An irrevocable trust is an arrangement in which the grantor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income.

A discretionary trust is a trust where the beneficiaries and/or their entitlements to the trust fund are not fixed, but are determined by the criteria set out in the trust instrument by trustor. Discretionary trusts can be discretionary in two respects. First, the trustees usually have the power to determine which beneficiaries (from within the class) will receive payments from the trust. Second, trustees can select the amount of trust property that the beneficiary receives. Although most discretionary trusts allow both types of discretion, either can be allowed on its own. It is permissible in most legal systems for a trust to have a fixed number of beneficiaries and for the trustees to have discretion as to how much each beneficiary receives.

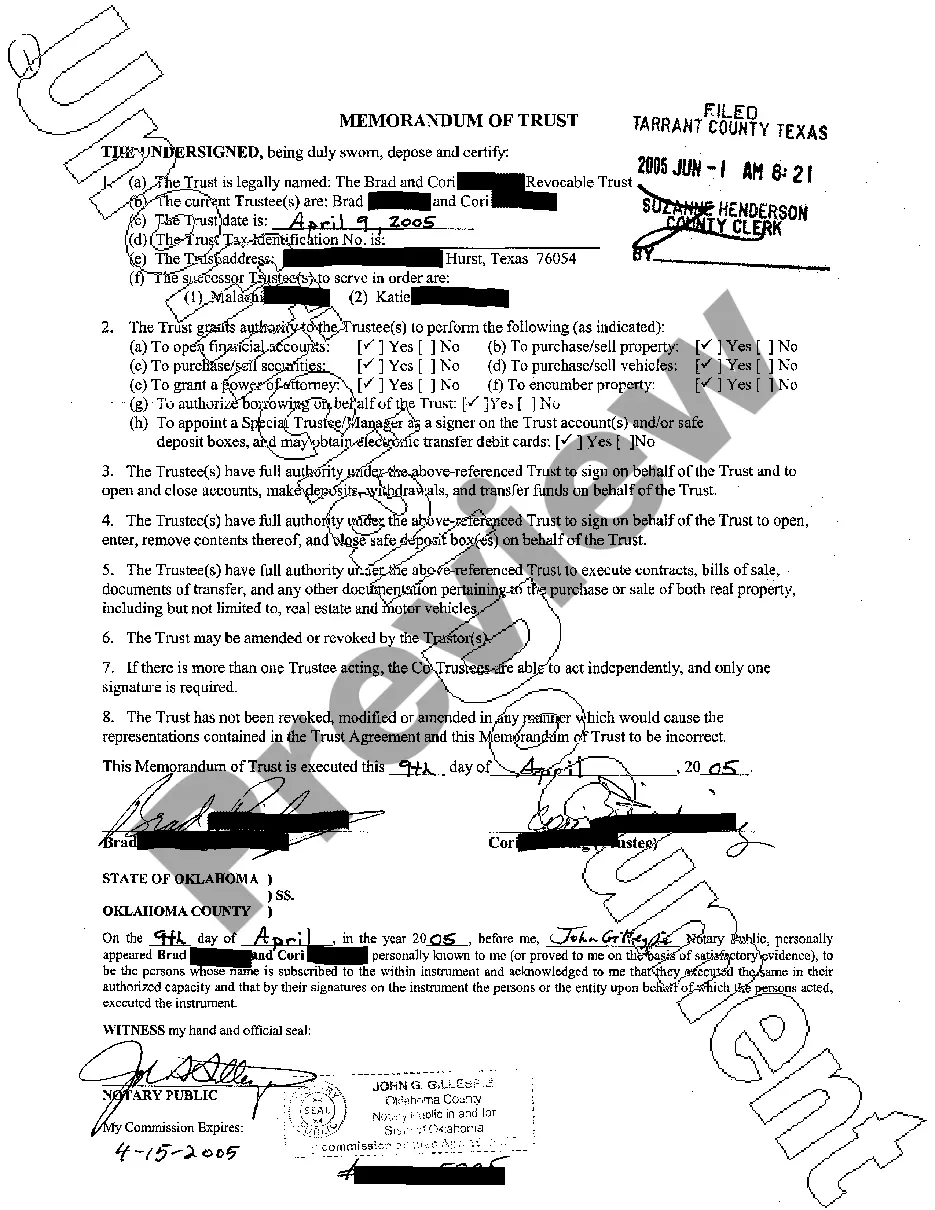

The Harris Texas Irrevocable Trust Agreement for the Benefit of Trust or's Children Discretionary Distributions of Income and Principal is a legal document that sets out specific instructions and guidelines for how a trust should be managed and distributed for the ultimate benefit of the trust or's children. This type of trust is designed to provide flexibility and discretion to the trustee, allowing them to make decisions regarding the distribution of both income and principal on behalf of the trust beneficiaries. The main purpose of the Harris Texas Irrevocable Trust Agreement for the Benefit of Trust or's Children Discretionary Distributions of Income and Principal is to protect and preserve assets for the trust or's children while granting the trustee the authority to determine the timing and amount of distributions based on the beneficiaries' needs and circumstances. By granting discretionary powers to the trustee, the trust can adapt and respond to changing situations and ensure that the beneficiaries' best interests are always considered. There may be different types or variations of the Harris Texas Irrevocable Trust Agreement for the Benefit of Trust or's Children Discretionary Distributions of Income and Principal depending on the specific goals and preferences of the trust or. Some common variations may include: 1. Harris Texas Irrevocable Trust Agreement with Special Needs Provisions: This type of trust includes additional clauses and provisions to meet the unique requirements of a beneficiary with special needs. It ensures that the discretionary distributions consider the person's ongoing care and support without jeopardizing any government benefits they may be receiving. 2. Harris Texas Irrevocable Trust Agreement with Generation-Skipping Provisions: This trust is designed to skip one or more generations of beneficiaries, typically grandchildren, while still allowing for discretionary distributions to be made for their benefit. It can provide estate tax planning benefits and help preserve family wealth for future generations. 3. Harris Texas Irrevocable Trust Agreement with Charitable Remainder Trust Provisions: This type of trust allows the trustee to make discretionary distributions to both the trust or's children and charitable organizations while maintaining tax advantages. Through this provision, the trust assets can be transferred to a charitable organization after a specified period or upon the death of the trust or beneficiaries. 