Bexar Texas Sale of Partnership to Corporation refers to the process by which a partnership is converted or sold to a corporation in the county of Bexar, Texas. This transaction involves the transfer of ownership and assets from a partnership to a corporation, resulting in a change in the legal structure of the business entity. The sale of partnership to corporation can occur for various reasons, such as a desire for increased liability protection, tax advantages, or a change in business strategy. It typically involves a comprehensive legal and financial process, including the reorganization of assets, the approval of partners or shareholders, and the creation of new corporate bylaws. There are different types of Bexar Texas Sale of Partnership to Corporation, including: 1. General Partnership (GP) to C Corporation: This type involves the conversion of a general partnership, where all partners have unlimited liability, to a C corporation structure that provides limited liability to shareholders. 2. Limited Partnership (LP) to S Corporation: Here, a limited partnership, which consists of both general and limited partners, is transformed into an S corporation. This conversion allows for limited liability protection and potential tax advantages. 3. Limited Liability Partnership (LLP) to C Corporation: Laps, which provide limited liability to all partners, may undergo a sale to a C corporation to take advantage of the separate legal entity's benefits. 4. Family Limited Partnership (FLP) to C Corporation: In this case, a Family Limited Partnership, often created for estate planning purposes, is converted to a C corporation structure to provide a more flexible ownership and management structure for family businesses. The Bexar Texas Sale of Partnership to Corporation process usually involves legal professionals, accountants, and financial advisors to ensure compliance with the applicable laws and regulations. It is essential for all parties involved to carefully assess the implications and benefits of such a conversion before proceeding. Overall, the Bexar Texas Sale of Partnership to Corporation is a significant business transaction that necessitates careful planning and execution to ensure a smooth transition from a partnership to a corporation structure.

