Oakland Michigan Personal Monthly Budget Worksheet is a helpful financial tool designed to assist individuals in managing their monthly expenses and income effectively. This worksheet provides a detailed breakdown of various expenses and income sources, allowing individuals to keep track of their financial situation accurately. One type of Oakland Michigan Personal Monthly Budget Worksheet is the basic version, which includes essential categories like housing, transportation, groceries, utilities, debt payments, and entertainment. This type of worksheet is suitable for individuals who want to start budgeting and have a clear overview of their expenses. Another type of Oakland Michigan Personal Monthly Budget Worksheet is an advanced version, which includes additional categories for a more comprehensive budgeting experience. These added categories may include healthcare costs, education expenses, retirement savings, and charity contributions. This type of worksheet is suitable for individuals who have more complex financial needs or long-term financial goals. Using Oakland Michigan Personal Monthly Budget Worksheet is simple. First, individuals need to gather information about their monthly income from various sources such as salary, investments, or side gigs. Then, they list their monthly expenses, categorizing them as fixed (e.g., rent or mortgage) or variable (e.g., dining out or shopping). Individuals using this worksheet can enter the estimated amount for each expense category and compare it to their actual spending at the end of each month. This comparison helps to identify areas where overspending might occur, enabling individuals to make necessary adjustments to stay within their budget. The Oakland Michigan Personal Monthly Budget Worksheet can also calculate the total income, total expenses, and the difference between the two, commonly referred to as the "savings" or "shortfall." This feature provides a quick look at an individual's financial situation and aids in making informed decisions about savings or possible necessary expense reductions. By utilizing this worksheet, individuals can gain a better understanding of their spending habits and financial priorities. It enables them to have a clearer picture of where their money is going, allowing for better decision-making and increasing the chances of reaching their financial goals. Overall, the Oakland Michigan Personal Monthly Budget Worksheet is a valuable tool for anyone looking to manage their finances efficiently. Whether using the basic or advanced version, this worksheet provides a systematic approach to budgeting, helping individuals take control of their money and achieve financial stability.

Oakland Michigan Personal Monthly Budget Worksheet

Description

How to fill out Oakland Michigan Personal Monthly Budget Worksheet?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Oakland Personal Monthly Budget Worksheet, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Oakland Personal Monthly Budget Worksheet from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Oakland Personal Monthly Budget Worksheet:

