The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. The buyer and must consider the law of contracts, taxation, and real estate in many situations. A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. In making this allocation, the buyer's interests will often conflict with the seller's. The seller will ordinarily seek to maximize its capital gain and ordinary loss by allocating the price to items producing such a result. The buyer will normally seek to have the price allocated to depreciable assets and to inventory in order to maximize ordinary deductions after the business is acquired.

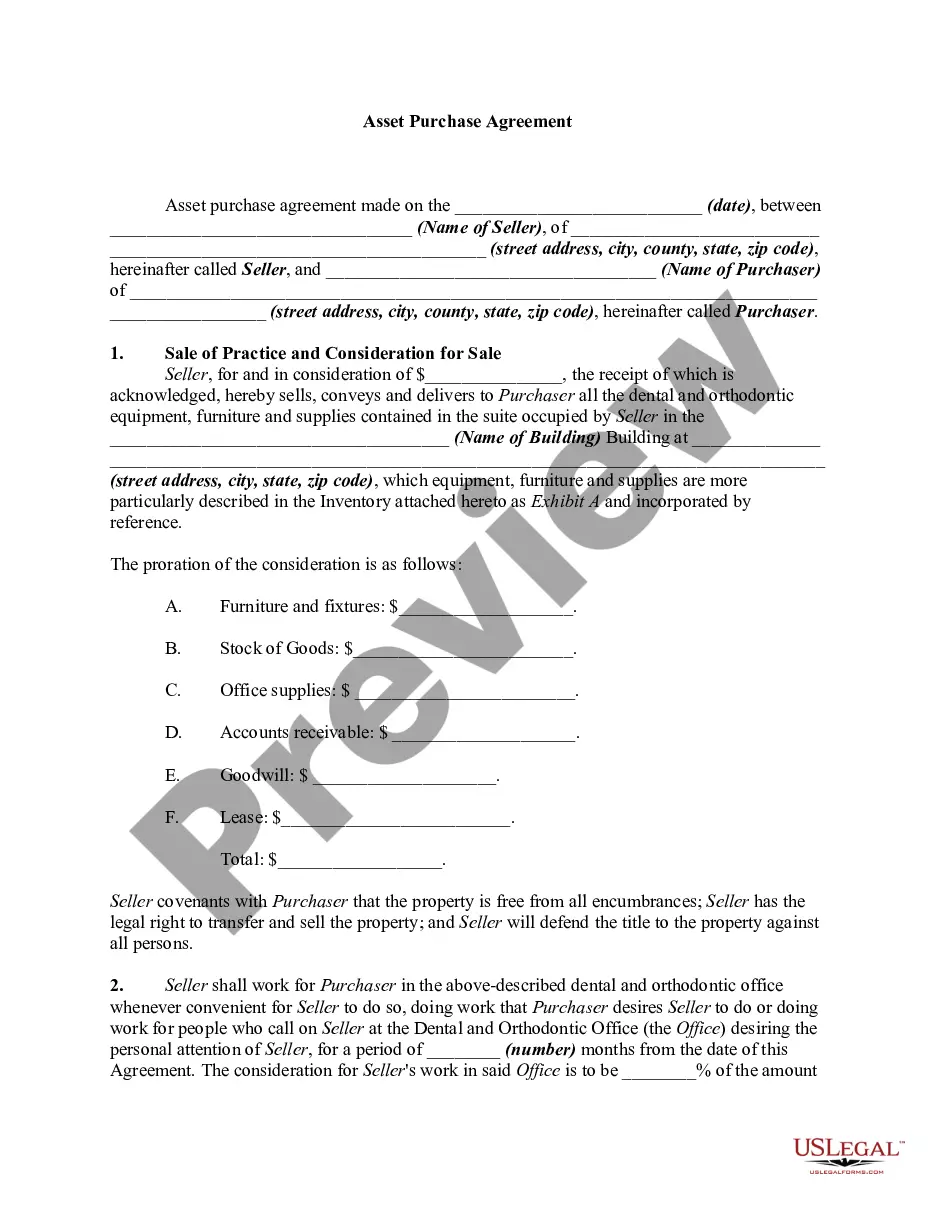

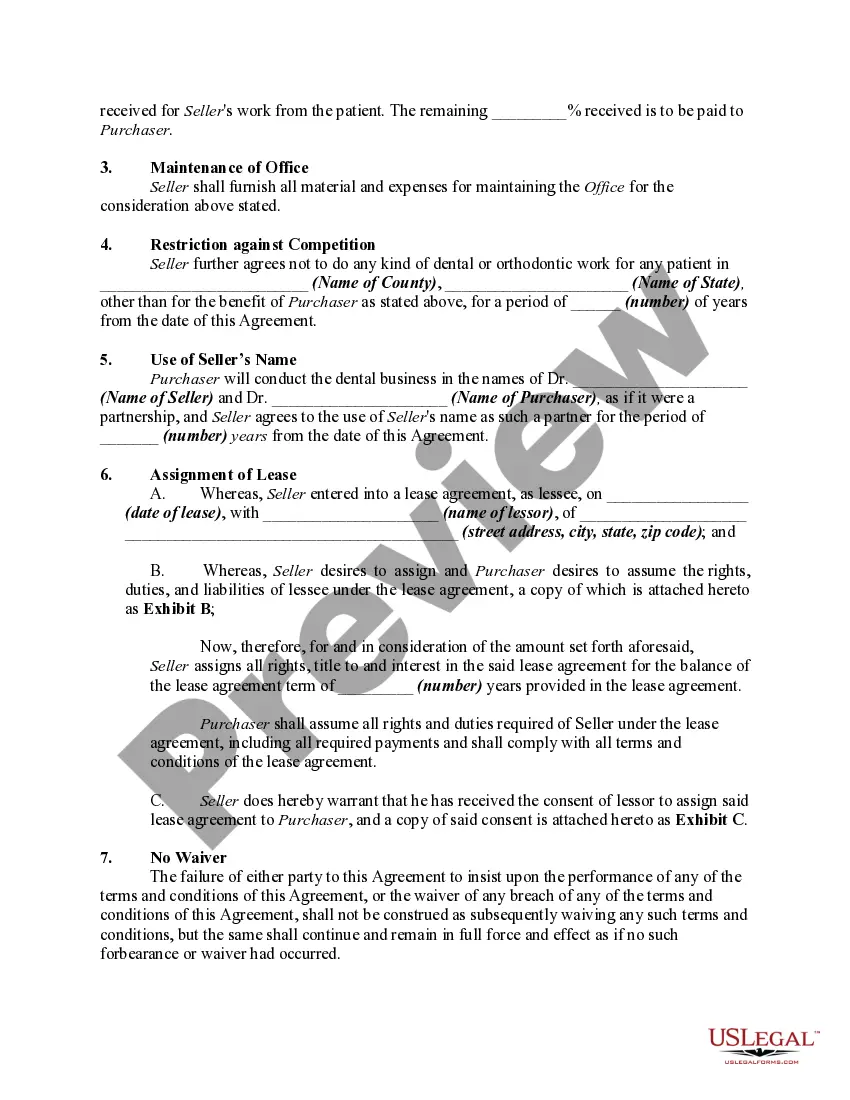

The Hennepin Minnesota Agreement for Sale of Dental and Orthodontic Practice is a legal contract that outlines the terms and conditions for the sale and transfer of a dental or orthodontic practice in Hennepin County, Minnesota. This agreement serves as a crucial document that protects the rights and interests of both the buyer and the seller, ensuring a smooth transition of ownership. Keywords: Hennepin Minnesota, Agreement for Sale, Dental Practice, Orthodontic Practice, legal contract, terms and conditions, sale and transfer, Hennepin County, Minnesota, buyer, seller, transition of ownership. There may be different types of Hennepin Minnesota Agreement for Sale of Dental and Orthodontic Practice, such as: 1. Asset Purchase Agreement: This type of agreement focuses on the sale and transfer of specific assets related to the dental or orthodontic practice, including equipment, supplies, patient records, and goodwill. 2. Stock Purchase Agreement: In this type of agreement, the sale and transfer revolve around the purchase of stocks or shares of a dental or orthodontic practice, which grants the buyer ownership and control of the entire entity. 3. Partnership Buyout Agreement: When there is a dental or orthodontic practice operated by multiple partners, this agreement type facilitates the buyout of one partner's share or interest in the practice, enabling the remaining partner(s) to continue the operation. 4. Transition Services Agreement: This agreement is designed to provide for a smooth transition period after the sale of a dental or orthodontic practice. It may involve the seller assisting the buyer in patient handovers, staff training, or any other necessary support during the transition period. In conclusion, the Hennepin Minnesota Agreement for Sale of Dental and Orthodontic Practice is a critical