Nassau New York Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

Laws and guidelines in every domain differ from one jurisdiction to another. If you're not an attorney, it’s simple to become disoriented in a myriad of rules when it comes to creating legal documents.

To prevent expensive legal fees when preparing the Nassau Retirement Cash Flow, you require a validated template applicable to your county. That’s when utilizing the US Legal Forms platform proves to be incredibly beneficial.

US Legal Forms is a reliable online repository trusted by millions, offering over 85,000 state-specific legal templates. It serves as an exceptional resource for professionals and individuals seeking do-it-yourself templates for various life and business situations.

Complete and sign the document in writing after you print it, or conduct the entire process electronically. This is the easiest and most cost-efficient way to obtain current templates for any legal requirements. Find them all with just a few clicks and maintain your documentation accurately with US Legal Forms!

- All the forms can be utilized repeatedly: once you obtain a template, it stays accessible in your profile for future reference.

- Thus, if you hold an account with an active subscription, you can simply Log In and re-download the Nassau Retirement Cash Flow from the My documents section.

- For first-time users, a few additional steps are needed to access the Nassau Retirement Cash Flow.

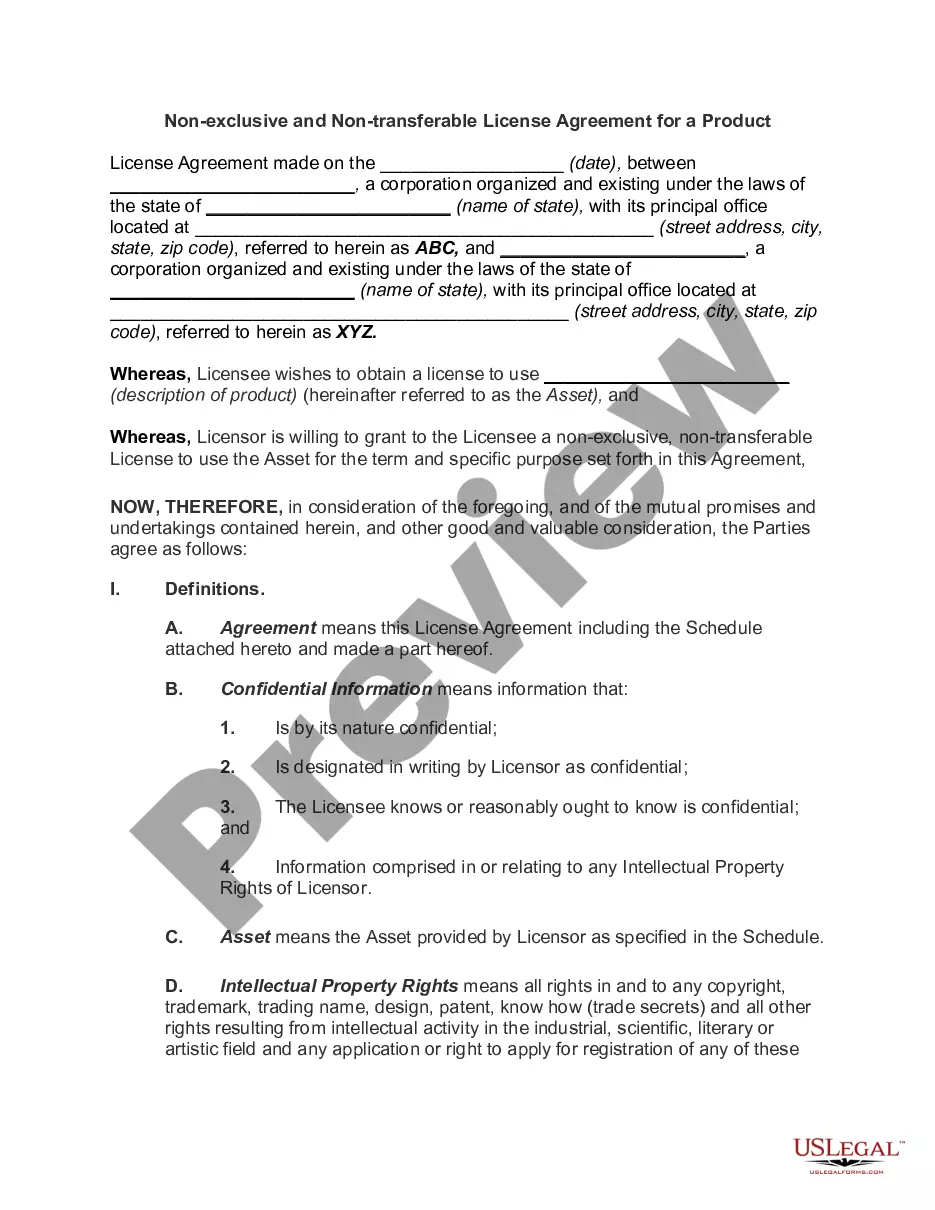

- Review the content on the page to confirm you've located the correct sample.

- Use the Preview feature or read the form description if one is provided.

- Look for another document if there are any mismatches with your requirements.

- Press the Buy Now button to acquire the document once you identify the appropriate one.

- Choose one of the subscription plans and log in or register for an account.

- Determine your preferred method to pay for your subscription (using a credit card or PayPal).

- Pick the format in which you desire to save the document and click Download.

Form popularity

FAQ

What is retirement accounting? Retirement accounting is the method businesses use to account for the retirement of assets when they are no longer in use. These assets are usually fixed assets, which include buildings, machinery, land, vehicles and computer hardware and software.

Save 15% of Your Income A good rule of thumb for the percentage of your income you should save is 15%. That's after taxes and before any matching contribution from your employer. If you can't afford to save 15% right now, that's okay. Saving even 1% is better than nothing.

A 401(k) is a retirement savings and investing plan that employers offer. A 401(k) plan gives employees a tax break on money they contribute. Contributions are automatically withdrawn from employee paychecks and invested in funds of the employee's choosing (from a list of available offerings).

Three types of retirement and how to plan for each Traditional Retirement. Traditional retirement is just that.Semi-Retirement.Temporary Retirement.Other Considerations.

How to create your personal retirement plan Step 1: Start with your goals. Your retirement plan should be based on your specific needs and goals.Step 2: See where you stand.Step 3: Decide how you'll save and invest.Step 4: Check and update your plan, regularly.

What Is a Good Retirement Income? According to AARP, a good retirement income is about 80 percent of your pre-tax income prior to leaving the workforce. This is because when you're no longer working, you won't be paying income tax or other job-related expenses.

The 5 steps of retirement planning Step 1: Know when to start retirement planning. Step 2: Figure out how much money you need to retire. Step 3: Prioritize your financial goals. Step 4: Choose the best retirement plan for you. Step 5: Select your retirement investments.

One frequently used rule of thumb for retirement spending is known as the 4% rule. It's relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation.

5 steps to creating your retirement plan Find out how much money you may need in retirement.Save.Know how Social Security fits in your retirement plan.If you're short, decide how you'll make up the difference.Make a date with your 401(k) plan and IRA once or twice a year.

To optimize your retirement accounts, experts recommend investing in both a 401(k) and an IRA in the following order: Max out your 401(k) match: The 401(k) is your top choice if your employer offers any kind of match. Once you receive this maximum free money, consider investing in an IRA.