Maricopa, Arizona, is a rapidly growing city located in Pinal County, Arizona, which offers a unique opportunity for businesses looking to expand or establish themselves in a vibrant and business-friendly environment. One of the common business transactions that occur in Maricopa, Arizona, is the sale of a partnership to a corporation. This process allows partnership owners to transform their business structure into a corporation, allowing for various benefits and opportunities. The sale of a partnership to a corporation in Maricopa, Arizona, involves the transfer of ownership and assets from a partnership entity to a newly formed or existing corporation. This transaction usually takes place when partners decide to restructure the business, either to facilitate growth or for strategic reasons. The process typically entails legal and financial considerations and requires careful planning to ensure a smooth transition. By selling a partnership to a corporation, business owners in Maricopa, Arizona, can enjoy several advantages. Firstly, a corporation offers limited liability protection to its owners, shielding their personal assets from business-related debts and obligations. This can be a significant motivating factor for partnership owners to pursue this transaction, as it provides a higher level of security and risk management. Furthermore, a corporation structure allows for easier transfer of ownership, facilitating succession planning and business continuity. Shares in a corporation can be easily bought or sold, which can be advantageous when attracting new investors or transitioning ownership to another party. In addition, the corporate structure often provides enhanced opportunities for raising capital through stock offerings or attracting investors. Different types of Maricopa, Arizona sale of partnership to corporation transactions can include: 1. General Partnership to C Corporation: This is the most common type of partnership to corporation transaction, whereby partners of a general partnership transfer their ownership and assets into a newly formed or existing C Corporation. 2. Limited Partnership to S Corporation: In this scenario, limited partners of a limited partnership convert their partnership interests and assets into an S Corporation structure. This type of transaction often seeks to take advantage of S Corporation tax benefits, allowing profits and losses to flow through the individual shareholders' tax returns. 3. Limited Liability Partnership (LLP) to C Corporation: Some partnerships, such as Laps, may choose to convert to a C Corporation structure to benefit from limited liability protection and other advantages associated with this corporate form. In conclusion, Maricopa, Arizona, offers a favorable environment for businesses considering the sale of a partnership to a corporation. This transaction provides numerous benefits, including enhanced protection of personal assets, expanded opportunities for raising capital, and increased ease of ownership transfer. Whether converting a general partnership, limited partnership, or limited liability partnership, partnership owners can benefit from careful planning and professional assistance to ensure a successful and seamless transition into a corporation.

Maricopa Arizona Sale of Partnership to Corporation

Description

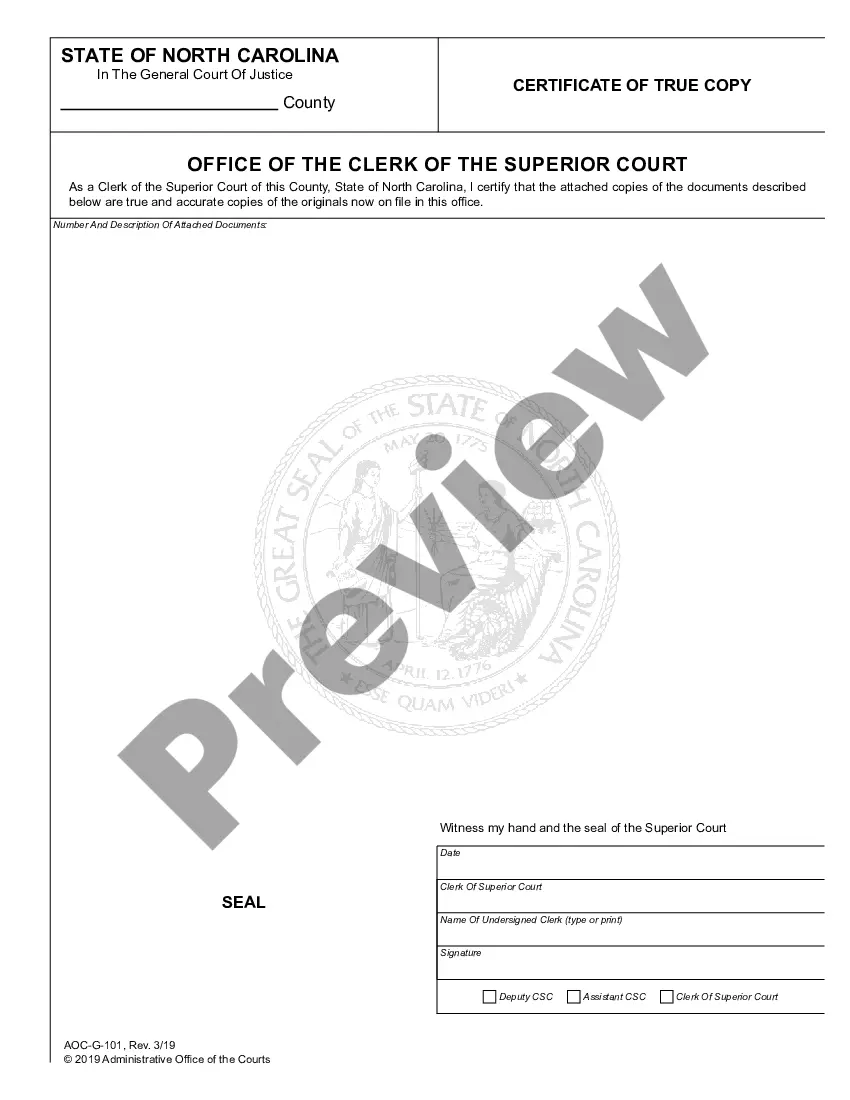

How to fill out Maricopa Arizona Sale Of Partnership To Corporation?

Are you looking to quickly draft a legally-binding Maricopa Sale of Partnership to Corporation or maybe any other document to manage your personal or business matters? You can go with two options: hire a professional to draft a valid paper for you or draft it completely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant document templates, including Maricopa Sale of Partnership to Corporation and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, double-check if the Maricopa Sale of Partnership to Corporation is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to verify what it's intended for.

- Start the search over if the template isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Maricopa Sale of Partnership to Corporation template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the documents we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!