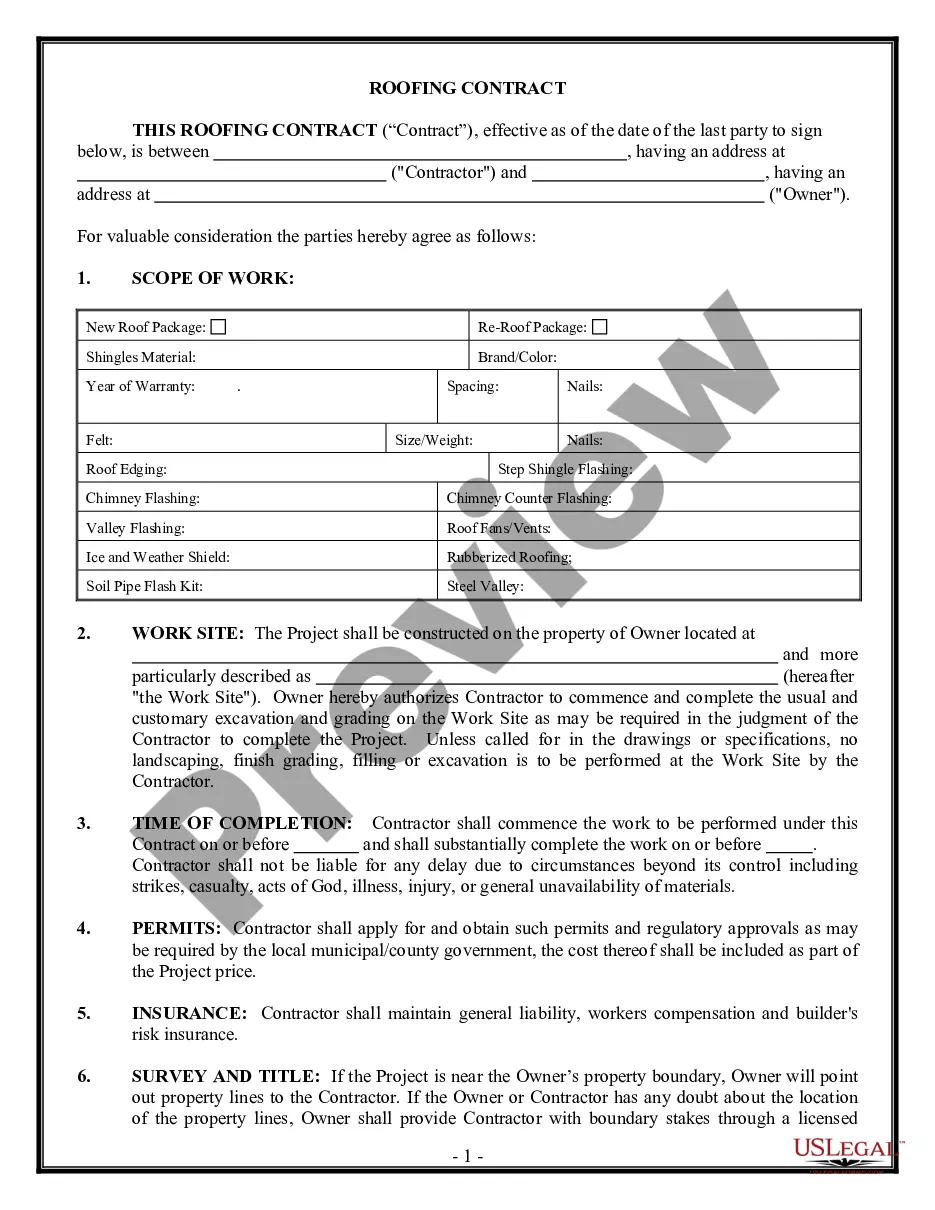

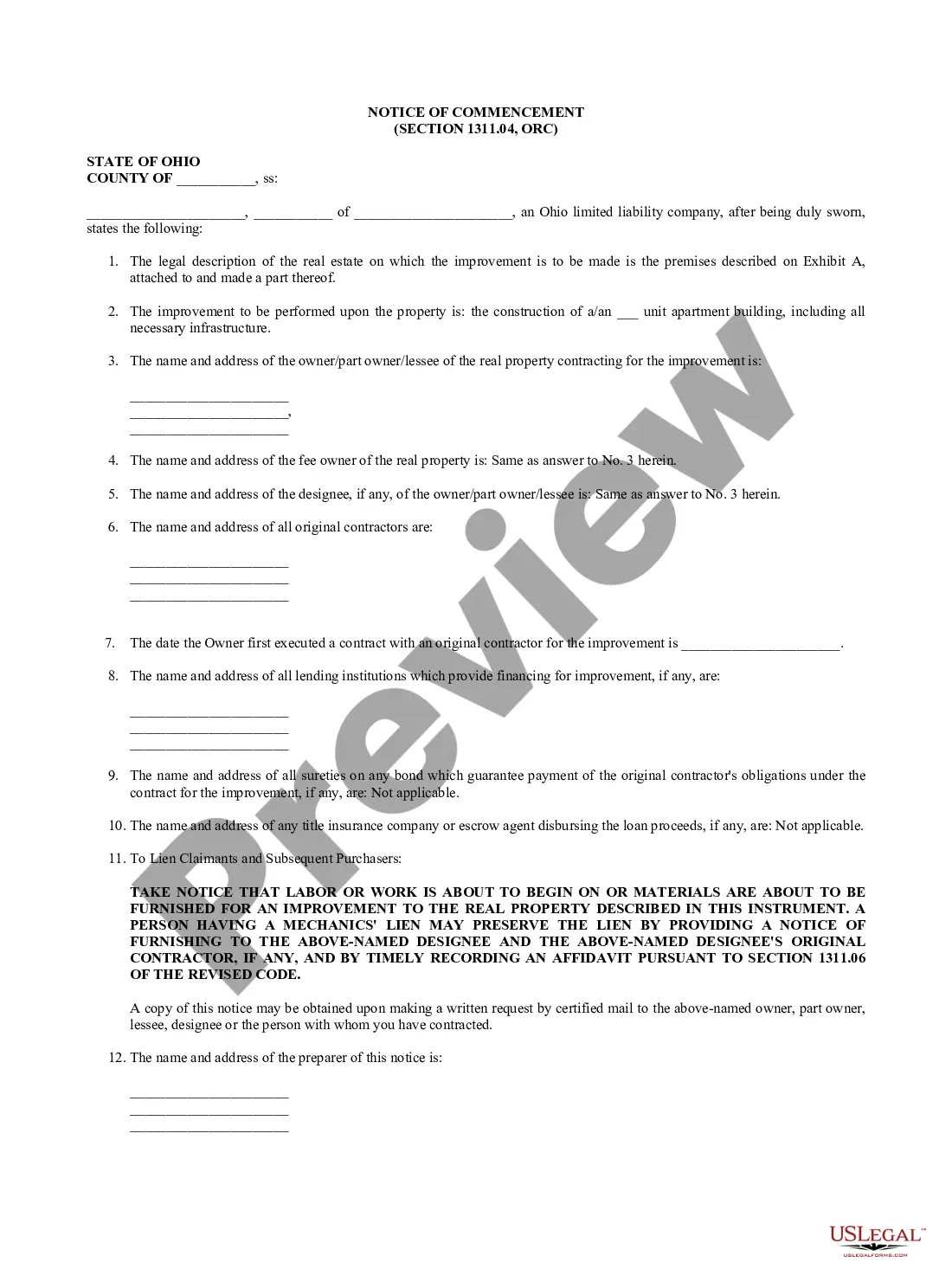

The Nassau New York Pledge of Shares of Stock is a legal agreement that pertains to the transfer of shares of stock as collateral for a loan or other financial transactions. This pledge serves as a security measure to ensure repayment and compliance with the terms and conditions outlined in the agreement. Keywords: Nassau New York, Pledge of Shares of Stock, legal agreement, transfer of shares, collateral, loan, financial transactions, security measure, repayment, compliance, terms and conditions. There are different types of Nassau New York Pledge of Shares of Stock, which are as follows: 1. Traditional Pledge: In this type of pledge, the stockholder pledges their shares as collateral for a loan without transferring the ownership rights. The stocks remain in the possession of the stockholder during the loan duration, but the lender holds the rights to sell or liquidate the shares in case of default. 2. Voting Pledge: With a voting pledge, the stockholder pledges their shares to another entity to obtain voting control over the shares. The shares' ownership may or may not be transferred, but the pledge recipient has the authority to vote on any matters related to those shares. 3. Non-possessory Pledge: In this type of pledge, the stockholder doesn't physically transfer the shares to the lender. Instead, the stockholder provides a written pledge agreement granting the lender a security interest in the shares. This type of pledge is sometimes used when the shares are held electronically by a third-party custodian. 4. Floating Pledge: A floating pledge enables the stockholder to pledge a varying number of shares within a certain class or types of stocks. The specific shares to be pledged under this arrangement may change periodically, based on the stockholder's discretion or the variation in the stock portfolio. 