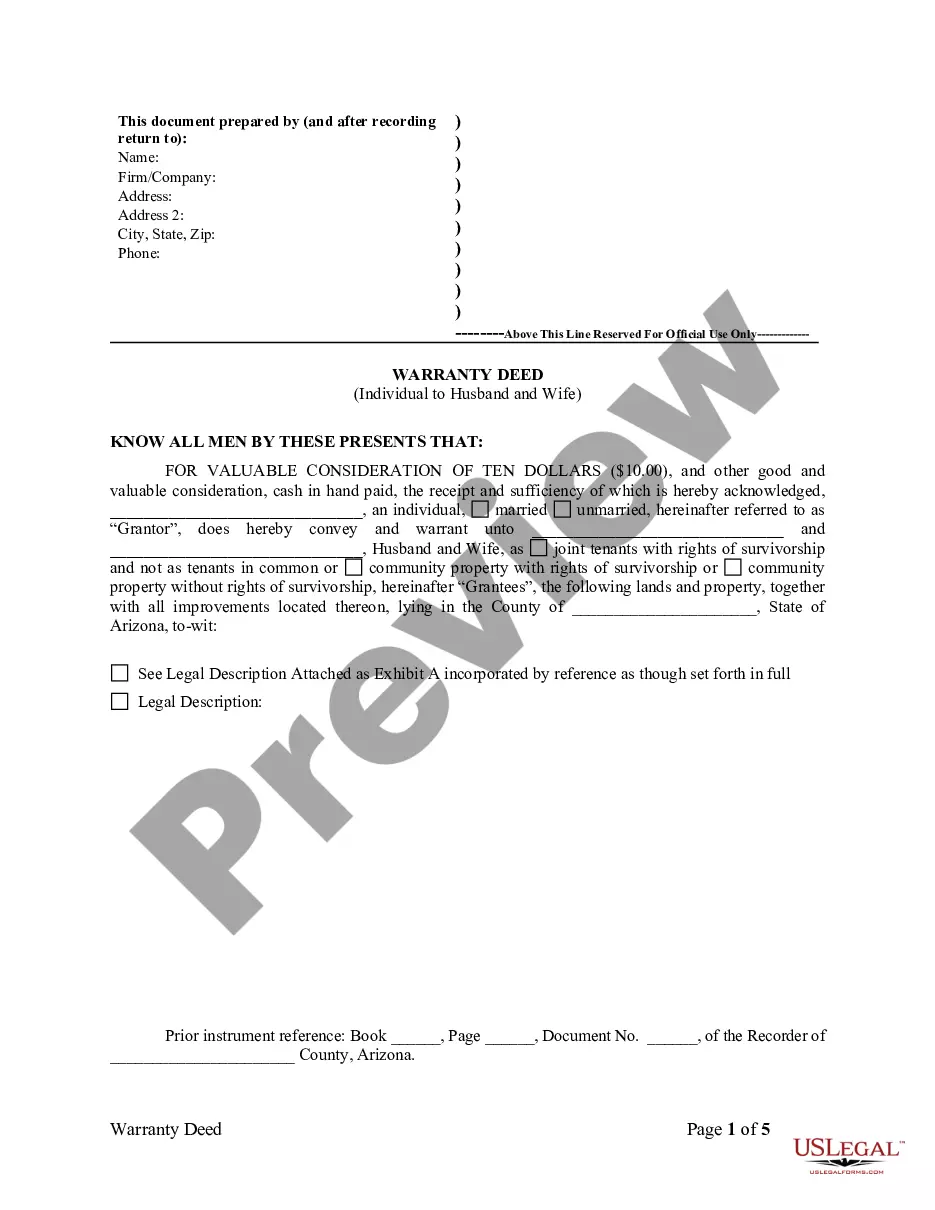

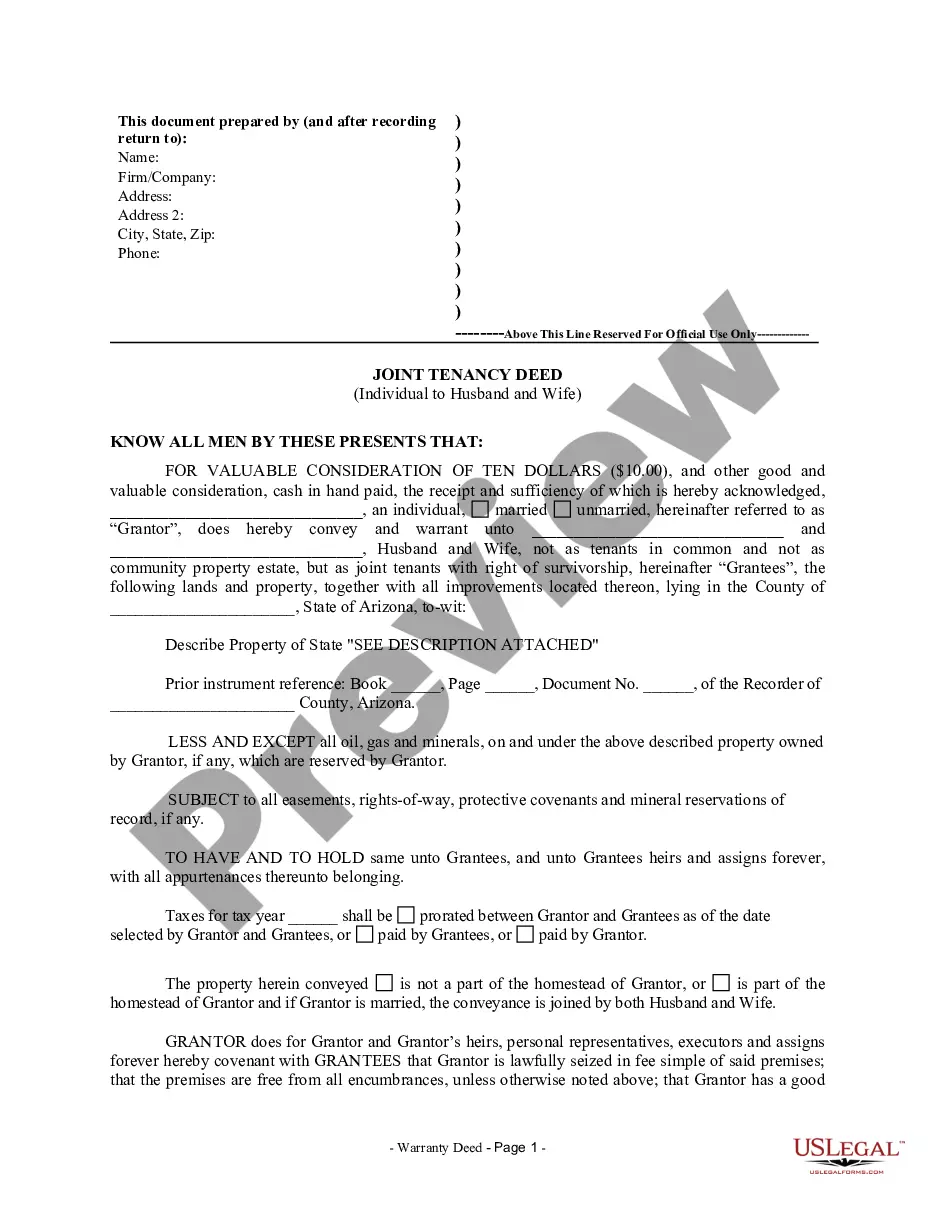

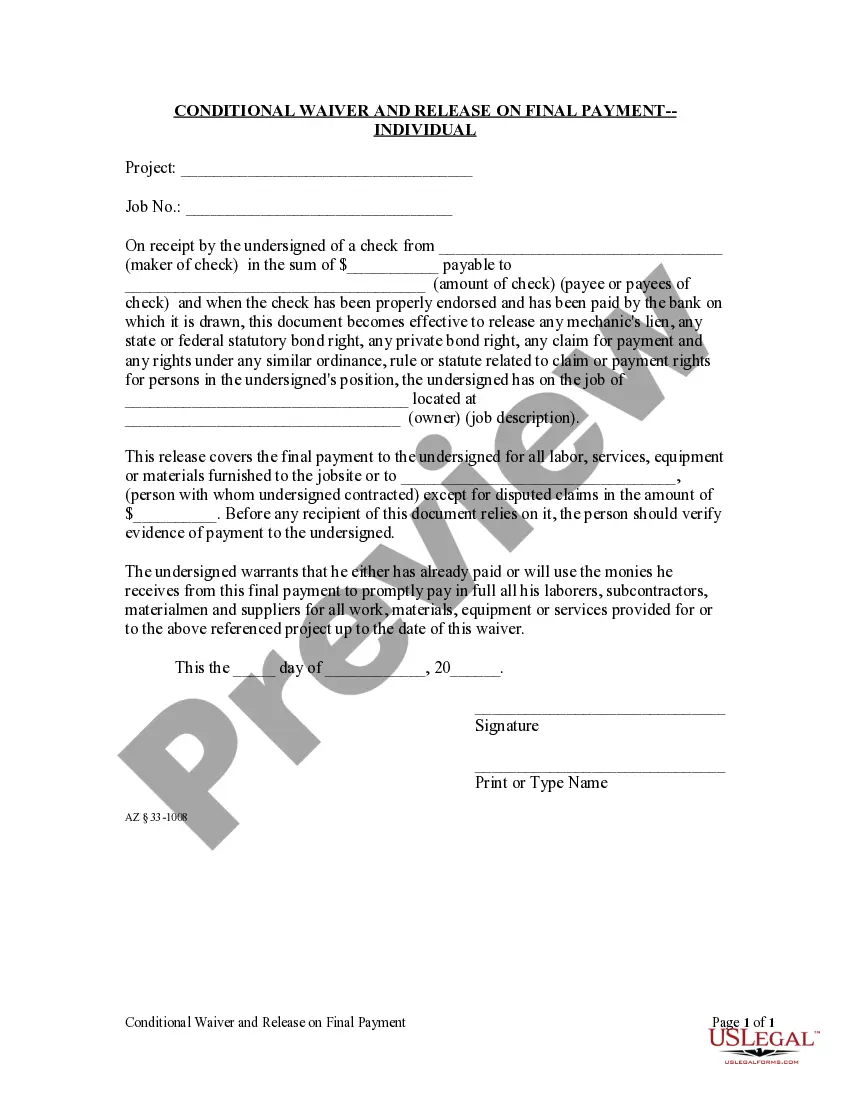

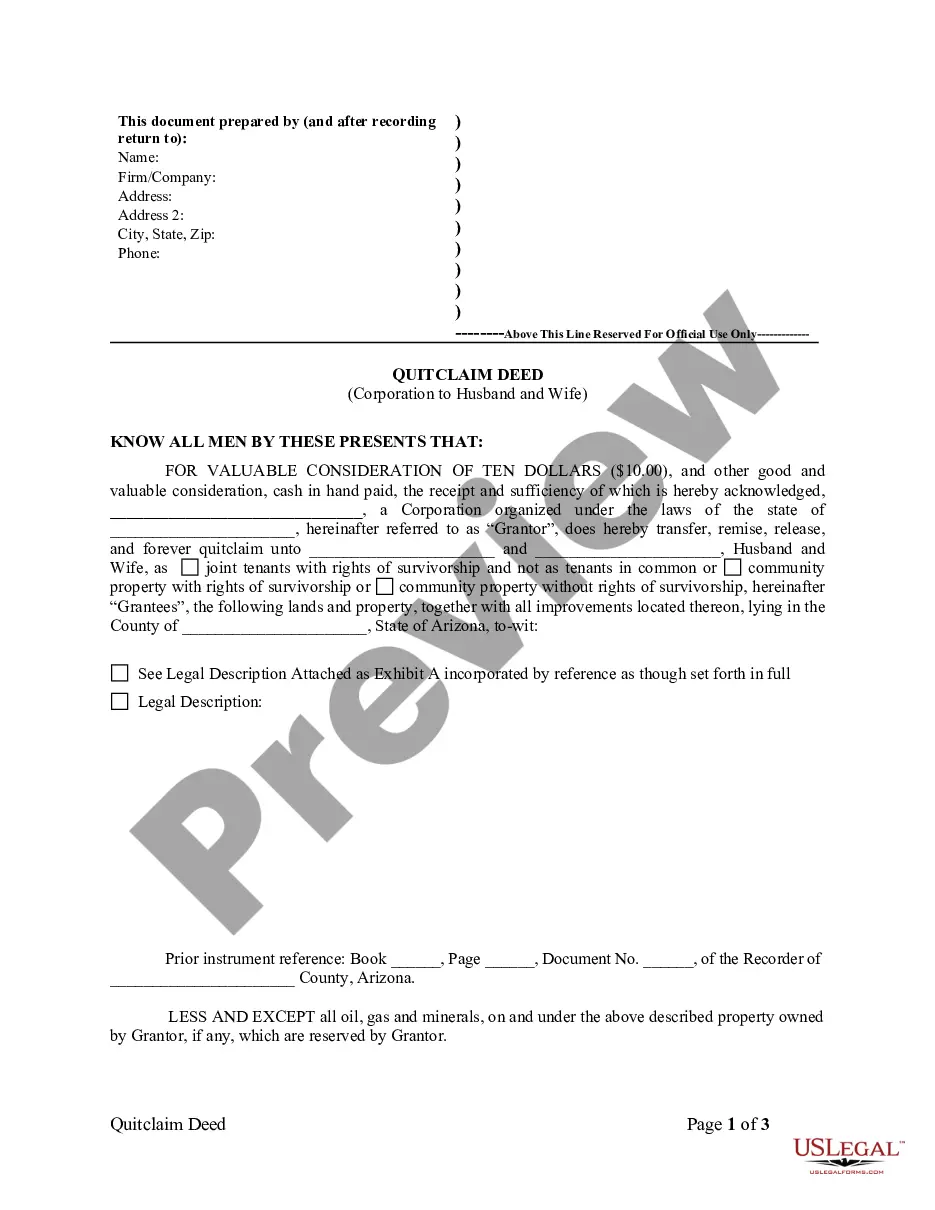

San Diego, California Escrow Instructions for Residential Sale Escrow instructions are legally binding documents that outline the terms and conditions of a real estate transaction in San Diego, California. They provide a roadmap for the escrow process, ensuring that both the buyer and seller understand their responsibilities and obligations. These instructions serve as a crucial part of the home selling process, safeguarding the interests of all parties involved. In San Diego, California, there are various types of escrow instructions for residential sales, depending on the specific conditions and requirements of the transaction. Here are some common types: 1. Standard Residential Escrow Instructions: This is the most commonly used type of escrow instructions