This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

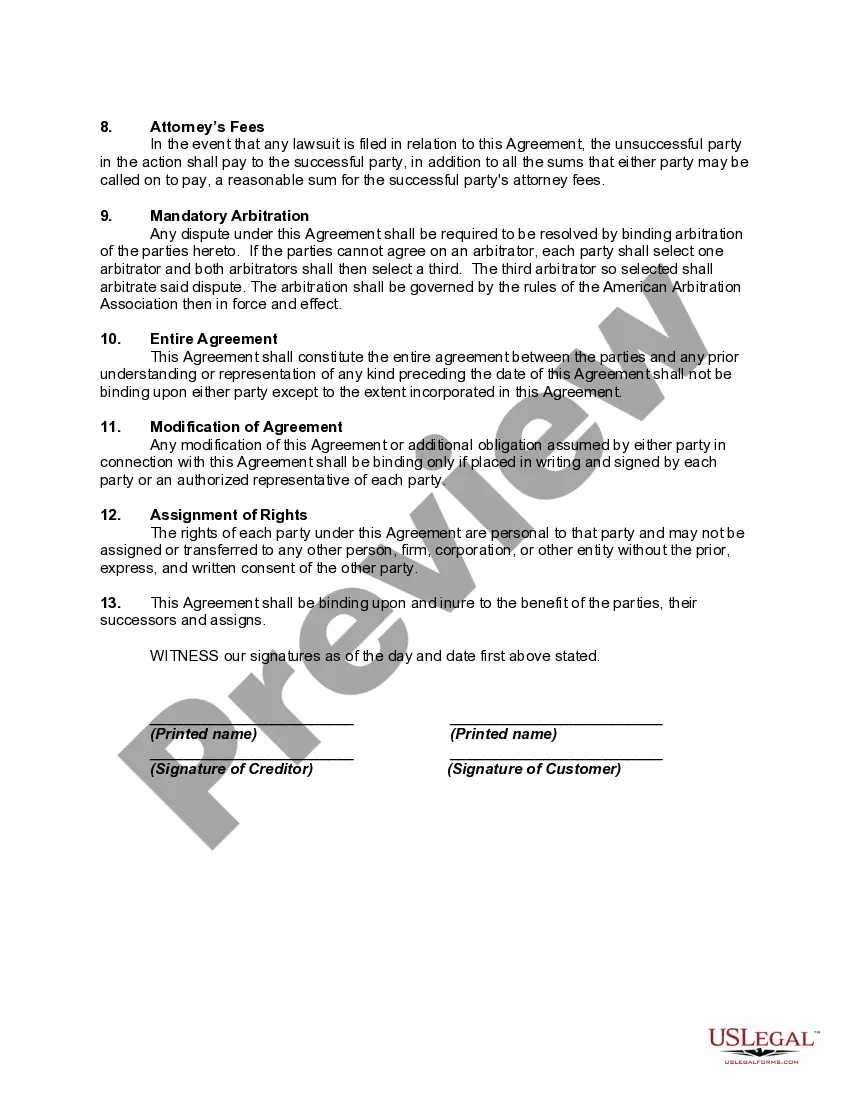

The Alameda California Agreement to Extend Debt Payment is a legal document that outlines the terms and conditions under which a borrower can extend their debt payment period in Alameda, California. This agreement provides borrowers with a structured plan to manage their outstanding debts effectively. By entering into this agreement, both the borrower and the lender can come to a mutually beneficial arrangement that allows the borrower more time to repay their debts without facing severe consequences. One type of Alameda California Agreement to Extend Debt Payment is the Personal Loan Extension Agreement. This agreement is specifically designed for individuals who have taken out personal loans and are struggling to meet the repayment schedule. Through this agreement, the borrower can negotiate a new payment plan with the lender, whether it be by extending the loan term or reducing the monthly payments, to ensure the debt is paid off in a more manageable way. Another type is the Business Debt Extension Agreement that caters to businesses in Alameda, California, which may be encountering financial difficulties. This agreement enables business owners to negotiate with their creditors to extend the repayment schedule of their debts, providing them with critical breathing room to stabilize their finances and boost their chances of survival and recovery. Key terms that are often included in the Alameda California Agreement to Extend Debt Payment encompass the debt's total amount, interest rates, repayment periods, and any penalties or fees associated with defaulting on the agreed-upon terms. It is recommended for borrowers to thoroughly review and understand the terms before signing the agreement to ensure they are comfortable with the proposed changes. The Alameda California Agreement to Extend Debt Payment can be a beneficial solution for both borrowers and lenders. It allows borrowers to avoid foreclosure, bankruptcy, or other severe financial consequences of providing them with a structured path to regaining control over their debts. Lenders also benefit as they have a higher chance of recouping the outstanding debt in a timeframe that better aligns with the borrower's financial situation. Overall, the Alameda California Agreement to Extend Debt Payment provides a legal framework for borrowers to negotiate more favorable repayment terms for their outstanding debts, allowing them to regain financial stability and avoid dire financial consequences.The Alameda California Agreement to Extend Debt Payment is a legal document that outlines the terms and conditions under which a borrower can extend their debt payment period in Alameda, California. This agreement provides borrowers with a structured plan to manage their outstanding debts effectively. By entering into this agreement, both the borrower and the lender can come to a mutually beneficial arrangement that allows the borrower more time to repay their debts without facing severe consequences. One type of Alameda California Agreement to Extend Debt Payment is the Personal Loan Extension Agreement. This agreement is specifically designed for individuals who have taken out personal loans and are struggling to meet the repayment schedule. Through this agreement, the borrower can negotiate a new payment plan with the lender, whether it be by extending the loan term or reducing the monthly payments, to ensure the debt is paid off in a more manageable way. Another type is the Business Debt Extension Agreement that caters to businesses in Alameda, California, which may be encountering financial difficulties. This agreement enables business owners to negotiate with their creditors to extend the repayment schedule of their debts, providing them with critical breathing room to stabilize their finances and boost their chances of survival and recovery. Key terms that are often included in the Alameda California Agreement to Extend Debt Payment encompass the debt's total amount, interest rates, repayment periods, and any penalties or fees associated with defaulting on the agreed-upon terms. It is recommended for borrowers to thoroughly review and understand the terms before signing the agreement to ensure they are comfortable with the proposed changes. The Alameda California Agreement to Extend Debt Payment can be a beneficial solution for both borrowers and lenders. It allows borrowers to avoid foreclosure, bankruptcy, or other severe financial consequences of providing them with a structured path to regaining control over their debts. Lenders also benefit as they have a higher chance of recouping the outstanding debt in a timeframe that better aligns with the borrower's financial situation. Overall, the Alameda California Agreement to Extend Debt Payment provides a legal framework for borrowers to negotiate more favorable repayment terms for their outstanding debts, allowing them to regain financial stability and avoid dire financial consequences.