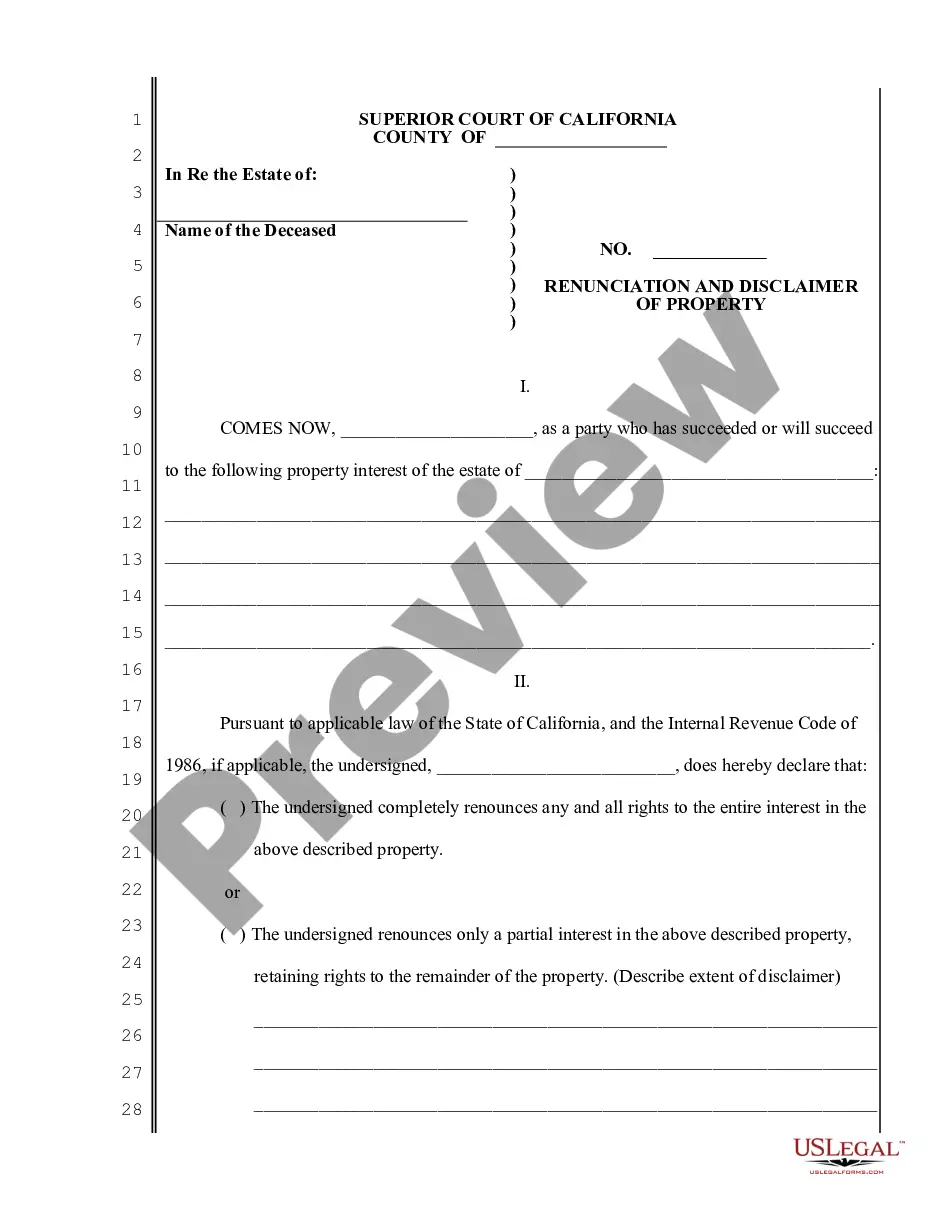

Miami-Dade County is a vibrant and diverse region located in the southeastern part of Florida, known for its stunning beaches, world-class entertainment, and bustling economic activity. When it comes to financial reporting, Miami-Dade Florida Cash Flow Statement plays a crucial role in assessing the financial health of the county. A Cash Flow Statement is a financial document that tracks the inflow and outflow of cash within a specific period. It provides valuable insights into how Miami-Dade County manages its financial resources and helps stakeholders, such as investors, creditors, and government agencies, make informed decisions. The Cash Flow Statement includes three main sections: operating activities, investing activities, and financing activities. Each section focuses on different aspects of cash flow to provide a comprehensive view of how Miami-Dade County generates and utilizes its funds. 1. Operating Activities: This section reflects the cash flow generated or used by Miami-Dade County from its primary operations. It includes cash receipts from taxes, fees, fines, grants, and other revenue sources. Additionally, it considers cash payments for employee salaries, utility bills, vendor payments, and other day-to-day expenses related to running the county services. 2. Investing Activities: This section accounts for cash flow resulting from Miami-Dade County's investments in assets and other ventures. It includes cash inflows from the sale or maturity of investments, such as bonds or stocks, as well as cash outflows for purchasing new capital assets, land, buildings, or investments in other entities. 3. Financing Activities: This section deals with cash flow related to Miami-Dade County's long-term financial obligations and capital structure. It includes cash inflows from issuing bonds, loans, or raising capital through other means. Conversely, cash outflows occur when the county repays its debt or distributes dividends to shareholders if applicable. By analyzing these three sections, stakeholders can assess Miami-Dade County's ability to generate cash from its operations, its investment decisions, and its financing capabilities. They can determine whether the county is generating sufficient cash to cover its expenses, whether it is investing wisely, and whether its financial structure is sustainable. Different types of Cash Flow Statements specific to Miami-Dade County include the Annual Cash Flow Statement, which provides a comprehensive overview of cash flow activities for a particular fiscal year. Additionally, there could be quarterly or monthly Cash Flow Statements that offer more frequent updates on the county's cash flow performance. In summary, the Miami-Dade Florida Cash Flow Statement is a crucial financial document that provides insights into how the county manages its cash flow. It helps stakeholders understand the financial health, investment decisions, and funding strategies of Miami-Dade County, facilitating well-informed decision-making within the region.

Miami-Dade Florida Cash Flow Statement

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-01716-AZ

Format:

Word;

Rich Text

