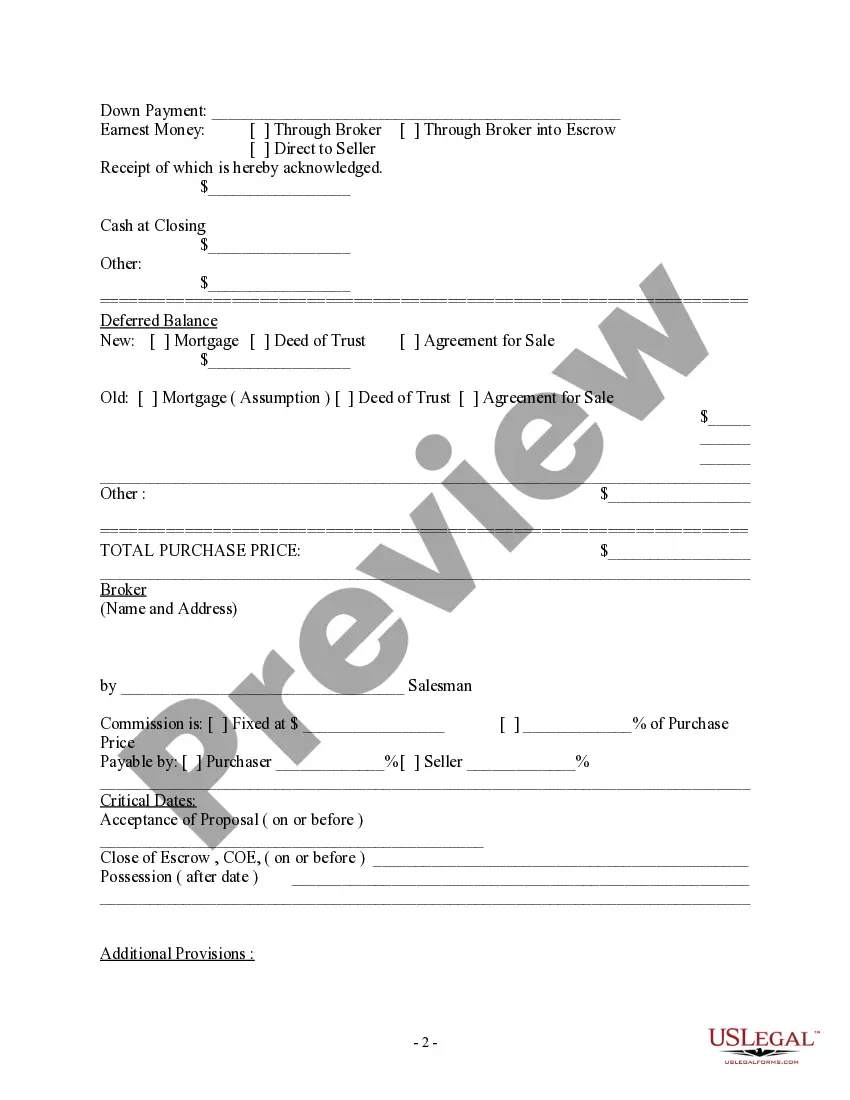

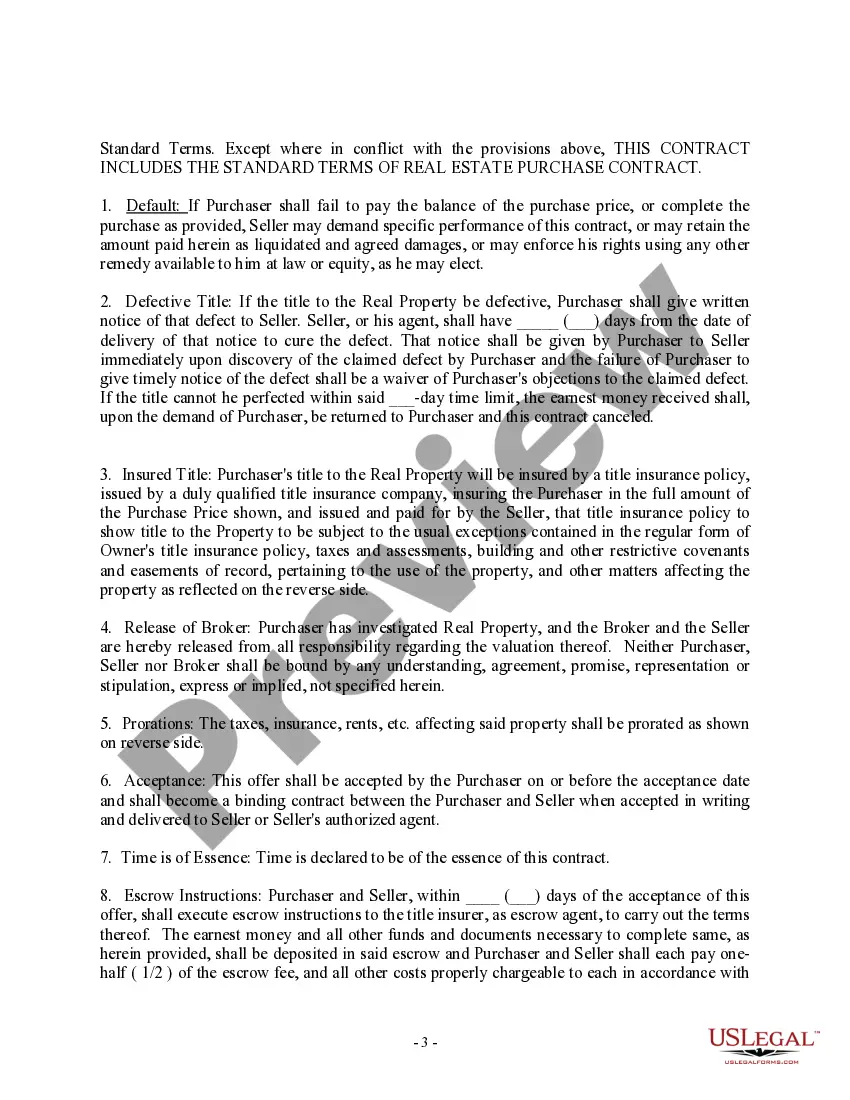

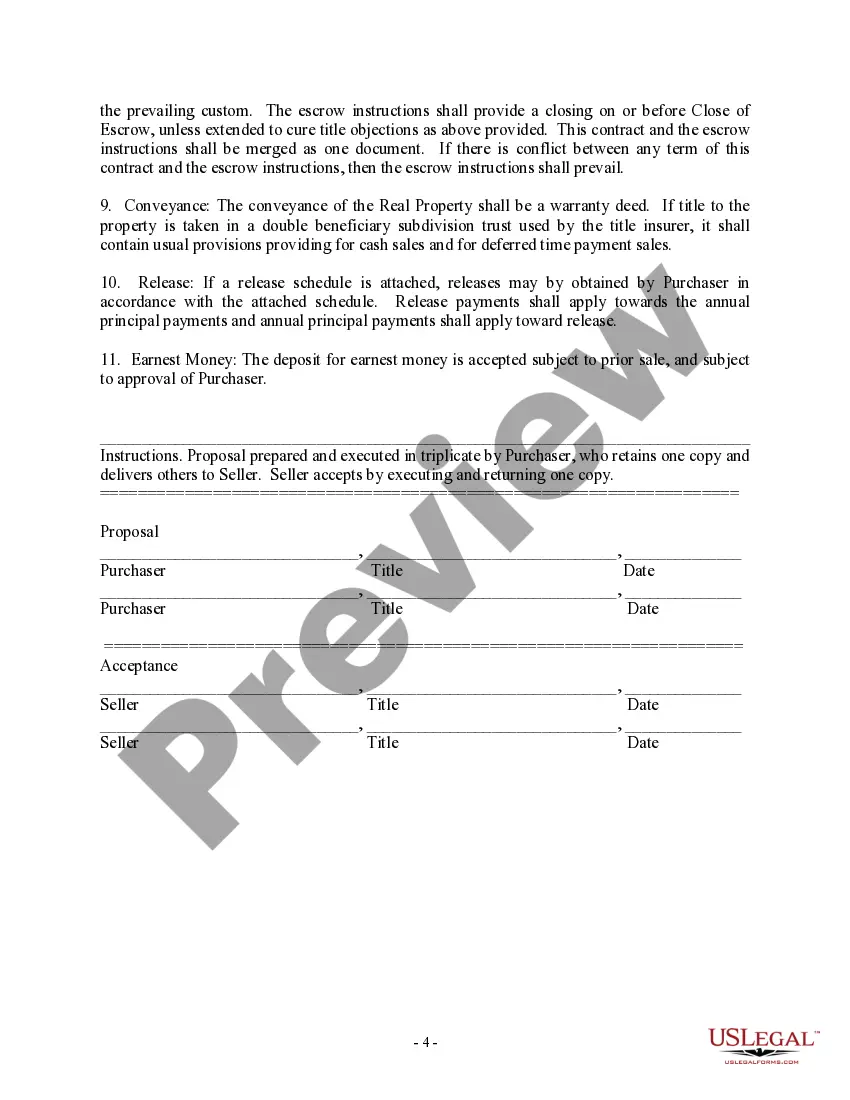

The Cook Illinois Purchase Contract and Receipt — Residential is a legally binding agreement used when purchasing residential real estate in Cook County, Illinois. This document outlines the terms and conditions agreed upon by the buyer and seller involved in the transaction. Here is a detailed description of what this contract entails: 1. Parties Involved: The contract identifies the buyer and seller involved in the transaction, including their legal names, addresses, and contact information. 2. Property Description: A detailed description of the residential property being sold is provided, including the address, legal description, and any unique characteristics that define the property. 3. Purchase Price and Financing: The contract states the agreed-upon purchase price of the property, specifying the currency and any accepted forms of payment or financing terms. 4. Earnest Money: This section outlines the amount of earnest money, also known as a good faith deposit, which the buyer must provide upon signing the contract. It specifies when and how this deposit will be applied towards the purchase price. 5. Contingencies: The contract may include contingencies that protect the buyer's interests. Common contingencies include home inspections, financing approval, appraisal, and attorney review. These contingencies provide an opportunity for the buyer to back out of the contract without financial penalties if specific conditions are not met. 6. Disclosures and Representations: The contract requires the seller to disclose any known defects or issues with the property, such as structural problems, environmental hazards, or ongoing legal disputes. These disclosures help the buyer make an informed decision during the purchase process. 