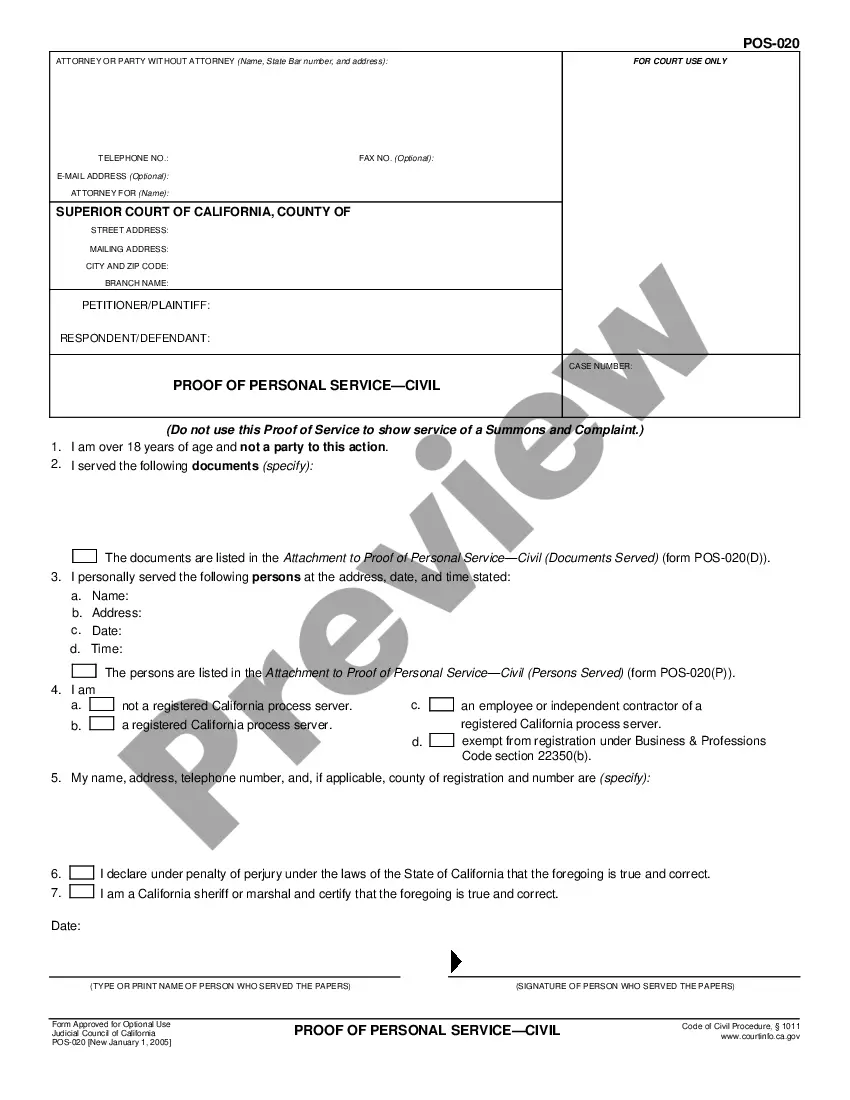

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montgomery Maryland Agreement to Extend Debt Payment is a financial arrangement specifically designed to provide debtors with an opportunity to extend the repayment period for their outstanding debts in the region of Montgomery, Maryland. This agreement aims to alleviate the financial burden on individuals and businesses struggling to meet their debt obligations on time. The Montgomery Maryland Agreement to Extend Debt Payment allows debtors to negotiate with their creditors and lenders for an extended period to repay their debts. This arrangement ensures that debtors have the flexibility required to manage their financial obligations effectively. By extending the debt payment schedule, debtors can adjust their monthly payments to better align with their current financial capacity. One possible type of Montgomery Maryland Agreement to Extend Debt Payment is a debt consolidation loan. This type of agreement allows debtors to combine their multiple debts into a single loan, often at a lower interest rate. By opting for a debt consolidation loan, individuals can simplify their repayment process and potentially save on interest charges. Another type of agreement is a debt repayment plan, which is typically facilitated by a credit counseling agency. Through this arrangement, the agency negotiates with creditors on behalf of the debtor to develop a structured repayment plan. Debtors make monthly payments to the agency, which then distributes the funds among the participating creditors according to the agreed-upon plan. It's important to note that the precise terms, conditions, and eligibility criteria may vary based on the specific Montgomery Maryland Agreement to Extend Debt Payment. Additionally, the availability of such agreements may depend on the creditor's willingness to cooperate and the debtor's financial situation. Therefore, it's advisable for individuals seeking debt relief in Montgomery, Maryland, to consult a financial advisor or credit counseling agency for personalized guidance and assistance in determining the most suitable agreement to address their specific needs. Key relevant keywords: Montgomery Maryland, Agreement, Extend, Debt Payment, Financial arrangement, Repayment period, Debtors, Financial burden, Individuals, Businesses, Debt consolidation loan, Debt repayment plan, Debt relief, Creditors, Lenders, Flexibility, Monthly payments, Interest rate, Eligibility criteria, Financial advisor, Credit counseling agency.Montgomery Maryland Agreement to Extend Debt Payment is a financial arrangement specifically designed to provide debtors with an opportunity to extend the repayment period for their outstanding debts in the region of Montgomery, Maryland. This agreement aims to alleviate the financial burden on individuals and businesses struggling to meet their debt obligations on time. The Montgomery Maryland Agreement to Extend Debt Payment allows debtors to negotiate with their creditors and lenders for an extended period to repay their debts. This arrangement ensures that debtors have the flexibility required to manage their financial obligations effectively. By extending the debt payment schedule, debtors can adjust their monthly payments to better align with their current financial capacity. One possible type of Montgomery Maryland Agreement to Extend Debt Payment is a debt consolidation loan. This type of agreement allows debtors to combine their multiple debts into a single loan, often at a lower interest rate. By opting for a debt consolidation loan, individuals can simplify their repayment process and potentially save on interest charges. Another type of agreement is a debt repayment plan, which is typically facilitated by a credit counseling agency. Through this arrangement, the agency negotiates with creditors on behalf of the debtor to develop a structured repayment plan. Debtors make monthly payments to the agency, which then distributes the funds among the participating creditors according to the agreed-upon plan. It's important to note that the precise terms, conditions, and eligibility criteria may vary based on the specific Montgomery Maryland Agreement to Extend Debt Payment. Additionally, the availability of such agreements may depend on the creditor's willingness to cooperate and the debtor's financial situation. Therefore, it's advisable for individuals seeking debt relief in Montgomery, Maryland, to consult a financial advisor or credit counseling agency for personalized guidance and assistance in determining the most suitable agreement to address their specific needs. Key relevant keywords: Montgomery Maryland, Agreement, Extend, Debt Payment, Financial arrangement, Repayment period, Debtors, Financial burden, Individuals, Businesses, Debt consolidation loan, Debt repayment plan, Debt relief, Creditors, Lenders, Flexibility, Monthly payments, Interest rate, Eligibility criteria, Financial advisor, Credit counseling agency.