A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships.

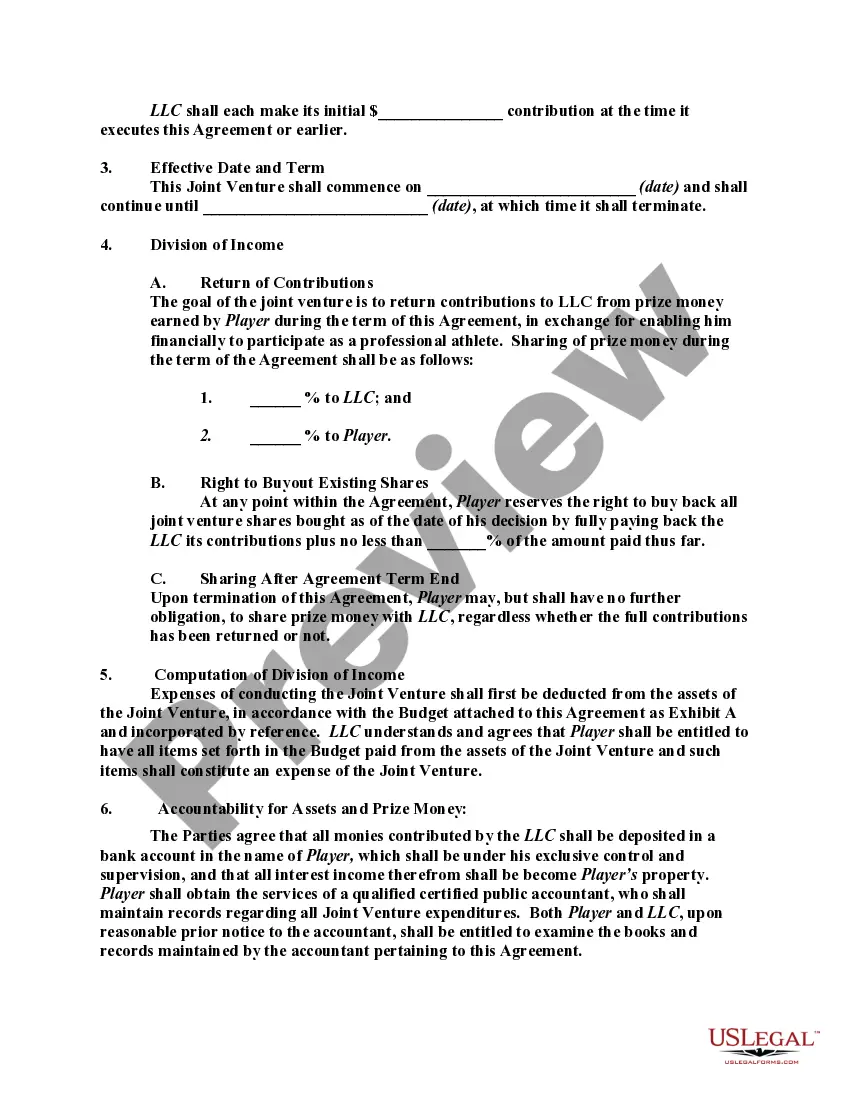

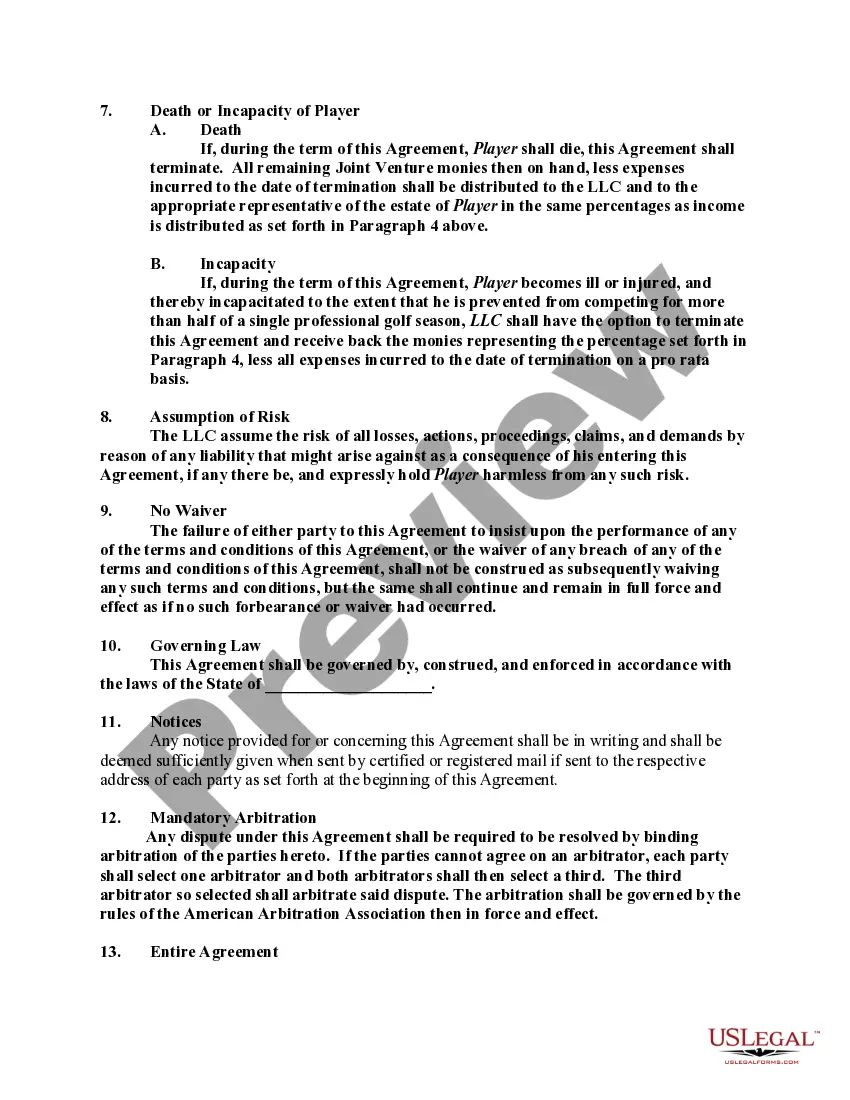

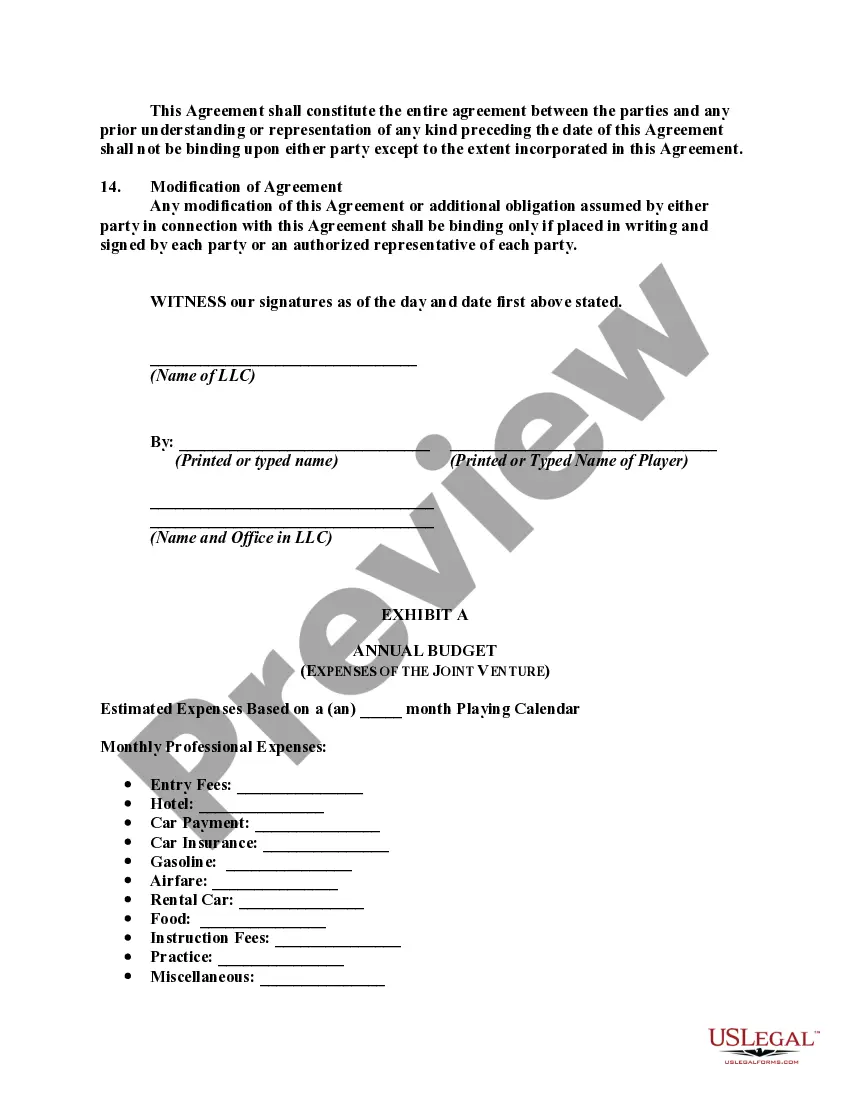

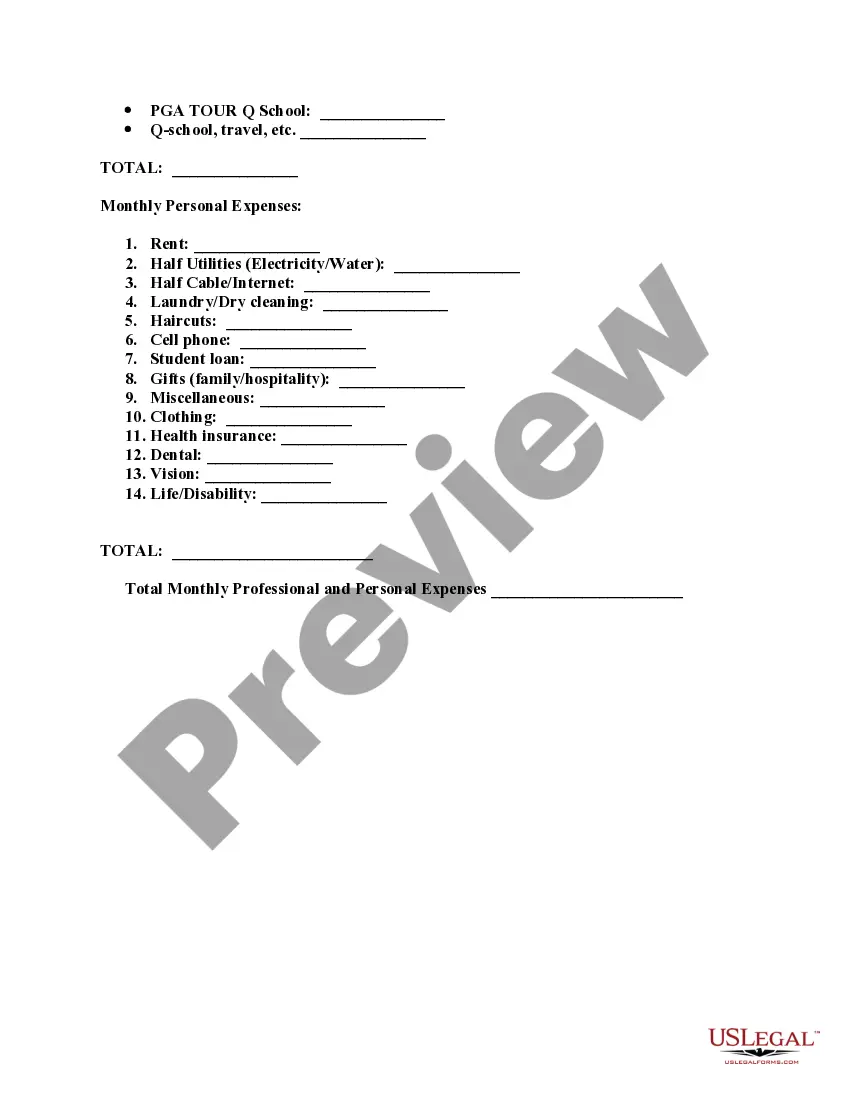

Phoenix Arizona Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds Keywords: Phoenix Arizona, joint venture agreement, limited liability company, professional golfer, sponsor, provide funds Introduction: A Phoenix Arizona Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer is a legal contract that outlines the terms and conditions for a collaborative business venture between the LLC and the golfer. This agreement establishes a partnership where the LLC sponsors and provides financial support to the professional golfer in exchange for certain benefits and shared profits. Types of Phoenix Arizona Joint Venture Agreements between an LLC and a Professional Golfer: 1. Sponsorship Joint Venture Agreement: In this type of agreement, the LLC becomes the sponsor or financial backer of the professional golfer. The golfer agrees to promote the LLC's brand or products and represent the company in various golf tournaments or events. The LLC provides financial backing for the golfer's training, travel expenses, equipment, and other related costs in return for advertising and exposure opportunities. 2. Profit-sharing Joint Venture Agreement: This agreement focuses on sharing the profits generated by the professional golfer's performance and endorsements. The LLC invests funds in the golfer's career, such as covering tournament fees, training, and marketing expenses. In return, both parties agree to split the income generated from prize money, sponsorships, appearance fees, and other related revenues. 