Instant download

Description

This cash flow statement shows incoming and outgoing income and expenses of a typical household. Good for budgeting purposes. Adapt to your needs.

Miami-Dade County is a vibrant and diverse region located in the southeastern part of Florida, known for its stunning beaches, world-class entertainment, and bustling economic activity. When it comes to financial reporting, Miami-Dade Florida Cash Flow Statement plays a crucial role in assessing the financial health of the county. A Cash Flow Statement is a financial document that tracks the inflow and outflow of cash within a specific period. It provides valuable insights into how Miami-Dade County manages its financial resources and helps stakeholders, such as investors, creditors, and government agencies, make informed decisions. The Cash Flow Statement includes three main sections: operating activities, investing activities, and financing activities. Each section focuses on different aspects of cash flow to provide a comprehensive view of how Miami-Dade County generates and utilizes its funds. 1. Operating Activities: This section reflects the cash flow generated or used by Miami-Dade County from its primary operations. It includes cash receipts from taxes, fees, fines, grants, and other revenue sources. Additionally, it considers cash payments for employee salaries, utility bills, vendor payments, and other day-to-day expenses related to running the county services. 2. Investing Activities: This section accounts for cash flow resulting from Miami-Dade County's investments in assets and other ventures. It includes cash inflows from the sale or maturity of investments, such as bonds or stocks, as well as cash outflows for purchasing new capital assets, land, buildings, or investments in other entities. 3. Financing Activities: This section deals with cash flow related to Miami-Dade County's long-term financial obligations and capital structure. It includes cash inflows from issuing bonds, loans, or raising capital through other means. Conversely, cash outflows occur when the county repays its debt or distributes dividends to shareholders if applicable. By analyzing these three sections, stakeholders can assess Miami-Dade County's ability to generate cash from its operations, its investment decisions, and its financing capabilities. They can determine whether the county is generating sufficient cash to cover its expenses, whether it is investing wisely, and whether its financial structure is sustainable. Different types of Cash Flow Statements specific to Miami-Dade County include the Annual Cash Flow Statement, which provides a comprehensive overview of cash flow activities for a particular fiscal year. Additionally, there could be quarterly or monthly Cash Flow Statements that offer more frequent updates on the county's cash flow performance. In summary, the Miami-Dade Florida Cash Flow Statement is a crucial financial document that provides insights into how the county manages its cash flow. It helps stakeholders understand the financial health, investment decisions, and funding strategies of Miami-Dade County, facilitating well-informed decision-making within the region.