania Business Credit Applications, varying financial institutions may have their unique application formats or additional requirements. It is crucial for businesses to carefully review the precise application details of each financial institution to ensure compliance and maximize their chances of obtaining credit. Some relevant keywords associated with the Philadelphia Pennsylvania Business Credit Application include "business credit application process," "Philadelphia business funding," "financial institutions in Philadelphia," "creditworthiness assessment," "collateral requirements," "owner guarantee," "financial statements," and "business plan." By utilizing these keywords effectively, businesses can navigate the application process more efficiently and enhance their chances of securing the necessary credit to thrive in Philadelphia, Pennsylvania.

Philadelphia Pennsylvania Business Credit Application

Description

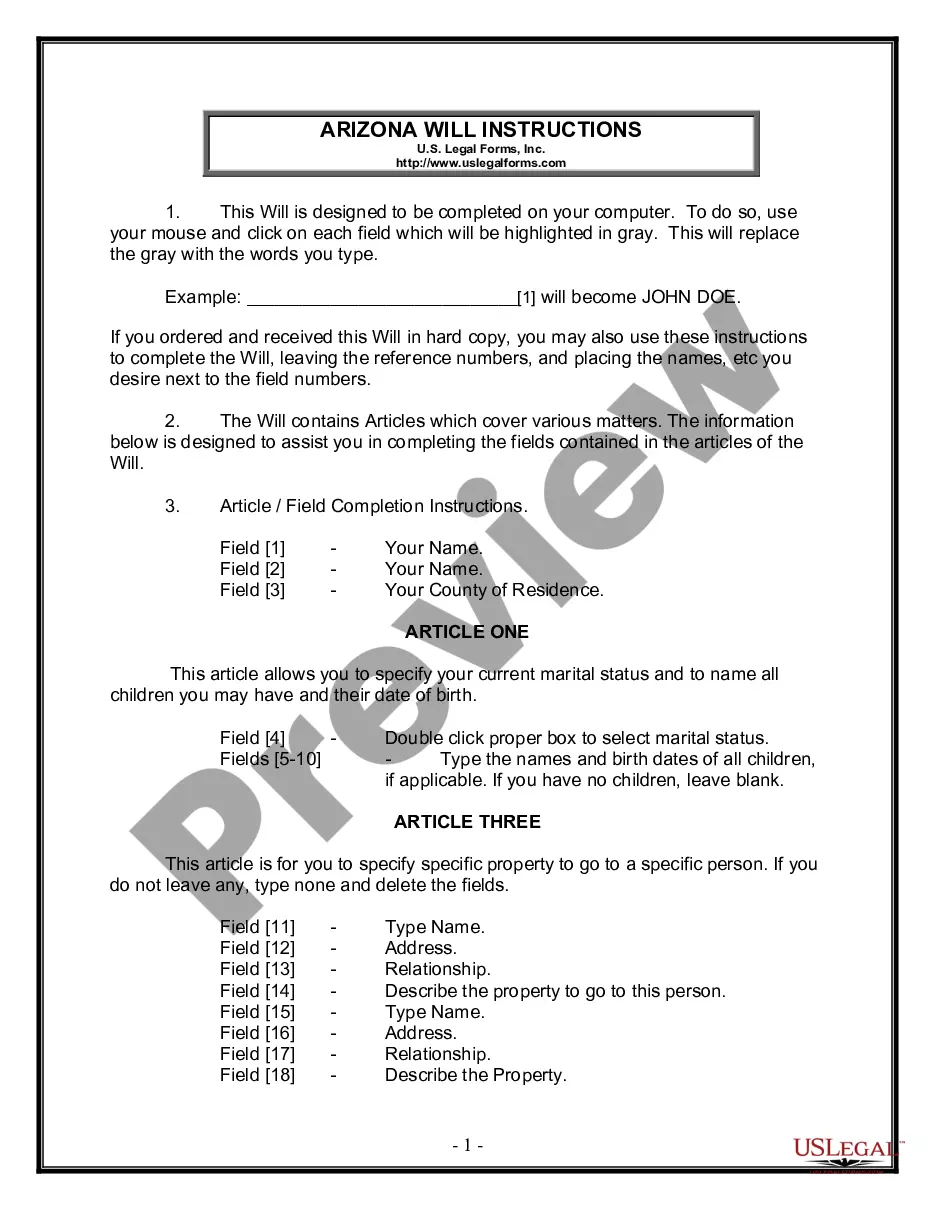

How to fill out Philadelphia Pennsylvania Business Credit Application?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Philadelphia Business Credit Application is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to obtain the Philadelphia Business Credit Application. Follow the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia Business Credit Application in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!