3. Development Joint Venture Agreement: This type of agreement involves the LLC providing developmental support to the professional golfer, aiming to enhance their skills and career growth. The LLC may offer coaching, training facilities, expert guidance, and financial backing for professional development. In return, the golfer commits to representing the LLC's brand and contributing to its promotion. Key Elements of a Phoenix Arizona Joint Venture Agreement: 1. Parties Involved: Clearly identify the LLC and the professional golfer, including their legal names, addresses, and any relevant professional affiliations. 2. Purpose and Scope: Describe the purpose of the joint venture, including the specific goals, objectives, and activities. Outline the geographical scope of the venture, focusing on Phoenix, Arizona, and its surrounding areas. 3. Financial Responsibilities: Detail the financial obligations of the LLC concerning the sponsorship and funding provided to the golfer. Specify the agreed-upon financial terms, such as the amount, frequency, and method of fund disbursement. 4. Ownership and Profit-sharing: Define how the profits generated from the joint venture will be distributed between the LLC and the professional golfer. Include provisions for how costs, expenses, and revenues will be accounted for and shared. 5. Rights and Obligations: Establish the rights and obligations of both parties, outlining the golfer's responsibilities for promoting the LLC's brand and participating in tournaments or events as agreed upon. Address legal and compliance issues, confidentiality, and non-compete clauses, if applicable. 6. Termination: Specify the conditions under which either party can terminate the joint venture agreement, including breach of contract, mutual agreement, or completion of the agreed-upon objectives. Conclusion: A Phoenix Arizona Joint Venture Agreement between a Limited Liability Company and Professional Golfer is a legally binding contract that ensures a mutually beneficial partnership. It symbolizes the collaborative effort between the LLC and the