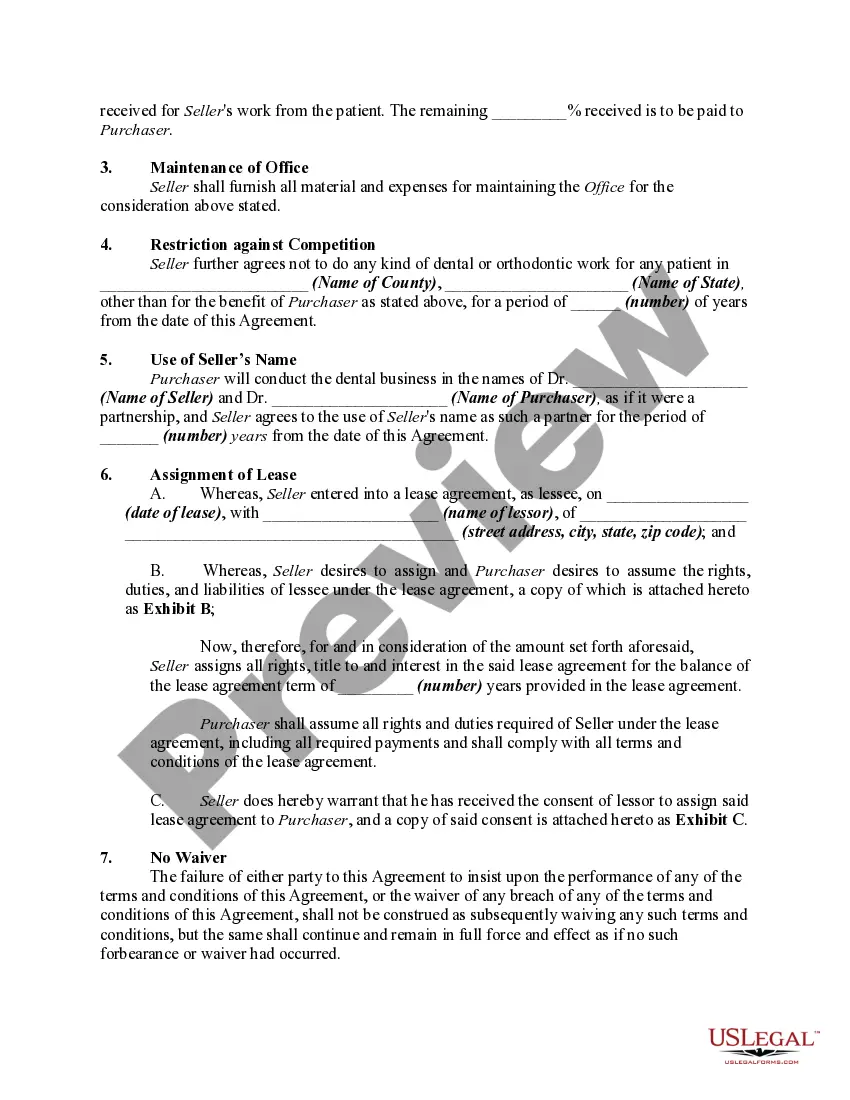

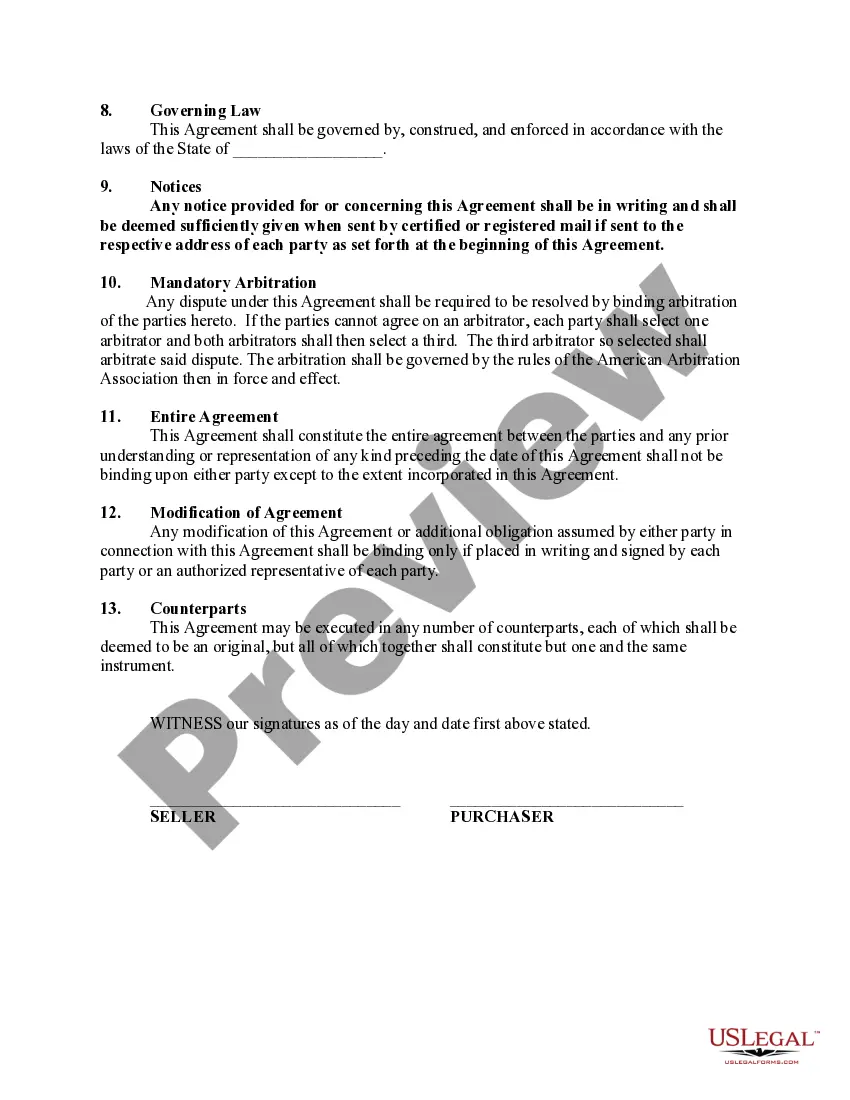

The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. The buyer and must consider the law of contracts, taxation, and real estate in many situations. A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. In making this allocation, the buyer's interests will often conflict with the seller's. The seller will ordinarily seek to maximize its capital gain and ordinary loss by allocating the price to items producing such a result. The buyer will normally seek to have the price allocated to depreciable assets and to inventory in order to maximize ordinary deductions after the business is acquired.

Corpus Christi Texas Agreement for Sale of Dental and Orthodontic Practice

Category:

State:

Multi-State

City:

Corpus Christi

Control #:

US-01759BG

Format:

Word;

Rich Text

Instant download

Description

Free preview