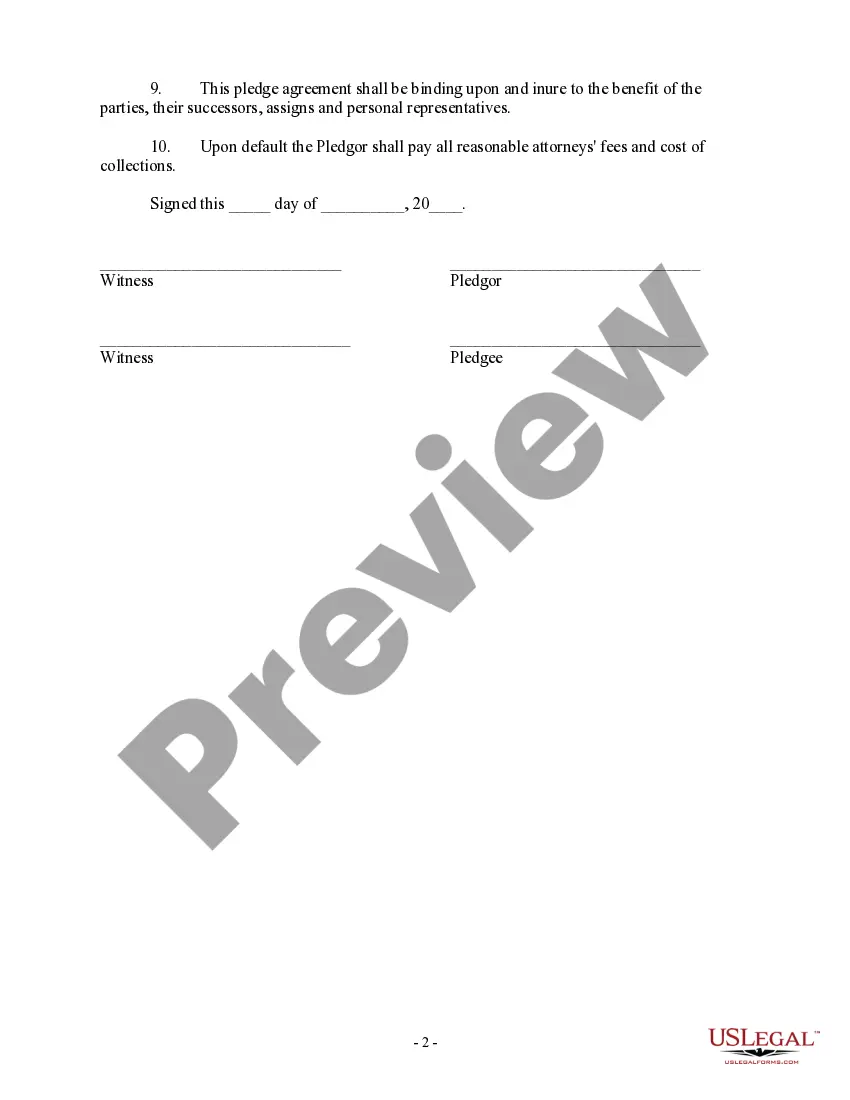

Philadelphia Pennsylvania Pledge of Shares of Stock is a legally binding agreement that outlines the transfer of ownership rights over shares of stock to secure a debt or obligation in Philadelphia, Pennsylvania. This type of pledge is common in various financial and business contexts, such as loans, investments, and partnerships. In a Philadelphia Pennsylvania Pledge of Shares of Stock, the pledge (also known as the borrower) pledges their shares of stock as collateral to the pledge (also known as the lender or creditor) until the debt is repaid or the obligation is fulfilled. This pledging arrangement provides security and ensures that the pledge has a claim over the shares in case of default or non-payment. Typically, a Philadelphia Pennsylvania Pledge of Shares of Stock includes specific details, including: 1. Parties Involved: The agreement identifies the pledge and pledge, along with their contact information. 2. Description of Shares: The agreement provides details about the shares being pledged, such as the class, quantity, and any relevant stock certificates. 3. Purpose of Pledge: It states the purpose of the pledge, highlighting the debt or obligation being secured by the shares, such as a loan or investment agreement. 4. Terms and Conditions: The agreement outlines the terms and conditions of the pledge, including the duration of the pledge, the interest rate, and any associated fees. 5. Rights and Responsibilities: It describes the rights and responsibilities of both the pledge and pledge, such as voting rights, dividend entitlements, and how any proceeds from the shares are handled. 6. Default and Remedies: The agreement defines the circumstances that constitute a default, such as non-payment or breach of terms, and the remedies available to the pledge in such cases. 7. Release of Pledge: It specifies the conditions under which the pledge will be released, such as full repayment of the debt or fulfillment of the obligation, triggering the return of the shares to the pledge. While there is typically no specific classification of different types of Philadelphia Pennsylvania Pledge of Shares of Stock, the underlying purpose and terms may vary depending on the specific context and parties involved.

Philadelphia Pennsylvania Pledge of Shares of Stock

Description

How to fill out Philadelphia Pennsylvania Pledge Of Shares Of Stock?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Philadelphia Pledge of Shares of Stock, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Philadelphia Pledge of Shares of Stock from the My Forms tab.

For new users, it's necessary to make several more steps to get the Philadelphia Pledge of Shares of Stock:

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!