The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. The buyer and must consider the law of contracts, taxation, and real estate in many situations. A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. In making this allocation, the buyer's interests will often conflict with the seller's. The seller will ordinarily seek to maximize its capital gain and ordinary loss by allocating the price to items producing such a result. The buyer will normally seek to have the price allocated to depreciable assets and to inventory in order to maximize ordinary deductions after the business is acquired.

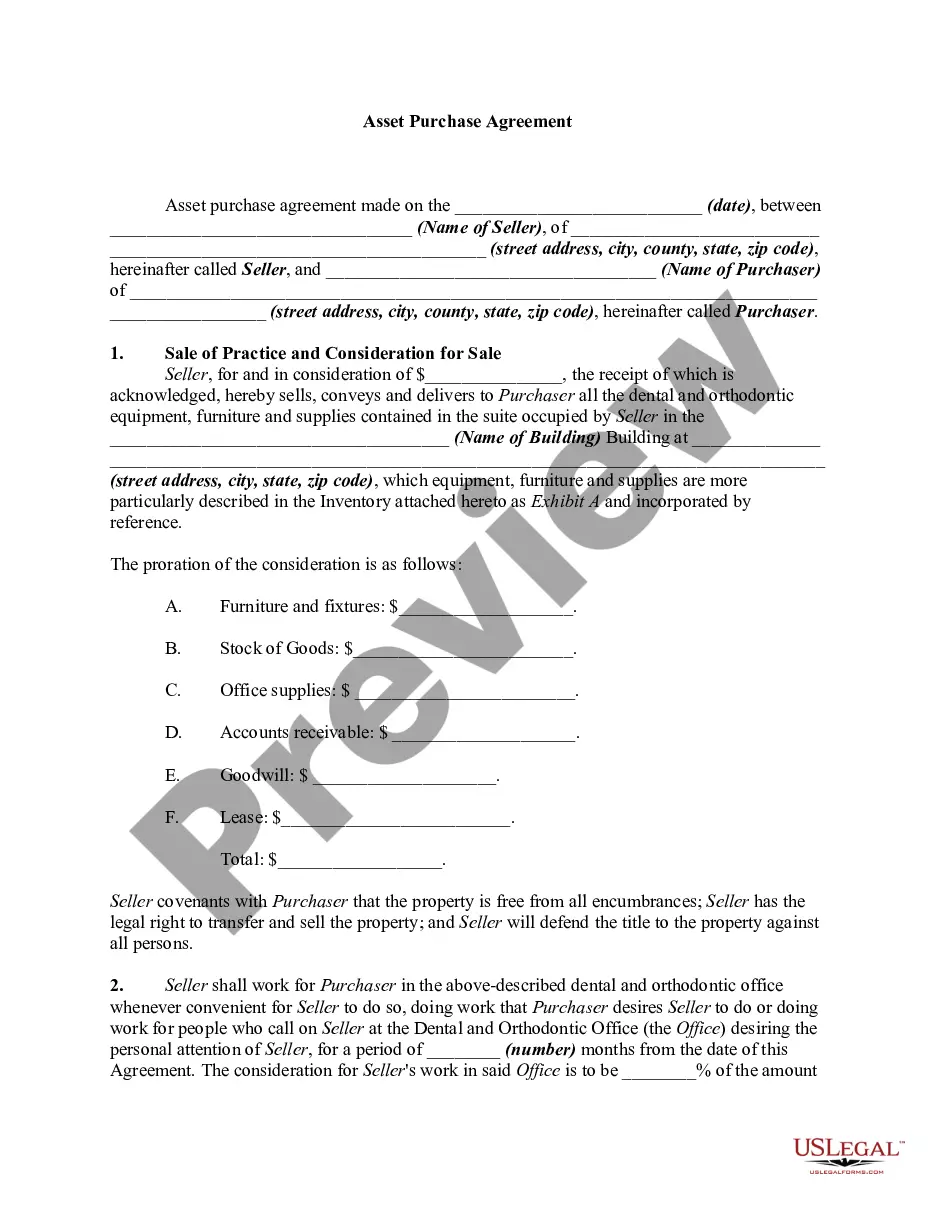

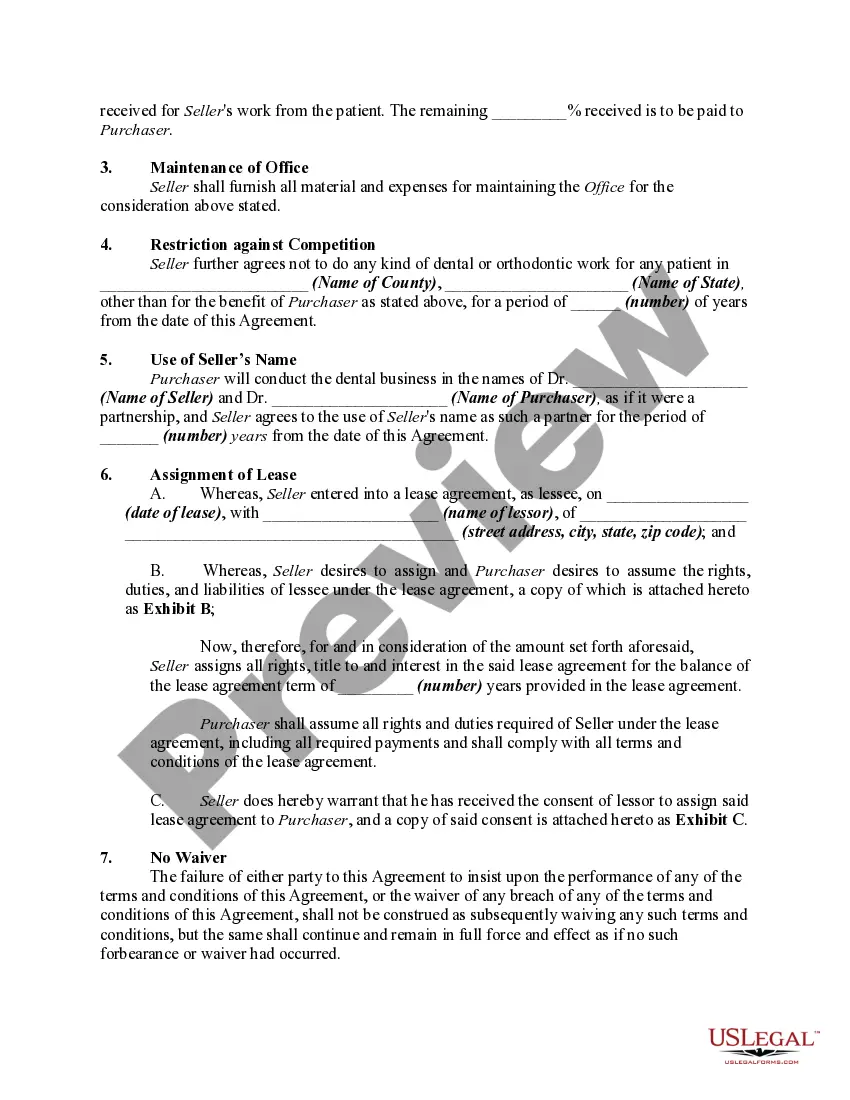

The Mecklenburg North Carolina Agreement for Sale of Dental and Orthodontic Practice is a legal document that outlines the terms and conditions for the sale of a dental or orthodontic practice in Mecklenburg County, North Carolina. This agreement is crucial in facilitating a smooth and legally binding transaction between the seller and the buyer. Keywords: Mecklenburg North Carolina, Agreement for Sale, Dental and Orthodontic Practice. The agreement typically includes: 1. Parties involved: The agreement will clearly state the names and contact information of both the seller and the buyer. It may also include details about any legal representatives or brokers involved in the transaction. 2. Terms of the sale: This section outlines the specific terms agreed upon by both parties. It covers the purchase price, payment terms, and any financing arrangements made. The agreement may also indicate whether the buyer will assume any existing liabilities or debts of the practice. 3. Assets included in the sale: It is important to list all tangible and intangible assets that are part of the practice sale. This includes equipment, patient records, inventory, intellectual property, lease agreements, and any other relevant assets. 4. Transition period: The agreement may specify a transition period during which the seller will work with the buyer to ensure a smooth transfer of ownership. This period may include introductions to patients, training, and assistance in transitioning the practice's operations. 