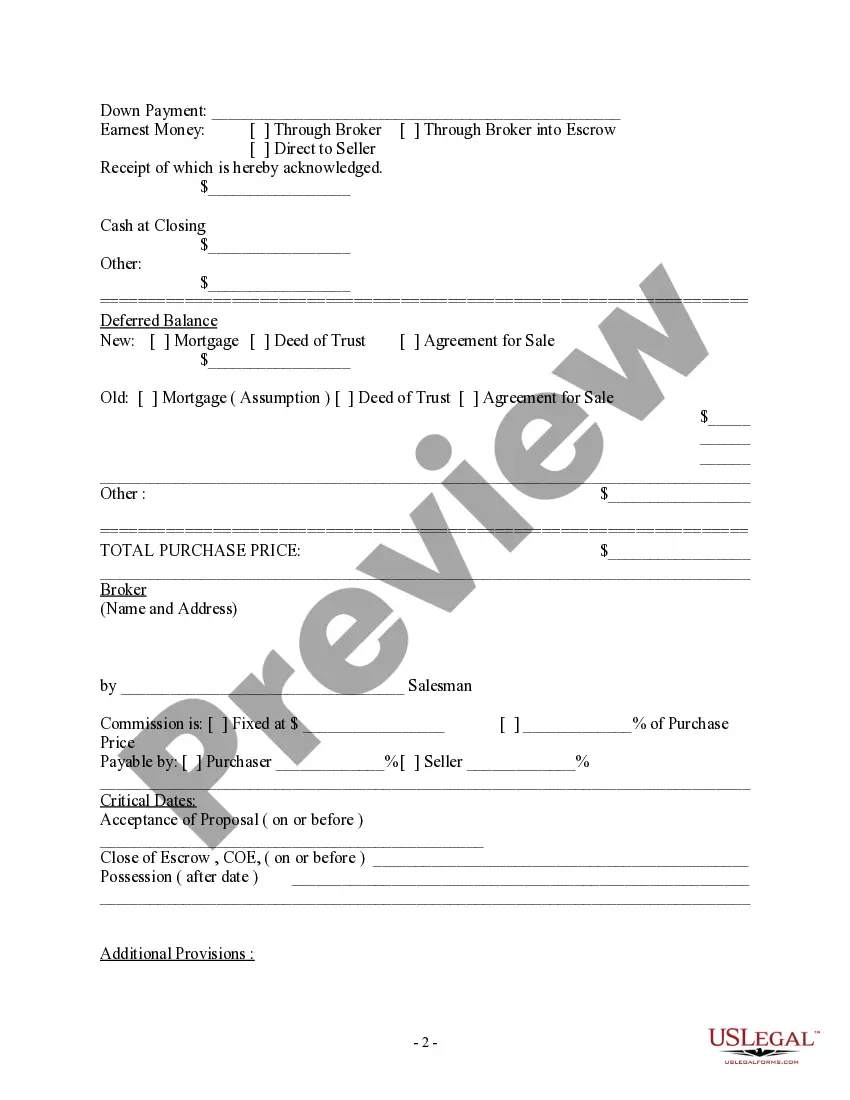

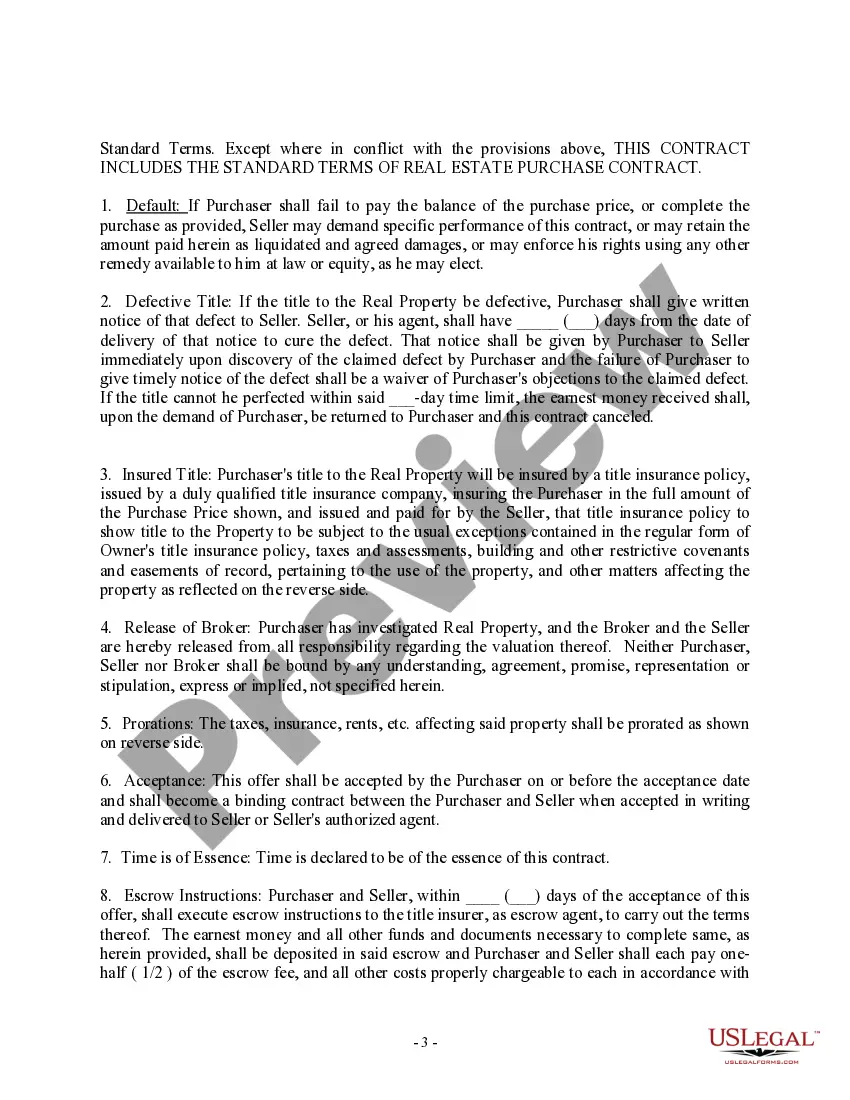

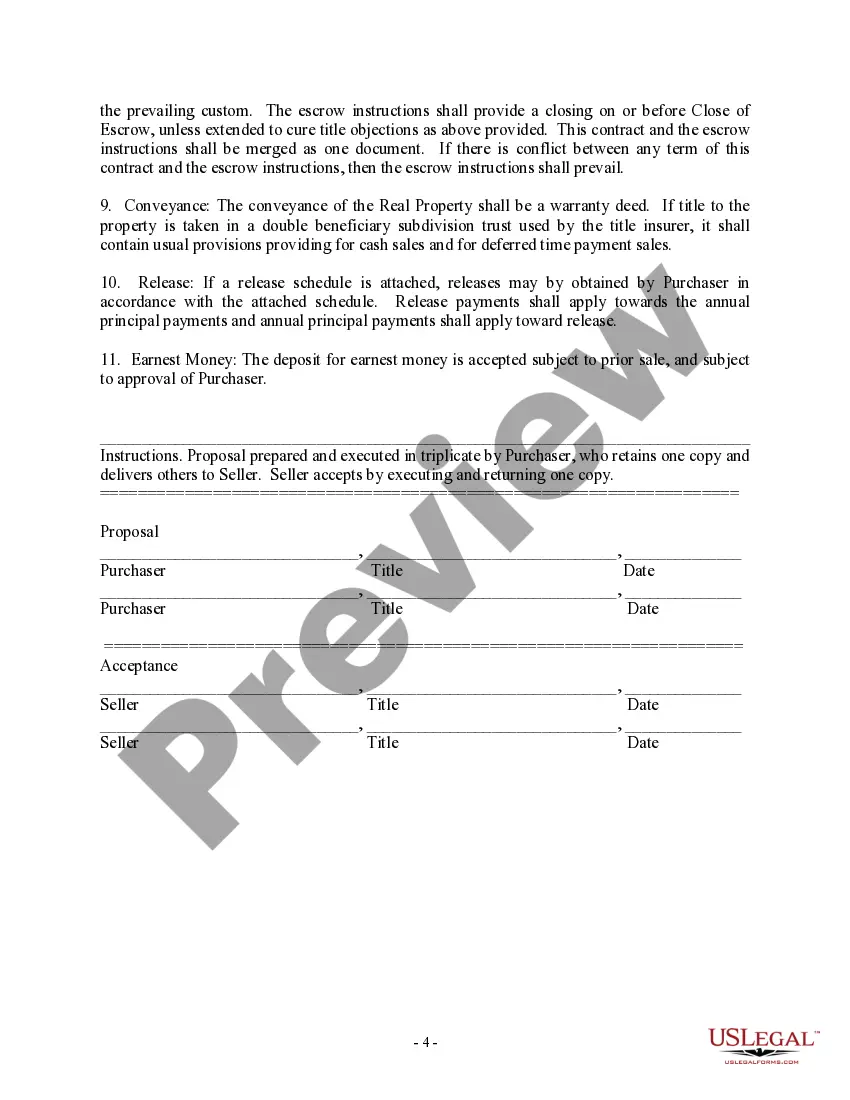

Contra Costa California Purchase Contract and Receipt — Residential is a legally binding agreement commonly used in the state of California for the purchase of residential properties located in Contra Costa County. This document outlines the terms and conditions agreed upon by the buyer and seller in a real estate transaction, ensuring a smooth and transparent process. The Contra Costa California Purchase Contract and Receipt — Residential involves several crucial elements, such as: 1. Property Description: The contract contains a detailed description of the property, including its address, legal description, and parcel identification number (APN). This information ensures clarity regarding the specific property being bought or sold. 2. Purchase Price: The contract specifies the agreed-upon purchase price between the buyer and seller. It outlines whether the purchase price is all-cash or financed through a mortgage, and any contingencies related to the financing process. 3. Terms and Conditions: The contract includes various terms and conditions that cover aspects like earnest money deposit, allocation of closing costs, property inspection, and repairs. It may also incorporate any specific contingencies, such as the sale being contingent on the buyer securing adequate financing or selling their current property. 4. Disclosures: The Contra Costa California Purchase Contract requires the seller to provide certain disclosures about the condition of the property. These disclosures ensure that the buyer is aware of any known defects or issues before finalizing the purchase. 5. Contingencies: The contract may include contingencies that protect the buyer's interests and allow them to back out of the deal without penalties under certain circumstances. These contingencies typically encompass obtaining financing, satisfactory property inspections, or the sale of the buyer's existing property. 