The Nassau New York sale of deceased partner's interest refers to the legal process and transaction that occurs when a partner in a business passes away, and their ownership stake needs to be transferred or sold to another party. This process is governed by specific laws in Nassau County, New York, and involves various legal and financial considerations. When a partner passes away, their ownership interest in the business becomes part of their estate. The deceased partner's interest may be subject to an estate tax, and it is typically the responsibility of the deceased partner's executor or administrator to handle the sale or transfer of their interest. There are several types of Nassau New York sales of deceased partner's interest, including: 1. Sale to Remaining Partners: In some cases, the remaining partners in the business may have the option to purchase the deceased partner's interest. This type of sale allows for a seamless transition of ownership within the existing partnership structure. 2. Sale to Third Party: If the remaining partners are unable or unwilling to purchase the deceased partner's interest, it may be sold to a third party. This could be an individual who is interested in becoming a partner in the business or an outside buyer who sees value in acquiring the ownership stake. 3. Public Auction: In certain situations, the deceased partner's interest may be sold through a public auction. This method allows for a fair and transparent sale process, and it may attract potential buyers who are interested in acquiring a stake in the business. 4. Private Negotiation: Alternatively, the sale of the deceased partner's interest can be conducted through private negotiations between the executor or administrator and potential buyers. This approach allows for more flexibility in terms of price and terms of the sale. The Nassau New York sale of deceased partner's interest requires careful evaluation of the business's value, legal documentation, and compliance with applicable tax laws. It is crucial to engage the services of experienced attorneys, appraisers, and accountants to ensure a smooth and legally compliant transaction. In summary, the Nassau New York sale of deceased partner's interest involves the legal process of transferring or selling a deceased partner's ownership stake in a business. This can be done through various methods, including sale to remaining partners, sale to a third party, public auction, or private negotiation. Executing such sales involves navigating complex legal and financial considerations to ensure a fair and legally compliant transaction.

Nassau New York Sale of Deceased Partner's Interest

Description

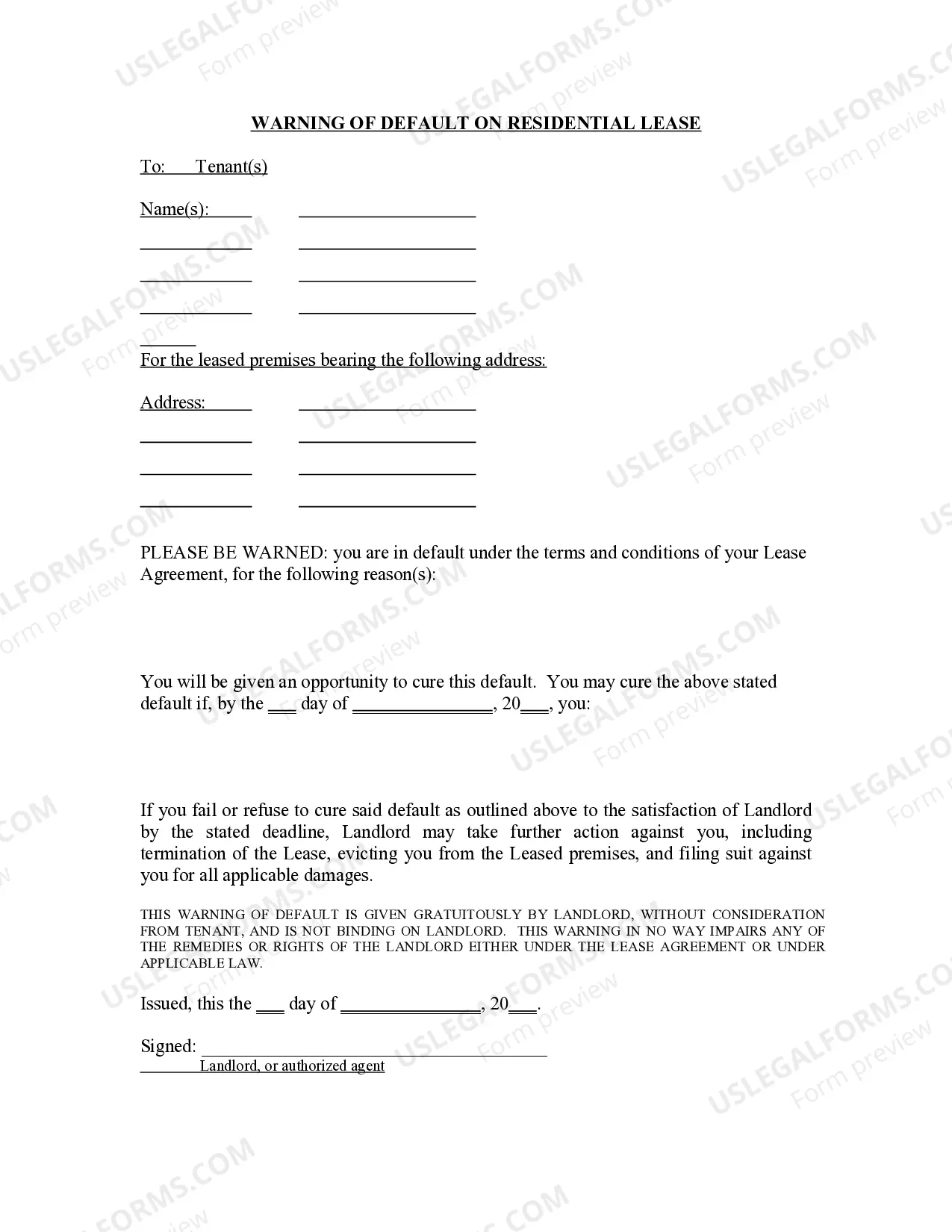

How to fill out Nassau New York Sale Of Deceased Partner's Interest?

Creating documents, like Nassau Sale of Deceased Partner's Interest, to take care of your legal matters is a difficult and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for various cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Nassau Sale of Deceased Partner's Interest template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before downloading Nassau Sale of Deceased Partner's Interest:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Nassau Sale of Deceased Partner's Interest isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and get the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!