Dallas Texas Sale of Deceased Partner's Interest refers to the process of selling the ownership stake of a deceased partner in a business or partnership located in Dallas, Texas. When a partner passes away, their interest in the partnership needs to be transferred or sold to ensure the continuity of the business. The sale of a deceased partner's interest involves several important steps. Initially, the remaining partners or the legal representative of the deceased partner must determine the value of the interest. This valuation is crucial to establish a fair price for the deceased partner's share and facilitate a smooth transaction. In Dallas, Texas, two primary types of sales of a deceased partner's interest generally occur: internal transfer and external sale. An internal transfer occurs when the remaining partners agree to purchase the deceased partner's interest in the business. This type of sale often involves negotiations and discussions among the partners, as they determine the buyout terms and conditions. Conversely, an external sale involves selling the deceased partner's interest to an outside buyer who is not currently associated with the partnership. In such cases, the remaining partners may decide to advertise the interest for sale, seek potential buyers, or engage business brokers who specialize in facilitating partnership transfers. The external sale option allows for more choices and might attract buyers who are interested in investing in established Dallas-based businesses. In both scenarios, the sale process also requires legal documentation, including the creation of a purchase agreement or contract that outlines the terms of the sale. This agreement usually covers issues such as the purchase price, payment terms, transfer of ownership, and any other relevant provisions. Furthermore, it is crucial to consider the tax implications associated with the sale of a deceased partner's interest. Depending on the specific circumstances and applicable laws, there may be estate taxes, capital gains taxes, or other tax obligations that need to be addressed during the sale process. Seeking professional advice from tax attorneys or accountants who are familiar with Dallas-specific regulations is highly recommended ensuring compliance and minimize tax liabilities. In summary, a Dallas Texas Sale of Deceased Partner's Interest involves transferring or selling the ownership stake of a deceased partner in a partnership or business located in Dallas, Texas. These sales can be categorized as internal transfers, where the remaining partners buy out the interest themselves, or external sales, where the interest is sold to an outside buyer. Both types of sales require careful valuation, negotiation, legal documentation, and consideration of tax implications to ensure a smooth and successful transfer of ownership.

