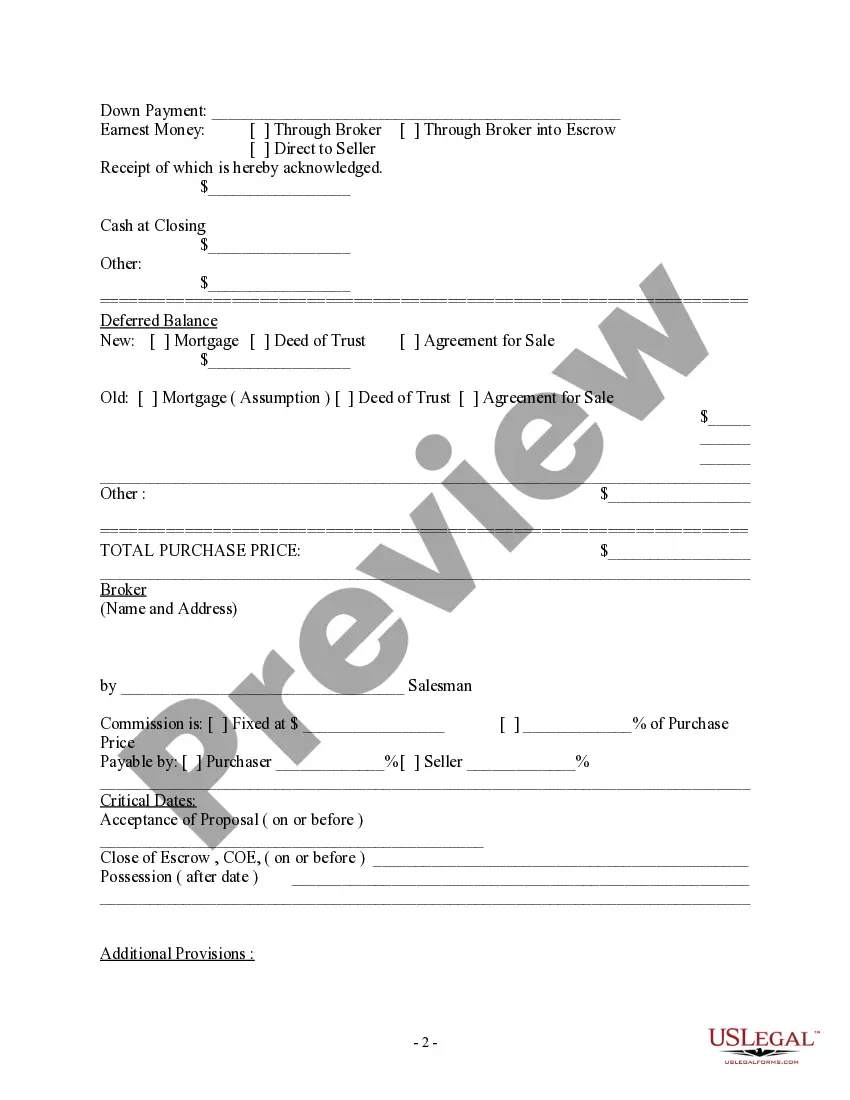

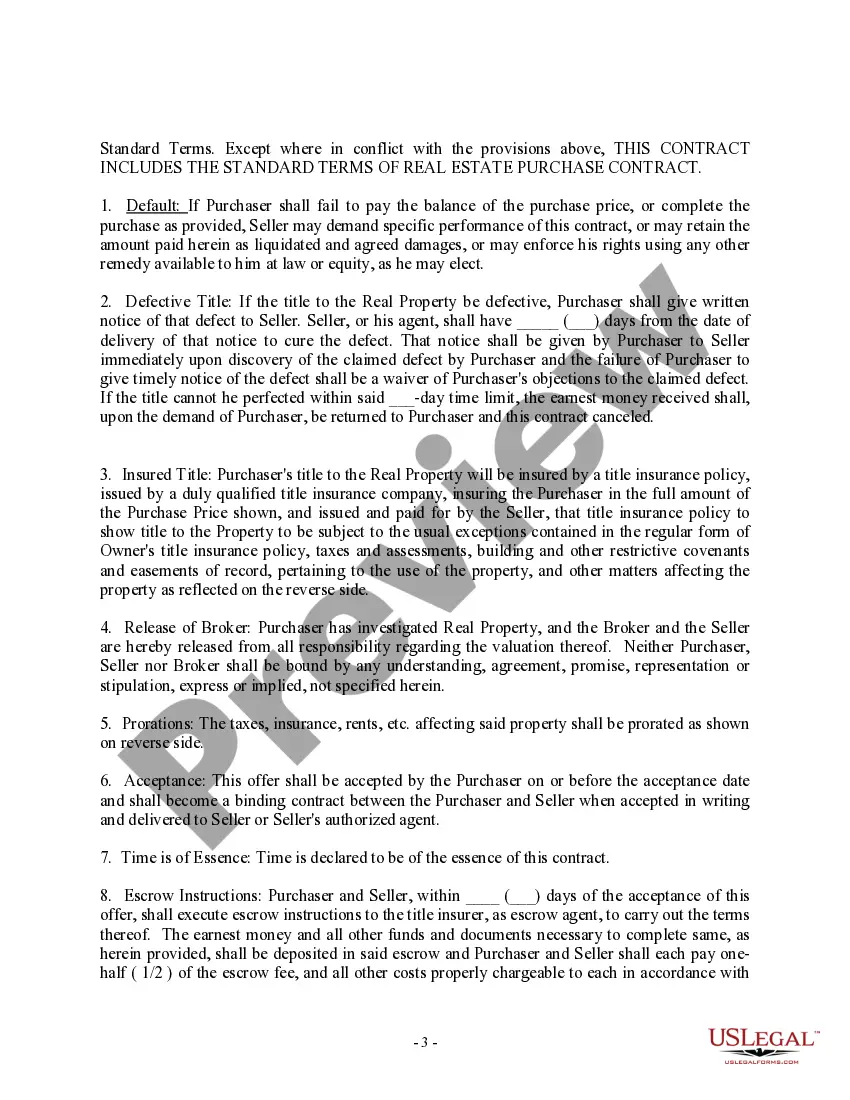

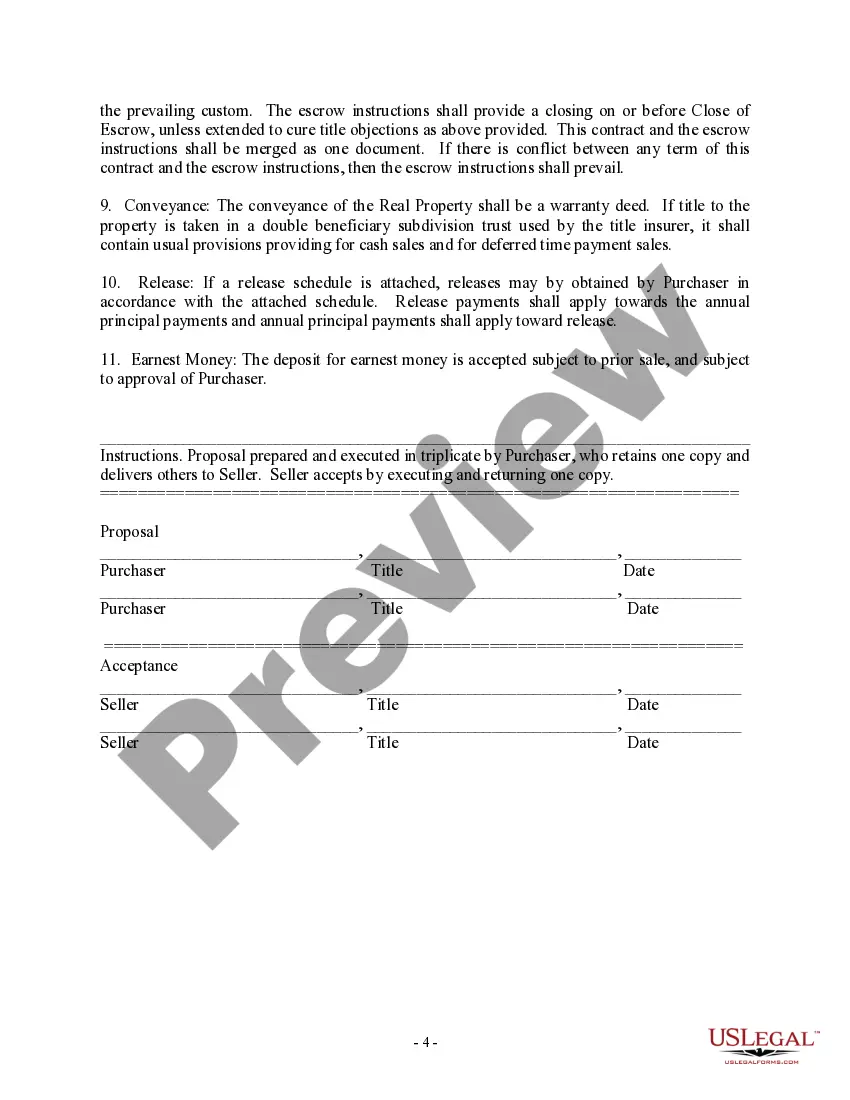

San Antonio Texas Purchase Contract and Receipt — Residential A San Antonio Texas Purchase Contract and Receipt — Residential is a legal document that outlines the terms and conditions of buying a residential property in San Antonio, Texas. This contract serves as a binding agreement between the buyer and the seller, ensuring a smooth and transparent transaction. It is an essential document that protects the rights and interests of both parties involved in the property sale. The San Antonio Texas Purchase Contract and Receipt — Residential includes several key components, which are crucial to understanding the terms of the property purchase. These components typically include: 1. Purchase Price: The agreed-upon price at which the buyer will purchase the property from the seller. 2. Property Description: A detailed description of the residential property, including its address, legal description, and any specific details about the house or land. 3. Terms and Conditions: This section covers the specific terms and conditions agreed upon by the buyer and seller. It includes information such as financing details, closing date, possession date, and any contingencies or conditions required for the sale. 4. Earnest Money: The amount of money the buyer provides as a deposit to demonstrate their seriousness and commitment to the purchase. This amount is typically held in escrow until the closing process is complete. 