7. Closing Date and Possession: The contract specifies the agreed-upon closing date, which is the date when ownership of the property transfers to the buyer. It also addresses possession, outlining when the buyer will take possession of the property. 8. Prorations: This section covers prorations for property taxes, homeowner association fees, utility bills, and other expenses related to the property. Prorations ensure that both parties are responsible for their fair share of expenses, based on the closing date. 9. Default and Remedies: The consequences of a party's default on the contract are detailed in this section. It outlines the steps to be taken if either the buyer or seller fails to meet their obligations under the agreement. 10. Additional Provisions: Additional provisions, such as special agreements or conditions negotiated between the buyer and seller, are included in this section. These provisions can address specific concerns or requirements unique to the transaction. Different types of Cook Illinois Purchase Contract and Receipt — Residential may exist based on variations specific to the property or parties involved. Examples include contracts tailored for condominiums, townhouses, single-family homes, or multi-unit residential properties. Each contract type may have distinct terms and conditions suited to the specific property type.

Cook Illinois Purchase Contract and Receipt - Residential

Description

How to fill out Cook Illinois Purchase Contract And Receipt - Residential?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Cook Purchase Contract and Receipt - Residential, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information resources and guides on the website to make any activities associated with paperwork completion simple.

Here's how you can locate and download Cook Purchase Contract and Receipt - Residential.

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Check the similar forms or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Cook Purchase Contract and Receipt - Residential.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Cook Purchase Contract and Receipt - Residential, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer completely. If you need to deal with an exceptionally difficult case, we recommend getting a lawyer to check your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!

Form popularity

FAQ

Backed by GPO administrative and technical assistance, the Simplified Purchase Agreement (SPA) ensures vendor compliance with GPO Contract Term Quality Assurance Through Attributes Program for Printing and Binding and Government Paper Specification Standardswhile offering the best value for purchases up to $10,000.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

The short answer is yes. Handwritten contracts are slightly impractical when you could just type them up, but they are completely legal if written properly. In fact, they're even preferable to verbal contracts in many ways.

Affordable business financing. Crazy fast. Identity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.

Writing a real estate purchase agreement. Identify the address of the property being purchased, including all required legal descriptions. Identify the names and addresses of both the buyer and the seller. Detail the price of the property and the terms of the purchase. Set the closing date and closing costs.

Writing a real estate purchase agreement. Identify the address of the property being purchased, including all required legal descriptions. Identify the names and addresses of both the buyer and the seller. Detail the price of the property and the terms of the purchase. Set the closing date and closing costs.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.