5. Cross Pledge: A cross pledge involves multiple stockholders who pledge their shares to secure a common obligation, such as a joint loan. The pledged shares collectively serve as collateral for the obligation, and each stockholder's shares are subject to sale or liquidation in case of default by any of the pledges. 6. Equitable Pledge: This type of pledge grants the lender the right to possess and control the pledged shares directly. It is commonly used in situations where the stockholder has defaulted or the loan agreement includes specific provisions allowing the lender to exercise this level of control. Remember, it's crucial to consult with legal professionals or financial advisors to understand the specific requirements and implications of the Nassau New York Pledge of Shares of Stock based on your unique circumstances.

Nassau New York Pledge of Shares of Stock

Description

How to fill out Nassau New York Pledge Of Shares Of Stock?

Creating paperwork, like Nassau Pledge of Shares of Stock, to take care of your legal affairs is a difficult and time-consumming process. Many situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms created for various scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Nassau Pledge of Shares of Stock form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before downloading Nassau Pledge of Shares of Stock:

- Ensure that your template is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Nassau Pledge of Shares of Stock isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Definition: Pledging of shares is one of the options that the promoters of companies use to secure loans to meet working capital requirement, personal needs and fund other ventures or acquisitions. A promoter shareholding in a company is used as collateral to avail a loan.

Definition: Pledging of shares is one of the options that the promoters of companies use to secure loans to meet working capital requirement, personal needs and fund other ventures or acquisitions. A promoter shareholding in a company is used as collateral to avail a loan.

You will be able to track your pledged holdings in the 'Statement of transaction' provided by CDSL. In the statement of transaction, you will find the pledged shares as a 'Debit'.