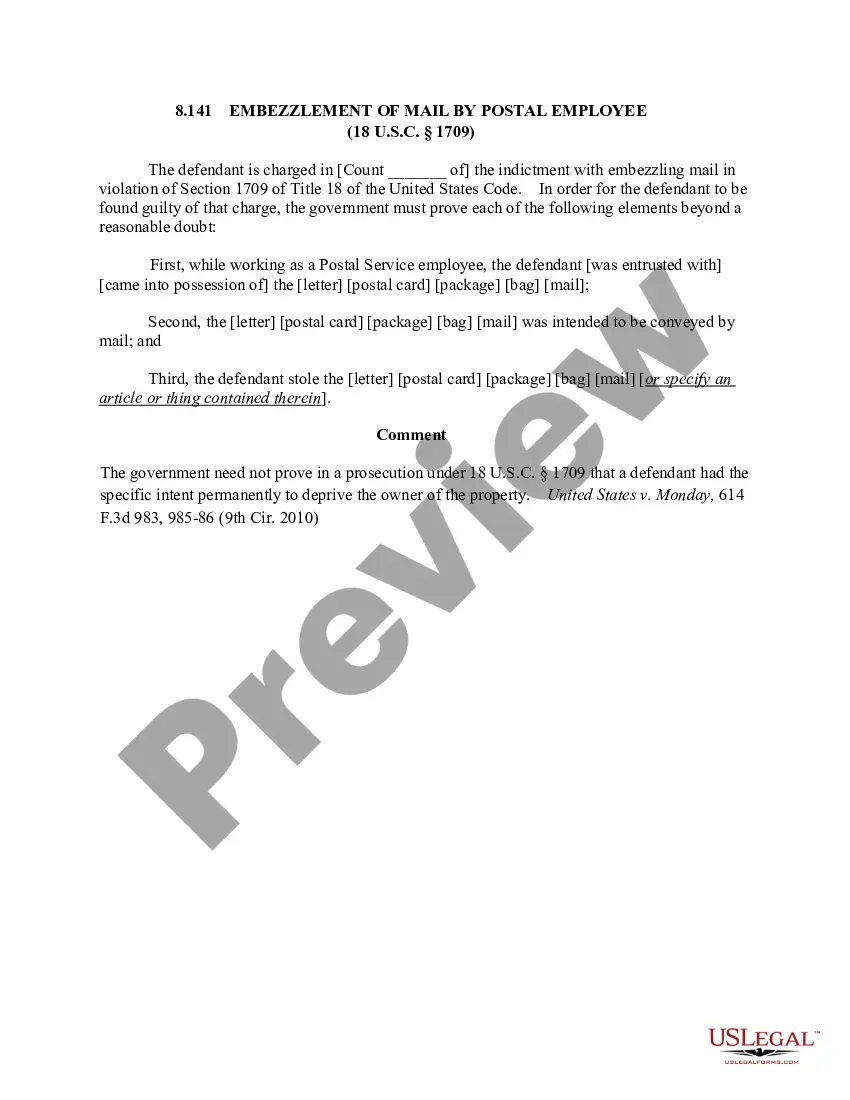

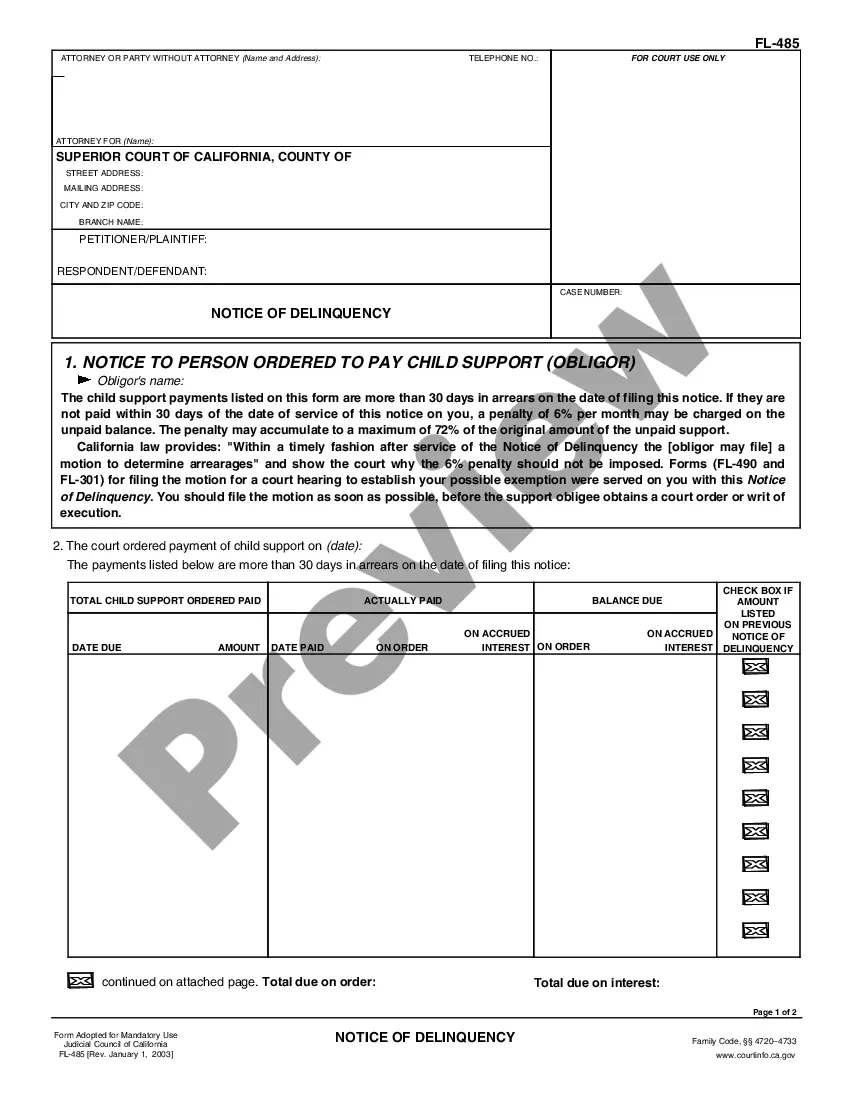

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!