Bexar Texas Sale of Partnership to Corporation

Description

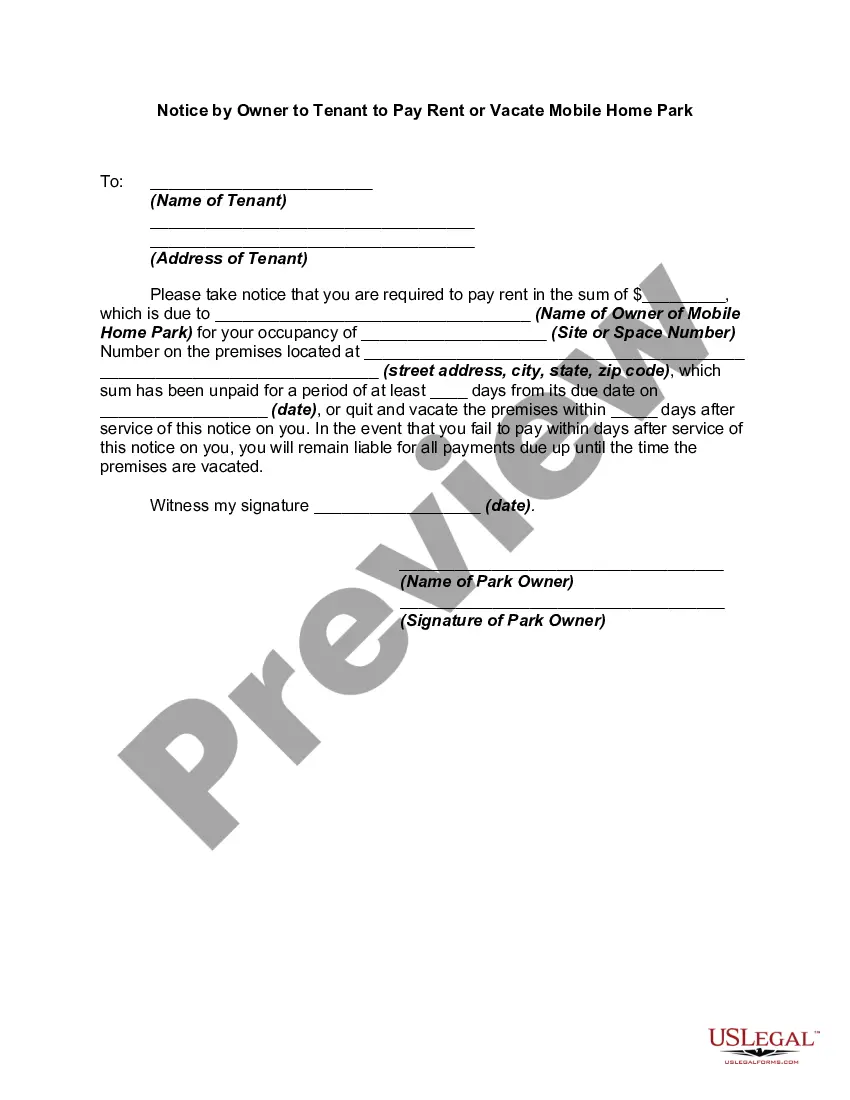

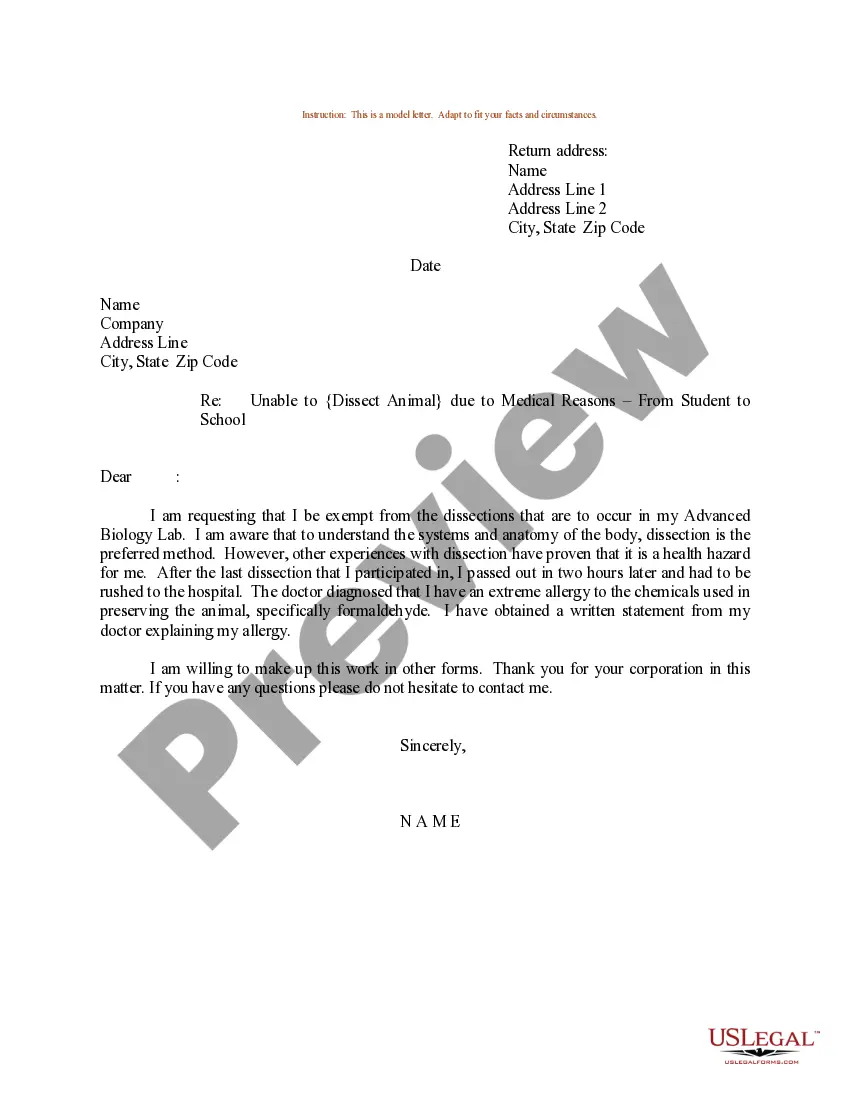

How to fill out Bexar Texas Sale Of Partnership To Corporation?

If you need to get a trustworthy legal document provider to find the Bexar Sale of Partnership to Corporation, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support make it simple to locate and complete various documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Bexar Sale of Partnership to Corporation, either by a keyword or by the state/county the form is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Bexar Sale of Partnership to Corporation template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more affordable. Create your first company, organize your advance care planning, create a real estate contract, or execute the Bexar Sale of Partnership to Corporation - all from the comfort of your home.

Sign up for US Legal Forms now!