An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

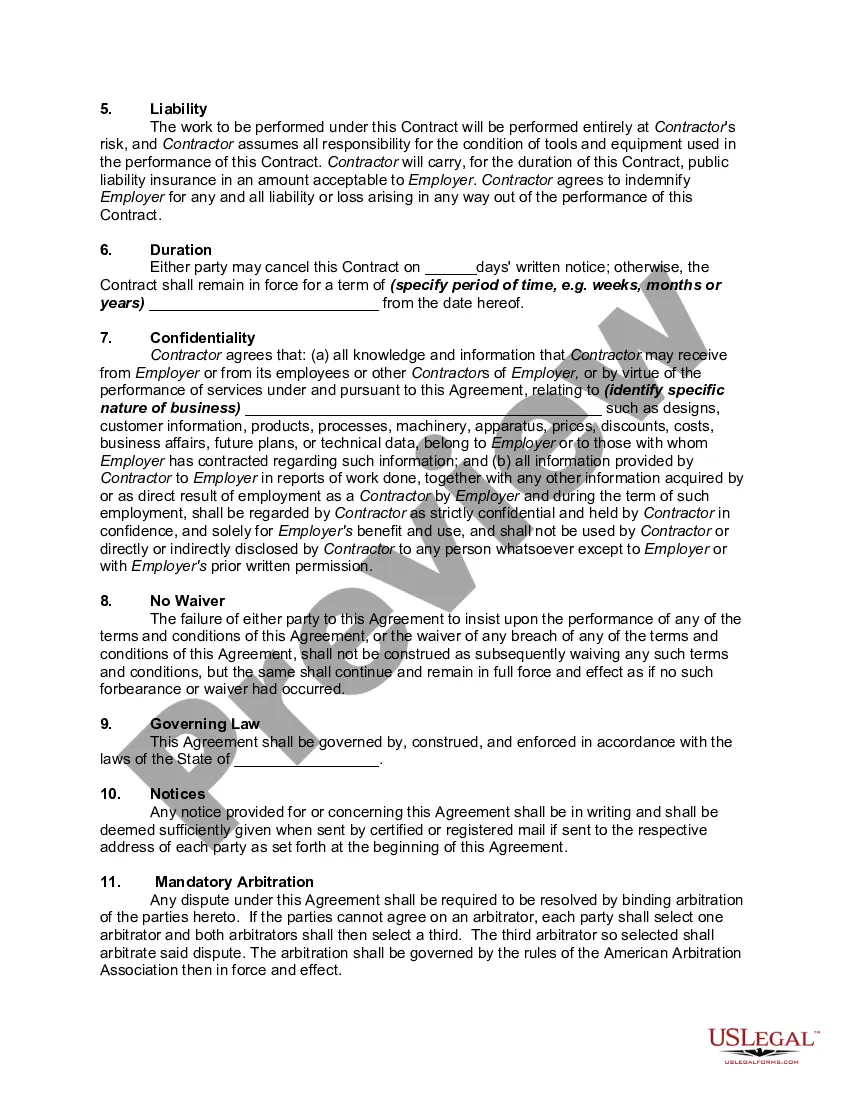

This form contains a confidentiality clause. The most important part of a confidentiality clause is the definition or description of the confidential information. Ideally, the contract should set forth as specifically as possible the scope of information covered by the agreement. However, the disclosing party may be reluctant to describe the information in the contract, for fear that some of the confidential information might be revealed in the contract itself.

