Montgomery Maryland Pledge of Shares of Stock is a legal contract or agreement wherein a shareholder pledges their shares of stock as collateral for a loan or other financial obligation. This pledge serves as a security measure, providing lenders with assurance that they have a tangible asset to recover their investment in case the borrower defaults. In Montgomery, Maryland, there are three main types of Pledge of Shares of Stock: 1. Voluntary Pledge: This type of pledge is initiated by the shareholder themselves, with their consent and willingness to borrow funds against their shares. It is commonly used for personal loans or to secure financing for business purposes such as expansion or acquisition. 2. Involuntary Pledge: Also known as a compulsory pledge, this type of pledge is typically initiated by an external party, such as a bank or financial institution, when the shareholder defaults on a loan or fails to meet their financial obligations. The creditor then takes ownership or control of the pledged shares to recover their losses. 3. Floating Pledge: This type of pledge allows shareholders to pledge their shares without specifying the exact number of shares initially. Instead, they pledge a particular percentage of their overall shareholdings. This allows flexibility, as shareholders can freely transfer shares while still keeping the pledged percentage constant. Floating pledges are often used when shareholders want to maintain control of their shares while raising capital through other means. It is important to note that the specifics of Montgomery Maryland Pledge of Shares of Stock may vary depending on state laws, the terms agreed upon by the parties involved, and the purpose of the pledge. Seeking professional legal advice is recommended when entering into such agreements to ensure compliance and protect the interests of all parties involved.

Montgomery Maryland Pledge of Shares of Stock

Description

How to fill out Montgomery Maryland Pledge Of Shares Of Stock?

Preparing documents for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Montgomery Pledge of Shares of Stock without professional assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Montgomery Pledge of Shares of Stock by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Montgomery Pledge of Shares of Stock:

- Look through the page you've opened and check if it has the document you require.

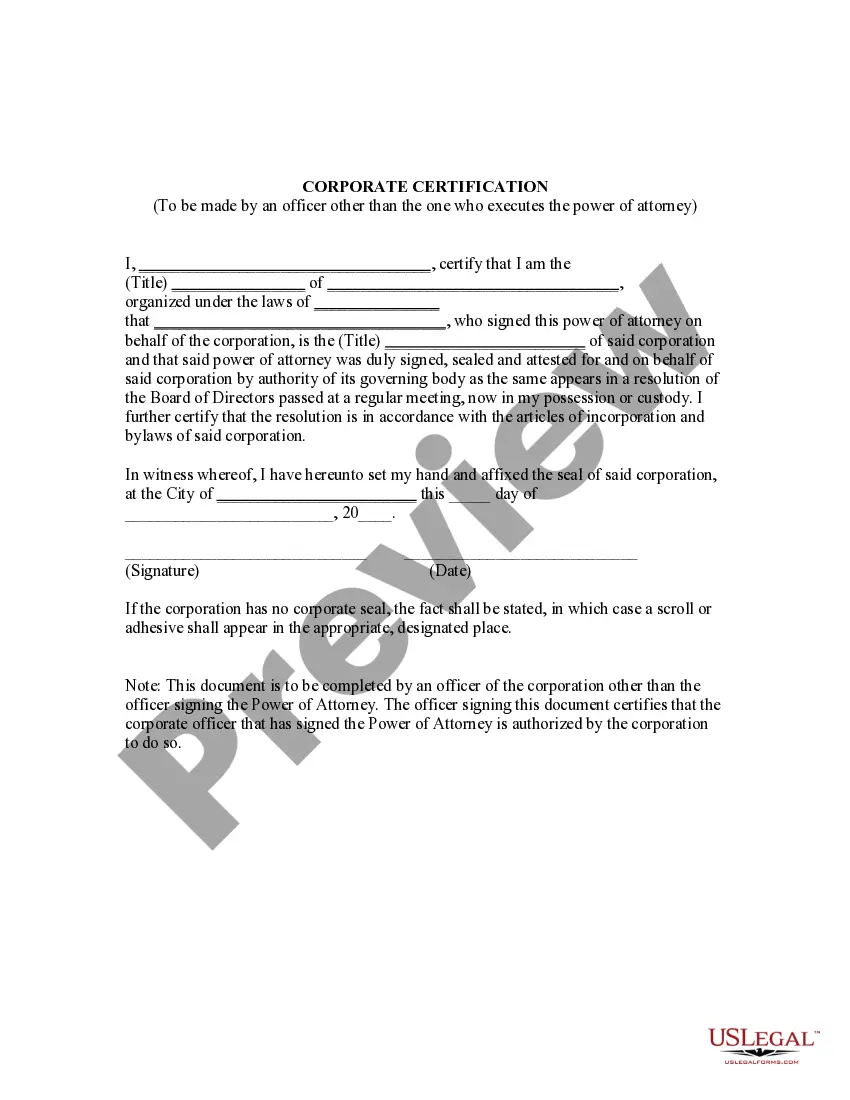

- To do so, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!