professional golfer, combining financial support and promotional activities for shared success in the golf industry.Phoenix Arizona Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds Keywords: Phoenix Arizona, joint venture agreement, limited liability company, professional golfer, sponsor, provide funds Introduction: A Phoenix Arizona Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer is a legal contract that outlines the terms and conditions for a collaborative business venture between the LLC and the golfer. This agreement establishes a partnership where the LLC sponsors and provides financial support to the professional golfer in exchange for certain benefits and shared profits. Types of Phoenix Arizona Joint Venture Agreements between an LLC and a Professional Golfer: 1. Sponsorship Joint Venture Agreement: In this type of agreement, the LLC becomes the sponsor or financial backer of the professional golfer. The golfer agrees to promote the LLC's brand or products and represent the company in various golf tournaments or events. The LLC provides financial backing for the golfer's training, travel expenses, equipment, and other related costs in return for advertising and exposure opportunities. 2. Profit-sharing Joint Venture Agreement: This agreement focuses on sharing the profits generated by the professional golfer's performance and endorsements. The LLC invests funds in the golfer's career, such as covering tournament fees, training, and marketing expenses. In return, both parties agree to split the income generated from prize money, sponsorships, appearance fees, and other related revenues. 3. Development Joint Venture Agreement: This type of agreement involves the LLC providing developmental support to the professional golfer, aiming to enhance their skills and career growth. The LLC may offer coaching, training facilities, expert guidance, and financial backing for professional