A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. The property that is subject to the security interest is called the collateral. The party holding the security interest is called the secured party.

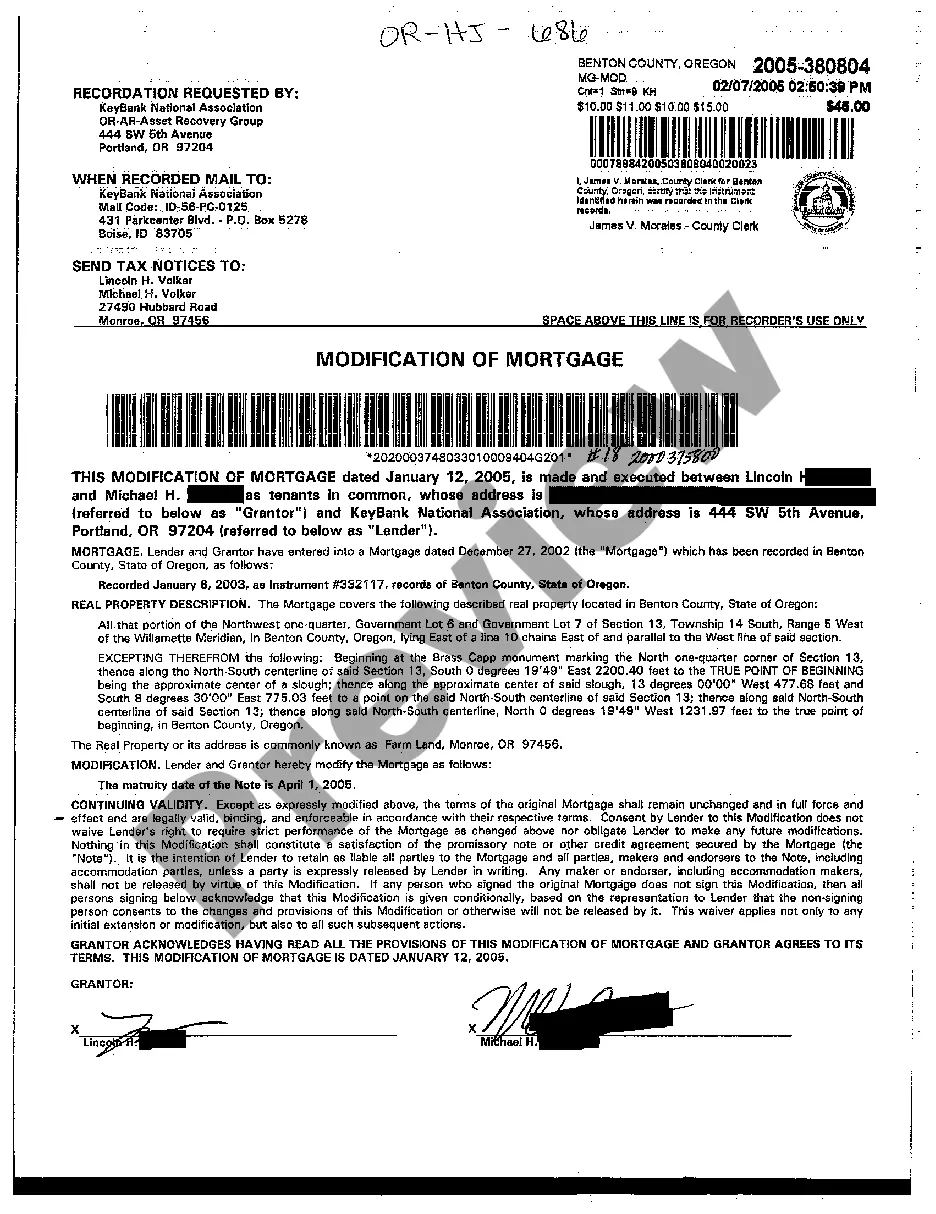

A Montgomery Maryland Security Agreement in Accounts and Contract Rights refers to a legally binding document that establishes a security interest in accounts and contract rights as collateral for a loan or debt. This agreement is commonly used in commercial transactions to provide lenders with additional assurance and protection in case of default by the borrower. Keywords: Montgomery, Maryland, Security Agreement, Accounts, Contract Rights, collateral, loan, debt, lenders, assurance, protection, default. There are several types of Montgomery Maryland Security Agreement in Accounts and Contract Rights depending on the specific context or purpose. Here are a few common variations: 1. Traditional Security Agreement: This type of agreement typically involves the borrower granting the lender a security interest in their accounts receivable and contract rights. It outlines the rights and obligations of both parties, including the conditions of default and the remedies available to the lender. 2. Factoring Security Agreement: In a factoring arrangement, where a business sells its accounts receivable to a factor (a specialized financial institution), a different type of security agreement may be used. This agreement enables the factor to monetize the accounts receivable and contract rights by providing assurances of future payments and protecting against potential risks. 3. Assignment Security Agreement: In certain cases, a creditor may assign their rights, including accounts and contract rights, to another entity as collateral for a loan. An assignment security agreement outlines the terms and conditions of the assignment, ensuring that the assignee can legally enforce and collect on the assigned rights. 4. Pledge Security Agreement: A pledge security agreement occurs when the borrower pledges their accounts and contract rights as security for a loan or debt without transferring ownership. The lender holds the pledged assets until the borrower repays the loan, providing an additional layer of security. 5. Subordination Agreement: This type of agreement may accompany a security agreement when multiple creditors have conflicting claims on the same accounts and contract rights. It establishes the priority of the security interests, ensuring that each creditor's rights are recognized and enforced in accordance with their agreement. In Montgomery, Maryland, these various types of security agreements in accounts and contract rights play a crucial role in facilitating commercial transactions, providing lenders with protection and borrowers with access to financing. It is essential to consult legal professionals to draft and finalize such agreements to ensure compliance with applicable laws and to protect the interests of all parties involved.