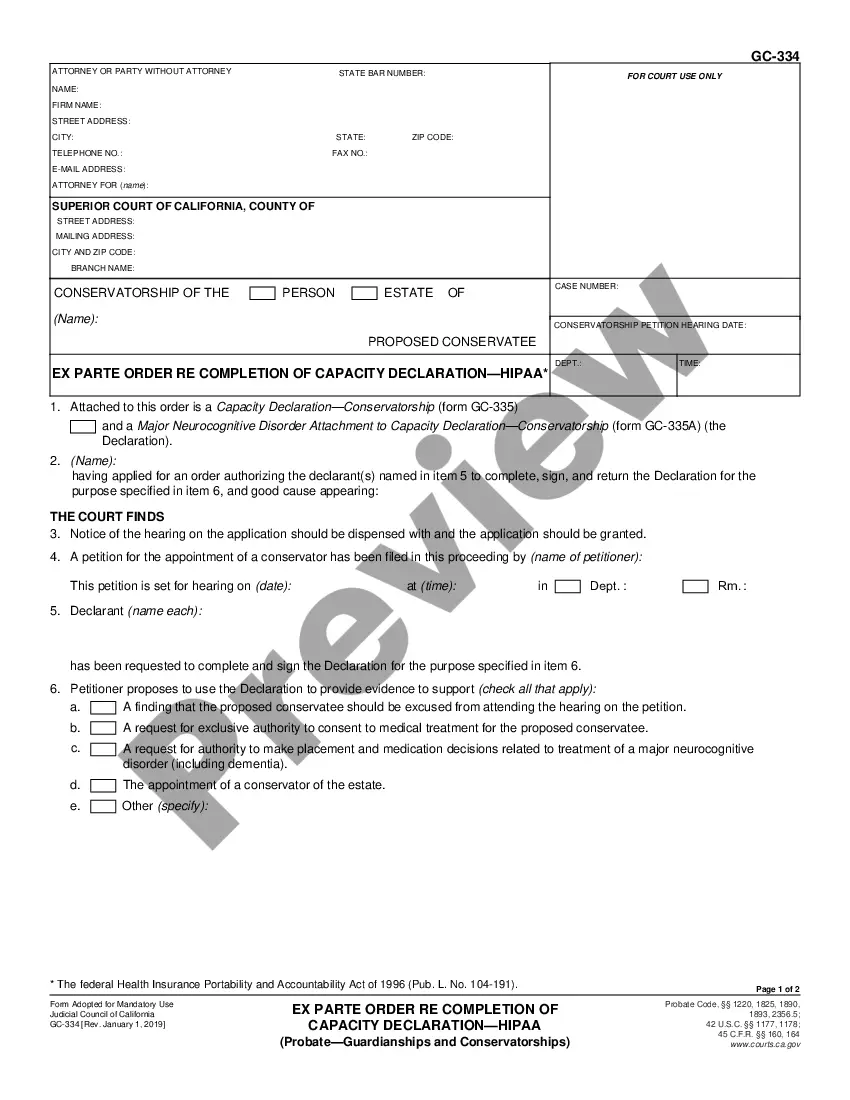

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Collin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness is a legal process that involves transferring ownership rights and interests in an estate to settle outstanding debts. This assignment is crucial when an individual or entity owes debts and needs to allocate their expected interest in an estate to pay off these obligations. In Collin Texas, there are different types of Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, which are significant for various scenarios: 1. Voluntary Assignment: This type of assignment occurs when the debtor willingly transfers their expected interest in the estate to the creditor(s). With the debtor's consent, the assignee gains control over the debtor's portion in the estate to fulfill the financial obligations. 2. Judicial Assignment: In certain cases, a court order may be required to impose an Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. This can happen if there are disputes between the debtor and creditor(s), or if the debtor is unable or unwilling to cooperate voluntarily. The court's decision ensures a fair and transparent distribution of the debtor's interest in the estate. 3. Testate Assignment: When an individual dies leaving a valid will, the assignment of expected interest in their estate can be guided by the provisions stated in the will. The executor or administrator of the estate follows the instructions in the will to assign the debtor's interest to the respective creditors, safeguarding the deceased person's wishes and ensuring proper debt repayment. 4. Intestate Assignment: If an individual passes away without leaving a valid will, the assignment of expected interest in their estate follows the laws of intestate succession. In this case, a designated administrator distributes the debtor's interest in the estate among the creditors according to the applicable laws, such as Texas laws regarding intestacy. Overall, the Collin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness is a critical legal process that facilitates debt repayment using the debtor's share of an estate. Whether executed voluntarily or by court order, these assignments ensure fair and just distribution among creditors while adhering to the specific circumstances and legal requirements involved.Collin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness is a legal process that involves transferring ownership rights and interests in an estate to settle outstanding debts. This assignment is crucial when an individual or entity owes debts and needs to allocate their expected interest in an estate to pay off these obligations. In Collin Texas, there are different types of Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, which are significant for various scenarios: 1. Voluntary Assignment: This type of assignment occurs when the debtor willingly transfers their expected interest in the estate to the creditor(s). With the debtor's consent, the assignee gains control over the debtor's portion in the estate to fulfill the financial obligations. 2. Judicial Assignment: In certain cases, a court order may be required to impose an Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. This can happen if there are disputes between the debtor and creditor(s), or if the debtor is unable or unwilling to cooperate voluntarily. The court's decision ensures a fair and transparent distribution of the debtor's interest in the estate. 3. Testate Assignment: When an individual dies leaving a valid will, the assignment of expected interest in their estate can be guided by the provisions stated in the will. The executor or administrator of the estate follows the instructions in the will to assign the debtor's interest to the respective creditors, safeguarding the deceased person's wishes and ensuring proper debt repayment. 4. Intestate Assignment: If an individual passes away without leaving a valid will, the assignment of expected interest in their estate follows the laws of intestate succession. In this case, a designated administrator distributes the debtor's interest in the estate among the creditors according to the applicable laws, such as Texas laws regarding intestacy. Overall, the Collin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness is a critical legal process that facilitates debt repayment using the debtor's share of an estate. Whether executed voluntarily or by court order, these assignments ensure fair and just distribution among creditors while adhering to the specific circumstances and legal requirements involved.