An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

Another factor to be considered is the connection and regularity of business between the independent contractor and the hiring party. Important factors to be considered are separate advertising, procurement of licensing, maintenance of a place of business, and supplying of tools and equipment by the independent contractor. If the service rendered is to be completed by a certain time, as opposed to an indefinite time period, a finding of an independent contractor status is more likely.

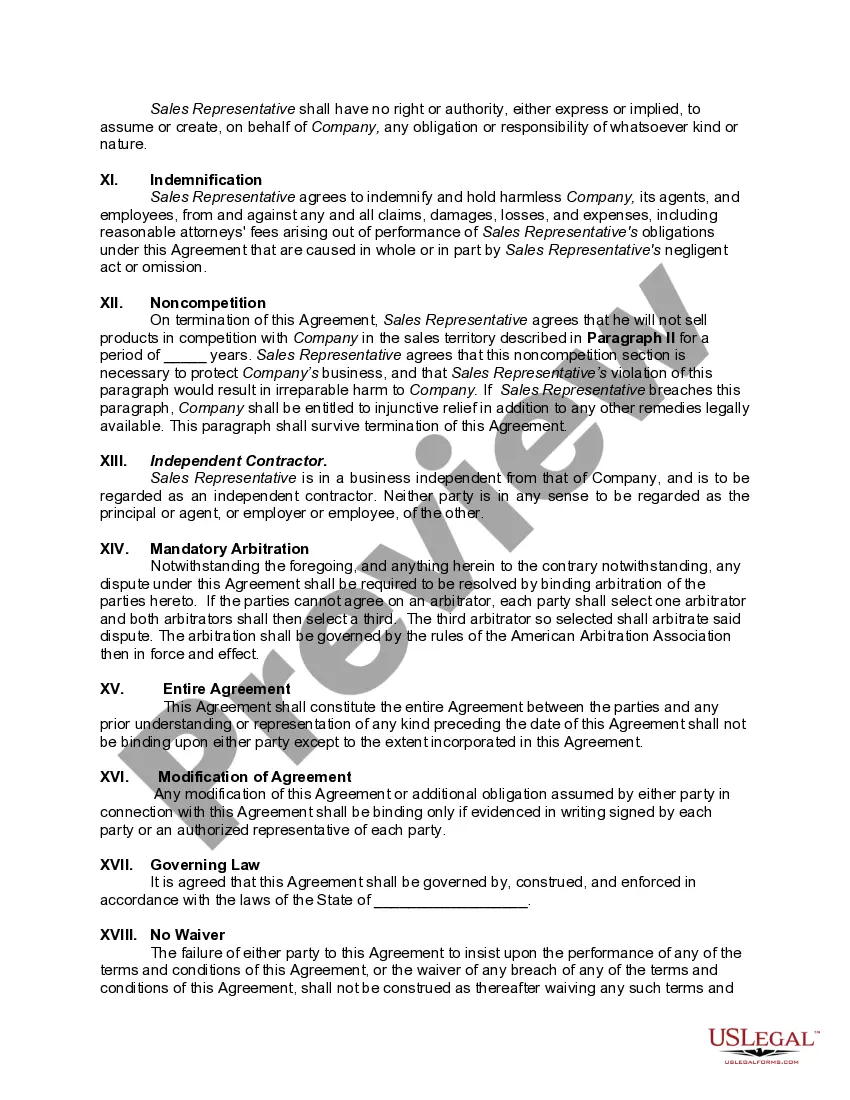

Restrictions to prevent competition by a present or former employee are held valid when they are reasonable and necessary to protect the interests of the employer. For example, a provision in an employment contract which prohibited an employee for two years from calling on any customer of the employer called on by the employee during the last six months of employment would generally be valid. Courts will closely examine covenants not to compete signed by individuals in order to make sure that they are not unreasonable as to time or geographical area.