for residential sales in San Diego, California. It covers the basic aspects of the transaction, including the purchase price, identification of the property, conditions for closing, and how the funds will be handled. 2. Short Sale Escrow Instructions: In situations where the property is being sold for less than the outstanding mortgage balance, short sale escrow instructions come into play. These instructions address the unique requirements and considerations associated with short sales, such as lender approvals, negotiation of outstanding debts, and allocation of proceeds. 3. RED (Real Estate Owned) Escrow Instructions: If the property in question is bank-owned or has gone through the foreclosure process, RED escrow instructions are used. These instructions typically involve additional requirements and conditions set by the seller, such as paying off any outstanding liens or addressing statutory disclosure obligations. 4. Contingency Escrow Instructions: When certain conditions must be met for the transaction to proceed, such as buyer obtaining financing or seller making necessary repairs, contingency escrow instructions are used. These instructions outline the specific events that need to occur, the timeline for fulfilling them, and the consequences if the conditions are not met. 5. Joint Escrow Instructions: In cases where multiple parties, such as co-owners or investors, are involved in the purchase or sale of a residential property, joint escrow instructions are utilized. These instructions establish the roles, responsibilities, and rights of each party, as well as the division of proceeds or ownership after the transaction is completed. It is important to consult with a qualified escrow officer or real estate attorney to ensure that the escrow instructions align with the specific requirements of San Diego, California, and the intricacies of the residential sale. Accuracy, attention to detail, and compliance with local regulations are crucial when drafting and executing escrow instructions in the San Diego area, to ensure a smooth and successful real estate transaction.

San Diego California Escrow Instructions for Residential Sale

Description

How to fill out San Diego California Escrow Instructions For Residential Sale?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business objective utilized in your county, including the San Diego Escrow Instructions for Residential Sale.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the San Diego Escrow Instructions for Residential Sale will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the San Diego Escrow Instructions for Residential Sale:

- Ensure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Diego Escrow Instructions for Residential Sale on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!