5. Non-compete and confidentiality clauses: To protect the buyer's investment, the agreement may include non-compete and confidentiality clauses that prohibit the seller from competing against or disclosing confidential information about the practice. Types of Mecklenburg North Carolina Agreement for Sale of Dental and Orthodontic Practice: 1. Asset Purchase Agreement: This type of agreement involves the purchase of specific assets of the dental or orthodontic practice, rather than the entity itself. This may be suitable when the buyer only wants to acquire certain assets, such as equipment or patient records. 2. Stock Purchase Agreement: In this type of agreement, the buyer purchases the entire entity, including all assets, liabilities, contracts, and obligations associated with the dental or orthodontic practice. This may be more appropriate when the buyer wants to acquire the entire business entity. 3. Partnership Buyout Agreement: If there are multiple partners in a dental or orthodontic practice and one partner wishes to sell their share, a partnership buyout agreement is used. This agreement outlines the terms by which the remaining partner(s) will purchase the selling partner's interest in the practice. In conclusion, the Mecklenburg North Carolina Agreement for Sale of Dental and Orthodontic Practice is a legally binding document that details the terms and conditions of the sale. It covers aspects such as the purchase price, assets included, transition period, and non-compete clauses. There are different types of agreements, such as asset purchase, stock purchase, or partnership buyout agreements, depending on the specific circumstances of the sale.The Mecklenburg North Carolina Agreement for Sale of Dental and Orthodontic Practice is a legal document that outlines the terms and conditions for the sale of a dental or orthodontic practice in Mecklenburg County, North Carolina. This agreement is crucial in facilitating a smooth and legally binding transaction between the seller and the buyer. Keywords: Mecklenburg North Carolina, Agreement for Sale, Dental and Orthodontic Practice. The agreement typically includes: 1. Parties involved: The agreement will clearly state the names and contact information of both the seller and the buyer. It may also include details about any legal representatives or brokers involved in the transaction. 