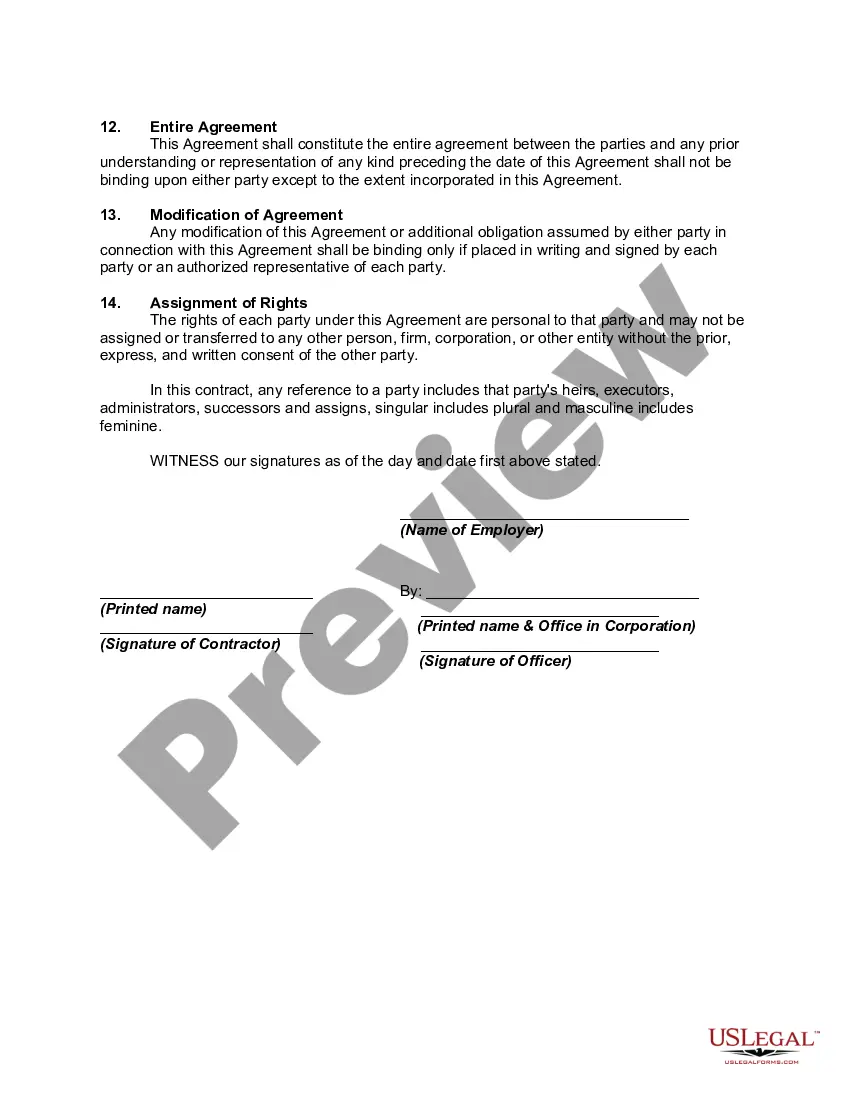

San Jose, California is a vibrant city known for its technological innovation and thriving business environment. One key aspect of conducting business in San Jose is the utilization of contracts with self-employed independent contractors that include confidentiality agreements. These contracts are crucial in protecting the interests and proprietary information of both parties involved. A San Jose California contract with a self-employed independent contractor with a confidentiality agreement is a legally binding document that outlines the terms and conditions of the working relationship between a business and an independent contractor. This type of agreement is primarily used when a business engages an individual contractor for a specific project or task, rather than hiring them as an employee. The contract typically includes multiple key elements. Firstly, it clearly defines the scope of work to be performed by the contractor, ensuring that both parties have a clear understanding of the project expectations. This section may outline specific deliverables, deadlines, and any relevant milestones. Additionally, the agreement includes the payment terms, covering details such as the agreed-upon rate and payment schedule. It is essential that these terms are agreed upon and clearly outlined to avoid any potential disputes or misunderstandings during the course of the project. Moreover, the contract includes clauses for confidentiality and non-disclosure. These provisions are crucial to safeguard any sensitive or proprietary information shared between the business and the contractor. This ensures that confidential information, trade secrets, or intellectual property are protected from unauthorized disclosure or use. The contractor is bound by this agreement not to disclose any confidential information during or after the contract period. There may be different types or variations of San Jose California contracts with self-employed independent contractors with a confidentiality agreement. Some types may focus on specific industries or professions, such as technology, marketing, or creative services. The specific details and clauses within the contract may vary based on the nature of the work being performed and the specific requirements of the parties involved. In conclusion, a San Jose California contract with a self-employed independent contractor with a confidentiality agreement is a crucial tool for businesses to protect their interests while engaging independent contractors. By clearly defining project expectations, payment terms, and maintaining confidentiality, both parties can establish a solid foundation for a successful working relationship. It is important to consult with legal professionals to ensure that the contract meets all necessary legal requirements while addressing the specific needs of the business.San Jose, California is a vibrant city known for its technological innovation and thriving business environment. One key aspect of conducting business in San Jose is the utilization of contracts with self-employed independent contractors that include confidentiality agreements. These contracts are crucial in protecting the interests and proprietary information of both parties involved. A San Jose California contract with a self-employed independent contractor with a confidentiality agreement is a legally binding document that outlines the terms and conditions of the working relationship between a business and an independent contractor. This type of agreement is primarily used when a business engages an individual contractor for a specific project or task, rather than hiring them as an employee. The contract typically includes multiple key elements. Firstly, it clearly defines the scope of work to be performed by the contractor, ensuring that both parties have a clear understanding of the project expectations. This section may outline specific deliverables, deadlines, and any relevant milestones. Additionally, the agreement includes the payment terms, covering details such as the agreed-upon rate and payment schedule. It is essential that these terms are agreed upon and clearly outlined to avoid any potential disputes or misunderstandings during the course of the project. Moreover, the contract includes clauses for confidentiality and non-disclosure. These provisions are crucial to safeguard any sensitive or proprietary information shared between the business and the contractor. This ensures that confidential information, trade secrets, or intellectual property are protected from unauthorized disclosure or use. The contractor is bound by this agreement not to disclose any confidential information during or after the contract period. There may be different types or variations of San Jose California contracts with self-employed independent contractors with a confidentiality agreement. Some types may focus on specific industries or professions, such as technology, marketing, or creative services. The specific details and clauses within the contract may vary based on the nature of the work being performed and the specific requirements of the parties involved. In conclusion, a San Jose California contract with a self-employed independent contractor with a confidentiality agreement is a crucial tool for businesses to protect their interests while engaging independent contractors. By clearly defining project expectations, payment terms, and maintaining confidentiality, both parties can establish a solid foundation for a successful working relationship. It is important to consult with legal professionals to ensure that the contract meets all necessary legal requirements while addressing the specific needs of the business.