6. Closing and Possession Dates: The contract specifies the date when the transaction will close, and often includes the date of possession when the buyer can move into the property. Clear delineation of these dates helps both parties plan their logistics accordingly. Some different types of Contra Costa California Purchase Contract and Receipt — Residential may include: 1. Standard Purchase Contract: This is the standard contract used for most residential real estate transactions in Contra Costa County. It covers all the essential elements mentioned above and is typically used for transactions without any special circumstances. 2. As-Is Purchase Contract: This contract type is used when the seller explicitly states that the property is being sold "as-is," meaning they will not undertake any repairs or renovations on the property. It provides additional protection for the seller against potential claims regarding undisclosed property issues. 3. Lease-to-Own Purchase Contract: This contract is used when the buyer intends to lease the property for a specific period with an option to purchase it at a later date. It outlines the terms of the lease and the conditions under which the buyer can exercise their right to buy the property. Overall, the Contra Costa California Purchase Contract and Receipt — Residential is a vital legal document that ensures both buyer and seller are protected throughout the real estate transaction process, establishing clear expectations and obligations for both parties.

Contra Costa California Purchase Contract and Receipt - Residential

Description

How to fill out Contra Costa California Purchase Contract And Receipt - Residential?

Drafting papers for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Contra Costa Purchase Contract and Receipt - Residential without expert help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Contra Costa Purchase Contract and Receipt - Residential on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Contra Costa Purchase Contract and Receipt - Residential:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