2. Terms of the sale: This section outlines the specific terms agreed upon by both parties. It covers the purchase price, payment terms, and any financing arrangements made. The agreement may also indicate whether the buyer will assume any existing liabilities or debts of the practice. 3. Assets included in the sale: It is important to list all tangible and intangible assets that are part of the practice sale. This includes equipment, patient records, inventory, intellectual property, lease agreements, and any other relevant assets. 4. Transition period: The agreement may specify a transition period during which the seller will work with the buyer to ensure a smooth transfer of ownership. This period may include introductions to patients, training, and assistance in transitioning the practice's operations. 5. Non-compete and confidentiality clauses: To protect the buyer's investment, the agreement may include non-compete and confidentiality clauses that prohibit the seller from competing against or disclosing confidential information about the practice. Types of Mecklenburg North Carolina Agreement for Sale of Dental and Orthodontic Practice: 1. Asset Purchase Agreement: This type of agreement involves the purchase of specific assets of the dental or orthodontic practice, rather than the entity itself. This may be suitable when the buyer only wants to acquire certain assets, such as equipment or patient records. 2. Stock Purchase Agreement: In this type of agreement, the buyer purchases the entire entity, including all assets, liabilities, contracts, and obligations associated with the dental or orthodontic practice. This may be more appropriate when the buyer wants to acquire the entire business entity. 3. Partnership Buyout Agreement: If there are multiple partners in a dental or orthodontic practice and one partner wishes to sell their share, a partnership buyout agreement is used. This agreement outlines the terms by which the remaining partner(s) will purchase the selling partner's interest in the practice. In conclusion, the Mecklenburg North Carolina Agreement for Sale of Dental and Orthodontic Practice is a legally binding document that details the terms and conditions of the sale. It covers aspects such as the purchase price, assets included, transition period, and non-compete clauses. There are different types of agreements, such as asset purchase, stock purchase, or partnership buyout agreements, depending on the specific circumstances of the sale.