Harris Texas Sale of Partnership to Corporation refers to the process of transferring ownership of a partnership to a corporation in the state of Texas, specifically in Harris County. This type of transaction typically occurs when partners in a partnership decide to convert their legal structure into a corporation or when a corporation acquires a partnership in order to expand its business operations or take advantage of new opportunities. The Harris Texas Sale of Partnership to Corporation involves several important steps and legal considerations. It requires careful planning, negotiation, and documentation to ensure a smooth and legally compliant transition. Some key aspects to consider during this process include: 1. Partnership Agreement: Reviewing the existing partnership agreement is crucial as it may have specific provisions related to the sale or transfer of the partnership to a corporation. The partners should carefully analyze the agreement and consult with legal professionals to understand the rights, responsibilities, and restrictions associated with the sale. 2. Valuation of Partnership Assets: The partners and corporation need to determine the value of the partnership's assets and liabilities. This evaluation is essential for establishing the purchase price or the allocation of shares in the new corporation. A professional appraiser or valuation expert can help in this process. 3. Purchase Agreement: Drafting a comprehensive purchase agreement is vital to protect the interests of both parties involved. The agreement should address key terms such as the purchase price, payment terms, allocation of assets, assumption of liabilities, and any warranties or representations made by the partners. 4. Taxes and Legal Obligations: The Harris Texas Sale of Partnership to Corporation may have significant tax implications for both the partners and the corporation. Seeking advice from tax professionals is crucial to ensure compliance with federal, state, and local tax laws. Additionally, partners should consider any legal obligations, such as obtaining necessary permits and licenses for the corporation. Different types of Harris Texas Sale of Partnership to Corporation may include: 1. General Partnership to C Corporation: In this type of conversion, a general partnership, which is typically formed by two or more individuals, transfers its ownership to a corporation. This allows the partners to enjoy limited liability protection and facilitates the corporation to access capital through issuing stock. 2. Limited Partnership to S Corporation: A limited partnership consists of one or more general partners and one or more limited partners. In this conversion, the limited partners may choose to sell their interests to an S Corporation. This structure provides the corporation with pass-through taxation benefits while limiting the liability of the partners. 3. Limited Liability Partnership to LLC: A limited liability partnership (LLP) is a partnership where all partners have limited liability protection. The conversion to a limited liability company (LLC) offers similar limited liability benefits while providing the partners with flexibility in management and taxation. 4. Family Partnership to Family Corporation: In some cases, a family partnership may decide to convert into a family corporation to facilitate generational transfer or succession planning. This allows for effective business management and the transfer of ownership to successive family members. In conclusion, the Harris Texas Sale of Partnership to Corporation involves various legal and financial considerations. It requires careful planning, drafting of appropriate agreements, valuation of assets, tax analysis, and compliance with legal obligations. Seeking advice from legal, tax, and financial professionals is crucial for a successful and smooth transition.

Harris Texas Sale of Partnership to Corporation

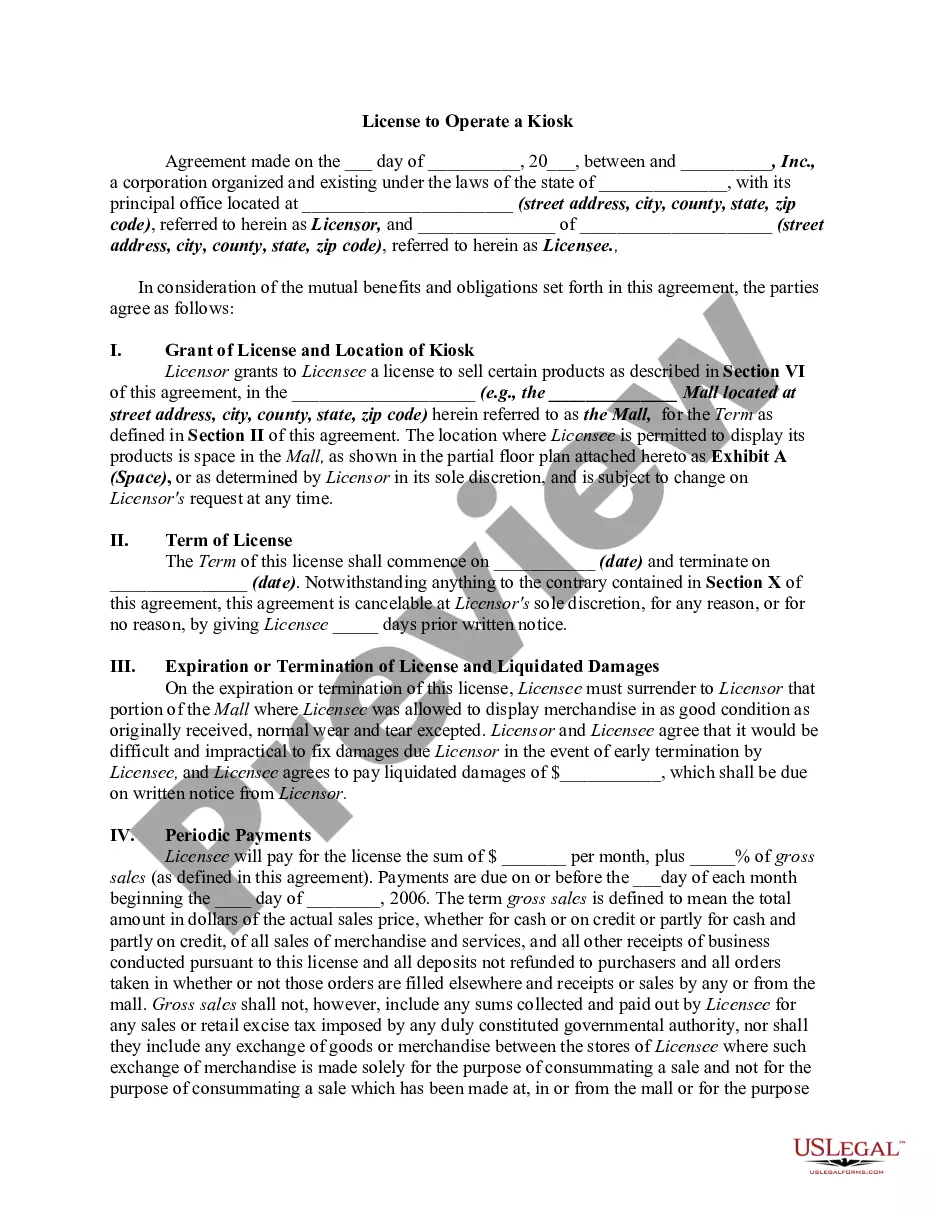

Description

How to fill out Harris Texas Sale Of Partnership To Corporation?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Harris Sale of Partnership to Corporation meeting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Aside from the Harris Sale of Partnership to Corporation, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Harris Sale of Partnership to Corporation:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Harris Sale of Partnership to Corporation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!