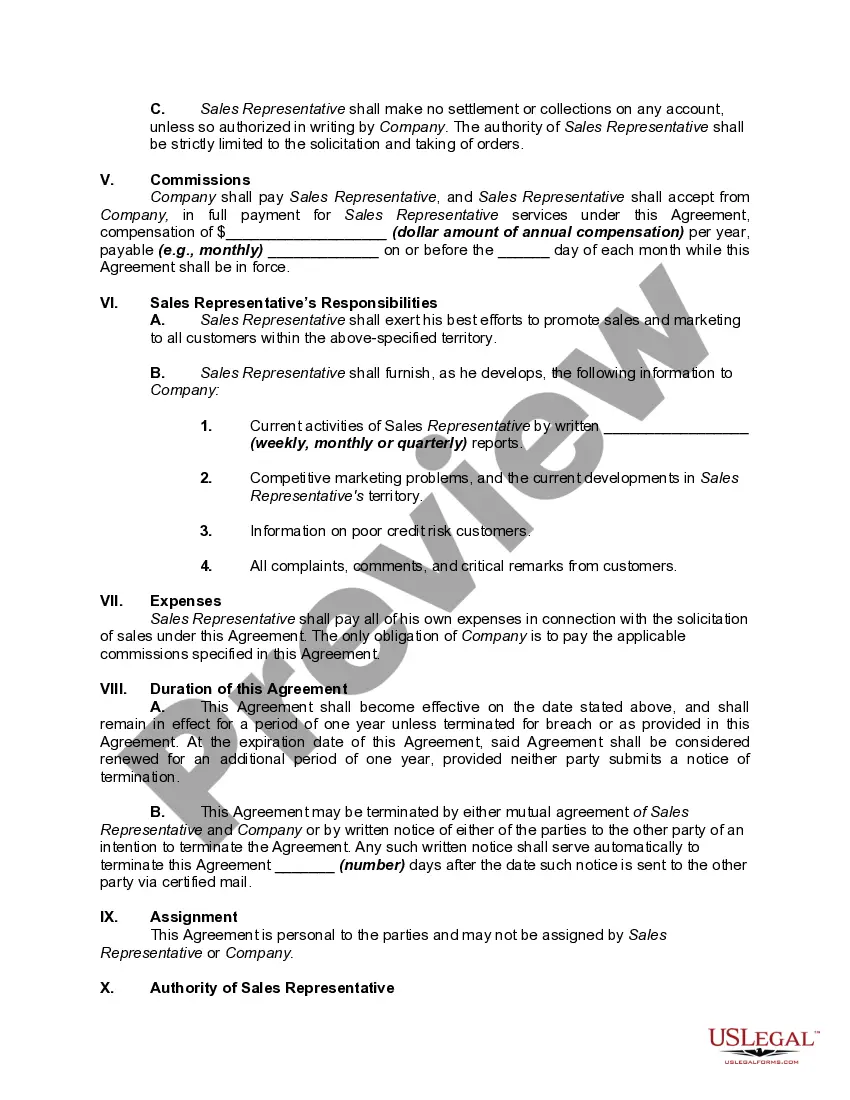

A Riverside California Self-Employed Independent Contractor Agreement with Sales Representative is a legal document that outlines the terms and conditions between a self-employed sales representative and a company based in Riverside, California. This agreement is essential for establishing a clear understanding of the working relationship, responsibilities, and expectations between the sales representative and the company. Before entering into any agreement, it is important to understand the different types of Riverside California Self-Employed Independent Contractor Agreements with Sales Representative. There are typically two major types, which include: 1. Commission-Based Agreement: This type of agreement is based on a commission structure, where the sales representative earns a percentage of the sales they generate. The agreement specifies the commission rate, payment terms, and any applicable performance targets or thresholds. 2. Non-Commission-Based Agreement: In this type of agreement, the sales representative receives a fixed salary or remuneration, regardless of the sales they generate. This agreement may include additional performance-related bonuses or incentives, but the primary compensation is not directly tied to sales. Now let's delve into the key components typically included in a Riverside California Self-Employed Independent Contractor Agreement with Sales Representative: 1. Parties Involved: Clearly state the names and contact information of both parties, including the sales representative and the company they are working for in Riverside, California. 2. Services Provided: Define the scope of services the sales representative is expected to perform, including sales targets, territories, products, or services they will be promoting, and any specific responsibilities or tasks. 3. Compensation and Commission Structure: Outline how the sales representative will be compensated, whether through a commission-based system or a fixed salary. Specify the commission rate, payment terms, and any conditions (if applicable). 4. Expenses and Reimbursement: Clarify what business expenses, such as travel or client entertainment, will be reimbursed by the company and under what conditions. 5. Non-Compete and Confidentiality: Include provisions to protect the company's trade secrets, client lists, and confidential information. It may also outline restrictions on the sales representative's ability to work for competing companies in Riverside, California, during or after the agreement. 6. Term and Termination: Define the duration of the agreement, whether it is for a fixed term or ongoing until terminated. Also, specify the conditions under which either party can terminate the agreement, such as breach of contract or non-performance. 7. Independent Contractor Relationship: Clearly state that the sales representative is an independent contractor, not an employee, and outline the rights and obligations that come with this status, including tax responsibilities and insurance coverage. 8. Governing Law: Specify that the agreement will be governed by the laws of California, particularly Riverside, to ensure legal compliance. 9. Entire Agreement and Amendments: Include a clause stating that the agreement represents the entire understanding between the parties and that any amendments must be in writing and agreed upon by both parties. 