Riverside California Personal Monthly Budget Worksheet is a comprehensive financial tool designed to help individuals in Riverside, California, manage their monthly expenses and track their income. It assists users in gaining a clear understanding of their financial situation and making informed decisions. The worksheet typically consists of several sections that cover various aspects of personal finance, such as income sources, fixed and variable expenses, savings, and debt repayment. By filling in the worksheet, individuals can gain a comprehensive overview of their financial health and identify areas for improvement. Keywords: Riverside California, personal finance, monthly budget, worksheet, income, expenses, savings, debt repayment, financial health, financial tool. Types of Riverside California Personal Monthly Budget Worksheet: 1. Basic Monthly Budget Worksheet: This type of worksheet allows users to record their income and expenses for each month. It helps individuals track their monthly cash flow and categorize their spending habits. 2. Detailed Expense Tracking Worksheet: This variation offers more specific expense categories, breaking down discretionary and non-discretionary expenses. It provides a more detailed analysis of spending patterns and helps individuals identify areas where they can cut costs. 3. Debt Payoff Worksheet: This worksheet is tailored for individuals dealing with significant debt. It helps users track their debt balances, interest rates, and minimum payments. By highlighting the debt snowball or avalanche method, individuals can strategize and accelerate debt repayment. 4. Savings and Investment Worksheet: This type of worksheet focuses on helping individuals set savings goals and track progress towards achieving them. It allows users to allocate funds for various savings categories, such as emergency funds, retirement, or specific financial goals. 5. Irregular Income Worksheet: This specific worksheet is designed for those with irregular or variable income sources. It assists individuals in budgeting effectively by accommodating fluctuations in income and planning for irregular expenses. Overall, these different types of Riverside California Personal Monthly Budget Worksheets provide individuals with versatile tools to manage their finances effectively and work towards their financial goals.

Riverside California Personal Monthly Budget Worksheet

Description

How to fill out Riverside California Personal Monthly Budget Worksheet?

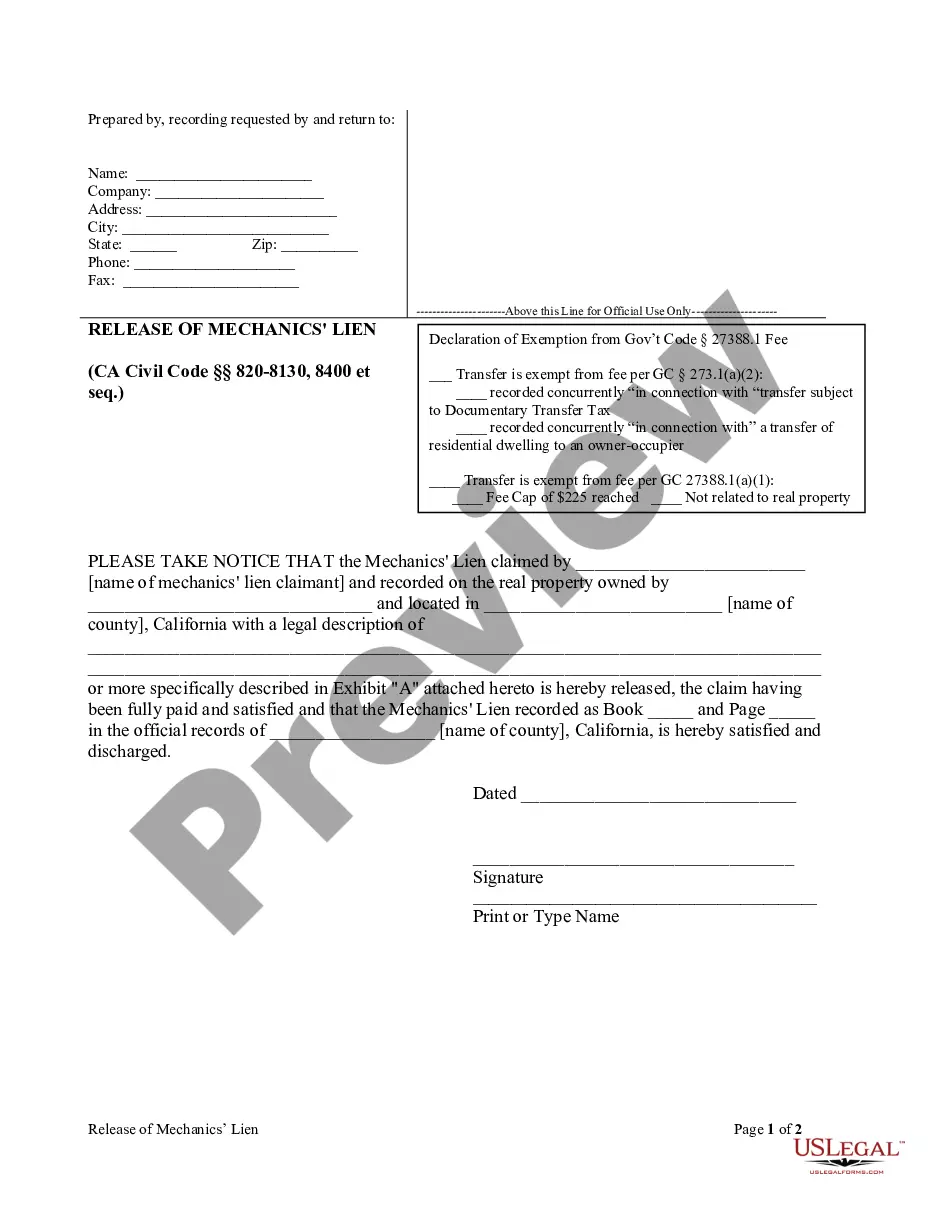

How much time does it typically take you to draw up a legal document? Since every state has its laws and regulations for every life situation, locating a Riverside Personal Monthly Budget Worksheet suiting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the Riverside Personal Monthly Budget Worksheet, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Riverside Personal Monthly Budget Worksheet:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Riverside Personal Monthly Budget Worksheet.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!