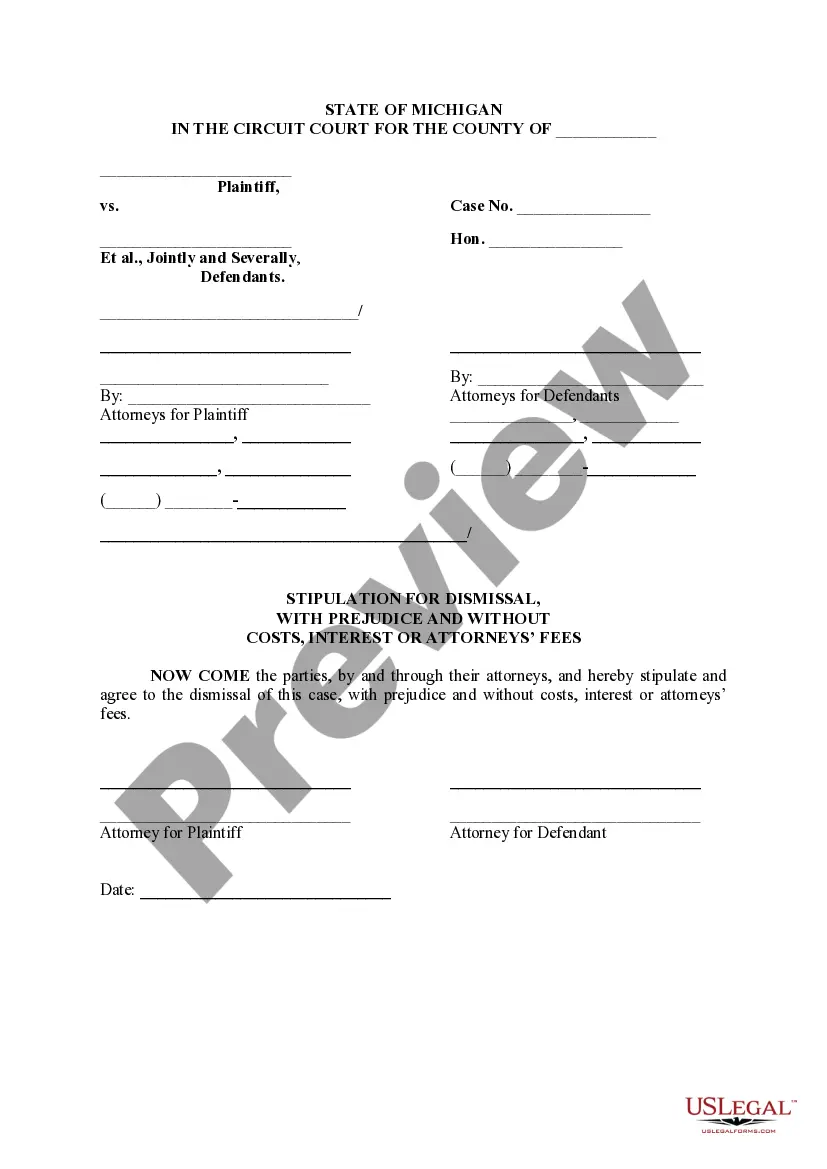

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Los Angeles, California is a vibrant and diverse city located in the western United States. It is renowned for its stunning beaches, glamorous entertainment industry, diverse culture, and thriving economy. As the second-largest city in the United States, Los Angeles attracts millions of visitors each year who come to explore its many attractions and take part in its renowned lifestyle. One specific legal document used in Los Angeles, California is the Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. This document allows an individual or entity to transfer a specific portion of their interest in an estate to another party in order to fulfill a debt or indebtedness. There can be various types of Los Angeles, California Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, including: 1. Voluntary Assignment: In this type, an individual willingly transfers a portion of their interest in an estate to pay off a debt. This can be done to secure a loan or settle an existing obligation. 2. Forced Assignment: Sometimes, individuals may be compelled by a court order to assign a portion of their interest in an estate to satisfy a debt. This type of assignment typically occurs when legal action has been taken against the individual or when they are facing insurmountable financial challenges. 3. Deed of Trust Assignment: This type of assignment is often used in real estate transactions. It allows a property owner to assign a portion of their interest in the property to a lender as collateral for a loan or to satisfy outstanding debts. 4. Testamentary Assignment: This assignment happens after a person's passing, as dictated by their will or testament. It may involve assigning a portion of the deceased individual's interest in an estate to pay off debts before assets are distributed to beneficiaries. When creating a Los Angeles, California Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, individuals must ensure they comply with local laws and regulations. It is recommended to seek legal advice to ensure the assignment is structured correctly and all necessary provisions are included. In conclusion, Los Angeles, California is a vibrant city offering various types of Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. These documents allow individuals to transfer a portion of their interest in an estate to fulfill a debt or financial obligation. Whether it be voluntary or forced, these assignments play a crucial role in managing and resolving financial matters in Los Angeles, California.