10. Signatures: Finally, provide space for both the sales representative and a representative of the company to sign and date the agreement, thereby legally binding both parties. In summary, a Riverside California Self-Employed Independent Contractor Agreement with Sales Representative is a crucial document that safeguards the interests of both the sales representative and the company. It ensures a clear understanding of the working relationship, compensation structure, and expectations, enabling a smooth and mutually beneficial business partnership.A Riverside California Self-Employed Independent Contractor Agreement with Sales Representative is a legal document that outlines the terms and conditions between a self-employed sales representative and a company based in Riverside, California. This agreement is essential for establishing a clear understanding of the working relationship, responsibilities, and expectations between the sales representative and the company. Before entering into any agreement, it is important to understand the different types of Riverside California Self-Employed Independent Contractor Agreements with Sales Representative. There are typically two major types, which include: 1. Commission-Based Agreement: This type of agreement is based on a commission structure, where the sales representative earns a percentage of the sales they generate. The agreement specifies the commission rate, payment terms, and any applicable performance targets or thresholds. 2. Non-Commission-Based Agreement: In this type of agreement, the sales representative receives a fixed salary or remuneration, regardless of the sales they generate. This agreement may include additional performance-related bonuses or incentives, but the primary compensation is not directly tied to sales. Now let's delve into the key components typically included in a Riverside California Self-Employed Independent Contractor Agreement with Sales Representative: 1. Parties Involved: Clearly state the names and contact information of both parties, including the sales representative and the company they are working for in Riverside, California. 2. Services Provided: Define the scope of services the sales representative is expected to perform, including sales targets, territories, products, or services they will be promoting, and any specific responsibilities or tasks. 3. Compensation and Commission Structure: Outline how the sales representative will be compensated, whether through a commission-based system or a fixed salary. Specify the commission rate, payment terms, and any conditions (if applicable). 4. Expenses and Reimbursement: Clarify what business expenses, such as travel or client entertainment, will be reimbursed by the company and under what conditions. 5. Non-Compete and Confidentiality: Include provisions to protect the company's trade secrets, client lists, and confidential information. It may also outline restrictions on the sales representative's ability to work for competing companies in Riverside, California, during or after the agreement. 6. Term and Termination: Define the duration of the agreement, whether it is for a fixed term or ongoing until terminated. Also, specify the conditions under which either party can terminate the agreement, such as breach of contract or non-performance. 7. Independent Contractor Relationship: Clearly state that the sales representative is an independent contractor, not an employee, and outline the rights and obligations that come with this status, including tax responsibilities and insurance coverage. 8. Governing Law: Specify that the agreement will be governed by the laws of California, particularly Riverside, to ensure legal compliance. 9. Entire Agreement and Amendments: Include a clause stating that the agreement represents the entire understanding between the parties and that any amendments must be in writing and agreed upon by both parties. 10. Signatures: Finally, provide space for both the sales representative and a representative of the company to sign and date the agreement, thereby legally binding both parties. In summary, a Riverside California Self-Employed Independent Contractor Agreement with Sales Representative is a crucial document that safeguards the interests of both the sales representative and the company. It ensures a clear understanding of the working relationship, compensation structure, and expectations, enabling a smooth and mutually beneficial business partnership.