The Allegheny County in Pennsylvania offers a unique option for businesses considering the sale of a partnership to a corporation. The sale of a partnership to a corporation refers to the process through which a partnership transitions into a corporation, typically to reap benefits such as limited liability and potential tax advantages. This legal transaction can be complex, involving various steps and considerations. In Allegheny, Pennsylvania, businesses have access to a diverse range of resources and professional expertise that can assist them throughout the sale process. A key benefit of this sale is the potential for increased financial stability and growth opportunities for the business. Before proceeding with a sale of partnership to a corporation in Allegheny, businesses are advised to understand the different types of transactions available. Some notable options include: 1. General Partnership to C Corporation: This type of sale involves converting a general partnership, where partners share equal responsibility and liability, into a C corporation. The C corporation structure provides limited liability for shareholders and enables the company to issue stock to raise capital from investors. 2. Limited Partnership to S Corporation: Limited partnerships, which consist of general partners and limited partners, have the option to transition into an S corporation. This process grants limited partners with protection against personal liability while allowing the business to enjoy the tax advantages associated with S corporations, such as pass-through taxation. 3. Limited Liability Partnership to LLC: Limited liability partnerships (Laps) have the option to convert into a limited liability company (LLC). This conversion can provide greater flexibility in terms of management and taxation, attracting potential investors while maintaining limited liability protection for partners. The sale of a partnership to a corporation involves careful consideration of legal and financial aspects. It is recommended to seek professional guidance from attorneys, accountants, and business advisors who are familiar with the specific laws and regulations in Allegheny County and the state of Pennsylvania. These professionals can assist businesses in drafting the necessary legal documents, conducting due diligence, valuing the partnership, and addressing tax implications. Overall, the Allegheny County in Pennsylvania offers a conducive environment for businesses seeking to transform their partnership into a corporation. Through the sale of partnership to a corporation, businesses have the opportunity to restructure their operations, enhance their financial standing, and position themselves for greater success in the dynamic business landscape.

Allegheny Pennsylvania Sale of Partnership to Corporation

Description

How to fill out Allegheny Pennsylvania Sale Of Partnership To Corporation?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your county, including the Allegheny Sale of Partnership to Corporation.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Allegheny Sale of Partnership to Corporation will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Allegheny Sale of Partnership to Corporation:

- Ensure you have opened the correct page with your local form.

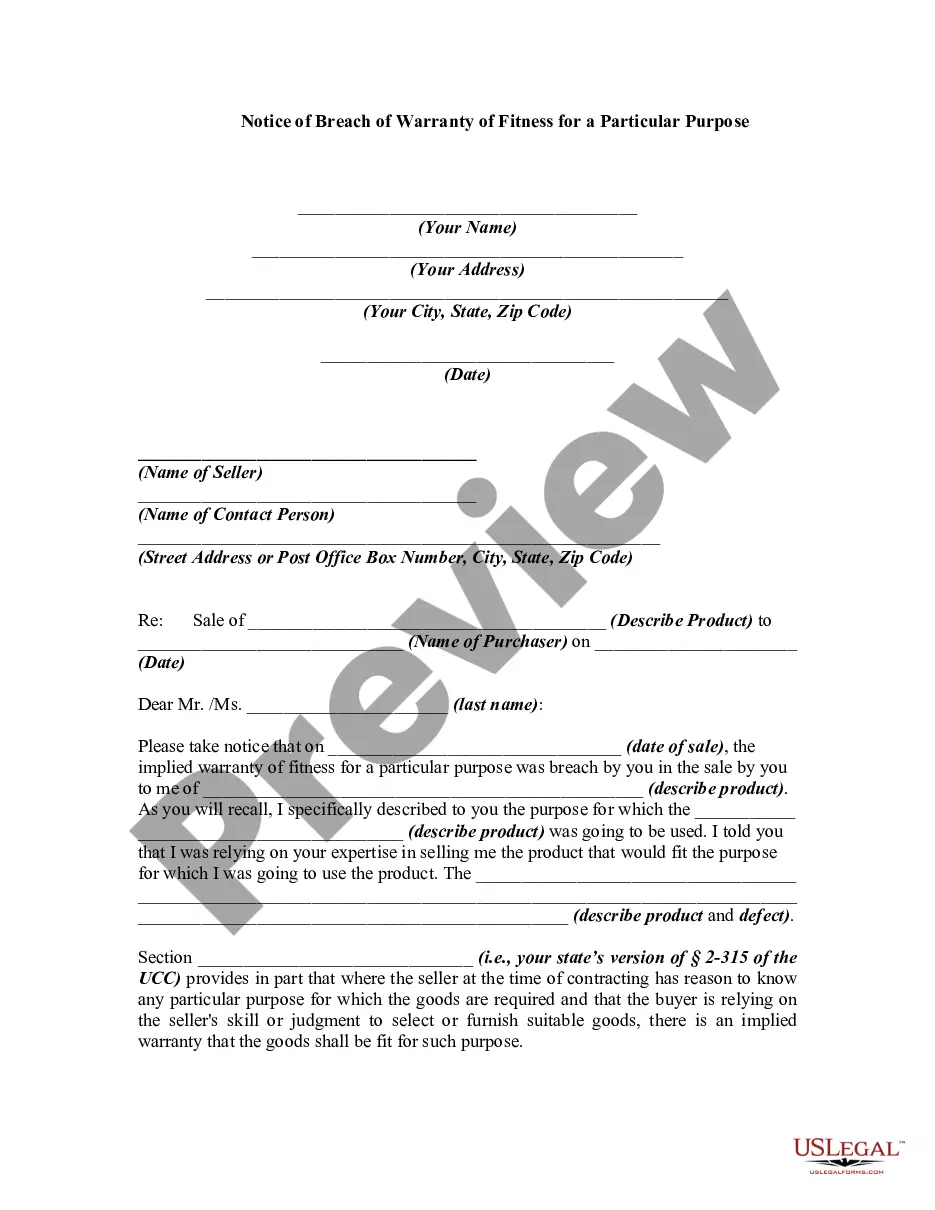

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Allegheny Sale of Partnership to Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!