Title: Tarrant Texas Non-Disclosure Agreement for Merger or Acquisition: A Comprehensive Guide Description: In this article, we provide a detailed description of Tarrant Texas Non-Disclosure Agreement for Merger or Acquisition, highlighting its significance, clauses, and various types available. This information is essential for businesses and individuals involved in merger or acquisition transactions in the Tarrant County region of Texas. Keywords: Tarrant Texas, non-disclosure agreement, merger, acquisition, NDA, confidentiality, business transaction, confidentiality agreement, proprietary information, sensitive data, intellectual property, contractual obligations, types 1. Understanding the Tarrant Texas Non-Disclosure Agreement for Merger or Acquisition The Tarrant Texas Non-Disclosure Agreement for Merger or Acquisition is a legally binding contract that ensures the confidentiality and protection of sensitive information shared during merger or acquisition negotiations. This agreement safeguards proprietary knowledge, trade secrets, financial data, customer records, and other critical information from being disclosed to unauthorized parties. 2. Key Clauses in a Tarrant Texas Non-Disclosure Agreement i. Confidentiality Obligations: This clause outlines the responsibilities of the recipient party in maintaining the confidentiality of the disclosed information, limiting its access to authorized personnel only. ii. Definition of Confidential Information: It defines the scope and nature of information considered confidential, encompassing business plans, financial statements, customer lists, technology, and other relevant proprietary data. iii. Non-Use and Non-Disclosure: This clause prevents the recipient party from using the disclosed information for any purpose other than evaluating the merger or acquisition. It also prohibits them from sharing or disclosing the information to any third party without prior written consent. iv. Term and Termination: Specifies the duration of the agreement and the circumstances under which it can be terminated, addressing post-termination obligations of both parties. v. Return or Destruction of Information: This clause requires the recipient party to return or destroy all confidential information received upon termination or at the disclosing party's request. 3. Types of Tarrant Texas Non-Disclosure Agreements for Merger or Acquisition (if applicable) a) Mutual Non-Disclosure Agreement (Two-Way NDA): This agreement is commonly used when both parties involved in the merger or acquisition transaction exchange confidential information. It ensures the confidentiality obligations are mutually binding, protecting the interests of both parties. b) Unilateral Non-Disclosure Agreement (One-Way NDA): In certain cases, only one party discloses confidential information to the other. This type of non-disclosure agreement offers protection solely for the disclosing party, preventing the recipient from disclosing or using the shared information without permission. c) Financial Non-Disclosure Agreement: This specialized NDA focuses on securing financial and investment-related information during the merger or acquisition process, such as revenue details, growth projections, and financial statements. d) Intellectual Property Non-Disclosure Agreement: Designed specifically for transactions involving the sharing of intellectual property, this agreement emphasizes the protection of patents, trademarks, copyrights, or any other IP assets involved in the merger or acquisition. By understanding the essence and types of Tarrant Texas Non-Disclosure Agreement for Merger or Acquisition, businesses and individuals can ensure the confidential nature of vital information throughout the merger or acquisition process, safeguarding their mutual interests.

Tarrant Texas Non-Disclosure Agreement for Merger or Acquisition

Description

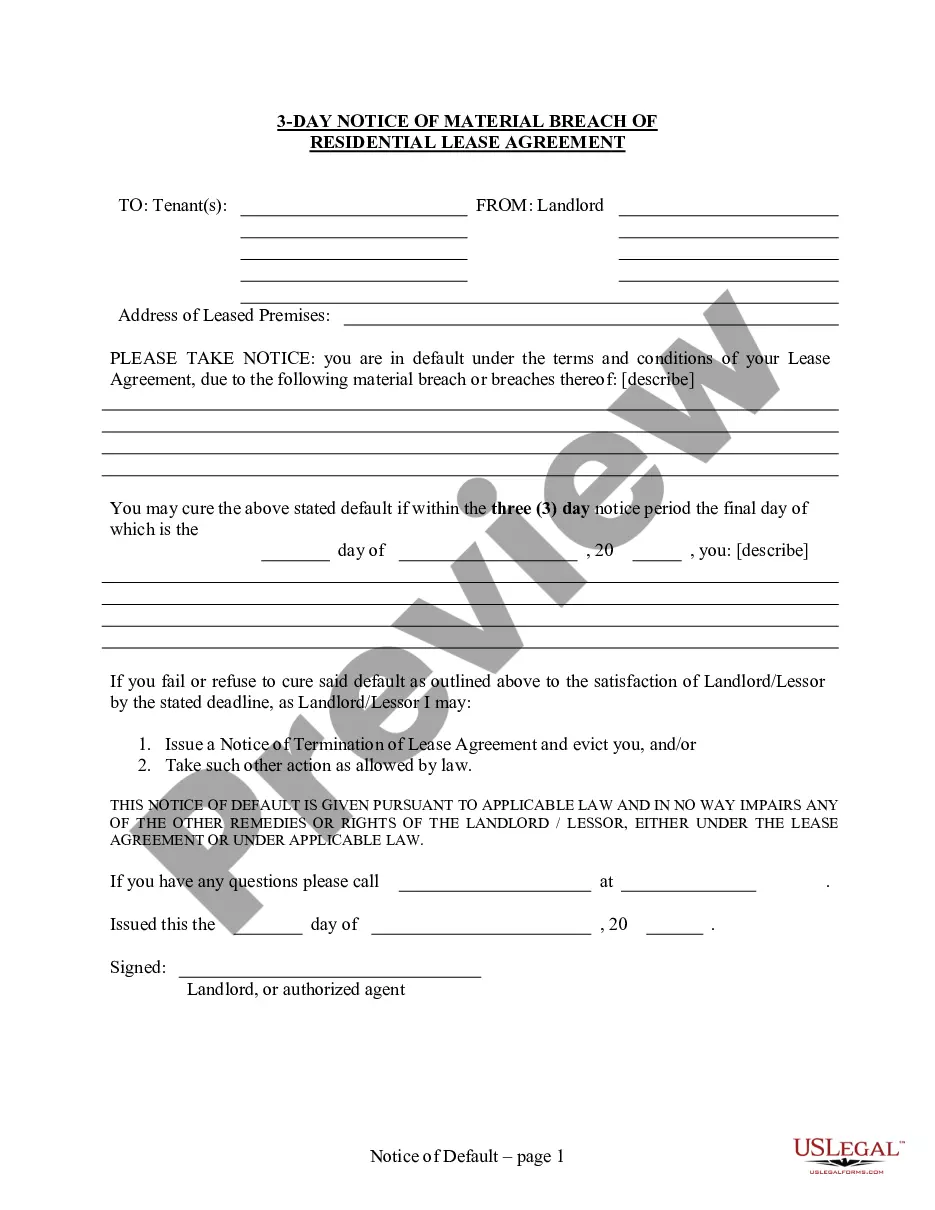

How to fill out Tarrant Texas Non-Disclosure Agreement For Merger Or Acquisition?

If you need to get a reliable legal form provider to get the Tarrant Non-Disclosure Agreement for Merger or Acquisition, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support team make it simple to find and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to search or browse Tarrant Non-Disclosure Agreement for Merger or Acquisition, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Tarrant Non-Disclosure Agreement for Merger or Acquisition template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first company, organize your advance care planning, create a real estate contract, or complete the Tarrant Non-Disclosure Agreement for Merger or Acquisition - all from the comfort of your home.

Sign up for US Legal Forms now!