5. Disclosures and Representations: The seller is required to disclose any known defects or issues with the property, ensuring transparency for the buyer. This section also covers representations made by both parties regarding the condition of the property and any warranties included. 6. Closing Costs: The expenses associated with the property's transfer are detailed in this section. It includes items such as appraisal fees, title insurance, inspection fees, and other related costs. The allocation of these costs between the buyer and seller is typically negotiated. 7. Contingencies: Contingencies are conditions that must be met for the sale to proceed. Common contingencies include obtaining financing, satisfactory home inspections, or the sale of the buyer's current property. Different types of San Antonio Texas Purchase Contract and Receipt — Residential may exist based on the specific needs or circumstances of the buyer and seller. Some variations include: 1. Cash Purchase Contract: This type of contract is used when the buyer intends to purchase the property outright without any financing, usually with funds readily available. 2. FHA or VA Contract: These contracts are specifically designed for buyers using Federal Housing Administration (FHA) or Department of Veteran Affairs (VA) financing. They include additional clauses and requirements specific to these loan programs. 3. Seller Financing Contract: In this arrangement, the seller acts as the lender and provides financing to the buyer. This type of contract typically includes details about the loan terms, interest rate, and repayment schedule. In summary, a San Antonio Texas Purchase Contract and Receipt — Residential is a legally binding document that outlines the terms and conditions of purchasing a residential property in San Antonio, Texas. It ensures transparency, protects both parties, and facilitates a smooth property transaction. Various types and variations of this contract exist to cater to different buyer and seller circumstances.

San Antonio Texas Purchase Contract and Receipt - Residential

Description

How to fill out San Antonio Texas Purchase Contract And Receipt - Residential?

If you need to get a reliable legal document provider to obtain the San Antonio Purchase Contract and Receipt - Residential, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it easy to find and complete various documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse San Antonio Purchase Contract and Receipt - Residential, either by a keyword or by the state/county the form is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the San Antonio Purchase Contract and Receipt - Residential template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less pricey and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate agreement, or execute the San Antonio Purchase Contract and Receipt - Residential - all from the convenience of your sofa.

Sign up for US Legal Forms now!