development. In return, the golfer commits to representing the LLC's brand and contributing to its promotion. Key Elements of a Phoenix Arizona Joint Venture Agreement: 1. Parties Involved: Clearly identify the LLC and the professional golfer, including their legal names, addresses, and any relevant professional affiliations. 2. Purpose and Scope: Describe the purpose of the joint venture, including the specific goals, objectives, and activities. Outline the geographical scope of the venture, focusing on Phoenix, Arizona, and its surrounding areas. 3. Financial Responsibilities: Detail the financial obligations of the LLC concerning the sponsorship and funding provided to the golfer. Specify the agreed-upon financial terms, such as the amount, frequency, and method of fund disbursement. 4. Ownership and Profit-sharing: Define how the profits generated from the joint venture will be distributed between the LLC and the professional golfer. Include provisions for how costs, expenses, and revenues will be accounted for and shared. 5. Rights and Obligations: Establish the rights and obligations of both parties, outlining the golfer's responsibilities for promoting the LLC's brand and participating in tournaments or events as agreed upon. Address legal and compliance issues, confidentiality, and non-compete clauses, if applicable. 6. Termination: Specify the conditions under which either party can terminate the joint venture agreement, including breach of contract, mutual agreement, or completion of the agreed-upon objectives. Conclusion: A Phoenix Arizona Joint Venture Agreement between a Limited Liability Company and Professional Golfer is a legally binding contract that ensures a mutually beneficial partnership. It symbolizes the collaborative effort between the LLC and the professional golfer, combining financial support and promotional activities for shared success in the golf industry.