Keywords: Oakland Michigan, Sale of Partnership, Corporation, partnership type, transfer of ownership, legal process, tax implications, buyout agreement, stock purchase, asset sale. Description: The sale of a partnership to a corporation in Oakland, Michigan refers to the process of transferring the ownership of a partnership to a newly formed or existing corporation. This transaction involves legal and financial considerations with significant implications for all parties involved. There are two types of partnership sales to a corporation commonly observed in Oakland, Michigan. The first type is a stock purchase, where the corporation acquires all or a portion of the partnership's shares, effectively gaining control and ownership of its assets and liabilities. The second type is an asset sale, involving the transfer of specific partnership assets and liabilities to the corporation, rather than shares. The sale of partnership to a corporation in Oakland, Michigan follows a structured legal process. Firstly, the partners and corporation must negotiate and draft a buyout agreement, which outlines the terms and conditions of the sale. This agreement typically covers the purchase price, payment terms, allocation of assets and liabilities, and any restrictions or warranties. Once the buyout agreement is finalized, the partnership's partners and the corporation's shareholders must obtain legal advice and formally approve the transaction. This may involve obtaining any required regulatory approvals or consents, such as from governmental bodies or those specified in the partnership agreement. One of the key considerations in a partnership sale to a corporation is the tax implications for both the partnership and the corporation. It is advisable for all parties involved to consult with tax professionals to ensure compliance with relevant tax laws and to optimize tax benefits. Additionally, the sale of a partnership to a corporation may affect the employees, contracts, and ongoing business relationships associated with the partnership. Therefore, thorough due diligence is crucial to identify and address any potential risks or concerns to mitigate disruption and maintain business continuity. Overall, the sale of partnership to a corporation in Oakland, Michigan requires careful planning, negotiation, and execution. Engaging experienced professionals, such as attorneys, accountants, and business advisors, can help navigate the complex legal and financial aspects associated with this transaction.

Oakland Michigan Sale of Partnership to Corporation

Description

How to fill out Oakland Michigan Sale Of Partnership To Corporation?

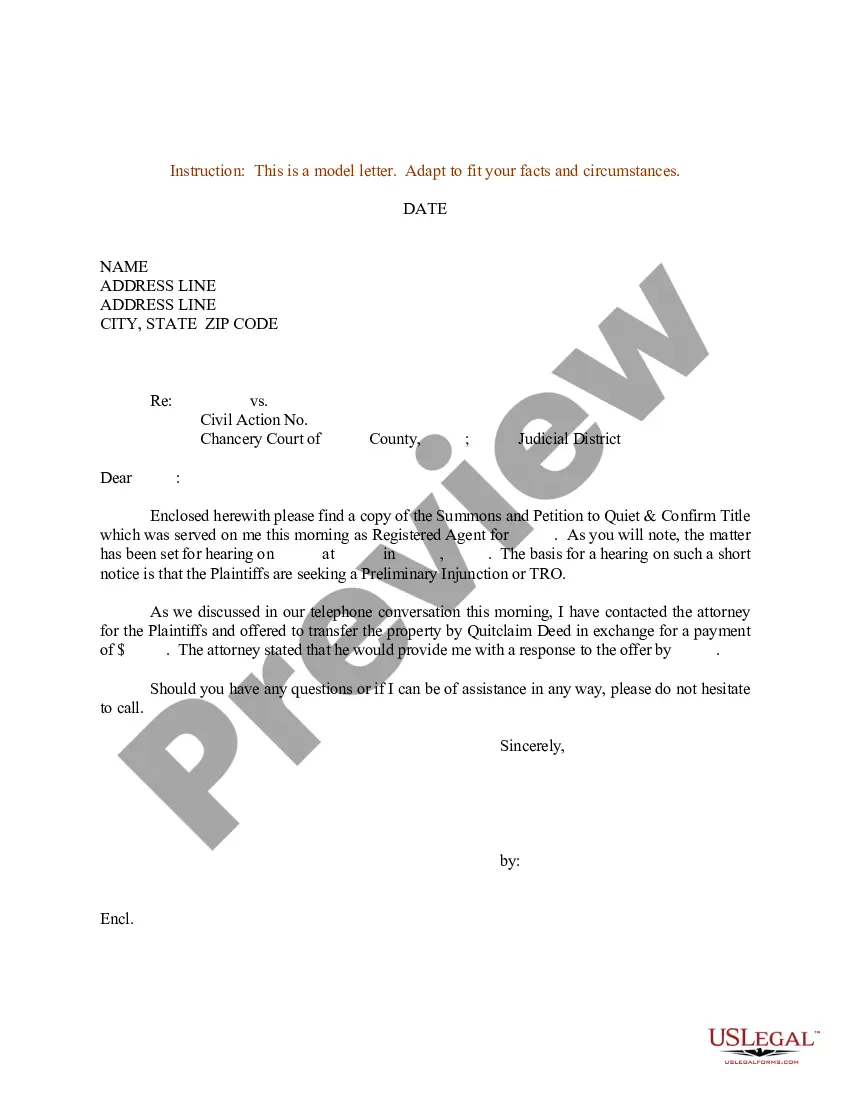

Are you looking to quickly draft a legally-binding Oakland Sale of Partnership to Corporation or probably any other document to handle your personal or business matters? You can select one of the two options: hire a legal advisor to draft a valid document for you or draft it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific document templates, including Oakland Sale of Partnership to Corporation and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, double-check if the Oakland Sale of Partnership to Corporation is adapted to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Oakland Sale of Partnership to Corporation template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!