4. Harris Texas Irrevocable Trust Agreement with Spendthrift Provisions: This variation includes clauses that protect trust assets from creditor claims and prevent beneficiaries from selling or giving away their future interests in the trust. It helps shield the trust assets from potential risks and financial mismanagement by the beneficiaries. The Harris Texas Irrevocable Trust Agreement for the Benefit of Trust or's Children Discretionary Distributions of Income and Principal is a powerful tool that allows the trust or to create a customized plan for asset protection and distribution while ensuring the trustee has the necessary flexibility to manage and adapt to changing circumstances.The Harris Texas Irrevocable Trust Agreement for the Benefit of Trust or's Children Discretionary Distributions of Income and Principal is a legal document that sets out specific instructions and guidelines for how a trust should be managed and distributed for the ultimate benefit of the trust or's children. This type of trust is designed to provide flexibility and discretion to the trustee, allowing them to make decisions regarding the distribution of both income and principal on behalf of the trust beneficiaries. The main purpose of the Harris Texas Irrevocable Trust Agreement for the Benefit of Trust or's Children Discretionary Distributions of Income and Principal is to protect and preserve assets for the trust or's children while granting the trustee the authority to determine the timing and amount of distributions based on the beneficiaries' needs and circumstances. By granting discretionary powers to the trustee, the trust can adapt and respond to changing situations and ensure that the beneficiaries' best interests are always considered. There may be different types or variations of the Harris Texas Irrevocable Trust Agreement for the Benefit of Trust or's Children Discretionary Distributions of Income and Principal depending on the specific goals and preferences of the trust or. Some common variations may include: 1. Harris Texas Irrevocable Trust Agreement with Special Needs Provisions: This type of trust includes additional clauses and provisions to meet the unique requirements of a beneficiary with special needs. It ensures that the discretionary distributions consider the person's ongoing care and support without jeopardizing any government benefits they may be receiving. 2. Harris Texas Irrevocable Trust Agreement with Generation-Skipping Provisions: This trust is designed to skip one or more generations of beneficiaries, typically grandchildren, while still allowing for discretionary distributions to be made for their benefit. It can provide estate tax planning benefits and help preserve family wealth for future generations. 3. Harris Texas Irrevocable Trust Agreement with Charitable Remainder Trust Provisions: This type of trust allows the trustee to make discretionary distributions to both the trust or's children and charitable organizations while maintaining tax advantages. Through this provision, the trust assets can be transferred to a charitable organization after a specified period or upon the death of the trust or beneficiaries. 4. Harris Texas Irrevocable Trust Agreement with Spendthrift Provisions: This variation includes clauses that protect trust assets from creditor claims and prevent beneficiaries from selling or giving away their future interests in the trust. It helps shield the trust assets from potential risks and financial mismanagement by the beneficiaries. The Harris Texas Irrevocable Trust Agreement for the Benefit of Trust or's Children Discretionary Distributions of Income and Principal is a powerful tool that allows the trust or to create a customized plan for asset protection and distribution while ensuring the trustee has the necessary flexibility to manage and adapt to changing circumstances.