California counties that allow intercounty base value transfers: Alameda, Los Angeles, Orange, Riverside, San Bernardino, San Diego, San Mateo, Santa Clara, Tuolumne, and Ventura. Since these counties are subject to change, we recommend you contact the county to which you wish to move to verify eligibility.

California Property Tax Rates CountyMedian Home ValueAverage Effective Property Tax RateCalaveras County$297,7000.81%Colusa County$249,8000.68%Contra Costa County$582,4000.85%Del Norte County$204,0000.73%54 more rows

The seller usually pays for the county transfer tax. The base transfer tax in Contra Costa and other California counties is $1.10 for every $1,000 of the home's value. (Example: On a $500,000 home, the transfer tax would be 500 x 1.10 for a total of $550.)

Contra Costa County Tax jurisdiction breakdown for 2022. California 6% Contra Costa 0.25% Contra Costa Co Local Tax Sl 1% Contra Costa County District Tax Sp 1.5%

What is the sales tax rate in Contra Costa County? The minimum combined 2022 sales tax rate for Contra Costa County, California is 8.75%. This is the total of state and county sales tax rates.

Real Estate Transfer Tax: Total: $1.10/per $1,000 property value (comprised of City Rate: $0.55/per $1,000 property value plus County Rate: $0.55/per $1,000 property value). Landlord Business License: City of Concord requires a business license for commercial and residential landlords renting four (4) or more units.

Contra Costa County Contra Costa's transfer tax rate is $0.55 per $500 consideration ($1.10 per $1,000).

The seller usually pays for the county transfer tax. The base transfer tax in Contra Costa and other California counties is $1.10 for every $1,000 of the home's value. (Example: On a $500,000 home, the transfer tax would be 500 x 1.10 for a total of $550.)

Contra Transactions: When Income is not Income, and Expenditure not Expenditure. It happens to all of us: sometimes members or clients accidentally get overcharged, or part of a grant has to be refunded, or we paid too much to someone else and get a refund. The accounting treatment of this trips many people up.

Real Estate Transfer Tax: County Rate: $1.10/per $1,000 property value.