Dallas Texas Sale of Deceased Partner's Interest

Description

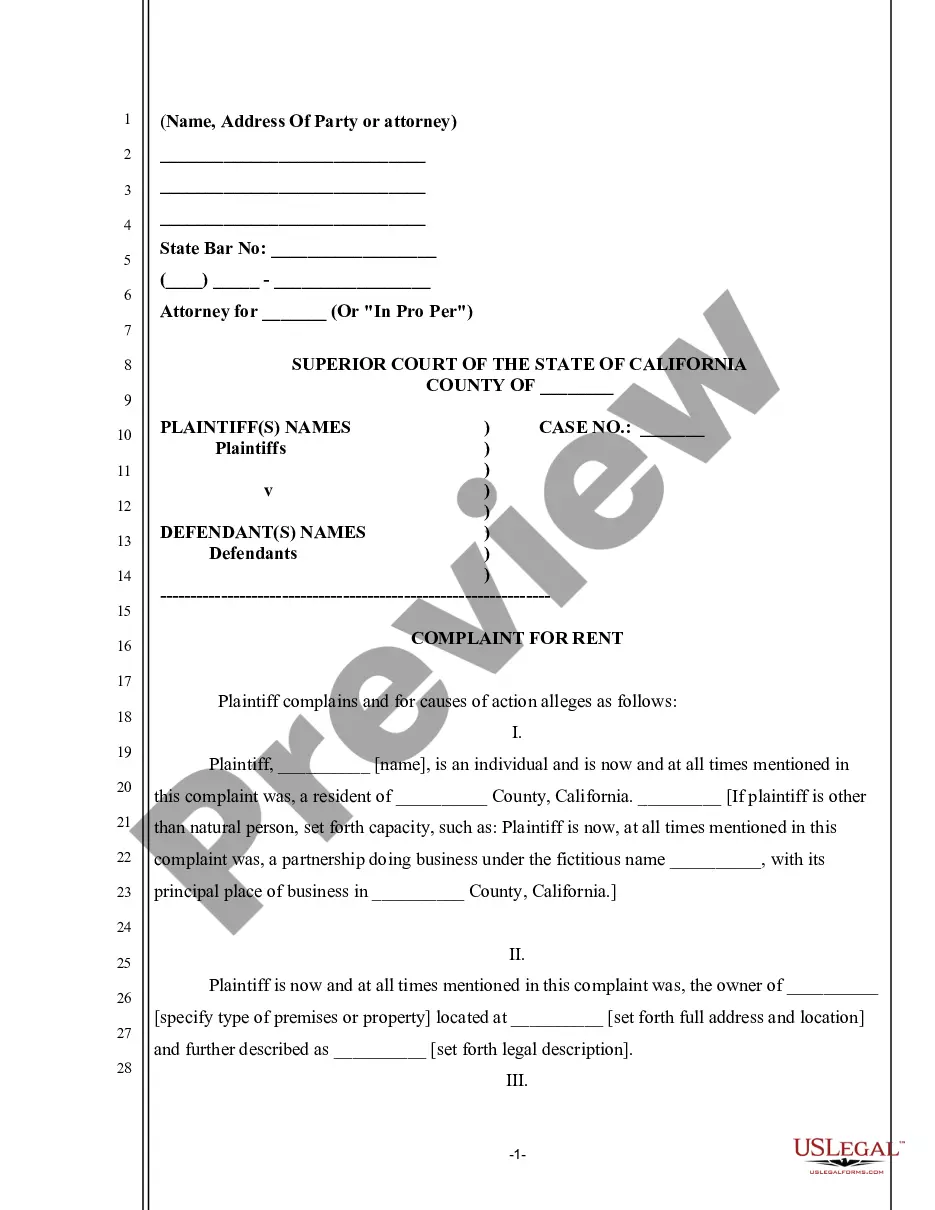

How to fill out Dallas Texas Sale Of Deceased Partner's Interest?

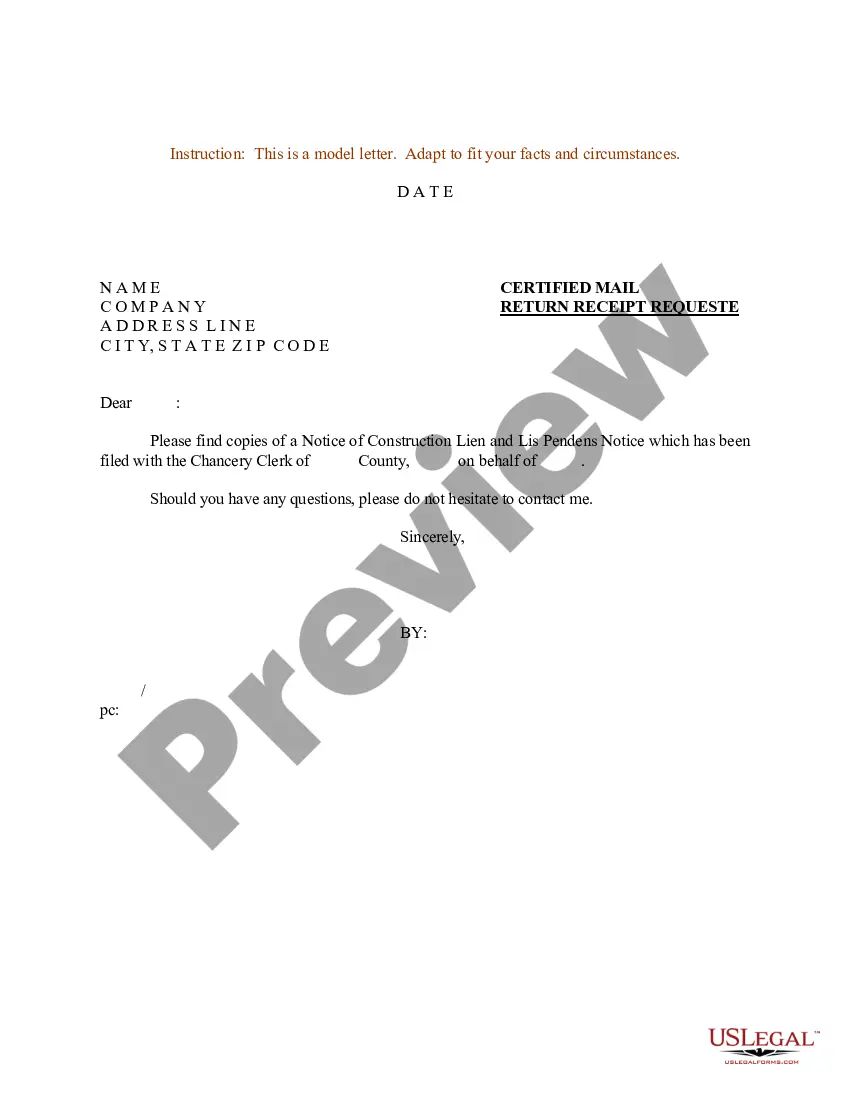

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Dallas Sale of Deceased Partner's Interest.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Dallas Sale of Deceased Partner's Interest will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Dallas Sale of Deceased Partner's Interest:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Dallas Sale of Deceased Partner's Interest on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

