Orange California Sale of Partnership to Corporation refers to the process in which a partnership in Orange California is converted into a corporation through a sale transaction. This allows for a shift in the legal structure and ownership of the business, as well as the formation of a new entity with enhanced benefits and potential growth opportunities. During the Sale of Partnership to Corporation in Orange California, the existing partnership's assets, liabilities, and interests are transferred to the newly formed corporation. This conversion typically involves the sale of partnership shares to the corporation, with the partnership's partners becoming shareholders of the new corporation. The Sale of Partnership to Corporation offers several advantages, including limited liability protection for shareholders, potential tax benefits, and increased access to capital. By converting into a corporation, the business gains the ability to issue stock, attract outside investors, and facilitate easier ownership transfers. This transition can also enhance the credibility and perception of the business, opening doors to new growth and expansion opportunities. There are different types of Orange California Sale of Partnership to Corporation, namely: 1. General Partnership to C Corporation Conversion: This type involves the conversion of a general partnership, where all partners have unlimited liability, into a C corporation, which provides limited liability protection to its shareholders. It is the most common conversion type. 2. Limited Partnership to S Corporation Conversion: In this scenario, a limited partnership, which consists of at least one general partner with unlimited liability and one or more limited partners with limited liability, converts into an S corporation. This conversion allows for pass-through taxation benefits and limited liability protection for shareholders. 3. Limited Liability Partnership (LLP) to C Corporation Conversion: Laps, which offer limited liability to all partners, can be converted into C corporations, providing even greater liability protection and potential tax advantages. 4. Limited Liability Company (LLC) to C Corporation Conversion: LCS, similar to Laps, offer limited liability protection, and converting them into C corporations brings additional benefits such as easier transfer of ownership and access to capital markets. It is important to consult with legal and financial professionals experienced in partnership and corporate law to navigate the complexities of Orange California Sale of Partnership to Corporation. They can guide businesses through the legal procedures, tax implications, and ensure a smooth conversion process that aligns with the company's goals and objectives.