In simple words, pledging of shares means taking loans against the shares that one holds. Shares are considered assets. Pledging of shares is a way for the promoters of a company to get loans to meet their business or personal requirements by keeping their shares as collateral to lenders.

When you have pledged the stock, you cannot sell it before pledging, that is why it is not shown in Kite Holdings.

Stock-Secured Loans With a stock-based loan, you pledge shares of stock as collateral against the repayment of the loan. Typically you do not make payments until the loan is due in two to three years and any dividends paid on the shares go toward the interest and principal of the loan.

How to pledge shares? The promoter has to initiate a request for pledging shares using the trading terminal. Once the request is received, the trading terminal sends the request to NSDL/CDSL for confirmation. NSDL/CDSL authenticates the request using email/mobile authentication for PAN/BOID.

How to pledge stocks and mutual funds for collateral margins - YouTube YouTube Start of suggested clip End of suggested clip Segment. So now let's suppose you want to take a one lakh rupee derivative. Position only 50 000 canMoreSegment. So now let's suppose you want to take a one lakh rupee derivative. Position only 50 000 can be used from the money you got by placing the collateral. The other 50 000 has to come from cash.

Generally, pledging of shares is considered as the last resort for the promoters to raise funds. Raising funds by issuing debt or equity is comparatively safer than pledging shares held by promoters. If they are planning to pledge shares, it means that all the other options to raise capital have been closed.

Pledging of shares allows an investor to trade higher volumes. Investor's savings there are locked in their trading account in the form of shares when they buy them. Even though they hold an asset in the form of shares, their funds are locked and cannot be used for a new trade.