Keywords: San Jose California, Right of First Refusal Clause, Shareholders' Agreement Introduction: San Jose, California is a vibrant and diverse city known for its proximity to Silicon Valley and its thriving tech industry. In the realm of business and investment, shareholders' agreements play a crucial role in defining the rights and responsibilities of the shareholders of a company. One key provision found in many San Jose California shareholder agreements is the Right of First Refusal Clause. This clause aims to protect the interests of shareholders by giving them priority in acquiring additional shares before they are offered to external parties. Let's explore the different types of Right of First Refusal Clauses that can be found in San Jose California Shareholders' Agreements. 1. Standard Right of First Refusal Clause: The standard Right of First Refusal (ROAR) clause entitles existing shareholders to have the first opportunity to purchase any shares being sold by another shareholder. This means that if a shareholder intends to sell their shares, they must first offer them to existing shareholders on the same terms and conditions they have received from an external party. 2. Proportional Right of First Refusal Clause: A Proportional Right of First Refusal (POOR) clause is a variation of the standard ROAR clause. In this scenario, existing shareholders have the right to purchase additional shares in proportion to their existing ownership percentage. This clause ensures that the ownership structure of the company remains relatively balanced and prevents any single shareholder from gaining an unfair advantage. 3. Enhanced Right of First Refusal Clause: The Enhanced Right of First Refusal (PROF) clause provides existing shareholders with an additional advantage. If a shareholder receives an external offer to purchase their shares, the PROF clause allows existing shareholders to match or surpass that offer, even if the initial offer falls short of the fair market value. This gives shareholders the opportunity to retain control of the company by exercising their right to purchase shares at a potentially lower price. 4. Right of First Offer Clause: The Right of First Offer (ROFL) clause, also sometimes referred to as the Right of First Negotiation, is another variation of the ROAR clause. Instead of providing existing shareholders with the right to purchase shares first, the ROFL clause grants them the right to be the first party to negotiate a potential share purchase with a shareholder looking to sell. This clause ensures that existing shareholders are not bypassed when it comes to selling shares, as they can engage in negotiations and potentially match any external offers. 5. Transfer Restrictions and Right of First Refusal Clause: Some San Jose California Shareholders' Agreements may combine the Right of First Refusal Clause with transfer restrictions. These additional provisions can prevent shareholders from freely transferring their shares to external parties without complying with certain conditions and obligations. By incorporating these transfer restrictions within the Right of First Refusal Clause, the agreement aims to maintain stability and protect the best interests of the company and its shareholders. In conclusion, the Right of First Refusal Clause in San Jose California Shareholders' Agreements serves as an important safeguard for shareholders' interests. Whether it is the standard ROAR clause, proportional ROAR clause, enhanced ROAR clause, ROFL clause, or a combination with transfer restrictions, these clauses ensure that existing shareholders have priority and fair opportunities when it comes to acquiring additional shares or negotiating share transfers.

San Jose California Right of First Refusal Clause for Shareholders' Agreement

Description

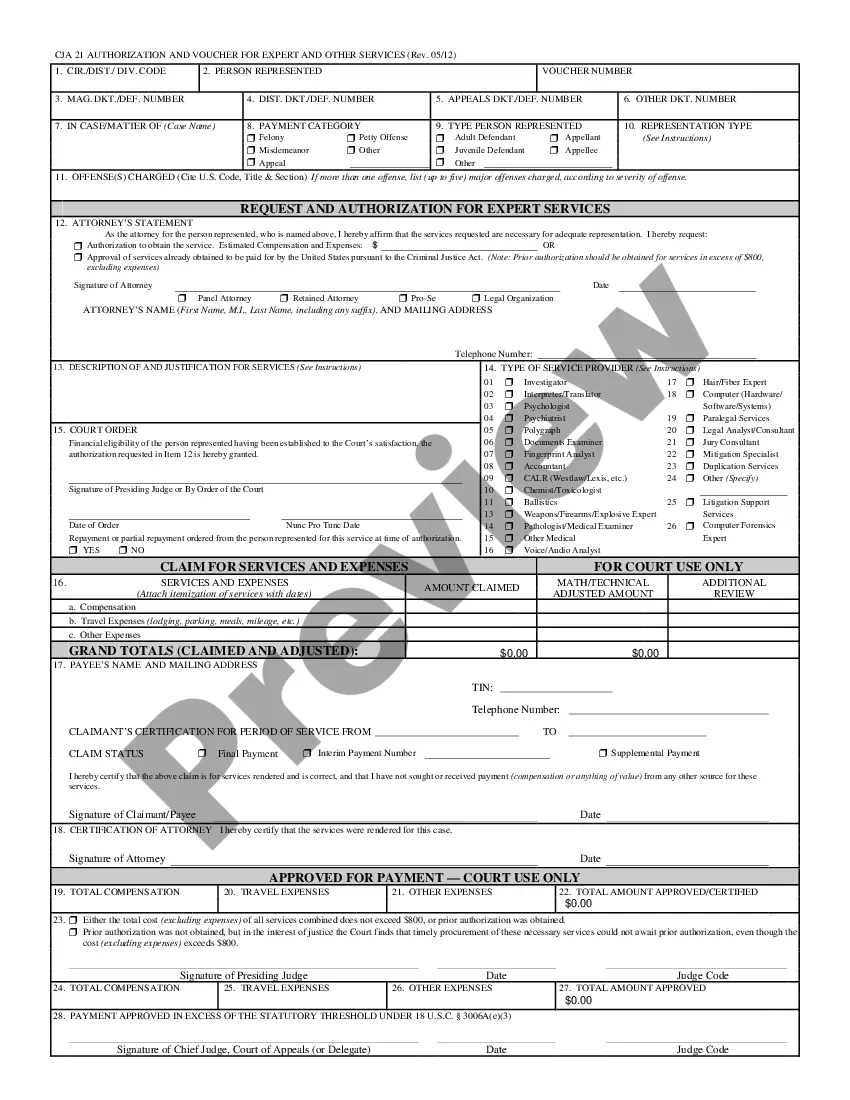

How to fill out San Jose California Right Of First Refusal Clause For Shareholders' Agreement?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the San Jose Right of First Refusal Clause for Shareholders' Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the San Jose Right of First Refusal Clause for Shareholders' Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to get the San Jose Right of First Refusal Clause for Shareholders' Agreement:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!