Orange California Sale of Partnership to Corporation

Description

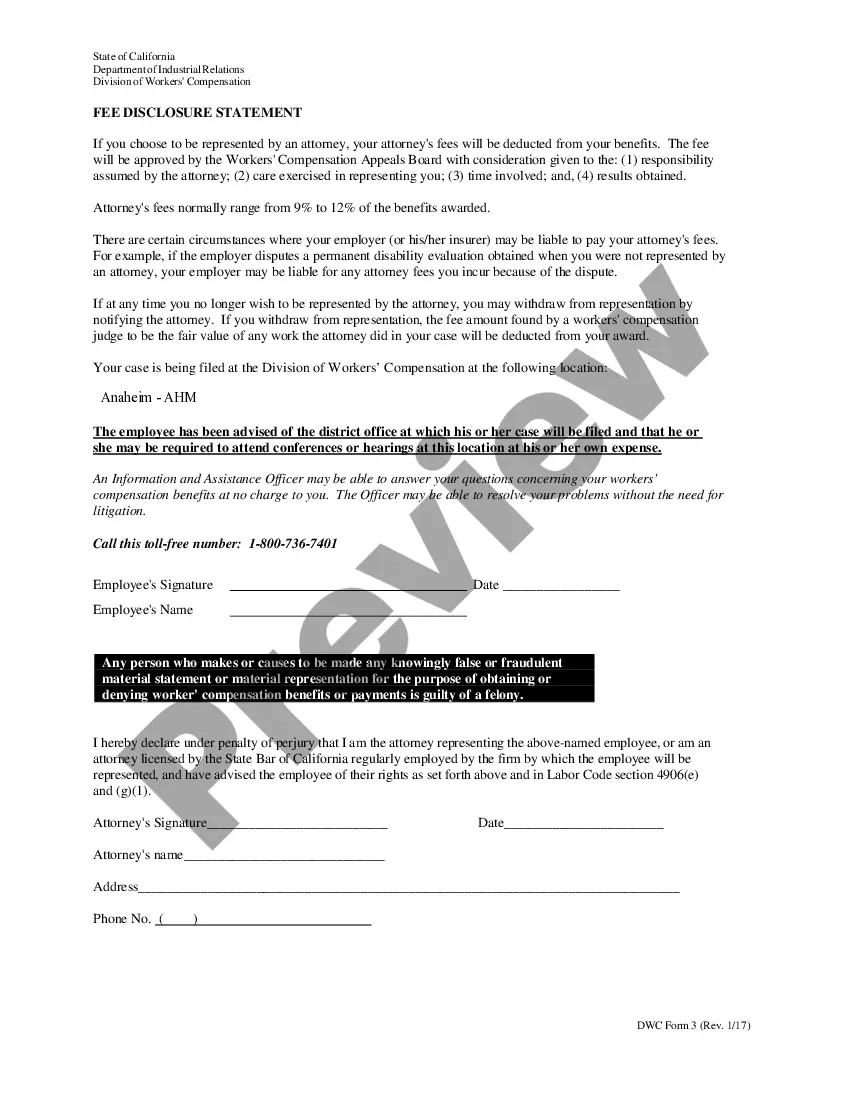

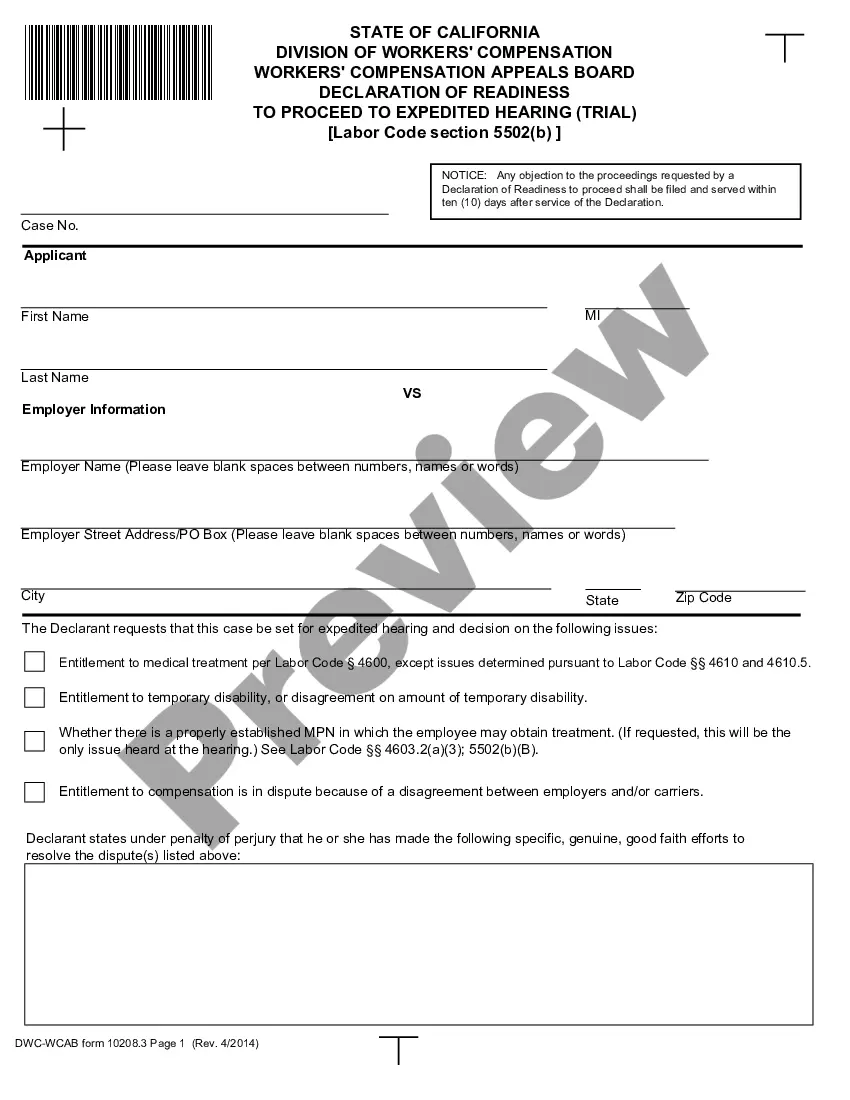

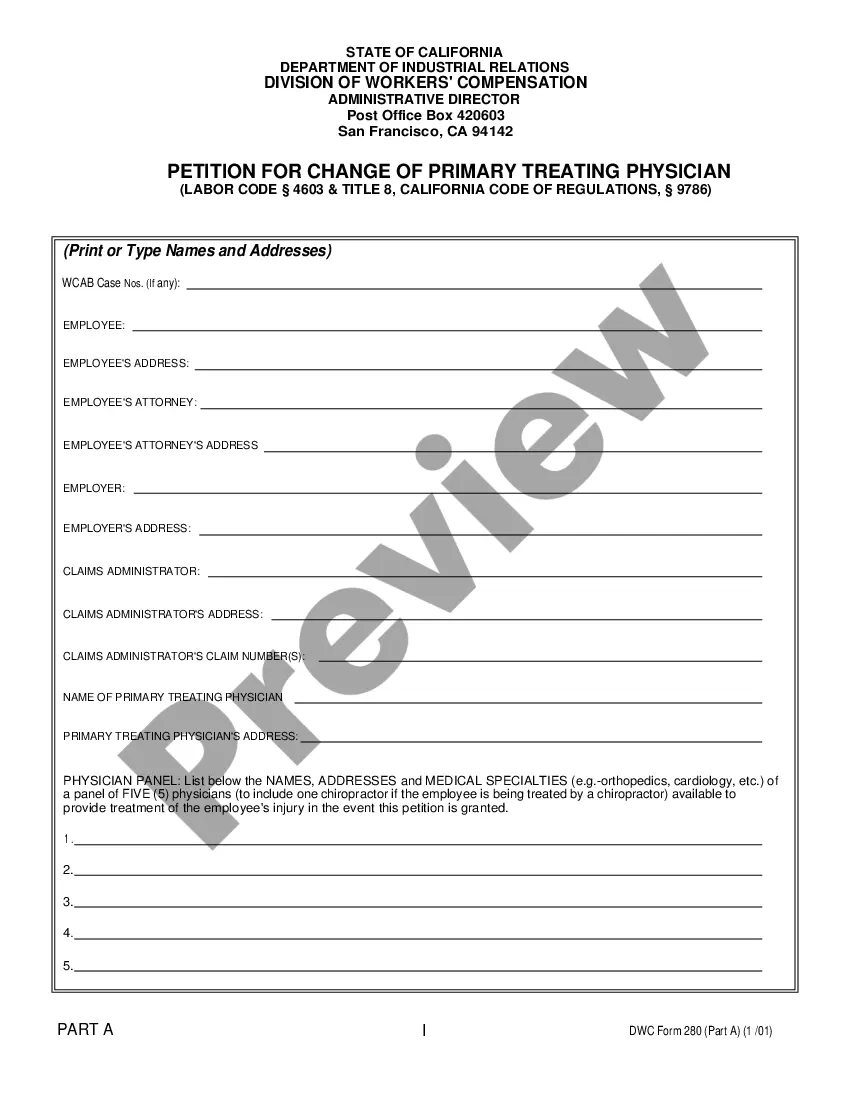

How to fill out Orange California Sale Of Partnership To Corporation?

Draftwing documents, like Orange Sale of Partnership to Corporation, to manage your legal affairs is a tough and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for different scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Orange Sale of Partnership to Corporation form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Orange Sale of Partnership to Corporation:

- Ensure that your template is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Orange Sale of Partnership to Corporation isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our website and get the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!