Cuyahoga Ohio Sale of Deceased Partner's Interest refers to the process of selling the ownership stake or shares of a deceased partner in a business located in Cuyahoga County, Ohio. This can occur in various types of partnerships, such as general partnerships, limited partnerships, or limited liability partnerships (Laps). The sale of the deceased partner's interest typically involves legal procedures and considerations, ensuring a fair and proper transfer of assets. When a partner passes away, their ownership interest in the partnership needs to be handled appropriately. In Cuyahoga County, Ohio, the sale of deceased partner's interest can take different forms, including: 1. Sale through Buy-Sell Agreement: If the partnership has a pre-existing buy-sell agreement, it may define the terms and conditions for selling a deceased partner's interest. This agreement specifies the valuation method, purchase price, and the rights and obligations of both the surviving partners and the deceased partner's estate. 2. Negotiated Sale: If there is no buy-sell agreement in place, the surviving partners and the deceased partner's estate can negotiate the sale of the interest. This involves determining a fair market value for the deceased partner's stake and reaching an agreement on the purchase price and terms of the sale. 3. Court-Ordered Sale: In some cases, when there are disputes or conflicts among the surviving partners and the deceased partner's estate, a court may intervene to facilitate the sale. The court will oversee the process, ensuring a fair valuation and equitable distribution of the proceeds from the sale. 4. Partnership Dissolution: In situations where the sale of the deceased partner's interest is not feasible or desired by the remaining partners, the partnership may be dissolved. In this case, the assets and liabilities of the partnership are liquidated and distributed according to the partnership agreement or state laws. Regardless of the type of sale, various legal and financial considerations need to be taken into account. These include estate planning, valuation of the interest, allocation of profits and losses, taxation, and compliance with partnership agreements and state laws. In conclusion, Cuyahoga Ohio Sale of Deceased Partner's Interest involves the proper transfer and sale of a deceased partner's ownership stake in a partnership. The process can take different forms depending on whether there is a pre-existing buy-sell agreement, the negotiations between the parties, or the involvement of the court. Proper legal and financial guidance is crucial to ensure a fair and efficient resolution in accordance with the partnership's interests and applicable laws.

Cuyahoga Ohio Sale of Deceased Partner's Interest

Description

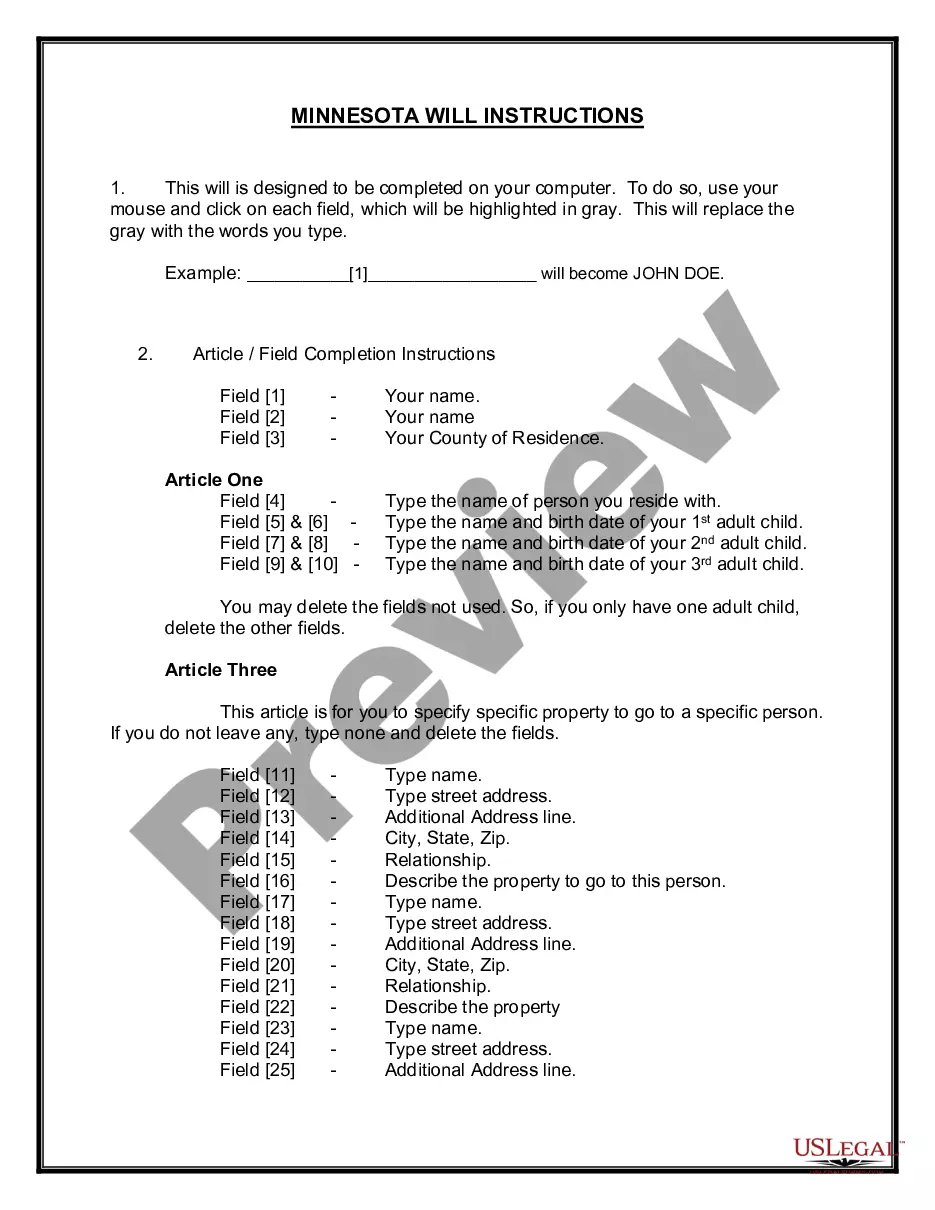

How to fill out Cuyahoga Ohio Sale Of Deceased Partner's Interest?

If you need to get a trustworthy legal form provider to obtain the Cuyahoga Sale of Deceased Partner's Interest, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to get and execute various papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Cuyahoga Sale of Deceased Partner's Interest, either by a keyword or by the state/county the form is created for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Cuyahoga Sale of Deceased Partner's Interest template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less costly and more affordable. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Cuyahoga Sale of Deceased Partner's Interest - all from the convenience of your home.

Sign up for US Legal Forms now!