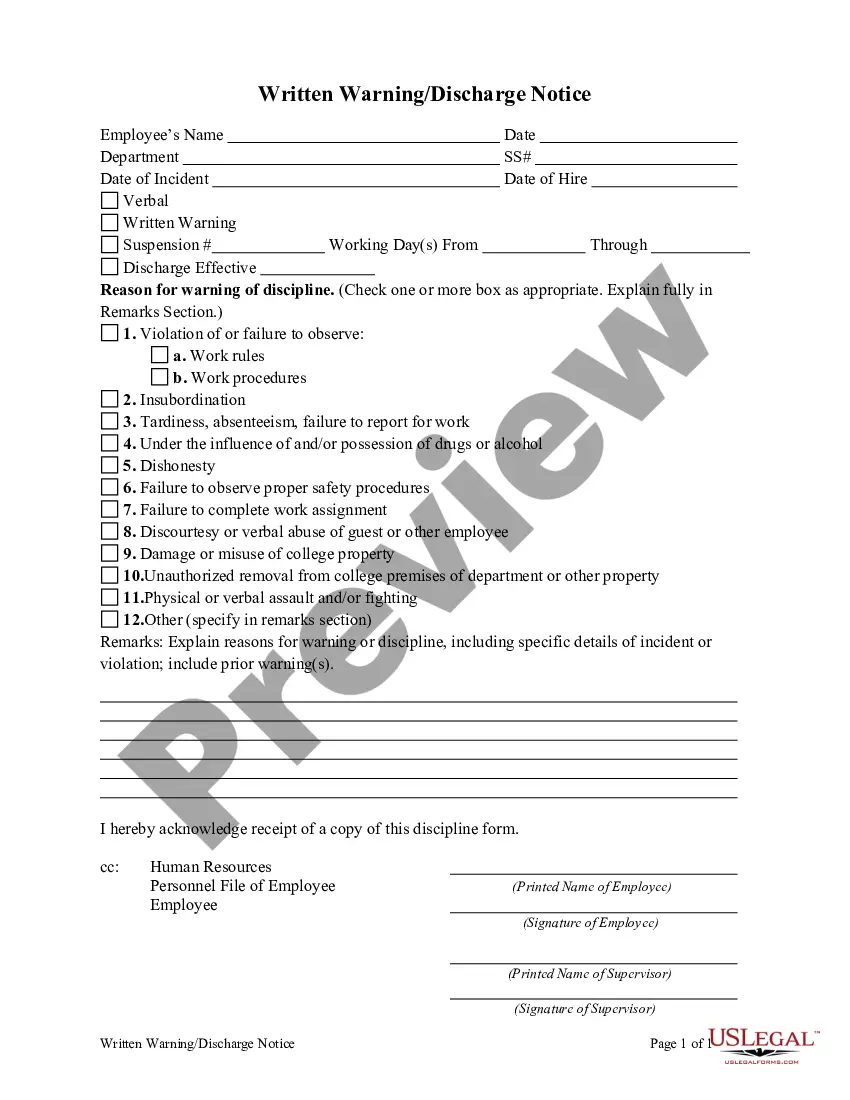

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

The selling partner's amount realized equals the amount of cash and FMV of any property received, plus the amount by which the selling partner's share of partnership liabilities are decreased.

Summary. The sale of a partnership interest is generally treated as the sale of a capital asset. As a result, the sale of a partnership interest will generally generate capital gain or loss for the difference between the amount realized on the sale and the partner's adjusted basis in the partnership interest.

person partnership does not terminate upon a partner's death if the deceased partner's successor in interest (usually the estate) continues to share in the partnership's profits or losses (Regs. Sec. 1. 7081(b)(1)(I)).

Gain Realized Generally, a partner selling his partnership interest recognizes capital gain or loss on the sale. The amount of the gain or loss recognized is the difference between the amount realized and the partner's adjusted tax basis in his partnership interest.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.