legal document that ensures a proper sale and transfer of ownership in dental and orthodontic practices in Hennepin County, Minnesota. It safeguards the interests of both parties involved and comes in various types, such as asset purchase agreements, stock purchase agreements, partnership buyout agreements, and transition services agreements.The Hennepin Minnesota Agreement for Sale of Dental and Orthodontic Practice is a legal contract that outlines the terms and conditions for the sale and transfer of a dental or orthodontic practice in Hennepin County, Minnesota. This agreement serves as a crucial document that protects the rights and interests of both the buyer and the seller, ensuring a smooth transition of ownership. Keywords: Hennepin Minnesota, Agreement for Sale, Dental Practice, Orthodontic Practice, legal contract, terms and conditions, sale and transfer, Hennepin County, Minnesota, buyer, seller, transition of ownership. There may be different types of Hennepin Minnesota Agreement for Sale of Dental and Orthodontic Practice, such as: 1. Asset Purchase Agreement: This type of agreement focuses on the sale and transfer of specific assets related to the dental or orthodontic practice, including equipment, supplies, patient records, and goodwill. 2. Stock Purchase Agreement: In this type of agreement, the sale and transfer revolve around the purchase of stocks or shares of a dental or orthodontic practice, which grants the buyer ownership and control of the entire entity. 3. Partnership Buyout Agreement: When there is a dental or orthodontic practice operated by multiple partners, this agreement type facilitates the buyout of one partner's share or interest in the practice, enabling the remaining partner(s) to continue the operation. 4. Transition Services Agreement: This agreement is designed to provide for a smooth transition period after the sale of a dental or orthodontic practice. It may involve the seller assisting the buyer in patient handovers, staff training, or any other necessary support during the transition period. In conclusion, the Hennepin Minnesota Agreement for Sale of Dental and Orthodontic Practice is a critical legal document that ensures a proper sale and transfer of ownership in dental and orthodontic practices in Hennepin County, Minnesota. It safeguards the interests of both parties involved and comes in various types, such as asset purchase agreements, stock purchase agreements, partnership buyout agreements, and transition services agreements.