Hennepin County, Minnesota is a thriving region known for its vibrant business community and diverse economic opportunities. One common transaction that occurs in this area is the sale of a partnership to a corporation. This process involves one or more partners of a business entity selling their ownership interests to a corporation, thereby transforming the partnership into a corporate structure. The Hennepin County Sale of Partnership to Corporation allows partners to capitalize on new growth opportunities or address changing business needs. This strategic move can provide numerous benefits, such as limited liability protection, potential tax advantages, and enhanced access to capital markets. Moreover, this transaction often proves to be a catalyst for expansion and improved operational efficiency. There are different types of Hennepin County Sale of Partnership to Corporation, which largely depend on the specific situation and partners' goals: 1. Merger and Acquisition: A partnership may merge with or be acquired by an existing corporation. This typically involves a negotiation process, where terms such as purchase price, stock exchange ratios, and post-transaction roles are determined. 2. Incorporation: Partners may decide to incorporate their partnership by forming a corporation. This creates a separate legal entity with its own rights and responsibilities. The partnership's assets, contracts, and liabilities are transferred to the new corporation. 3. Conversion: Partnerships can convert their structure to a corporation without involving external entities or stakeholders. This internal conversion often requires partners to adopt new bylaws, obtain necessary licenses and permits, and comply with statutory requirements outlined by Hennepin County and the state of Minnesota. 4. Partial Sale: In some cases, only a portion of the partnership's ownership interests are sold to a corporation. This enables existing partners to retain some control and ownership while facilitating infusion of capital or strategic partnership. It is essential to consult legal and financial advisors well-versed in Hennepin County regulations and Minnesota business laws to navigate the complexities of the Sale of Partnership to Corporation. Proper due diligence, documentation, and compliance with legal formalities are crucial for a smooth transition and to safeguard the interests of all involved parties. If executed successfully, the Hennepin County Sale of Partnership to Corporation can unlock new growth avenues, strengthen market position, and offer enhanced business opportunities. This strategic move demonstrates the dynamic business environment in Hennepin County, where entrepreneurs and investors are always seeking ways to optimize their operations and maximize value creation.

Hennepin Minnesota Sale of Partnership to Corporation

Description

How to fill out Hennepin Minnesota Sale Of Partnership To Corporation?

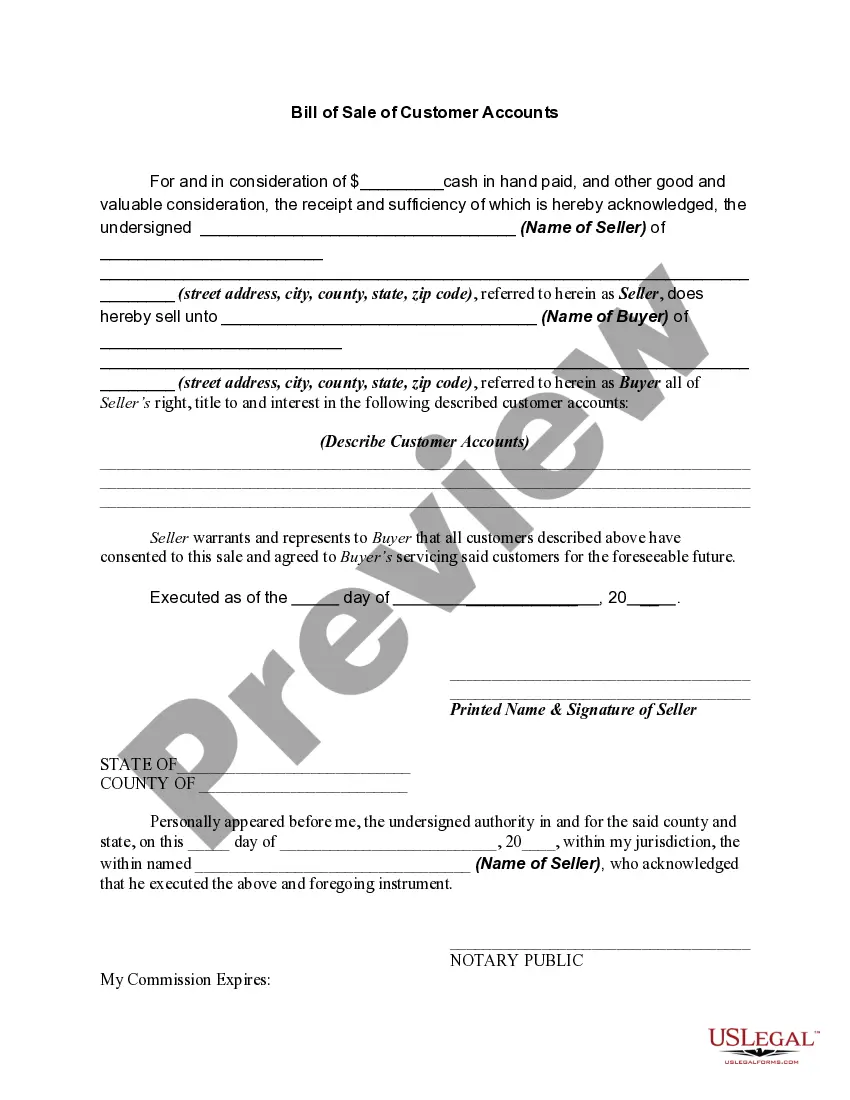

Do you need to quickly draft a legally-binding Hennepin Sale of Partnership to Corporation or probably any other form to take control of your own or business affairs? You can go with two options: hire a legal advisor to write a valid document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific form templates, including Hennepin Sale of Partnership to Corporation and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, double-check if the Hennepin Sale of Partnership to Corporation is adapted to your state's or county's laws.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Hennepin Sale of Partnership to Corporation template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!