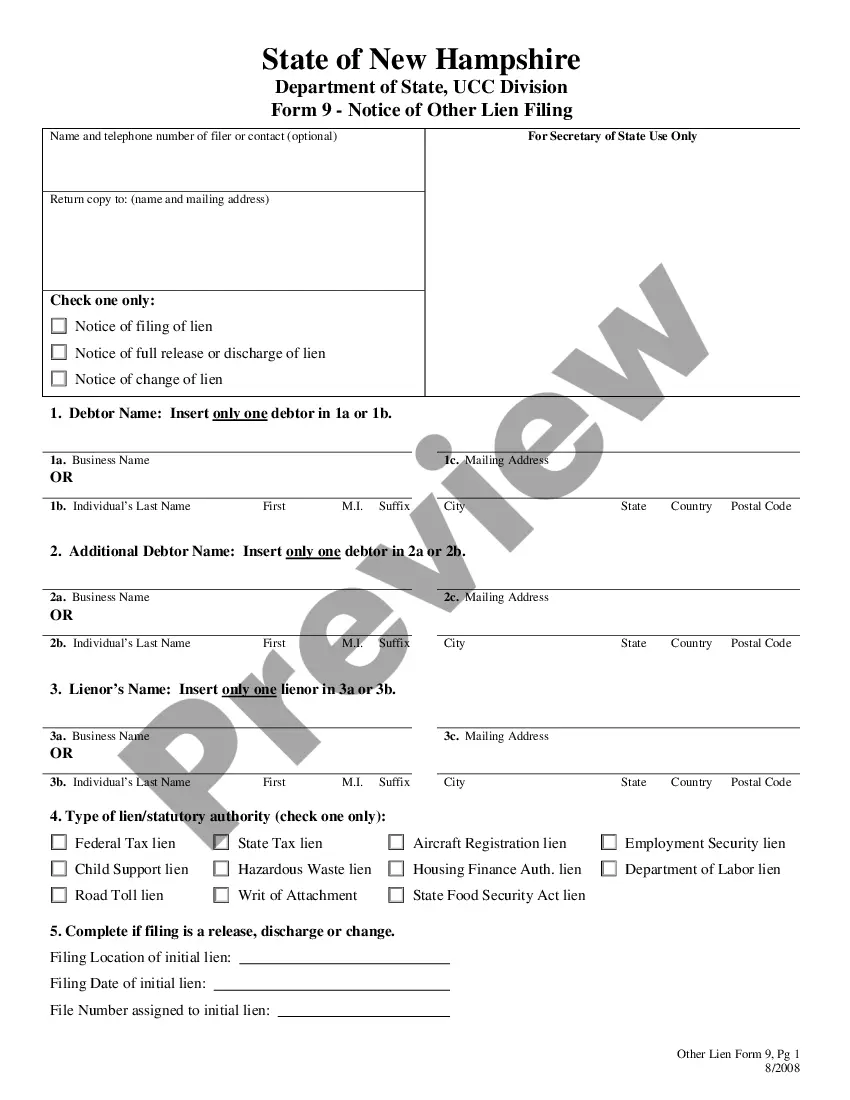

A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. The property that is subject to the security interest is called the collateral. The party holding the security interest is called the secured party.

A Contra Costa California Security Agreement in Accounts and Contract Rights is a legally binding agreement that pertains to the rights and security of accounts and contract rights in the Contra Costa County area of California. This agreement is designed to protect creditors' interests by establishing a lien or security interest in the debtor's accounts receivable and contract rights as collateral for a debt or other obligation. It provides a framework for the creditor to recover their investment in the event of default or non-payment. The Contra Costa County area is located in the San Francisco Bay Area and is home to numerous businesses and industries. With many commercial activities taking place, the need for security agreements arises to safeguard the interests of lenders and creditors. The Security Agreement in Accounts and Contract Rights serves as a tool to mitigate risks associated with financing agreements and promotes the flow of capital by providing financial security to lenders and creditors. The security agreement is typically executed between a debtor, who is the party owing the debt, and a secured party, who is the creditor or lender. It outlines the terms and conditions under which the debtor pledges their accounts and contract rights as collateral. The agreement details the obligations, rights, and remedies of both parties involved. There can be different variations or types of Contra Costa California Security Agreement in Accounts and Contract Rights, depending on the specific nature of the transaction or the type of collateral being pledged. These variations may include: 1. General Security Agreement: This is the most common type of security agreement where the debtor offers a general security interest in all of their accounts and contract rights as collateral. It provides broad protection to the secured party against any default or non-payment. 2. Specific Security Agreement: In certain cases, a creditor may only require security over specific accounts or contract rights. This type of agreement is tailored to secure the specific assets that are most significant to the creditor. 3. Floating Security Agreement: This type of agreement allows the debtor to continue conducting business and using their accounts and contract rights as usual. The security interest "floats" over the assets until an event of default triggers the attachment of the security interest, after which the secured party can exercise their rights. 4. Subordination Agreement: In some instances, multiple creditors may have a security interest in the same accounts and contract rights. A subordination agreement determines the priority of repayment among these creditors in case of default or liquidation. It is important to note that the terms and conditions of a Contra Costa California Security Agreement in Accounts and Contract Rights may vary depending on the parties involved and the specific requirements of the financing arrangement. Professional legal advice should be sought to ensure compliance with applicable laws and to protect the interests of all parties involved in such agreements.